Demand-Driven Price Hikes Are Underway

Economics / Inflation Jun 29, 2021 - 04:38 PM GMTBy: John_Mauldin

James Bianco, president of Bianco Research, thinks most of the near-term inflation he foresees will be demand-driven. The fact that a lot of people have a lot of spending money will push prices even higher.

James Bianco, president of Bianco Research, thinks most of the near-term inflation he foresees will be demand-driven. The fact that a lot of people have a lot of spending money will push prices even higher.

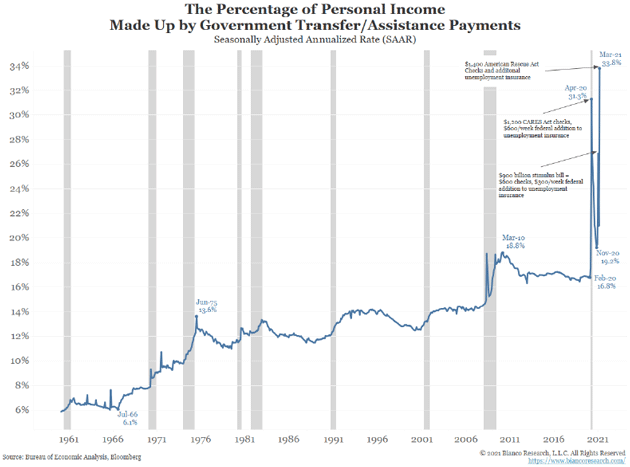

At Mauldin Economics' 2021 Strategic Investment Conference, he posed the question: Where did this cash come from? Check out this chart...

Source: Bianco Research

The blue line shows the percentage of personal income from government transfer payments. This includes Social Security, disability benefits, unemployment insurance, and various other programs.

It also includes the three pandemic “stimulus” payments sent to most American adults. The months in which those payments were made created the peaks you see on the right side.

Notice the steep drop after the first stimulus package and prior to the even higher peak of the start of the second stimulus wave. Ditto for the third.

These percentages rose not only because the stimulus payments were so huge but also because wage income had dropped. However, the cash stimuli made no such distinction.

Everyone got their check, needed or not. So, a lot of it went into savings.

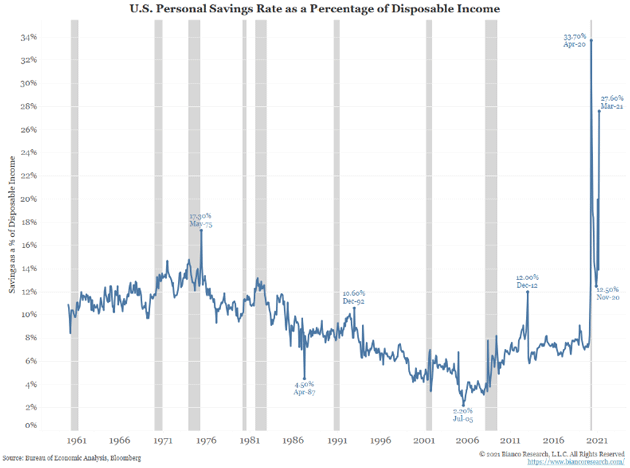

Source: Bianco Research

Again, look at the steep drop-off and increase between the first, second, and third stimulus waves. Some of this excess found its way into financial assets, helping stock prices, Bitcoin, etc. soar. But much of it was spent on other goods and services.

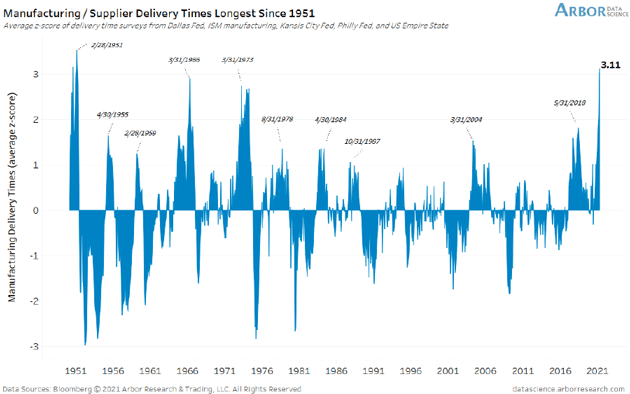

Jim Bianco pointed to rising demand in a variety of sectors that is outstripping producers’ ability to deliver, as you can see in this index of delivery times.

Source: Bianco Research

Having to wait for an item you would once have easily found in the store is itself a kind of inflation, even if the price is the same.

You get less value than you would by taking it straight home. That’s happening right now, and it doesn’t show up in the Consumer Price Index (CPI) or the Personal Consumption Expenditures (PCE) price index.

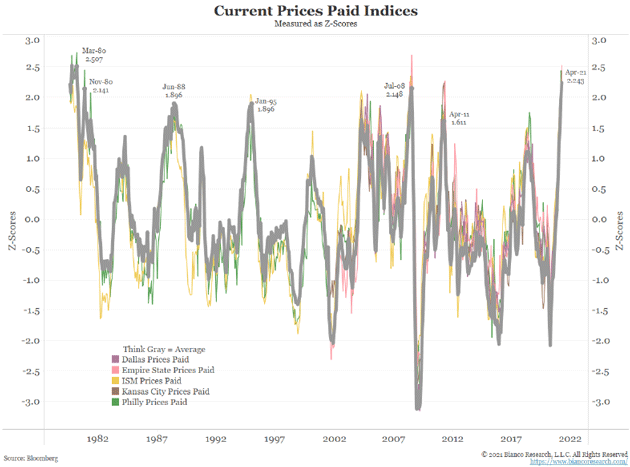

But actual prices are rising too. Jim noted it in raw materials and said finished-goods prices should follow.

He showed this chart of several price indexes tracked by regional Federal Reserve banks. The average (gray line) was last at this level in 1980. Those old enough may recall a little inflation was evident at the time. (1980 saw 13.9% inflation.)

Source: Bianco Research

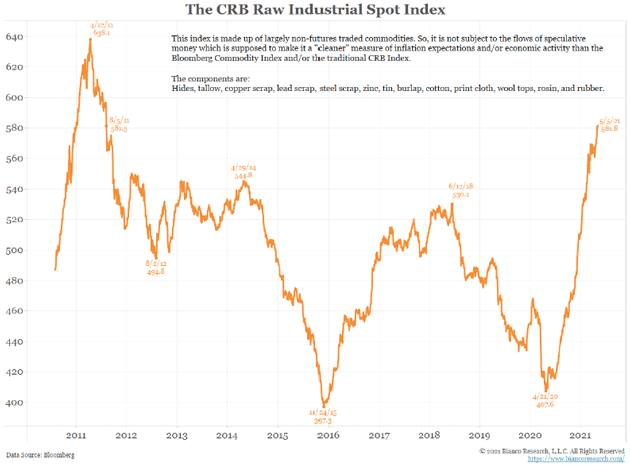

Next, Jim presented this chart of the CRB Raw Industrials Spot Price Index.

This index includes copper and several other commodities that don’t have associated futures markets: steel scrap, tallow, burlap, print cloth, etc.

These are quite important to some key industries—and their prices are rising right now.

Source: Bianco Research

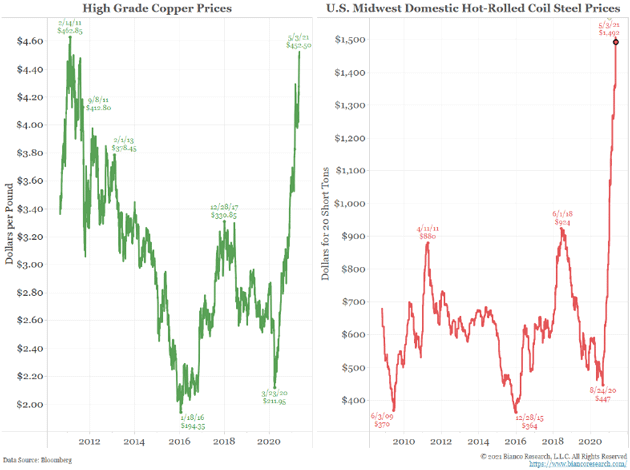

High-grade copper, hot-rolled coil steel, and lumber are all soaring.

Source: Bianco Research

Source: Bianco Research

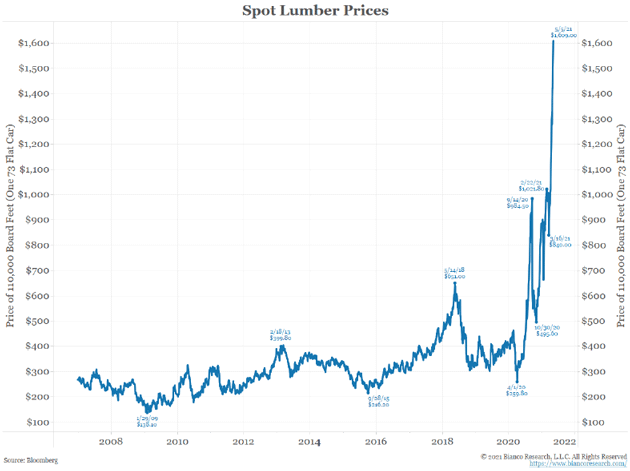

To be fair, much of this price inflation was due to production closures during the pandemic.

Lumber has backed off its heights recently as more supply has come online and high prices are deterring some buyers. This is why the Federal Reserve thinks inflation will be “transitory.”

To some extent, the Fed is correct. But not completely, and certainly not in the other elements of inflation.

Source: Business Insider

Jim summed up his view this way:

One-third of everybody's income is now mailed to them from the government. Everybody is stuffed full of money. They're buying stuff like crazy. The supply chain cannot keep up. It is not a problem of COVID, semiconductors.

Look, the head of Intel said that the semiconductor supply chain is going to be a problem for two years. There is a simple fix for the supply chain. Charge more money; that's called inflation. What they've done now isn't status, they've rationed the product, delivery times are at a 70-year high, but I think the next step is they're going to charge more money, and we're going to get inflation…

But I have a feeling that we're going to find that once the base effect passes, those price increases are going to stick around. People are going to become comfortable raising prices, unanchoring, and then we're going to have something we haven't seen in a long time, and that's inflation.

You pretty much have to be over the age of 50, probably over the age of 60, to remember inflation firsthand. It's been such a long period of time. But what I try to show with this is almost every measure says that inflation is coming back—and it's coming back with a vengeance.

Note: When Jim says “un-anchoring,” that is an economic term. Prices over time tend to be “anchored” to previous prices.

When prices become generally unanchored, you get inflation.

We are already seeing an inflationary heartbeat. The question now becomes how much that pulse will quicken.

The Great Reset: The Collapse of the Biggest Bubble in History

New York Times best seller and renowned financial expert John Mauldin predicts an unprecedented financial crisis that could be triggered in the next five years. Most investors seem completely unaware of the relentless pressure that’s building right now. Learn more here.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.