Gold in the year of the Coronavirus Pandemic

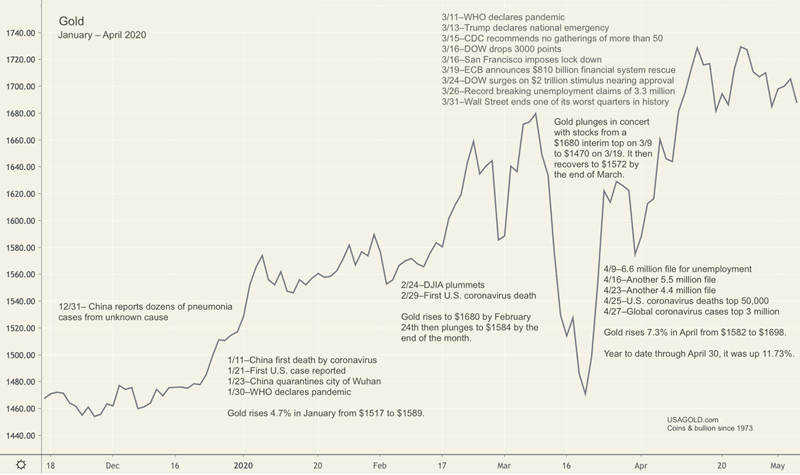

Commodities / Gold & Silver 2020 May 12, 2020 - 04:47 PM GMTWhat it cannot do is cure the virus. What it could do, however, according to a good many analysts, is act as an effective hedge against its economic consequences. Since the beginning of the year through April, the metal was up 11.73% during probably the worst period in economic history since the 1930s Great Depression. Below we chronicle what top experts have to say about gold in the year of the pandemic – its portfolio role, its qualities as a disaster hedge, and its price potential.

Sources: TradingView.com, NBC News

Hedge fund involvement in gold deep and unlikely to unwind soon

Financial Times ran a comprehensive report on recent involvement of hedge funds in the gold market citing several prominent names, among them Paul Singer’s Elliot Management. “New York-based Elliott,” says FT, “which manages about $40bn in assets, told its investors last month that gold was ‘one of the most undervalued’ assets available and that its fair value was ‘multiples of its current price’.” Hedge funds have been among the chief supporters of the gold bullion market in recent months. Gold ETFs, the primary beneficiary of that interest, added a strong 298 tonnes to their holdings in the first quarter of the year, according to the World Gold Council. Total ETF holdings now stand at 3,185 tonnes – a new record and the third-largest holding after the United States (8,133.5 tonnes) and Germany (3,373.6 tonnes).

Hedge fund involvement in the gold market is deep, the players are prominent, and their commitments, given the rationales publicly stated, are unlikely to unwind anytime soon. “ALL the smart money,” writes market analyst Fred Hickey at his Twitter feed, “Dalio, Druckenmiller, Tudor Jones, Zell, Gundlach, Singer, Klarman, Einhorn, Mobius (and some who I know are loading up but are doing it quietly) are long gold and understand the simple concept Hugh Hendry explains here. Question is: What are YOU waiting for?” Hickey then reposts famed hedge fund manager Hugh Hendry’s comments: “Today, however, ‘if you fear inflation then you should buy more gold.’ It is simple. The Fed is trying to debase the $ to help the economy. Will it help? Maybe. Will it help the stock market? Probably. Will it help gold? Definitely. This is the final leg that I envisaged in 2002.”

Bank of America says gold is going to $3000

“[B]eyond traditional gold supply and demand fundamentals,” writes Bank of America in a client memo referenced at Barron’s and titled The Fed Can’t Print Gold, “financial repression is back on an extraordinary scale. … Beyond real rates, variables such as nominal GDP, central bank balance sheets, or official gold reserves will remain the key determinants of gold prices, in our view. As central banks and governments double their balance sheets and fiscal deficits respectively, we have also decided to up our 18 month gold target from $2,000 to $3,000/oz.”

Jim Rogers, Steve Forbes jump on the gold bandwagon

Popular commentator Jim Rogers from Beeland Interests has not publicly recommended gold for quite some time, but now that has changed. He told Financial Times that he started buying gold last year and that “inflows into gold and silver will increase as investors lose confidence in government money-printing experiments.”

Steve Forbes also jumped on the gold bandwagon recently saying “the trillions of dollars being spent to save our virus-battered economy are stoking fears of inflation. Gold has always been a hedge against government’s economic blunders.” Forbes’ declaration of interest in gold though does not come as a great surprise. At one time, he advocated a gold standard for the United States as the best way to restore a sound dollar.

Bloomberg’s John Authers enlists his considerable analytical skills to explain what gold might be telling us about the economy and the stock market. “A rising gold price,” he says in a recent column headlined “Gold still shines 50-years after Nixon. Will Netflix?“, “is always a disquieting sign … The stock market, home of optimists everywhere, is doing very well at present. But gold, where pessimists find a home, is doing even better. In dollars, the shiny metal closed on Tuesday at its highest since 2012. The all-time high is in sight, and it has gained more than 60% since its nadir in 2015.”

Over the past twelve months through Friday, May 8, gold is up 33.4%. It is up 11.73% year to date through April. The Dow Jones Industrial Average is down 6.7% over the past twelve months – and 16.1% year to date.

Inflation or deflation? Gold doesn’t care

There are two schools of thought on where we could end up ultimately the result of the aggressive measures deployed monetarily and fiscally by governments and central banks. One says the stimulus fails and we end up in a deflationary depression. The other says it works and we end up with runaway inflation, perhaps even hyperinflation. Some, more optimistic analysts see “V”, “U” and “W” shaped recoveries in our economic future. The worry, though, is that even if such a recovery were to occur, it would be flawed and serve as a precursor to a less than desirable outcome.

Physical gold ownership – and we emphasize the word physical as in the form of coins and bullion – is a peace of mind investment. It balances error elsewhere in your portfolio structure and takes the emphasis off deciding on inflation or deflation simply because it protects, as analyst Clif Droke points out in his regular Seeking Alpha column, against either eventuality. Historically, it is the ultimate store of value and safe haven simply because it is an asset that is not simultaneously someone else’s liability.

“Historically, investors turn to gold at both extremes of the long-term economic cycle; those two extremities encompass both inflation and deflation. Although many consider gold as being mainly an inflation hedge, a historical overview of the metal’s performance shows that gold tends to benefit just as much from the threat of deflation than from inflation. The proof of this can be seen by gold’s outstanding performance during 2008-2011, and again in 2018-2020 when deflationary undercurrents were sweeping some of the world’s biggest economies.

But gold also clearly has benefited when inflation becomes a problem for the U.S. economy in particular. The last time gold was driven by inflation concerns was during the years between 2002 and 2007 when commodity prices were booming as wartime spending was massive, and the U.S. dollar was rapidly losing value.”

Pricing aberrations could reflect bullion banks caught short physical metal

Something very odd is going on in the pricing of gold as we are sure most of you are aware. Thus far the explanations provided, as participants in a recent Gold Panel hosted by Grant Williams point out, fall short of being persuasive. In comments attached to that Panel’s lead page, former COMEX trader and past member of the COMEX Board Brian Willis’ offers a plausible explanation as to what might be happening behind the scenes at the commodities exchange and in the London bullion market.

“The recent blow out of the spot / nearby spread,” he says, “smacks of extreme [panic buying] short covering. The open interest on COMEX has dropped considerably during this time. While the spike in volatility would account for a portion of the drop. It doesn’t appear to explain the totality of the fall off. Therefore I think it would be helpful to explore [to whatever degree possible] what the role of the bullion banks has been in this market aberration. Have the banks and/or their counterparties been ‘caught’ without the physical positions necessary to offset their shorts??? Could it be a short term supply chain issue?? And, has the short exposure been covered, or is there more short covering necessary to flatten out their positions??”

The idea that bullion banks and/or their counterparties might be “caught without the physical positions to offset their shorts” implies substantial positions standing for physical delivery. Of course, under such a scenario, mine closures, refinery shutdowns, and other coronavirus-related developments would only exacerbate the problem. One panel participant, David Ferguson, alludes to the most puzzling aspect of them all and admits to being baffled by it: Normally, a shortage of bullion would put the market in backwardation* – the opposite of what is happening. Willis, in our view, asks the essential questions. The source of this market aberration remains hidden, but unmistakably we see the footprints in the sand. Market participants will be watching closely come June when the next high-volume gold contract on the commodities exchange comes up for delivery.

$10,000 gold?

Myrmikan Capital’s Daniel Oliver in a detailed essay titled Inflation Good and Hard offers three end-game scenarios resulting from the current crisis. In one, he predicts gold could go to $10,000 per ounce. It involves a helicopter drop of money that causes a global currency crisis. “Those who have lived through currency crises,” he says, “know that they are swift, brutal, and irreversible. The lucky who have income or saving in a non-local currency see a sudden, dramatic increase in their purchasing power. Most see their living standards collapse. When the dollar fails, so will nearly all of the other global currencies, since most central banks use dollars as their core reserve asset. Gold will prove to be the only non-local currency.”

One of the more infamous episodes of hyperinflation occurred in Argentina during the late 1970s-early 1980s. A series of poorly executed policies begun under the administration of Juan Peron including the nationalization of industries, expansion of state services, and substantial overseas borrowing undermined the economic prosperity of the country. Unable to finance its spending, the government opted to print money without much in the way of restrictions. It was not long before the inflation rate jumped to an annual average of 300%.

In 1970, it took roughly four pesos to buy a dollar. At the height of the debasement in 1983, the price of a single greenback jumped to 98,500 pesos. To illustrate the value of gold as a hedge during the crisis, in 1970 the melt value of Argentina’s Argentino 5 peso gold coin (pictured below) was about 33 pesos. By 1983, the melt value of that single roughly one-quarter troy ounce gold coin rose to almost 7.3 million pesos. Consider for a moment what it might have meant to the saver astute enough to put away a few 50-coin rolls of the Argentino before the runaway inflation spun out of control.

MAY SPECIAL OFFER Argentina Argentinos Almost Uncirculated Minted 1881-1896 .2334 troy ounces, net fine gold content 300 coins Low premium, beautiful coins reminiscent of 19th century early American coinage Priced competitively with the modern one-quarter ounce gold American Eagle First-come, first-served

Your interest is welcome! Ready to be shipped.

See details / Order online HERE.

Or please call 800-869-5115 x 100

Bloomberg’s McGlone says ‘gold is just hitting its stride’

“When the history of 2020 is told,” writes Bloomberg’s senior commodities strategist Mike McGlone recently in his Twitter feed, “We expect gold to have been a main beneficiary of unprecedented monetary stimulus that typically supports stock prices. New highs in terms of many major currencies portend something similar in dollar-denominated gold as a matter of time. The advancing gold price is just hitting its stride, in our view, as unprecedented global monetary stimulus supports equities but likely does more to sustain the metal’s rise. Gold is outperforming the S&P 500 and the ratio between the two is poised to revert to the higher mean.”

In reading McGlone’s viewpoint, I am reminded of a prescient essay on fiat money and gold published in 2012 by the Cato Institute and written by Kevin Dowd, Martin Hutchinson, and Gordon Kerr. Titled The Coming Fiat Money Cataclysm and the Case for Gold, it comes far in advance of the coronavirus crisis but speaks to the widespread suspicion that the pandemic has not so much been the cause of the current economic crisis, but its catalyst. It exposed what amounts to a pre-existing condition built into the global monetary system as a result of the constant, ever-expanding proliferation of debt and printed money.

“States,” they write, “have claimed the right to manipulate money for thousands of years. The results have been disastrous, and this is particularly so with the repeated experiments with inconvertible or fiat paper currencies such those of medieval China, John Law and the assignats in 18th century France, the continentals of the Revolutionary War, the greenbacks of the Civil War, and, most recently, in modern zimbabwe. All such systems were created by states to finance their expenditures (typically to finance wars) and led to major economic disruption and ultimate failure, and all ended either with the collapse of the currency or a return to commodity money. Again and again, fiat monetary systems have shown themselves to be unmanageable and, hence, unsustainable.”

Closing thought: Hugging as biological terrorism

To close this month’s issue, we will leave with an unsettling thought courtesy of Sovereign Man’s Simon Black. “We’re now living in a world,” he says, “where hugging is considered an act of biological terrorism. It would be silly to think that everyone will come out of hiding and go back to normal… packing bars, airplanes, shopping malls, elevators, offices, etc. like we used to do. There’s going to be some serious, worldwide Post-Traumatic Stress Disorder. Millions of people will permanently change their behavior, reduce consumption, stay home, and avoid contact with others. And this is clearly going to have a lingering economic impact.”

Have you begun to think about the world after the first pandemic wave washes away? …… We all hope for a ‘V-shaped recovery’ and there are some good economic reasons to believe that it is possible although we fall into the camp that foresees the right side of the ‘V’ as being considerably shorter than the left. One of the themes developing among top economic thinkers is that we are rolling into a new paradigm that will create changes in investor psychology that few can predict or define at this point. One of those changes, as Ben Rosenberg suggests in a recent interview at Financial Sense, could very well be a return to saving – saving for a rainy day or saving just to know you have capital put away that can be tapped if events warrant. He believes we are going to end up with “a form of depression”.

“A depression,” he says, “is a shock that creates scars that linger for years. And depression is different than a recession because while a depression is a recession, a depression invokes a secular change in people’s behavior. So how they approach savings, how they approach spending, how they approach indebtedness, how they approach, in this case, where we’re going to work, how we’re going to travel. I think that in both the context of the personal sector and the business sector, it’s going to be a big shift on how we create savings in cash and liquidity. It’s phenomenal to me that liquidity became almost a dirty nine letter word going into this—nobody had any.”

Given the circumstances, saving gold for the long run, in our view (and we admit to a bias), is likely to return to prominence. Rosenberg advocates gold ownership. In fact, earlier in the year he predicted gold would surge to $3000. “Paradigm shifts,” writes Financial Times’ Rana Faroohar in a recent op-ed piece, “tend to happen slowly, and then all at once. That’s the lesson I’ve taken away from the recent market turmoil. As I wrote last week, the surprise is only that the upset didn’t come sooner.” Like Rosen, she gives the green light to gold ownership as a means to hedging that market turmoil.

Up-to-the-minute gold market news, opinion and analysis as it happens. If you appreciate NEWS & VIEWS, you might also take an interest in our Daily Top Gold News and Opinion page.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.