What Do Fresh U.S. Economic Reports Imply for Gold?

Commodities / Gold & Silver 2020 Jan 21, 2020 - 06:35 PM GMTBy: Arkadiusz_Sieron

Latest economic data were published last week, indicating that the U.S. economy remains on solid footing. Gold prices held up relatively well – but can it last?

Recent U.S. Economic Data Show General Health

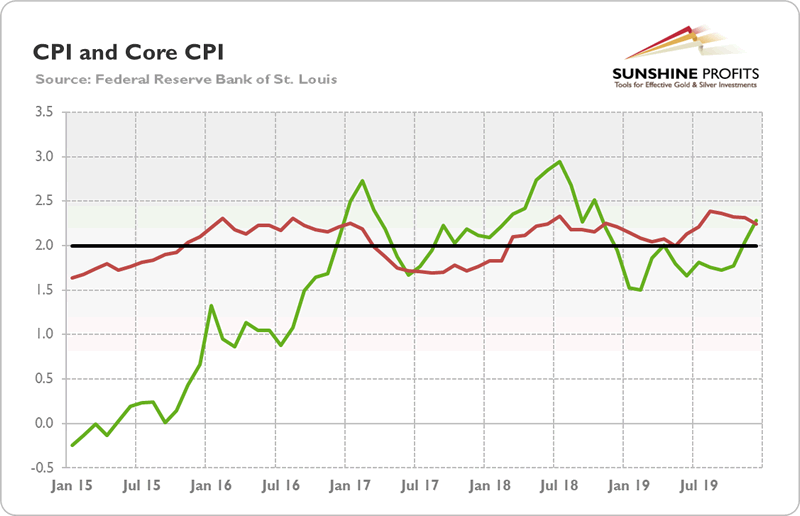

Last week was full of economic reports. Let’s analyze them. First, the CPI rose 0.2 percent in December, slightly below expectations and the 0.3-percent increase in November. But as the chart below shows, the CPI (and the core CPI as well) rose 2.3 percent over the whole 2019, which was the largest advance since the 3.0-percent rise in 2011. Yet inflation is still quite low by historical standards.

Chart 1: Annual percentage change in the US CPI (green line) and the core CPI (red line) from January 2015 to December 2019.

The wholesale inflation measured by the PPI rose just 1.3 percent last year, half as much as it did in 2018. It means that inflationary pressures are limited in the U.S. economy. Moreover, the PCEPI, the Fed’s preferred inflation gauge, rose just 1.5 percent over the twelve months ending in November. The muted inflation implies that it is unlikely the Fed will hike the federal funds rate anytime soon. Although gold likes high and accelerating inflation, the U.S. central bank keeping interest rates on hold is positive for the gold prices.

Second, the Fed’s Beige Book shows that the U.S. economic activity continued to expand “modestly” over the last six weeks of 2019. What is important is that the expectations of the near-term outlook “remained modestly favorable”. However, the Beige Book reports also job cuts in manufacturing, transportation and energy sectors, which is in line with the last report on the nonfarm payrolls.

Third, when it comes to the industrial sector, industrial production fell 0.3 percent in December, the third decline in the past four months. In the whole last year, the output fell 1 percent. It shows that the sector is still weak, hurt by the trade wars, but excluding the motor vehicle sector, factory output rose 0.5 percent, so we could perhaps see revival in the near future.

Fourth, retail sales increased 0.3 percent in December and 5.8 percent in the whole 2019, slightly above the average for the past 30 years. It shows that the consumer spending remains solid.

Last but not least, the privately‐owned housing starts in December came at a seasonally adjusted annual rate of 1,608,000, which was 17 percent above November and 41 percent above December 2018. The new residential construction reached a 13-year high, but it was mainly because of the warmer-than-usual temperatures. The change in building permits, which are less sensitive to weather, was weaker.

Implications for Gold

Leaving the industrial production aside, last week’s economic reports were generally positive, showing that the U.S. economy is still solid. It keeps looking like a goldilocks economy: inflation is low, the pace of economic growth is moderate, the retail sales and the housing market are solid. Theoretically, gold should suffer in face of positive economic news.

Indeed, as we have seen last week not only good economic reports, but also two important developments for the global economy. First, the potentially dangerous conflict between the U.S. and Iran deescalated as quickly as it appeared. Second, the U.S. and China signed the ‘phase one’ accord in their trade dispute. In consequence, the U.S. stock market reached a new all-time record.

So, one could reasonably expect the bearish trend in the gold market. However, the yellow metal held steady, which is a solid performance given the headwinds that occurred last week. Why was gold so resilient? One explanation might be that investors worry about the long-term consequences of the recent ultra-easy monetary policy. After all, even central bankers worry! Dallas Fed President Robert Kaplan said last week that the recent Fed’s actions were contributing to elevated risk asset valuations as they have given investors green light to buy risky assets and this is a concern. Anyway, gold’s resilience in face of headwinds might be a bullish sign.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.