What If Gold Is NOT In A New Bull Market?

Commodities / Gold & Silver 2019 Sep 16, 2019 - 05:13 AM GMTBy: Kelsey_Williams

What if it’s not a new bull market for gold? What if gold prices are going lower – not higher?

What if it’s not a new bull market for gold? What if gold prices are going lower – not higher?

Think it can’t happen? Think again.

In December 1987, gold prices stood at just over $500.00 per ounce. They had been on a tear for the previous three years after hitting a post-peak low of just under $300.00 per ounce in February 1985.

The increase in gold’s price of $200.00 per ounce may not sound like much, but it represents a sixty-seven percent increase over that three year period. Coming on the heels of a similar percentage decline after reaching an all-time high of $850.00 per ounce in January 1980, it was a welcome salve for those who had been wounded so severely.

Proclamations of a new bull market were abundant. Expectations for exceeding the old highs had some investors fantasizing rabidly. They were rudely disappointed.

Within eleven months, gold’s price was back below $400.00. By November 1988, gold was at $390.00 per ounce, a decline of twenty-two percent. It didn’t stop there.

A pattern of sideways to lower prices continued until August 1999, when gold traded at $256.00 per ounce – twelve years after its post-peak recovery high of $502.00 per ounce. That is a decline of nearly fifty percent for the twelve years, and a decline of seventy percent from its then all-time peak of $850.00 per ounce.

All told, the bear market for gold prices lasted twenty years; and even after reaching its low of $256.00 per ounce, it did not trade above $300.00 per ounce for most of the next three years.

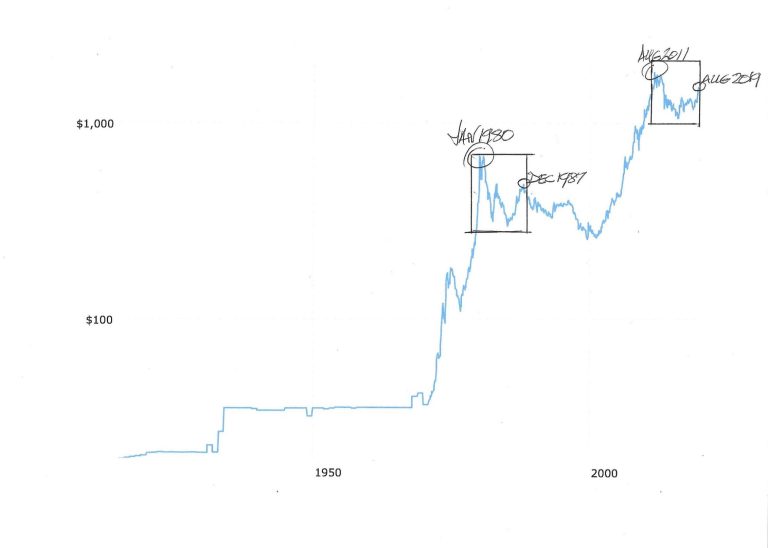

On the chart below, there is a box around the years and price action of gold from January 1980 to December 1987. There is another box around the years which include gold’s price peak in August 2011 and it’s recent high of $1545.00 in August 2019.

Both periods are identical in length – eight years. Also, both periods began with all-time highs and included low-points and recovery high points which occurred over similar time frames…

(source: macrotrends.net)

First Box: A low point for gold of $298.00 was reached in February 1985, five years after its January 1980 peak. The subsequent uptrend took its price back up to $500.00 three years later, in December 1987.

Second Box: The low of $1050.00 came in December 2015, four years and four months after the August 2011 peak. The uptrend since then has brought us to the recent high of $1545.00 last month, August 2019.

The rally in gold’s price from its post-peak low of $1050.00 to its recent high of $1545.00 amounts to forty-seven percent. That is considerably less than the sixty-seven percent of thirty years ago; but the time frames are identical and the price action is reasonably similar.

A continuation of the relatively similar pattern to that which occurred thirty years ago could take gold’s price down to below $800.00 per ounce. Ouch!

That is not a prediction. However, if you are ardently bullish about gold, you might want to revisit your expectations. Are they realistic? Or are you being carried away by a tide of emotional optimism?

Even if gold doesn’t sink to new lows, it could trend downwards and sideways for many years. After reaching $500.00 in December 1987, gold dropped sharply, then traded for the next ten years between $300.00 and $400.00.

In today’s dollars, that would be the equivalent of gold dropping back to about $1200.00 per ounce initially, then meandering somewhere between $1000.00 and $1200.00 for the next decade.

Here is the bottom line. After reaching its post-peak recovery high of $500.00 per ounce in December 1987, gold did not get back above $500.00 per ounce until December 2005, eighteen years later. And, it did not exceed its previous all-time high of $850.00 per ounce until January 2008.

Are you in gold “for the long haul”? Can you wait twenty more years to see gold’s price at a new all-time high?

By Kelsey Williams

http://www.kelseywilliamsgold.com

Kelsey Williams is a retired financial professional living in Southern Utah. His website, Kelsey’s Gold Facts, contains self-authored articles written for the purpose of educating others about Gold within an historical context.

© 2019 Copyright Kelsey Williams - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.