The Everything Stock Market Rally Continues

Stock-Markets / Stock Market 2021 Feb 25, 2021 - 06:03 PM GMTBy: Troy_Bombardia

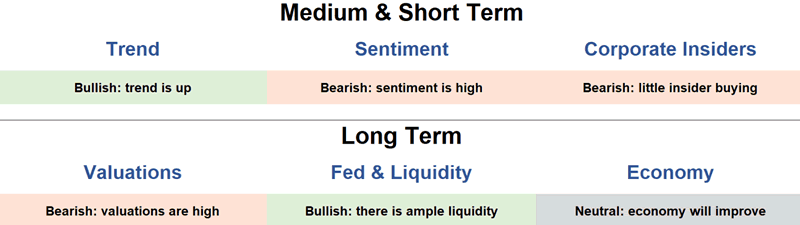

The market’s strong uptrend remains intact despite some lingering concerns about high valuations, extreme sentiment, and other overbought signals. Investors continue to pour into all markets (stocks, commodities, crypto etc.) with ever increasing liquidity.

Now let’s look at some bullish and bearish factors to get a balanced view of the markets.

Average momentum

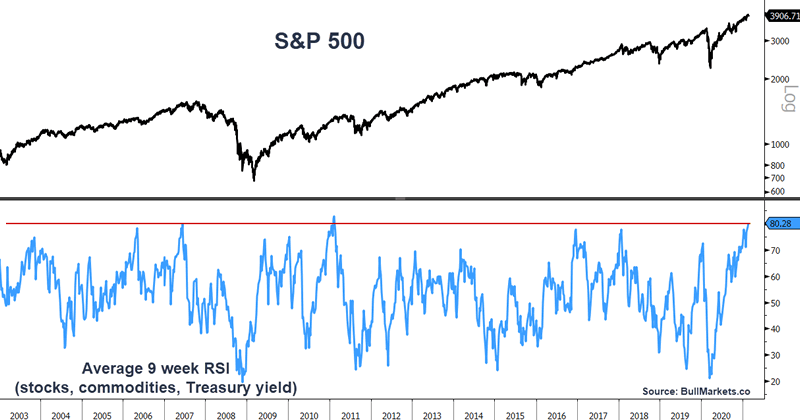

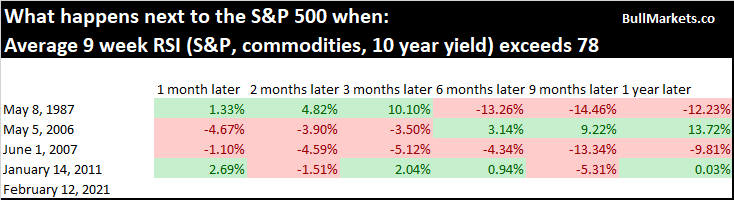

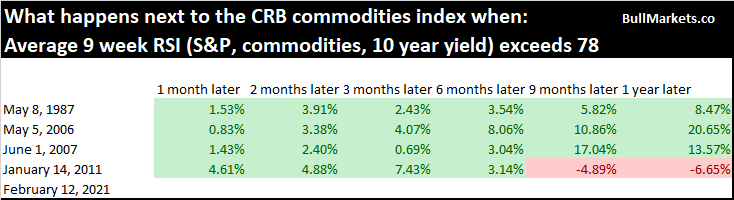

The non-stop rally across almost all markets has pushed many indicators to extreme levels. Taking a 9 week RSI of a combination of stocks, commodities and treasury yields quickly shows that we are at one of the most overbought levels in history.

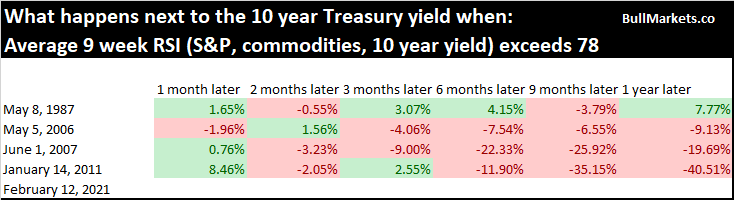

When this happened in the past, it was not a good sign for stocks or the 10-year treasury yield over the next year on most time frames.

However, this was a very bullish sign for commodities over the next year.

Strong Breadth

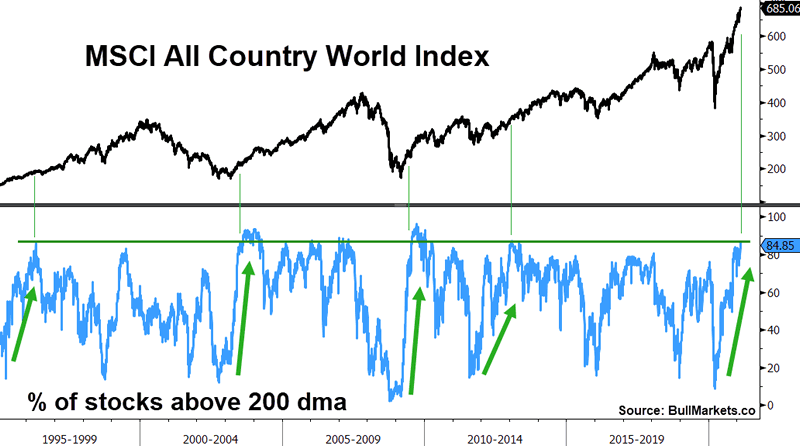

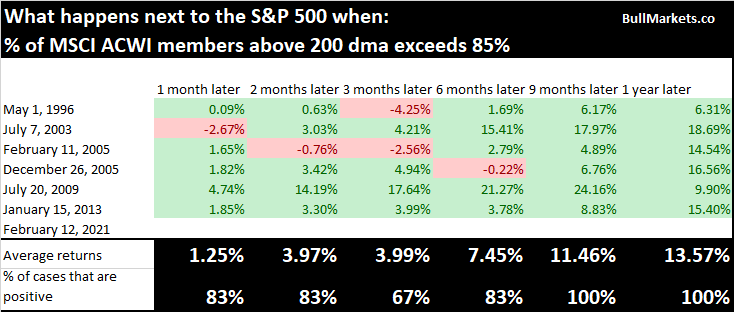

Breadth is incredibly strong around the world. The MSCI All Country World Index has more than 84% of stocks above their 200 day moving average.

Historically, such strong breadth led to more gains in the stock market over the next year.

Improving Economy

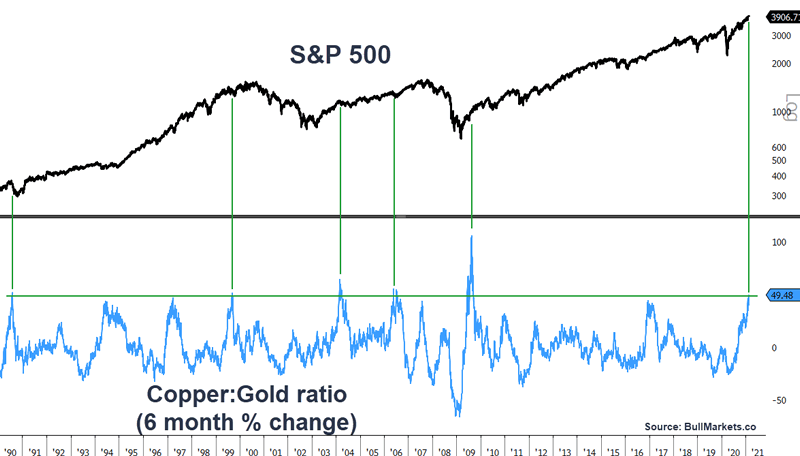

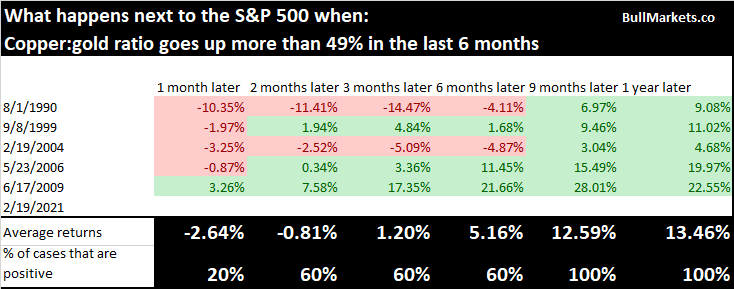

The recent surge in copper has caused the copper:gold ratio to spike. The 6 month percent change of this ratio is now close to 50%.

Such a large spike was only seen 5 other times and this was great for stocks over the next year.

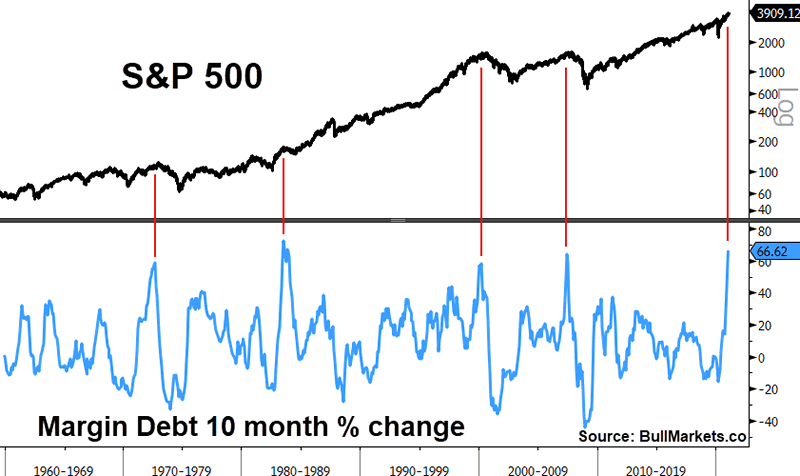

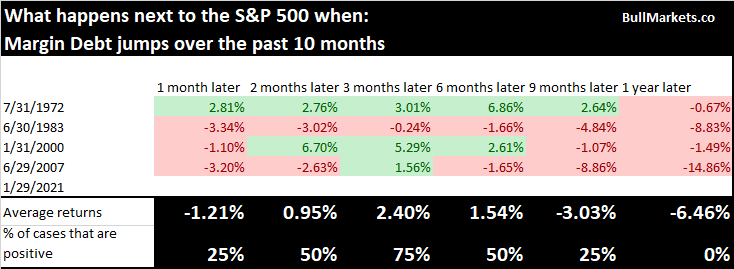

Surging margin debt

U.S. margin debt soared in the past 10 months since March 2020. This kind of increase was only seen 4 other times since 1959.

Three of these cases in 1972, 2000 and 2007 led to a bear market with the exception of 1983, which marked the start of a -14.3% correction that lasted a year.

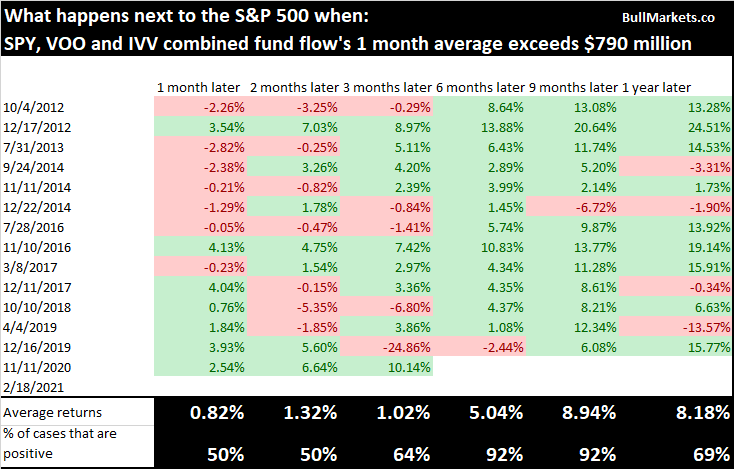

Fund flows

Fintwit has been captivated with the idea that there is a lot of money left on the sidelines that can push stocks higher because fund flows (e.g. SPY ETF) are not registering extremes. This argument is wrong because:

- There is always “more cash in the sidelines”, even at the peak of bubbles. There is no way to measure just how much cash there is left “on the sidelines” because “the sidelines” is a vague concept.

- Not everyone buys funds. This rally has been heavily pushed by traders that are gobbling up individual stocks.

- While fund flow indicators are extremely popular, there are a lot of nuances that traders don’t think.

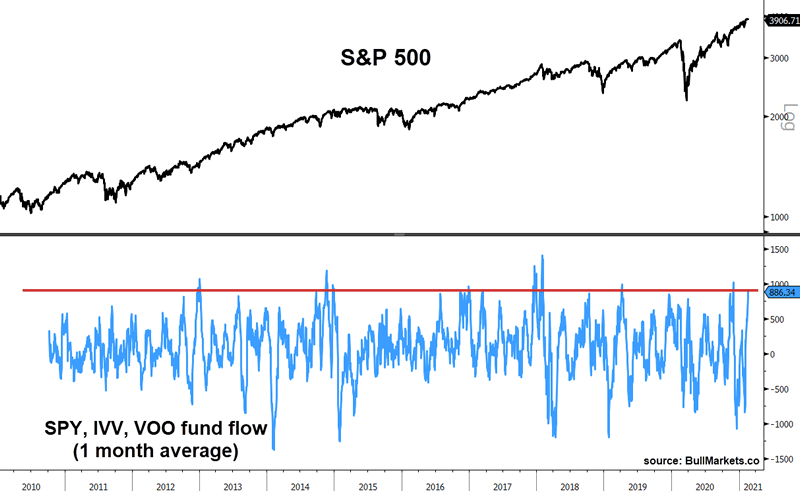

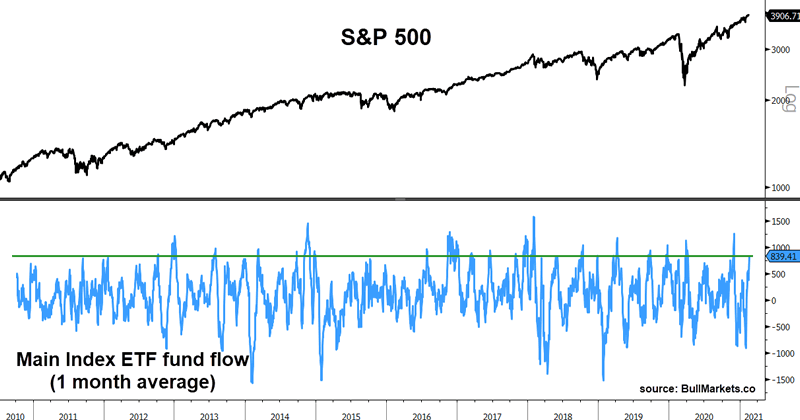

One such nuance is related to SPY. A popular social media artist mentioned that the past 2 years saw crazy outflows from stocks. Crazy outflows = bullish for stocks. But as SentimenTrader pointed out, this is a mis-representation of the truth. Strong outflows from SPY were offset by inflows into other S&P 500 ETFs such as VOO and IVV. When we look at fund flows for these 3 ETFs, the aggregate is not screaming “CRAZY OUTFLOWS! PREPARE TO BUY STOCKS!”

In the past, such strong inflows into S&P 500 ETFs sometimes led to a pullback over the next 1-2 months:

If we look at fund flows into the 3 S&P ETFs and QQQ, DIA, and IWM, we can still see strong inflows:

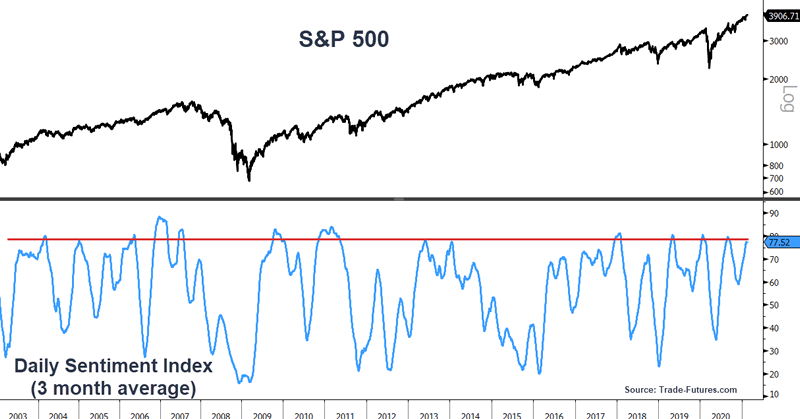

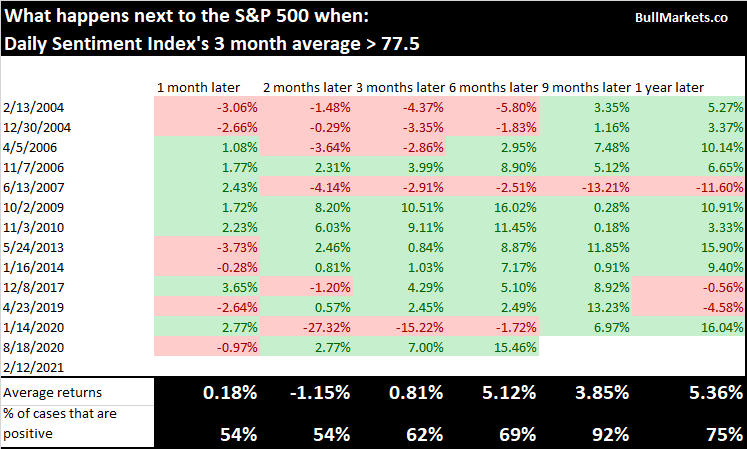

Stock market sentiment

The S&P 500’s Daily Sentiment Index is quite elevated. In the past, this was a somewhat bearish signal for stocks.

Historically, this was a short term worry for stocks over the next 2 months.

Conclusion: market outlook

Here’s how I think about markets based on 3 different strategies & time frames.

- Long term investors should be highly defensive right now. Look for opportunities away from public equities where there is less long term risk.

- Medium term contrarian traders should go neither long nor short. Wait. Risk:reward doesn’t favor long positions right now, while shorting into a speculative rally can end in disaster.

- Short term trend-focused portfolios should continue to ride the bull trend because no one knows exactly when it will end.

My discretionary market outlook does not reflect how I trade the markets right now. I trade based on my trading algorithm that cuts through the noise of endless research, indicators and charts.

By Troy Bombardia

Copyright 2021 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.