As COVID-19 Rocks Markets, Uncertainty Rises in ASEAN

Stock-Markets / Financial Markets 2020 Mar 03, 2020 - 02:24 PM GMTBy: Dan_Steinbock

As the virus momentum is shifting from China to other countries, Southeast Asia faces new economic pressures and indirect collateral damage, due to outbreaks in Japan and South Korea, and inadequate international preparedness.

As the virus momentum is shifting from China to other countries, Southeast Asia faces new economic pressures and indirect collateral damage, due to outbreaks in Japan and South Korea, and inadequate international preparedness.

Worldwide, the number of confirmed novel coronavirus (COVID-19) cases could exceed 100,000 in a matter of week or so. The momentum of the outbreak has shifted, however.

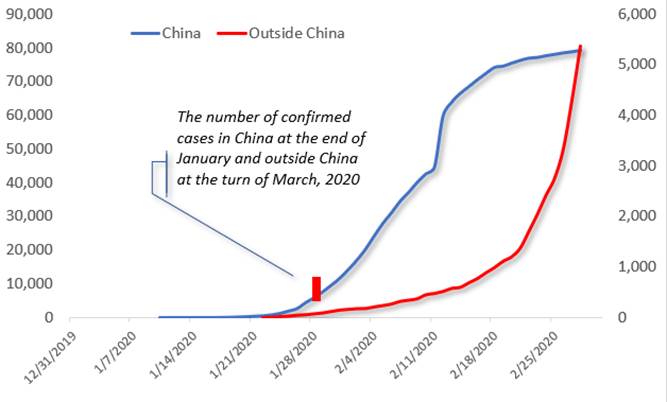

In early February, I predicted a turnaround in the growth rate of new virus cases in China, but acceleration internationally. That's now the new normal. Until then, the cases in China were increasing exponentially. Now the momentum is increasingly outside China. In terms of the timeline, the number of confirmed cases outside China is now about the same as it was in the Chinese mainland about a month ago (Figure).

Figure The Shift in the Outbreak Momentum from China to Outside China

Source: WHO, China National Health Commission, Difference Group

Three scenarios – and current realities in China, US, Europe

After mid-January, I projected three probable virus impact scenarios in China. Let’s take a closer look at those scenarios in light of the new evidence.

In the first scenario of “SARS-like impact,” a sharp quarterly effect, accounting for much of the damage, would be followed by a rebound. The broader impact would be relatively low and regional. In the second scenario of “extended impact,” the adverse impact would last at least two quarters. The broader impact would be more severe and have an effect on global prospects, with rebound only in the summer. In the third scenario of “accelerated impact,” adverse damage would be far steeper with dire repercussions in the global economy.

Recently, IMF projected China's growth to fall to 5.6% in 2020, while global growth would fall 0.1 percentage points from the expected 3.3%. In China, the rebound story is still possible. In light of the virus acceleration in the past month, the IMF’s global estimate may be too optimistic, however.

Prior to the virus outbreak, the IMF expected US growth to moderate from 2.3% in 2019 to 2% in 2020 and decline further to 1.7% in 2021, due to the anticipated waning support of fiscal and financial conditions. Recently, the IMF projected US growth to suffer a 0.4% slowdown in the annualized growth; from 2.0% to 1.6%. But that would require successful outbreak management.

In Europe, recessionary pressures come in a bad time, as German GDP is stalling, while France and Italy have been contracting. In the fourth quarter of 2019, the Eurozone real GDP grew only 0.1%; the weakest since the contraction in early 2013. If the Brexit and trade wars were not bad enough, there is worse ahead in the coming months, particularly if these pressures are not offset with appropriate fiscal and monetary support.

Rising pressures in Japan, ASEAN

In Japan, growth was expected to fall closer to 0%. After last fall’s consumption tax and the past month of economic and political turmoil, contraction is more likely and uncertainty overshadows the 2020 Olympics.

With more than 4,200 confirmed cases and more than 20 deaths, South Korea has been worst hit by the novel coronavirus outside of China. The dramatic escalation in just a week shows how a single super-spreader and belated quarantines can cause national havoc even in a relatively advanced nation. As the decline in exports will now be coupled by the decline of domestic demand, South Korea may contract in the first quarter, irrespective of the impending rate cuts and efforts at fiscal support.

Since Japan and South Korea are significant investors in Southeast Asia, their economic challenges will overshadow development in emerging Asia as well.

In ASEAN economies, downgrades were expected to reduce growth closer to 4%. In December, the Asian Development Bank (ADB) maintained 4.7% for 2020 on the basis of the anticipated mild recovery in China and the US. Since those recoveries are now undermined, old projections are unlikely to apply.

Even countries that have strong structural growth potential, including Indonesia and the Philippines, are not immune to indirect challenges as their trade, investment, migration and remittance flows depend on the state of the international, particularly regional environment.

In Southeast Asia, much also depends on whether the virus can be kept outside the region.

Around the world, significant downgrades loom ahead. The big question is whether the other major affected economies - US, EU/UK, Japan and largest emerging countries - can achieve China-like fast containment.

Early Chinese data, March is the critical month

According to new data, factory activity in China contracted at the fastest pace on record as the Purchasing Managers’ Index (PMI) fell to a record low of 35.7 from 50.0 in January. The services sector activity also posted the deepest contraction on record, with non-manufacturing PMI dropping to 29.6, from 54.1 in January.

Yet, both plunges were to be expected. For now, the outbreak has killed almost 3,000 people in mainland China and infected 80,000. Economic shocks translate to contractions. The real question is the strength of the post-shock rebound.

In China, the initial expectation in January was that the first quarter would be penalized by a reduction of 1.2 percentage points to about 5% or less, while the second quarter rebound would offset much (but not all) of the losses. While the hoped-for rebound effect is still viable; the question is how significant it will be. March data could still prove very high, given the low starting-point.

It is the assumptions of the first “SARS-like impact” scenario that fuel the bold projections by J.P. Morgan that the Chinese first quarter could go down to -4%, but second quarter would go up to +15%.

Today, the first – and most benign – “SARS-like impact” scenario is no longer likely. But nor is the second “extended impact” scenario inevitable if China gets back to business in March.

Yet, uncertainty is only beginning to grip the rest of the world – as evidenced by the past week’s dramatic market plunges in the US, Europe and Japan.

Dr. Dan Steinbock is the founder of Difference Group and has served at the India, China and America Institute (US), Shanghai Institute for International Studies (China) and the EU Center (Singapore). For more, see http://www.differencegroup.net/

© 2020 Copyright Dan Steinbock - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Dan Steinbock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.