Why a Biden Win will Keep Metals Prices Rocking

Commodities / Metals & Mining Oct 30, 2020 - 05:47 PM GMTBy: Richard_Mills

Joe Biden’s performance in Thursday night’s presidential debate was solid. The former vice president was combative against Donald Trump and frequently had the billionaire US President on the defensive. Post-debate analysis centered around the question of whether Trump, who is behind in the polls, did enough to convince voters that taking a chance on Biden would not be in their best interests. The consensus was he had not.

At AOTH we want to know what is coming for the world economy, and just as importantly, what is in store for the metals we are invested in. If Biden wins the election, I am extremely bullish on industrial metals and precious metals, in particular gold, silver, copper, zinc, and nickel sulfides.

Why?

The Democrats winning the White House and both Houses of Congress would throw markets into a tizzy, causing investors to clamber for safe havens. Gold is the world’s oldest flight to safety and the logical response to market fear.

Installing a Democrat in the White House would also be good for gold (and silver) because of Biden’s propensity to add to the debt.

If you think the $27 trillion national debt is too high now, it will go even higher under a Biden administration. In an earlier article we showed the close relationship between debt-to-GDP ratios and gold. The lower the GDP and the higher the debt, the better it is for gold.

As we have suggested, one way to spring the United States from the coronavirus trap is a massive infrastructure spending program, on the scale of President Roosevelt’s “New Deal”.

A global infrastructure spending push would mean a lot more energy metals will need to be mined, including lithium, nickel, cobalt and manganese for EV batteries; copper for electric vehicle wiring and renewable energy projects; silver for solar panels; and rare earths for permanent magnets that go into EV motors and wind turbines.

According to Inside Climate News, Biden has signaled he will embrace central concepts of the “New Green Deal” - a program first espoused by New York Senator, and Democratic wing-nut, imo, Alexandria Ocasio-Cortez - including spending $1.7 trillion over 10 years to achieve 100% clean energy and net-zero emissions by 2050.

(“AOC” will reportedly serve on a panel helping Biden to develop climate policy.)

Dubbed “Clean Energy Revolution”, the plan calls for installation of 500,000 electric vehicle charging stations by 2030, and would provide $400 billion for R&D in clean technology.

Copper

Copper’s widespread use in construction wiring & piping, and electrical transmission lines, make it a key metal for civil infrastructure renewal. A report by Roskill forecasts total copper consumption will exceed 43 million tonnes by 2035, driven by population and GDP growth, urbanization and electricity demand.

The global 5G buildout and the continued movement towards electric vehicles - including cars, trucks, vans, construction equipment and trains - are two big copper demand drivers.

Even though 5G is wireless, its deployment involves a lot more fiber and copper cable to connect equipment.

Electric vehicles and associated charging infrastructure may contribute between 3.1 and 4 million tonnes of net growth by 2035, according to Roskill. EVs contain about four times as much copper as regular vehicles. With each charging station using about 2 kg of copper, that’s 42 million tonnes, or double the current amount of copper mined in one year.

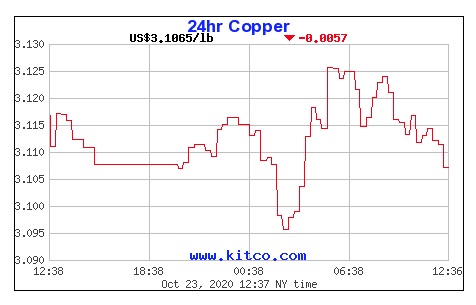

Copper approached a two and a half year high this week on the strength of continued demand from China, which consumes about half of the industrial metal used in construction, communications, transportation and energy transmission.

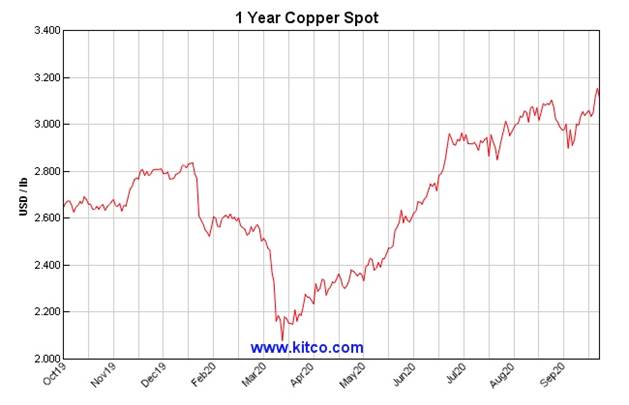

The most actively traded copper futures rose to nearly $3.20 a pound on Wednesday, the highest since June 2018. From four-year lows in March, when the reality of covid-19 shook metals markets, copper prices have gained about 60%, despite slack industrial demand in Europe, the United States and Canada, and a recent rise in copper warehouse inventories.

Indeed, the most pessimistic forecasts of copper demand, and pricing, during the worst pandemic in 102 years have failed to come to pass. The easiest explanation is China. Its manufacturing sector back on track, the country’s copper imports rose sharply over the past four months; in September, China imported 62% more copper than the same month in 2019.

The Chinese economy became the first major world economy to return to its pre-virus growth trajectory, when it posted positive numbers in the second quarter. Recent figures from China’s National Bureau of Statistics indicate that third-quarter GDP growth is up 4.9% from a year ago. Between April and June, Q2, the bureau reported a 3.2% rise.

According to the World Bank and the OECD, the Chinese economy in 2020 will grow 2% - the only G20 country to show positive economic output this year. Beijing has managed to largely contain the virus in recent months after the pandemic shut down its economy in February and March. Commerce and travel have been allowed to resume, which is driving economic growth and fueling demand for copper and other industrial metals, like aluminum and nickel, whose prices are also climbing.

There are other factors at play, including covid-19 related restrictions imposed on the copper mining industry in top producers Chile, Peru and Mexico, along with speculative interest in the metal due to a weaker dollar.

Copper output from the world’s top 10 producers declined 3.7% during the second quarter, due to virus-related lockdowns in Chile, Peru and Mexico.

According to GlobalData, total output during the three-month period decreased from 2.7 million tonnes to 2.6Mt. Total annual mined copper production is around 20 million tonnes.

Another supply squeeze is likely in Zambia, where copper mines have halted $2 billion worth of planned expansions, due to a dispute over a royalty tax introduced last year.

Copper traders are also growing more bullish on the prospect of a Joe Biden victory in the upcoming US presidential election. Obama’s VP has put forth a $2 trillion climate plan that includes upgrading the electrical grid and building more electric vehicle charging stations.

China

As mentioned, China buys around 50% of the world’s copper. The country also now accounts for more than half of demand for nickel, steel and aluminum.

But as we pointed out in a previous article, there is something off in China’s copper usage figures. The country’s importation of 3.55 million tonnes of refined copper during the first nine months of this year – already more than was consumed by China in 2019 – implies a 16% increase in copper consumption.

But JP Morgan, which tracks China’s copper usage, is only expecting a 0.5% increase in real copper consumption. According to the influential bank, via Reuters, the numbers are “strongly hinting that some invisible stocks have been accumulated”, maybe as much as 900,000 tonnes...

There has also been, as [the bank’s executive director Natasha Kaneva] pointed out, “a lot of talk about the State Reserves Bureau” (SRB) buying copper...”

The SRB remains a known unknown in the copper market.

But the key take-away from all the speculation is that everyone agrees there is an ongoing mass transfer of excess stock to statistically hidden inventories in mainland China.

In other words, China is stockpiling copper. The question is, why? The prevailing narrative is that China wants to be the world’s manufacturing hub, and will draw in billions of tonnes of metal – not just copper but iron ore, zinc, aluminum, nickel, etc. - through its Belt and Road Initiative (BRI). China wants to reclaim its position as the world’s most powerful empire and is doing what it needs to do to bring Central Asian countries, and those further afield, into its trading orbit.

As mentioned, China is also planning large investment in renewable energy, which will demand even more copper, silver, and battery metals to store the electricity.

There may, however, be darker underlying motives. China has stirred up the world’s resource markets, by acquiring or partnering with foreign mining companies. For example, grabbing stakes in lithium mines in Australia and Chile, iron ore and copper mines in Africa, nickel projects in Indonesia, and oilsands mines in Canada.

Obviously, we can’t say for sure, given China’s opaque statistics, but we suggest a good chunk of the raw materials are going into bulking up the Chinese Military, in particular its navy patrolling the South China Sea.

China’s problem is it is not a maritime nation, meaning that most of its supplies have to come via land bridges. For this reason, China needs to have firm control over its borders, and cannot risk a naval blockade in the South China Sea.

China’s clashes with India this year over their disputed border in the Himalayas is an example of China’s determination to carve out it’s own sphere of influence much like George Orwell described in his seminal novel, ‘1984’.

China began building up its Military in the mid-1990s, with the goal of keeping its enemies at bay in the waters off the Chinese coast. Claiming territory and building islands in the South China Sea was a way of creating a wide buffer zone to defend primarily against the United States, which sees itself as the defender of international law. The US has important strategic interests in the region, with major military bases in Japan, the Philippines and South Korea.

The region is also a critical shipping lane - roughly half a billion people live within 100 miles of the South China Sea coastline and shipping volumes have skyrocketed - and hosts a wealth of fisheries, oil and gas. According to the World Bank, the South China Sea holds proven oil reserves of at least 7 billion barrels and 900 trillion cubic feet of natural gas.

Long seen to be inferior to the powerful US Navy, including the Japan-based 7th Fleet, in just over two decades the People’s Liberation Army has amassed one of the largest navies in the world. According to an in-depth Reuters feature on the Chinese Military buildup,

China now rules the waves in what it calls the San Hai, or “Three Seas”: the South China Sea, East China Sea and Yellow Sea. In these waters, the United States and its allies avoid provoking the Chinese navy.

This increased Chinese firepower at sea - complemented by a missile force that in some areas now outclasses America’s - has changed the game in the Pacific. The expanding naval force is central to President Xi Jinping’s bold bid to make China the preeminent military power in the region. In raw numbers, the PLA navy now has the world’s biggest fleet.

China has acted to aggressively rein in regions with desires for self-determination, ie. Hong Kong and Taiwan.

Under Obama, the US could not prevent China from annexing 80% of the South China Sea, defend freedom of navigation through the $5-trillion annual maritime trade corridor, or stop China-backed North Korea from conducting nuclear tests.

Ongoing maneuvers in the South China Sea show that Beijing is willing to flex its muscles in a region it sees as strategically and economically important - even if it means going up against the almighty US Navy, mandated to safeguard international shipping lanes and to defend its ally, Taiwan, considered by China to be a renegade province that snatched traditional Chinese territory and must be united with the motherland.

China can’t afford to have Taiwan sitting there armed to the teeth by the US and eventually the PLA will take them out; in my opinion (I am not alone) an invasion will happen before July 2021, when the Chinese Communist Party marks its 100th anniversary.

Congressional leaders are currently deliberating a $3.6 billion bill to counter Chinese aggression in the Pacific, according to Defense News.

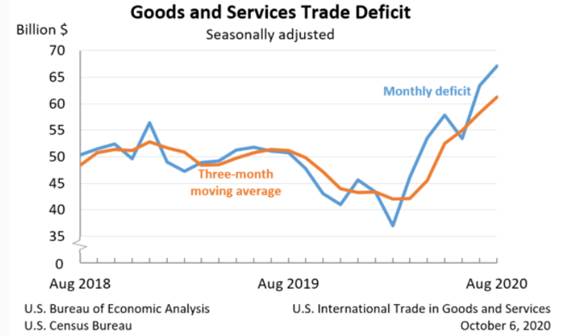

Of course, China and the US have been butting heads, economically, for the past 2.5 years. The US-China trade war has resulted in hundreds of billions worth of tariffs levied, attempts to counter Chinese barriers to entry, and sanctions against Chinese individuals and companies. China has even threatened to restrict its exports of rare earth elements, in what would be a repeat of Beijing’s trade action in 2010 that resulted in rare earth oxide prices going ballistic.

I wouldn’t be surprised to see China eventually cut North America off from all the metals it currently has a monopoly over. The Chinese have locked up the rare earths market and they are the primary player in a number of critical mineral markets including cobalt, graphite, manganese and vanadium.

Fortunately the US government has finally come around to understanding this could and probably will happen and is taking steps to prepare.

The Trump administration recognized this when the president issued an executive order in December 2017, instructing his government to devise “a strategy to reduce the Nation’s reliance on critical minerals” that are largely imported. Last week Trump signed another executive order declaring US reliance on importing these minerals from adversaries like China a national emergency.

If China were to suddenly refuse sale of any of the 20 metals the US deems critical to the economy or defense of the nation, such as manganese needed to make steel, or rare earths used by the Military, the US economy and its defense capabilities would be in serious trouble.

Not your father’s recovery

China’s dominance in the manufacture of personal protective equipment (PPE) and ventilators, has also raised alarm bells in Washington, amid widespread shortages of ventilators and PPE in US hospitals treating patients stricken with coronavirus.

Insufficient preparation for the pandemic is one of the main reasons the United States leads the world in the number of cases and fatalities from covid-19. The Trump administration’s highly criticized response to it may be what prevents the mercurial president from winning a second mandate. It is obviously the main blockage preventing the US economy from growing. Until the pandemic is beaten – and I mean beaten in the way that China has pummeled it – there will be no traditional recovery, like in previous recessions.

A lot has to happen. First the government must do everything it can to get people back to work. While there is optimism regarding unemployment – the number of weekly jobless fell to 767,000, the lowest since March – there are still tens of millions not working. Economists therefore expect the pace of recovery to be slow.

A recent survey published by NPR found that a majority of low-income minority households had their savings wiped out, compared to white households and others with incomes over $100,000, which managed to escape financial calamity. The recent expiration of $600 weekly stimulus checks, affecting tens of millions of Americans, has exacerbated the situation.

And it does not seem like help will be coming until after the election. The $2.2 trillion stimulus package agreed to by Trump and Nancy Pelosi was chopped down by Senate Republicans to a half a billion. That lesser package was recently rejected by Senate Democrats.

Globally there is no recovery either.

Countries that initially recovered from the pandemic, by lifting lockdowns, are now facing a long period of modest expansion, meaning it will likely take many months, if not years, for the global economy to bounce back to pre-pandemic levels.

For example, economists predict it will take until 2022 for the British economy, which suffered the worst decline among rich countries during the second quarter, to recuperate. It also won’t be until 2022 that the US economy recovers, economists say.

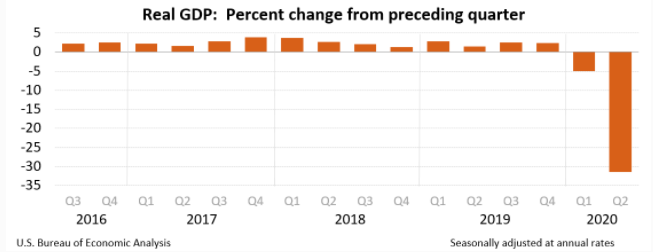

US real GDP

In the eurozone, industrial sentiment has collapsed. The global economy contracted for a second straight quarter in Q3. Across the Group of 20 leading economies, the 3.4% decline in output during the first quarter, was the largest since records began in 1998, while the steep second-quarter drop was without precedent since the end of World War Two.

Another depressing fact concerns the success rate of vaccines. Hundreds of companies are going balls to the wall trying to develop a covid-19 vaccine, but we know from previous coronaviruses (like SARS, MERS) that vaccines don’t work very well with this type of virus.

The challenges most countries are facing right now are daunting. Not only do they need to have a plan for recovering from covid-19, the supply chains that have been interrupted or broken by the virus have to be repaired, so that the essentials, ie., food/ medicine/ fresh water, can get to those in need.

In a previous article we reported on how the coronavirus is exacerbating inequality and global hunger.

The World Food Program’s recent ‘Global Report on Food Crises 2020’ highlights 55 countries where 135 million people are facing crisis-level food insecurity, and that was before covid-19. Adding the pandemic to their problems accessing food and proper nutrition, creates an “excruciating trade-off between saving lives or livelihoods or, in a worst-case scenario, saving people from the coronavirus to have them die from hunger.”

The report suggests that shutting down businesses and locking people in their homes to protect them from the virus, is expected to exacerbate poverty and hunger, thereby killing more people than the virus itself.

But there is more that needs to be done. A lot more. On top of the covid crisis there is a climate crisis, and for lack of a better term, a “technology” crisis. Governments must make funding available for 5G networks so that businesses are not left behind as the world moves more into digitization and automation which require robust Internet and cellular infrastructure.

The fossil-fueled based transportation system needs to be electrified, and the switch has to be made from oil, gas and coal-powered power plants to those which run on solar, wind and thorium produced nuclear energy. If we have any hope of cleaning up the planet, before the point of no return, a massive decarbonization needs to take place.

In a recent report, commodities consultant Wood Mackenzie said an investment of over $1 trillion will be needed in key energy transition metals over the next 15 years just to meet the growing demands of decarbonization.

“One can argue about both the pace and scale of the energy transition but the criticality of metals to its realization is without question,” says Julian Kettle, Wood Mackenzie’s vice chairman of metals and mining. “Put simply, the energy transition starts and ends with metals. If you want to generate, transmit or store low/no-carbon energy you need aluminum, cobalt, copper, nickel and lithium.”

Strange how Wood Mackenzie forgot about silver, without which there will be no energy transition.

The solar power industry currently accounts for 13% of silver’s industrial demand.

More and more silver will be demanded for its use in solar photovoltaic cells, as countries move further towards adopting renewable energy sources. Around 20 grams of silver are required to build a solar panel. The Silver Institute predicts 100 gigawatts of new solar facilities will be constructed per year between 2018 and 2022, which would more than double the world’s 2017 capacity of 398GW.

For now though, the immediate need is obviously rescuing economies that have been crushed by the pandemic.

In an earlier article we said what the global economy really needs, in this low-growth, spending-stalled environment , is a push - something big that will attract huge amounts of investment, and workers. We have suggested this could be a massive infrastructure spending program, on the scale of President Roosevelt’s “New Deal”.

The New Deal provided a template for focused government spending programs that target large infrastructure projects. Among its programs that helped the United States to recover from the Great Depression were the Tennessee Valley Authority, which built hydroelectric projects in the hard-hit Tennessee Valley region, and the Works Progress Administration, a jobs program that employed 8.5 million people from 1935 to 1943.

In an earlier article we suggested how a “Debt Jubilee” retiring the world’s $246 trillion debt burden, combined with a massive infrastructure building program, could kickstart the global economy flat-lined by the coronavirus.

Governments, relieved of their crushing debts, would be free to offer generous social programs without having to hike taxes. They could also finally dedicate the vast sums of tax dollars required to address global warming, and the trillions of dollars-worth of investment needed to close the global infrastructure gap. That means making funds available for worn-out highways, bridges, airports, sewage systems, new money for subway systems, buses, new recreation centers, etc.

Released from the thumb screws of debt, consumers, businesses and governments are free to spend and borrow, at rock-bottom interest rates. It's practically free money, and best of all, it comes with no strings. Over a short period of time, the world economy starts growing again.

The world faces a global infrastructure deficit of $94 trillion. To close the gap, annual infrastructure spending would need to rise by 0.5%, according to a report from the G-20-backed Global Infrastructure Hub.

The Federation of Canadian Municipalities says Canada needs to spend $2 billion a year, to meet current infrastructure needs.

According to the American Society of Civil Engineers, from 2013 to 2017 (when its last Infrastructure Report Card came out), there has been no improvement in bridges, roads, drinking water, energy, aviation and dams. Estimates are it will take $4.6 trillion by 2025 to bring US infrastructure up to an acceptable standard.

Biden and metals

During the presidential debate on Thursday, Joe Biden indicated if he becomes president, there will be a major shift away from fossil fuels to clean energy – wind and solar. In a prelude to what a future US-China relationship might look like, the Democratic nominee’s clean energy plan appears to be tracking China’s.

Last month, Chinese President Xi Jinping pledged to make his country carbon neutral by 2060, raising expectations that the China’s next Five Year Plan, starting in 2021, will heavily feature renewable energy projects. Bloomberg reports that China may accelerate its goal of making 20% of primary energy use from non-fossil fuels by 2025, instead of 2030, meaning a major increase in wind and solar installations.

Key to Biden’s $1.3 trillion infrastructure improvement plan, is a $50 billion investment in repairs to roads and bridges; $10 billion for transit construction in poor areas of the country; a doubling of BUILD and INFRA grants, and more funding for the US Army Corps of Engineers.

The plan also includes investments in high-speed rail, public transit, bicycling, school construction, expansion of rural broadband, and replacement of pipes and other water infrastructure.

There are two things that are practically certain if Biden wins the White House and the Democrats take back the House and clinch a majority in the Senate. The first is an avalanche of new spending without limits, as put forward by proponents of Modern Monetary Theory. The second is a huge investment in clean energy projects, similar to Obama’s 2009 plan to electrify the transportation system, of which Biden was a significant architect as vice president. As reported by CNBC,

Biden aims to push as much as $1.7 trillion over 10 years into a plan to boost renewable powerand speed introduction of electric vehicles, through tax credits, boosted research and development into technologies including large-scale battery power storage and carbon capture and minimization, and modernizing infrastructure, including the nation’s electricity grid and a nationwide network of public charging stations for EVs.

The Biden campaign has reportedly told US miners it supports boosting production of metals used to make EVS, solar panels and other materials crucial to his climate plan. He also supports bipartisan efforts to build a domestic supply chain for lithium, copper, rare earths and other strategic materials the US currently imports from China and other countries.

MMT

Biden, despite claims to be otherwise, is a socialist. He believes strongly in the power of the state to tax and spend, and will face overwhelming pressure from the left wing of the Democratic Party – supporters of hard-left progressives like Elizabeth Warren and Bernie Sanders – to toe the party line. A long wish list waits to be filled, with little to no consequence to the already out of control $27 billion national debt, courtesy of Modern Monetary Theory, or MMT.

Modern Monetary Theory is a new way of approaching the US federal budget that is both unconventional and absurd. It posits that rather than obsessing about how large the debt has grown and the ongoing annual deficits that fuel debt, we should focus on spending, specifically, how the government can target certain spending programs that will cause minimal inflation. Fiscal policy on steroids is, according to its proponents, to be the new engine of US growth and prosperity.

Government is therefore given a free pass on spending, because the only thing that we have to worry about with the national debt is inflation. Curb inflation and the debt can keep growing, with no consequences. This is because the US government can never run out of money. It just keeps printing money, because dollars are always in demand (with the dollar being the reserve currency, and commodities are traded in dollars).

One of MMT’s main proponents is Stephanie Kelton, an economics professor who advised Bernie Sanders’ 2016 presidential campaign. Among the statements she makes in a video explaining MMT, Kelton says “The US dollar is a simple public monopoly. In other words, the United States currency comes from the United States government.” That means the federal government doesn’t need to “come up with the money” in order to be able to spend. It just prints money and spends it.

Modern Monetary Theory and the ideas of the Democratic Party’s far left fit like hand and glove. Pleas for universal medical coverage, free college tuition and a minimum $15 per hour wage can all be paid for by setting the money presses free.

Among MMT’s critics is Stephen King (not that Stephen King) who disparages the theory in a recent Financial Times column:

Still, imagine for a moment that governments embrace MMT. Imagine too, as MMT proponents suggest, that control of the printing press is taken away from unelected central bankers and given to “accountable” elected fiscal representatives. Would we be any better off? Far from it. Giving elected representatives the keys to the printing press is the equivalent of giving a gambling addict the keys to the casino. For many politicians, the primary objective is to remain in power. As such, they will too often be incentivised to pursue instant gratification at the expense of longer-term stability.

More importantly, inflation and taxes are, in many ways, simply two sides of the same coin. Those governments without access to tax revenues can instead “debase the coinage”. Supporters of MMT claim this will never happen, yet history suggests otherwise: after all, it has been a tried and tested policy of kings and queens over hundreds of years. Too often, those with access to the printing press are prepared to take undue risks in the hope that “this time it’s different”.

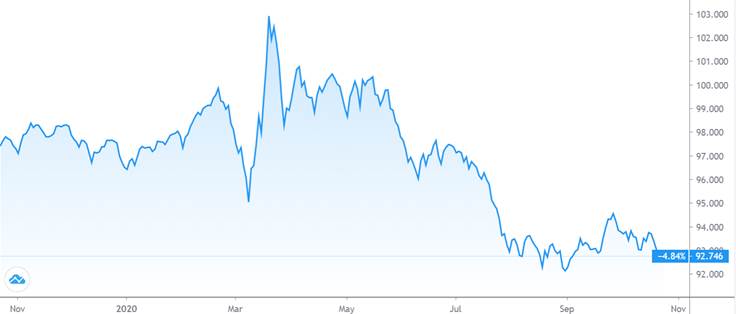

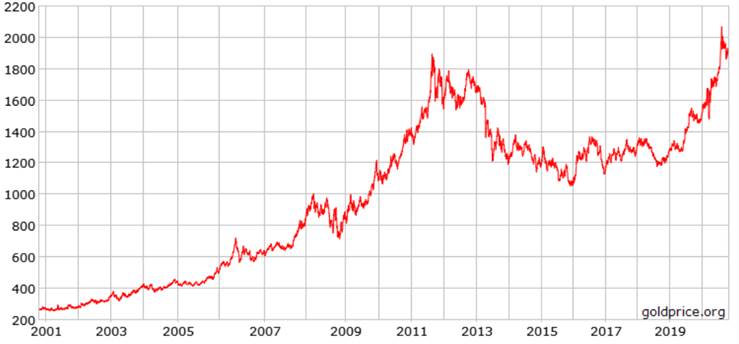

Sinking dollar

It doesn’t take a great deal of economics knowledge to see that MMT would decimate the value of the US dollar, which has lost a significant amount of value since hitting multi-year highs in March.

The dollar and commodities move in opposite directions, because when the dollar falls, those using other currencies get a better exchange when they swap their money for US dollars, thereby boosting demand for said commodities.

For example, when the dollar slumped between 1998 and 2008, gold prices nearly tripled, reaching $1,000 an ounce in early 2008. A falling dollar due to MMT will be good for gold, and all metal prices.

US $

Gold US $ ounce

Gold prices will also be strengthened by a slew of other factors, including covid-19, inflation expectations on the back of (seemingly) unlimited monetary stimulus, low interest rates worldwide, and geopolitical concerns especially US-China tensions over trade and the South China Sea.

Even if Biden’s doesn’t fully embrace MMT we expect stimulus spending on steroids especially if he gets a Democratic mandate from both the Senate and the House. The flood gates of coronavirus relief will be opened, with billions spent on mandatory masks, stricter social distancing protocols, increased and sustained relief for individuals, businesses, food banks, day cares etc. As long as interest rates remain low, and they are expected to until at least 2023, expect many trillions of dollars to fly out of the Treasury, with little to no consideration of the consequences.

Structural metals deficits

At this point I hope you are beginning to see the formulation of a bull case for precious, clean energy and industrial metals. On top of surging demand for copper, silver, zinc and nickel, from heavily green infrastructure programs designed to lift sagging economies out of the pandemic, we have current and emerging structural deficits for a number of metals, that will keep prices buoyant for the foreseeable future.

The only reason we haven’t seen metal prices spike higher, is that demand for them has come off a bit due to the pandemic. When demand is restored, the supply-demand imbalance will be striking.

According to the International Copper Study Group (ICSG), the refined copper market is likely to register a deficit this year of 52,000 tonnes – against a 280,000t surplus the group forecast this time last year. The reason as mentioned at the top is an unexpected push for copper imports from China, which has pretty much recovered from the pandemic; and the fact that global copper production has been upended by the coronavirus. The ICSG predicts global copper mine production will fall 1.5% this year, the second consecutive year of lower output.

Longer-term, copper supply is almost certain to be squeezed.

As we have reported, without new capital investments, Commodities Research Unit (CRU) predicts mine production will drop from the current 20 million tonnes to below 12Mt by 2034, leading to a supply shortfall of more than 15Mt. Over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place.

Despite new zinc mines opening in Australia and Cuba, zinc supply has failed to keep up with consumption. Some very large zinc mines have been depleted and shut down in recent years, with not enough new mine supply to compensate. Like copper, zinc has benefited from strong Chinese metals demand. While prices fell 17.3% during the first quarter owing to pandemic-related uncertainty, prices have since recovered, with three-month zinc averaging $2,121 per tonne over the first eight months of the year.

Tesla has expressed concern over whether there will be enough high-purity “Class 1” nickel needed for electric-vehicle batteries.

According to BloombergNEF, demand for Class 1 nickel is expected to out-run supply within five years, fueled by rising consumption by lithium-ion electric vehicle battery suppliers. Nickel’s inroads are due mainly to an industry shift towards “NMC 811” batteries which require eight times the other metals in the battery. (first-version NMC 111 batteries have one part each nickel, cobalt and manganese).

But a lot of nickel will still need to be mined for stainless steel and other uses. The nickel industry’s dilemma is therefore how to keep the traditional market intact, by producing enough nickel pig iron (NPI) and ferronickel from laterites to satisfy existing stainless steel customers, in particular China, while at the same time mining enough nickel sulfides to surf the coming wave of EV battery demand?

Among a wave of covid-19 shutdowns this summer, some of the biggest producing silver mines in the world were shut down, although some production has come back online. The Silver Institute is predicting a 13% decline in silver production from Latin America this year - equivalent to 67 million fewer ounces - with global supply set to fall 7.2%.

Given supply and demand factors (including robust industrial and investment demand for the precious metal), Capital Economics estimates the silver market will remain in a small deficit, right through to 2022.

Commodities bull

We aren’t the only ones with a sanguine view of commodities going forward.

Goldman Sachs contends, via Zero Hedge, that A weaker U.S. dollar, rising inflation risks and demand driven by additional fiscal and monetary stimulus from major central banks will spur a bull market for commodities in 2021, Goldman's chief commodity strategist Jeffrey Currie said on Thursday, also predicting that "all commodity markets are in, or moving toward, a deficit with inventories drawing in all but cocoa, coffee and iron ore."

The bank, which notes that markets are increasingly concerned about the return of inflation, forecast a return of 28% over a 12-month period on the S&P/Goldman Sachs Commodity Index (GSCI), with a 17.9% return for precious metals, 42.6% for energy, 5.5% for industrial metals and a negative return of 0.8% for agriculture.

Focusing on Gold, Currie said that expansionary fiscal and monetary policies in developed market economies continue to drive interest rates lower and create demand for hedging the tail risks of inflation, lifting demand for precious metals. As a result, Goldman forecasts gold prices at an average of $1,836 per ounce in 2020 and $2,300 per ounce in 2021, and expects silver prices to be at around $22 per ounce in 2020 and $30 per ounce next year.

Conclusion

History does not repeat itself, but it does rhyme. If Joe Biden is elected president in November, it’s going to be like Christmas morning for industrial, clean energy and precious metal focused junior resource companies.

Of course, we don’t know for sure what a Biden presidency will look like for mining, but we can use history as a guide. While vice president under Obama, Biden presided over a massive transportation electrification plan. Ahead of the Herd was there, in 2009, and we nailed it when we called lithium a huge investment opportunity.

Biden is a tax and spend Democrat, a socialist who believes in MMT and is going to flip the switch on massive coronavirus stimulus money, along with hundreds of billions, trillions, more for clean energy/ renewables and electrification of the US transportation system which is still heavily skewed toward regular vehicles.

The added stimulus will be great for gold and silver (though horrendous for the debt) and the clean energy/ infrastructure investments will be bullish for industrial metals silver, copper, zinc and nickel sulfides – the latter better suited for the fastest growing segment of the nickel market - EV batteries.

The Biden campaign has already said it supports mining for minerals that support his climate plan, and efforts to build a domestic supply chain for lithium, copper, rare earths and other strategic materials the US currently imports from China and other countries. That’s great news for US mining.

The only problem? We are facing structural deficits for several of these metals. Without a major push, and fat exploration budgets, to develop new deposits, all the majors will be scrambling for every kind of deposit, to replace reserves.

Copper miners will become gold miners, gold mining companies will covet copper-gold deposits, zinc miners will become silver miners, and vice versa.

We live in a finite resource world. Structural supply deficits in many of our soon to be much needed ‘recovery’ metals were already in evidence before covid-19. Global demand for these metals is going to accelerate.

Junior resource companies, not majors, own the worlds future mines and juniors are the ones most adept at finding these future mines. They already own, and find more of, what the world’s larger mining companies need to replace reserves and grow their asset base. The mad dash for resources is coming.

In our opinion there has perhaps never been a better time to be a junior owning a gold, silver, copper, zinc or nickel sulfide deposit, with decent grades in a safe jurisdiction.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2020 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.