Use the “Ferrari Pattern” to Predictably Make 431% with IPOs

Companies / IPOs Nov 29, 2019 - 03:50 PM GMTBy: Stephen_McBride

Justin Spittler :

Ferrari isn’t used to losing.

Justin Spittler :

Ferrari isn’t used to losing.

Its $250,000+ sports cars are the epitome of luxury, style, and exclusivity. When you see one cruising down the street, most people can’t help but stop and stare.

Ferrari started as a racing company. Founder Enzo Ferrari handcrafted finely tuned speed machines whose sole purpose was to go faster than any other car could.

Winning is in Ferrari’s blood. It has won a record 238 Grand Prix races. Yet recently, Ferrari looked like a loser.

The Hype Around Ferrari’s IPO Was Sky-High

On a cool October morning, eight pristine Ferraris sat parked outside the New York Stock Exchange in downtown Manhattan...

For most of its history, Ferrari was a private company. It was owned by the Ferrari family and Fiat Chrysler. That all changed when Ferrari IPO’d on October 20, 2015.

For the first time, individual investors could own a piece of the company... and many were dying to buy in.

Ferrari began trading on the New York Stock Exchange (NYSE) under the ticker “RACE.” No surprise, hype was sky-high.

Businesses don’t get much sexier than Ferrari. Ambitious young people dream of buying a Ferrari when they “make it.” Older folks buy Ferraris to feel young again.

Ferraris are the ultimate status symbol. At $200,000+ a pop, most folks will never own one. Ferrari’s IPO was a chance for any investor to own a tiny sliver of the iconic brand.

As you can imagine, Ferrari’s IPO was a media circus. CNBC reported that shares of the Italian carmaker were “well oversubscribed” heading into its IPO. That’s Wall Street’s way of saying demand was through the roof.

But Ferrari Stock Stumbled... Then Crashed

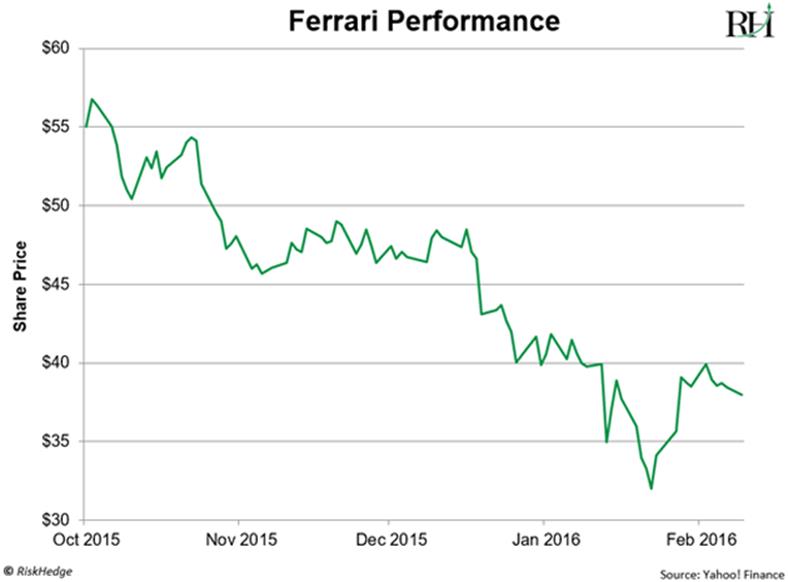

It suffered a disappointing first week of trading, slipping 6%. Ferrari then plunged 41% during its first four months as a publicly traded company, as you can see here:

If you’ve been reading me, this story should sound familiar by now: big, hyped-up IPOs often fail to deliver.

Ferrari went public at a $9 billion valuation. And at a price-to-earnings ratio of 33, it was priced for rapid growth.

Problem was, Ferrari’s business will NEVER grow rapidly. It can’t! Ferrari is in the exclusivity business. Ferraris are special because they’re rare. The company keeps a strict cap on production to make sure they remain special.

In 2015, before it went public, Ferrari sold just 7,000 a year. It has gradually ramped that up to 9,200 cars today... which is still tiny compared to automakers like Ford (F) that sell two-plus million cars a year.

Four Months after Ferrari Went Public, Things Were Looking Bleak

The stock had been nearly cut in half. But this was exactly the right time to buy Ferrari stock.It would bottom out and double over the next 12 months… and that was just the beginning.

As you can see below, Ferrari has soared 431% since bottoming out in early 2016. That’s more than five times the S&P 500’s return over the same period.

Ferrari Followed a Predictable Pattern…

I call this a FAILED IPO.

Failed IPOs can make you a killing if you know how to play them. See, all the hype around Ferrari doomed its IPO to failure. It went public at too high a valuation, virtually guaranteeing its stock would decline.

But although Ferrari’s IPO went poorly, its business was doing great. That’s an important distinction...

Ferrari turns a big profit, year after year, selling luxury cars to rich people. Its business is rock solid. Ferrari makes an average of around $80,000 profit per car it sells. This blows most other carmakers out of the water. Even luxury carmaker Porche only turns a $17,000 profit per car, according to Bloomberg.

Ferrari is one of few brands I’m certain will be around for many decades to come. Rich people will always want to own iconic cars, even with electric and self-driving cars coming.

This Happens All the Time with IPOs

A great business will suffer a failed IPO... handing you a chance to safely collect multi-bagger gains.

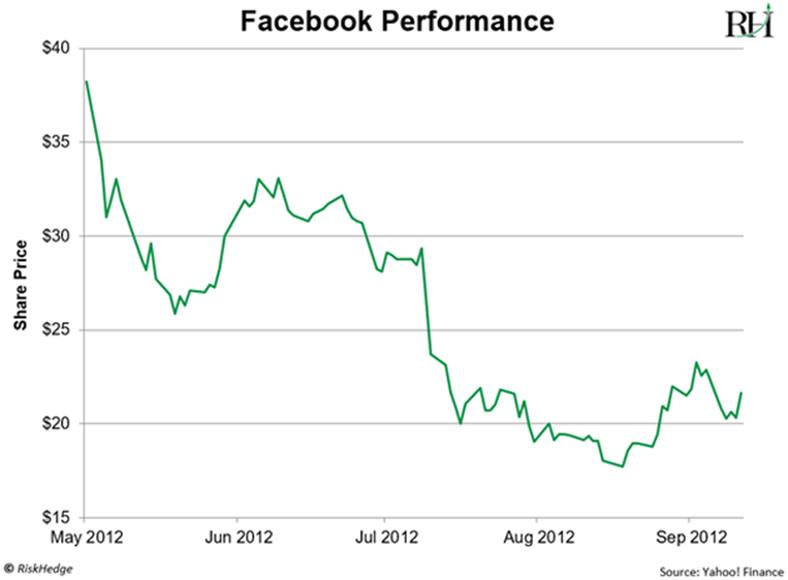

Facebook (FB) had a failed IPO too. It went public in May 2012. It raised a staggering $18.4 billion in its IPO, putting its valuation at a colossal $104 billion.

Its IPO was one of the most talked about investing events in history. But Facebook buckled under the pressure, just like Ferrari.

FB plummeted 54% five months after its IPO.

Of course, Facebook didn’t stay down. It’s now one of the biggest and most dominant companies on the planet.

You would’ve made a good profit of around 400% buying Facebook at IPO. But you could have collected a GREAT profit of more than 1,000% by waiting and buying Facebook three months after its IPO.

Square (SQ) Followed This Same Predictable Pattern…

Square is a mobile payments company. It makes the little white boxes that plug into your phone to swipe credit cards.

There was a ton of excitement around its IPO when it went public in November 2015. But the stock faltered, dropping 35% within two months.

It was the chance of a lifetime to buy Square cheap. It would go on to soar nearly 1,200% in the next two and a half years.

Never Buy a Big, Hyped-Up IPO on Day 1…

Instead, identify the ones that are great businesses and “stalk” them.

Let the hype fade. Let reality set in.

Chances are you’ll get an opportunity to buy in for around half price within a few months... setting you up to collect double the profits of anyone who bought at IPO.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get our latest report where I reveal my three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Justin Spittler

© 2019 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.