Gold Price Manipulation- Bear Stearns Murdered at the Golden Gates

Commodities / Market Manipulation Oct 10, 2008 - 03:01 AM GMTBy: Rob_Kirby

Much has already been written about the untimely demise of investment bank Bear Stearns. Most, if not all, that has been written to date – deals with issues related to equities / expiring options – or the share price.

Much has already been written about the untimely demise of investment bank Bear Stearns. Most, if not all, that has been written to date – deals with issues related to equities / expiring options – or the share price.

Recently, new information has come to light which allows us to forensically examine the demise of Bear Stearns from a completely different angle – GOLD .

No-one should be surprised by this development. Up until the untimely demise of Bear Stearns, the most celebrated and at the same time misreported and misunderstood financial collapse in American History was that of Long Term Capital Management [LTCM] back in 1998. The treatment – or more properly stated, the decision to bail-out LTCM – was all motivated by GOLD. For a primer on the LTCM / GOLD nexus, readers can gain a nuts-and-bolts background in these two articles:

• The Anatomy of a Fictional Hedge Fund Collapse

• LTCM Revisited - A Forensic Account

That Bear Stearns and LTCM should be mentioned in the same breath should also come as no surprise for another reason; Bear Stearns was the only major player invited by the NY Fed / Treasury to participate in the “then bail-out of LTCM” who refused to participate. Not participating, or bearing a portion of the financial burden, in the suppression of the gold price effectively made Bear Stearns “an enemy of the State”.

So, it's an ironic twist of fate that while LTCM's demise was cloaked because they were secretively and nefariously “short gold”; Bear Stearns was brought to heel [assassinated, more likely] because they were “long” – at a minimum - roughly 12 billion dollars worth of gold derivatives [futures].

At Their Demise, Bear Stearns Was Categorically “Long” Gold

That Bear would be “long gold” would only be consistent with the utterances of their former senior economist, Conrad DeQuadros – who on Jan. 12, 2008 stated,

“Approaching $900 an ounce does cause us to be significantly concerned about the inflation outlook, particularly because there doesn't seem to be a lot of concern from [Federal Reserve Chairman Ben] Bernanke”

and,

“…recent statements from Bernanke suggest the Fed has put inflation on the backburner as it frets about the possibility the United States is slipping into recession.”

Bear Stearns was clearly bullish on gold.

Contrast this to the [cough] official line [or double talk, perhaps?] at J.P. Morgan back in Dec. 14th, 2007,

JP Morgan analysts Steve Shepherd expects gold to trade around $820 an ounce in 2008 if its “intrinsic value remains unchanged” but considers it not “best of class” as a hedge except in the debasement of paper money.

Pretty gutsy call, eh, considering gold was already trading at 815 bucks per ounce two days before this article was published:

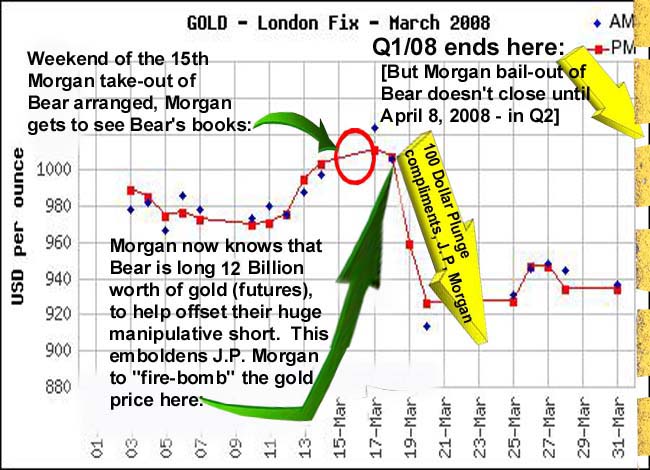

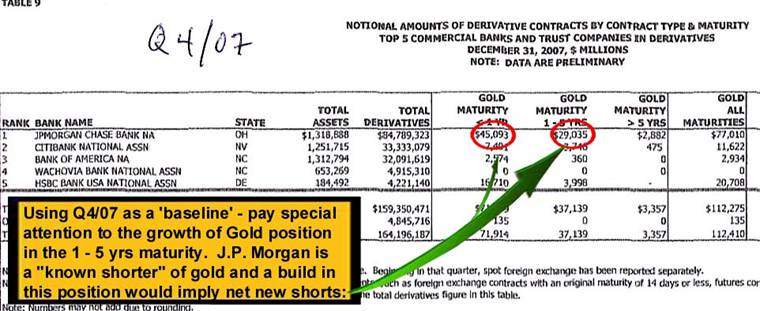

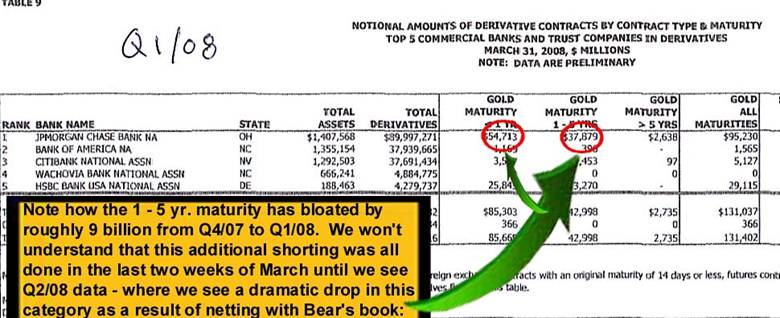

But it is not until one analyzes the gold derivatives [futures] positions of J.P. Morgan – comparing Q4/07 versus Q1/08 versus Q2/08 – that the true picture of the extent to which Bear Stearns was involved in the gold trade truly emerges.

Here's the relevant timeline that encompasses Q4/07 [baseline reference], Q1/08 and Q2/08 [capturing the closing/co-mingling/netting of Bear – Morgan assets in April 08].

“In accordance with the NYSE rule providing that exception, the Audit Committee of Bear Stearns' Board of Directors has expressly approved, and the full Board of Directors has unanimously concurred with, Bear Stearns' intended use of the exception. The closing of the sale of the 95 million shares is expected to be completed upon the conclusion of a shareholder notice period required by the NYSE, which is expected to occur on or about April 8, 2008.”

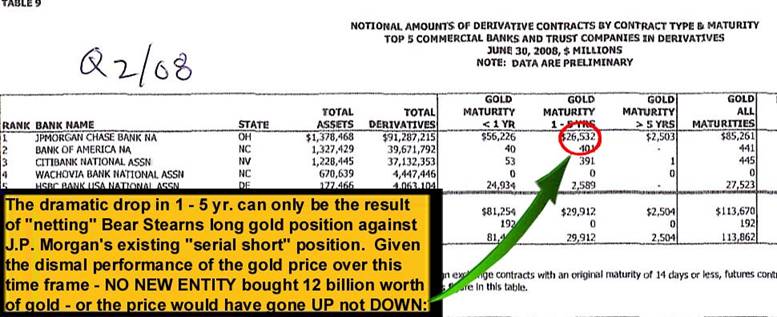

A full forensic reconstruction of the events surrounding the collapse / bail-out of Bear Stearns has not been possible until recently, with the passage of time and the recent release of Q2/08 derivatives report from the Office of the Comptroller of the Currency of the U.S. Here is the progression of J.P. Morgan's gold derivatives position from Q4/07 [baseline] through to Q2/08:

The 12 billion drop in J.P.Morgan's 1 – 5 yr. maturity is representative of the “netting effect” from co-mingling Bear Stearns derivatives book.

What folks need to realize is that a 12 billion injection [long or short] into the ‘relatively illiquid' medium-term gold futures complex [1 – 5 yrs.] – has much more market influence than 9 billion notional [or a like amount] in < than 1 yr. - as occurred in March 08. Cumulatively, the shorts added by J.P. Morgan over a very short period of time, like days or a couple of weeks, is utterly mind numbing – akin to having an elephant jumping through a key-hole. That the gold market was able to absorb this almost unthinkable, intentional, premeditated “criminal shellacking” at the hands of J.P. Morgan Chase is a testament to how enormous global investment demand really is for GOLD .

That J.P. Morgan Chase – an institution with historic and deep links to the Federal Reserve – acted in a criminal fashion is beyond-a-shadow-of-a-doubt. They are and have unquestionably engaged in “ INSIDER TRADING ” and completely desecrated the COMMODITIES TRADING LAW BOOK.

Not surprisingly, the financial world is now waking-up to the fact that high-stakes games are being played in the “paper” [futures] gold arena. This is why the fraudulent futures prices of gold and silver have become bifurcated from the physical markets.

Sadly, when this criminal experiment fails completely – which it will - the perpetrators are going to “wrap themselves in the flag” and claim that they were conducting these operations in the name of NATIONAL SECURITY – but in reality to save the bankers and “un-savable” U.S. Dollar.

Bear Stearns and its employees got in the way of this criminal enterprise – largely because they were long gold.

Absolutely pitiful.

Just remember, you heard it here first.

The J.P. Morgan Chase / Federal Reserve edifice is being run like a CRACK-HOUSE . For the sake of humanity, it needs to be shut down - NOW .

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is the editor of the Kirby Analytics Bi-weekly Online Newsletter, which provides proprietry Macroeconomic Research. Subscribers to Kirbyanalytics.com are benefiting from paid in-depth research reports, analysis and commentary on rapidly unfolding economic developments as well as recommendations on courses of action to profit from chaos. Subscribe here .

Copyright © 2008 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.