Bitcoin Bear Market Trend Forecast 2021 and Model Crypto Portfolio Buying Levels

Currencies / Bitcoin Sep 04, 2021 - 11:34 PM GMTBy: Nadeem_Walayat

Today is your lucky day for you gain FULL access to my original full spectrum analysis of the crypto markets that was first made available to Patrons who support my work, of what I expect to happen into the end of 2021 in terms of a Bitcoin price trend forecast, and the strategy I am deploying to capitalise on as well as 5 potential black swans that could collapse the crypto markets such as USDT stable coin. Furthermore you get an update of where Bitcoin price stands in terms of my trend forecast and thus what is likely to happen next.

Bitcoin Bear Market Trend Forecast 2021 and Model Crypto Portfolio Buying Levels

- Investing in the Tulip Crypto Mania

- Bitcoin Price Trend Forecast Review

- Lessons Learned

- Cathy Crypto Wood's View on Bitcoin

- BITCOIN HALVINGS TREND TRAJECTORY

- Stock to Flow Infinity and Beyond!

- Bitcoin, Crypto's and the Inflation Mega-trend

- Black Swan 1 - Will Crypto's Get Banned?

- Black Swan 2 - GOOGLE

- Black Swan 3 - USDT Tether Un-Stable Coin Ponzi Schemes!

- BLACK SWAN 4 - Bitcoin 51% Network Attack by China?

- Black Swan 5 - Bitcoin is Already Obsolete

- US Trending Towards Hyperinflation

- BITCOIN TREND ANALYSIS

- Bitcoin Bear markets analysis - How low could she blow?

- Bitcoin Trend Forecast

- Bitcoin Long-term probable Next bull market price target

- Alternative Scenarios

- My Crypto Bear Market Investing Strategy

- Crypto 1 - Ethereum (ETH) $2600

- Crypto 2 - Bitcoin $40,375

- Crypto 3 - Ravencoin $0.078

- Crypto 4 - Cardano $1.59

- Crypto 5 - Pokadot $25

- Crypto 6 - ChainLink $26

- Crypto's 7 to 10

- Creating The Perfect Crypto

- How to Invest in Crypto Without Getting SCAMMED

- CHIA SCAM COIN

- Binance vs Coinbase

The whole of which first made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for currently just $3 per month that is soon set to increase to $4 per month for new Patrons, so a short window of opportunity exists to lock in at $3 per month https://www.patreon.com/Nadeem_Walayat.

Including access to my most recent just published analysis - Stock Market FOMO Going into Crash Season, Chinese Stocks and Bitcoin Trend Update

- FOMO Fumes on Negative Earnings

- Cathy Woods ARK Funds Performance Year to Date - Chinese Stocks Big Mistake

- INTEL The Two Steps Forward One Step Back Corporation

- AMD Ryzen 3D

- New Potential Addition to my AI Stocks Portfolio

- Why is Netflix a FAANG Stock?

- Stock Market CRASH / Correction

- How to Protect Your Self From a Stock Market CRASH / Bear Market?

- Chinese Tech Stocks CCP Paranoia

- VIES - Variable Interest Entities

- CCP Paranoid

- Best AI Tech Stocks ETF?

- Best UK Investment Trust

- AI Stocks Buying Pressure Evaluation

- AI Stocks Portfolio Current State

- AI Stocks Portfolio KEY

- What to Buy Today?

- INVEST AND FORGET HIGH RISK STOCKS!

- High Risk Stocks KEY

- Bitcoin Trend Forecast Current State

- Crypto Bear Market Accumulation Current State

- Crazy Crypto Exchanges - How to Buy Bitcoin for $42k, Sell for $59k when trading at $47k!

So do consider becoming becoming a Patron by supporting my work.

And my analysis schedule includes:

- Silver Price Trend Analysis, AI Stocks Portfolio Update - 50% Done

- Stock Market Trend Forecast September to December 2021

- How to Get Rich! - 90% done - This is a good 6 month work in progress nearing completion.

- UK House Prices Trend Analysis, including an update for the US and a quick look at Canada - 15% done

- US Dollar and British Pound analysis

- Gold Price Trend Analysis - 10%

Original analysis first made available to Patrons -

Bitcoin Bear Market Trend Forecast 2021 and Model Crypto Portfolio Buying Levels

Investing in the Tulip Crypto Mania

I have always been skeptical of having any meaningful exposure to crypto's for the fundamental fact they have no intrinsic value, no earnings, backed by nothing, where at least the fiat currencies are backed by each nations tax payers and military. A store of value I hear you say? Well you cannot call something a store of value if it can double or halve within a matter of weeks which is what Bitcoin has done THIS YEAR! What's that? Bitcoin supply is limited to 21 million unlike fiat which is unlimited supply with the worlds central banks printing press going 24/7 at full speed. Yes it is true that fiat currency is continuously being devalued but along with Bitcoin there are what? 12,000 additional CRYPTO's, so called Alt Coins and smart contracts, reminds me a lot of mortgage backed securities giving the illusion of safety from money printing when in reality they are the exact opposite, leveraged up to the hilt where just like the subprimes it does not take much to bring the whole house of cards crashing down, hint USDT.

And then there are some really loony crackpot ideas that the many have fallen for hook line and sinker such as CHIA COIN that is busily soaking up the worlds supply of hard drives populated with tens of 100gb files each all for the chance to win a pair of chia coins in the 4608 daily CHIA coin lottery, in fact I consider CHIA to be a SCAM as I will elaborate on later. Then we have the GPU mania, the worlds stock of GPU's gobbled up mainly by Ethereum by 'miners' investing tens of thousands of dollars in mining rigs, hoping that the ETH price will stay high for long enough to get a return on investment which has sent the price of GPU's soaring to ridiculous levels, double, even triple MSRP, with 3 year old GPU's selling for more than what they cost when NEW!

Then there is the fundamental issue of how to value the likes of bitcoin, and as far as I can tell one cannot value it, it is pure speculation, does not matter if the supply is limited to 21 million, those 21 million bitcoins could just as well be valued at worth $1 than $1 trillion!

So the crypto's, regardless of what the crypto enthusiasts that flood the internet with their perma HODL messages are VERY HIGH RISK! Even worse one cannot spread ones risk to a basket of crypto's because they are all basically riding on the coat tails of Bitcoin i.e. whatever Bitcoin does up or down then the others will do twice more! So I consider investing in Crypto's as being very high risk, much higher than investing in a small cap stocks such as featured in my recent article. As at least there each has a real chance of making it, than all being directly correlated to Bitcoin. Which translates into Crypto's being assets that should NOT be held for the long-run, at best for the duration of a bull cycle as there is always the risk of the Emperor has no Clothes event happening i.e. the likes of Bitcoin could become worthless literally overnight as I will elaborate upon how in this analysis.

So Crypto's are HIGH risk, however to offset that high risk they offer high potential returns, especially during the mania peaks! As long as one does not get sucked into the crypto hype than one should be able to profit from the crypto booms by buying during the busts hence this article as we are at the beginnings of the great Crypto bear market of 2021, regardless of the what the likes of Cathy Crypto Wood pronounces such as Bitcoin bottomed at $35k.

So BUY LOW and SELL HIGH 'should' work with the more liquid of crypto's just as it does with most markets most of the time hence this timely analysis that seeks to present my accumulation strategy for what I am going to do over the coming weeks and months as well as the potential risks that could deliver huge flash crashes to the crypto world. So far I have limited myself to mining ETH with payout's in BTC with a couple of desktop PC's though knowing that bitcoin was going to CRASH and enter a bear market have ensured that the bulk of crypto generated has been SPENT.

DISCLAIMER - Investing in Crypto's is VERY HIGH RISK, all the way from putting funds on deposit with exchanges to the actual holding of crypto coins Therefore the analysis in this article is a matter of opinion provided for general information purposes only and is not intended as investment advice. Using Information and analysis derived from sources and utilising methods believed to be reliable, but I cannot accept responsibility for any trading or investing losses that may be incurred as a result of this analysis. Individuals should always consult with their personal financial advisors and do their own research before engaging in any investing or trading activities.

My primary focus is to fund the accounts and set the limit orders for the accumulation phase during the crypto bear market, following which I will rinse and repeat for the distribution phase of the next bull market as I don't buy into the hype that crypto's such as Bitcoin and Ethereum will replace fiat currencies or that Bitcoin is as good as Gold. We'll Gold's done diddly squat in terms of being a save haven if you go back and see what the gold bugs have written during the past decade then the Gold price today should be trading over $10k! The same could happen to the crypto's i.e. they hit a ceiling in terms of speculative interest given that neither generate earnings unlike stocks. So I cannot see how the decentralised crypto's are ever going to be as big as the hype implies as of courser the governments can and probably will adopt block chain technology in favour of their own centralised crypto's that will be backed by tax payers and thus supplant much of what today's crypto developers can ever hope to achieve.

So I am aiming to invest upto 1% at the right price in a small basket of crypto's for about 2 to 3 years., and who knows I may get lucky and double or triple or more my money for maybe a 50% risk of loss of funds invested and of course one can fantasise about crypto's X10ing again just as they have in the past.

Bitcoin Price Trend Forecast Review

Before I venture down the crypto rabbit hole in attempts to map out a potential multiyear trend forecast, here's a review of how my previous Bitcoin trend forecasts panned out.

17th Sept 2019 - Bitcoin Price Analysis and Trend Forecast

Forecast Conclusion

Therefore my forecast conclusion is for the Bitcoin price to hold support at $9,400 in preparations for an assault on $12k, a break of which would target a break of $14k. However if support at $9.4k fails than Bitcoin could trade down as low as $6k BEFORE heading higher.

Peering into the Mists of Time

It looks probable that Bitcoin will be trading at new all time highs, north of $20k during the second half of 2020. And if the price goes parabolic as Bitcoin has a tendency to do then $20k could be a mere blip in a much more aggressive bull run.

Which I updated in March 2020

4th March 2020 - Coronavirus Parabolic Pandemic, Bitcoin Price Trend Forecast

Forecast Conclusion

My forecast conclusion is for the Bitcoin price to mark time by trading down to as low as $7,500 before basing for a run higher to resistance of $10,500 that 'should' break to propel the Bitcoin price towards the next resistance level of $12,000. Thus the bitcoin price could drift lower for the next couple of months or so before resuming a bullish trend as illustrated by this chart.

Whilst my most recent quick take penciled in a target accumulation zone of between $19k and $22k after spending several months warning not to hold any crypto as Bitcoin traded along it's Q1 highs

10th May 2021 - Five More Small Cap Bio and Tech Stocks to Invest for 2021 and Beyond!

So $19k to $22k is where I would consider accumulating Bitcoin which I will develop further in my next analysis that I aim to soon complete and to include a strategy of what to do during an anticipated crypto bear market, of what crypto's I will be looking to accumulate at much lower prices than where they trade today with a significant amount of holdings generated via GPU mining, but for which we have plenty of time as I expect the bear market for most crypto's to run for a good year or so from peak to trough, so I am in no rush to panic buy on chaotic price action.

And this is what has transpired to date over the past couple of years.

Bitcoin traded down to $4k before going higher to $20k, breaking above $20k late 2020 to go parabolic before Bitcoin peaked along it's early 2021 highs and has now entered into a bear market that this analysis will seek to fine tune the probable destination of in terms of price and time with objective of replicating a similar outcome in terms of accuracy as my preceding bitcoin analysis.

Lessons Learned

Bitcoin price can tends to go a lot higher AND lower than anything that can be concluded from technical analysis, very high volatility i.e. it traded to well below $6k before bottoming and traded to well above $20k before topping where I personally thought in a parabolic move it could hit $50k as a far distant price target that it eventually exceeded by 15K to top out at $65k earlier this year. So to factor a higher probability for more distant price targets than technical analysis suggests.

Cathy Crypto Wood's View on Bitcoin

Virtually every one of Cathy Woods crypto videos this year has her restating that she expects Bitcoin to hit $500k, and a few mention an Ethereum target of $10,500. As in her recent video she reiterates Bitcoin going to $500k and that Bitcoin probably bottomed at $35k (https://www.youtube.com/watch?v=oT3vGInOjyY) And apparently in the not to distant future many millions of homes will have Tesla power walls and solar panels all for mining crypto's such as Bitcoin and ETH, so Cathy kills to birds with one stone, pumps Crypto's and Tesla at the same time!

Bitcoin $500k, if only things could be so simple! The ultimate free easy money, Sounds too good to true and so I am skeptical that it's ever going to happen! Still it gives a taste of the mindset of the crypto community, a case of HODL for $500k!

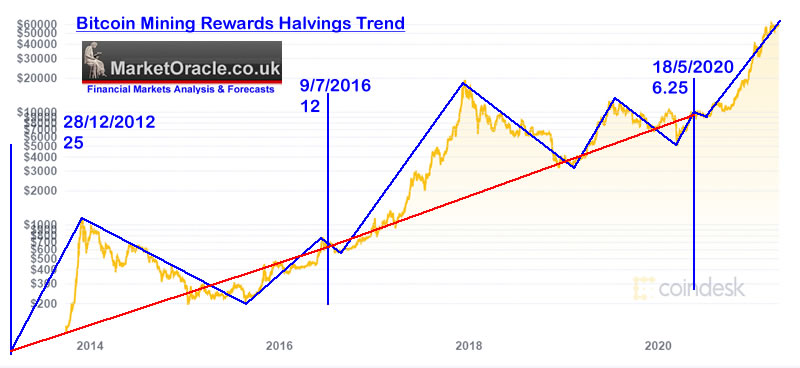

BITCOIN HALVINGS TREND TRAJECTORY

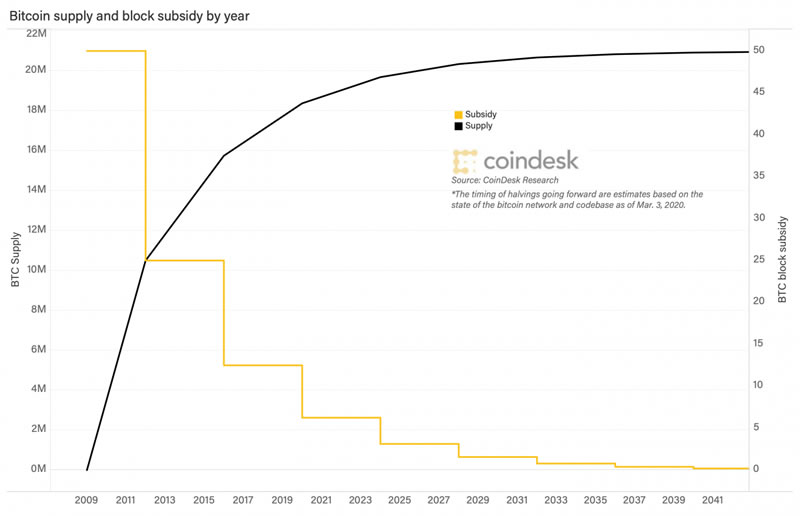

The supply of bitcoin is capped at 21 million coins. Imagine what would happen to the price of Gold if no more Gold could be mined, that's the trend trajectory that Bitcoin appears to be on i.e. there will come a time when NO MORE bitcoin can be mined!

So the simplest thing to do would be to to buy bitcoin when cheap and forget about it for a decade or so and then likely see a return of X10 that which one paid for it.

Total bitcoins mined to date number 18,700,000, 210,000 blocks will be mined from May 2020 to roughly March 2024, totaling 1.3 million bitcoins, which implies a total of 20 million bitcoins by the time of the next halving of rewards for miners to 3.125 bitcoin rewards per block mined (block rewards to miners is how the block chain works).

Which implies by 2028 to expect the bitcoin supply to increase by only 656,000 to roughly 20.65 million, then what? the next 4 years to 2032 will see only 328,000 new bitcoins produced that will take the supply to very close to the 21 million limit.

What this means is that price for transacting in Bitcoins is going to continuously become more prohibitive in terms of transaction fees in response to which bitcoin developers are developing layers on top such as the Lightening Network by doing transactions OFF the block chain, much as exchanges such as Coinbase seek to do i.e. transactions between other exchanges incur block chain transaction fees.

What this implies is that Bitcoin is going to gradually start to seize up both in terms of supply and demand, i.e. miners won't be able to generate rewards and fees to cover their hardware costs and those who transact in bitcoins won't be able to afford the transaction fees.

So how will the Bitcoin developers square this round peg?

By Wrapping Bitcoins into other crypto's namely Ethereum as one solution currently being implemented so most of the transactions will take place off the block chain which then risks the creation of fiat Bitcoins! Which is probably already happening to limited degree. FIAT BITCOIN!

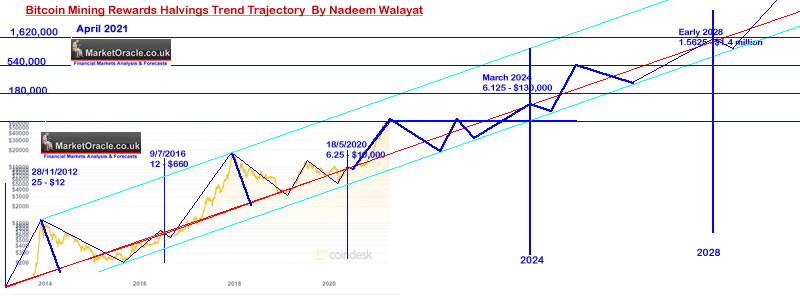

Clearly I am going to have to do a lot more pondering to try and divine what happens as Bitcoin approaches that 21 million limit. Perhaps developers decide to break all the rules and increase the supply of bitcoins, after all it is just code that can be reprogrammed if enough bitcoin holders agree to the change to implement it. Still in the meantime it appears that Bitcoin is on an inevitable long-terms upwards curve that gets accelerated around each halving of miner rewards, hence why so many are bullish about bitcoin in the long-run as the fundamental pattern for the bitcoin price is to surge higher following each halving in miner rewards at each 210k blocks mined with roughly the next halving due around March 2024 and then Mid 2028 that resolves in the following pattern.

Key points

- Bull market in advance of the halving of about 1 year.

- Bull market after halving's of about 1 year, as we experienced Since the May 2020 halving.

- Bear markets to the previous halving's bull market high so targets $20k

- Next halving at approx $130k

- Next Bull market could peak at between $500k and $600k

- 2028 Halving at approx $1.4 million.

Jeepers creepers! Can this pattern really continue as is ? Usually the more often a pattern repeats the more likely it is to fail next time as too many people will be expecting it to repeat.

What I expect to eventually happen is that Bitcoin hits a ceiling where it could remain stuck below for decades. Now the big question mark is where will that ceiling price be? Let's hope it's not already happened at $65k! Remember folks, in 1980 when Silver hit $50, where do you think precious metals investors thought Silver would trade to in future bull markets? I'd imagine a lot higher than $50!

Anyway before we all rush out and buy bitcoin, there is still the bear market to contend with which on face value implies $20k is probable.

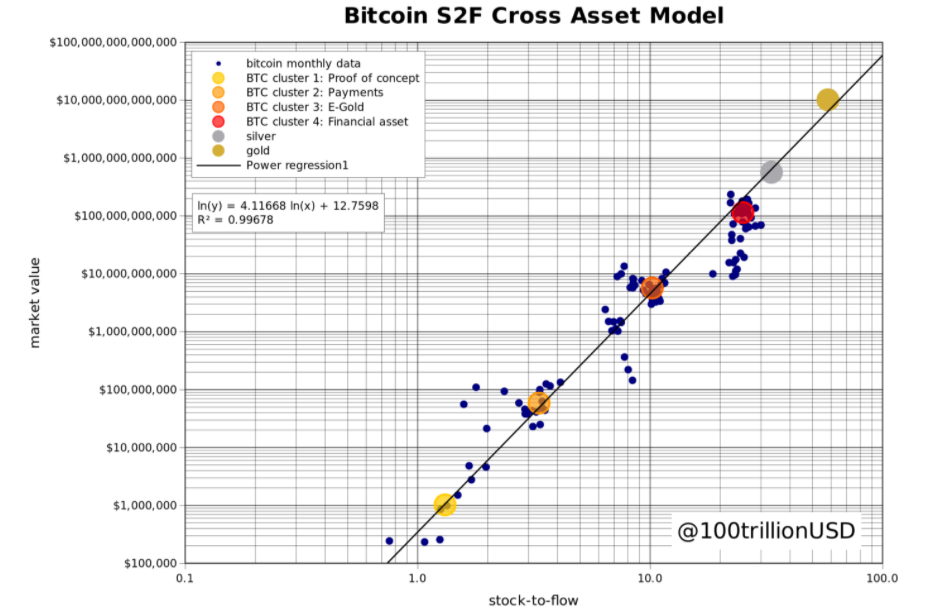

Stock to Flow Infinity and Beyond!

Once you venture into the realm of bitcoins future prospects then you are pretty soon going to be presented with Stock to Flow model projections. Which is basically how many years will it take for new annual supply of bitcoins to cover total available supply of bitcoins and what it suggests for future pricing given that Bitcoins future supply is reducing with each halving.

The stock to flow model suggests Bitcoin hitting $1.3 million during late 2025, sounds possible given what we have already seen happen but continue along this curve and we get to Bitcoin valued at $325 billion PER coin by 2045! Seriously, $325 billion per coin! In that case buy 1 Bitcoin at $40,000 today and then in 20 years time be richer than Jeff Bezos is today! This is what happens when people swallow their own hype. Clearly the stock to flow model is a load of crypto BS, not worth wasting any more time on.

Bitcoin, Crypto's and the Inflation Mega-trend

Where's the link? I don't see it. Which to me suggests that right now and maybe well into the future bitcoin and the rest of the crypto's are basically play money, outside of that which is leveraged to the Inflation Mega-trend. Akin to pyramid schemes where those who create and invest in the coins at start and hoard a large percentage of the coins basically can reap huge rewards the converse is that someone's got to lose and that's the Johnny come lately crypto traders and investors who have been convinced by hype that crypto's are the best thing since sliced bread.

I am not seeing a link between the real world i.e. the Inflationary mega-trend and Crypto's, so I treat crypto's as play money, yes I am mining which is giving me FREE crypto's, which at the current rate of exchange is FREE money. As long as I get a decent amount of free money for the inconvenience of the cooling fans running a little louder than normal then I will continue mining, and spending what the mining yields. But I am wary of investing in crypto's, because they are pyramid schemes.

You see the thing about stocks such as Google, Microsoft and Amazon is that I am pretty confident that any drop in stock price will be temporary because these corporations are growing their revenues and profits. With the likes bitcoin there is NOTHING there! Other than being charged GAS fees whenever one transacts in the crypto which for bitcoin is about $60 and $160 for Ethereum. and they call this a currency? Imagine going to buy a $5 cup of coffee and getting charged an extra fee of $xx, that's what it's like trying to transaction in Ethereum right now.

Today's get rich craze are crypto currencies, what will it be tomorrow? Probably something linked to climate change.

BITCOIN BLACK SWAN EVENTs

To reduce the length of this article the following including 5 crypto market black swans have been posted as a seperate article - Bitcoin, Crypto Market Black Swans from Google to Obsolescence

- Black Swan 1 - Will Crypto's Get Banned?

- Black Swan 2 - GOOGLE

- Black Swan 3 - USDT Tether Un-Stable Coin Ponzi Schemes!

- BLACK SWAN 4 - Bitcoin 51% Network Attack by China?

- Black Swan 5 - Bitcoin is Already Obsolete

- US Trending Towards Hyperinflation

BITCOIN TREND ANALYSIS

Bitcoins price action during the first half of 2021 was a classic distribution pattern that had the smart money (you and me) SELLING out of Bitcoin and other crypto positions.

The chart shows a lower high followed by a break of the 48,000 low which resulted in a measuring move to $36k, around which Bitcoin has been gyrating as it works off an over sold state i.e. so that the scared crypto investors after the May blood bath can start to feel bullish once more, hence if you go online you are going to see a lot of chest pounding going on out there in the crypto world that each passing day proclaim that the bottom is in, Bitcoin withstood it's test and thus it's a Wyckoff to the moon! $180k by October and more!

When instead all Bitcoin has done is to gradually undo an oversold state all without having gone anywhere in price which should mean that Bitcoin is preparing for another leg lower that could be on par with the decline from $65k to $31k off of about $44k, so technically Bitcoin price could trade as low as $10k! No I don't expect $10k to be probable but it is possible, nevertheless trend analysis so far continues to suggest that significantly lower prices than $31k are more probable than not. Though the moves will be very volatile because there are a lot of technical traders out there, trading on margin and reacting to price triggering moves thus magnifying the price trends in either direction that and exchanges running stops to their own advantage.

Elliot Wave - Suggests that we have seen the first ABC of a probable 3-3-5 wave pattern. Which means the current pattern is corrective, that could even extend higher back towards the Mid $40,000. That I am sure would lull many crypto maniacs into a false sense of security before the REAL bear market begins in percentage terms i.e. the move from the high ($44k?), will likely exceed the 52% drop from $65k. Anyway gaming a 52% off 44k would suggest a target of $22k. Which I would equate as to the upper end of a bear market target for Bitcoin.

Support - In terms of where a falling Bitcoin price would gravitate towards and find support we have $29k, $23.5k, $20k, $18k, $14k, and then heavy support at $11.5k. At this time I can not imagine Bitcoin could trade lower than $11.5k, but it could, just that sitting here at $40k it seems pretty far fetched.

So in terms of trend analysis bitcoin is WEAK. The obvious target is the previous highs at 20k. and even below that we have support all the way to $14k, that should act as the key target range to accumulate Bitcoin in should such a decline materialise.

Price Pattern - Mega head and shoulders pattern (weak pattern), where a a break of the neckline would measure all the way down to $4000! But it is a weak pattern.

Bitcoin Bear markets analysis - How low could she blow?

That magic number of $14,000 is cropping up once more when taking an average of the last 4 Bitcoin bear markets, this analysis also suggests that the bear market could run into 2022.

However taking the more conservative last bear market into March 2020 would project to a bottom at around Bitcoin $18,000 during December 2021.

Bitcoin Trend Forecast

Therefore pulling all of my analysis together then my forecast conclusion is for the bear market to Bottom during December 2021, targeting a trend to below $20k and possibly spike to as low as $14k during December 2021 with the most probable trading low is likely to be $16k. Though I expect the trend will be very volatile i.e. there will be a lot of fake out rallies to the upside and as is the case today every rally off the lows will be seen by many as the end of the bear market. So the key trend forecast is for bottom during December 2021 at between $18k and $16k as illustrated by my trend forecast graph.

Bitcoin Long-term probable Next bull market price target

As you may have picked up from the above I am not buying the bitcoin to the moon thesis that many crypto manic's see as the inevitable destination of the Bitcoin price and even more for alt coins. More probable is that the Bitcoin price hits a ceiling of sorts and then stagnates, failing to keep up with newer blockchain technologies. So where could the Bitcoin price hit its cap? That is hard to say, but I would not be counting on Bitcoin hitting $1.3 million by late 2025. At a best guess, what could be reasonably achievable is for the bitcoin price to double form it's recent all time high of $64k to about $128k by the time of the next crypto bull market peak. And I am sure it will act as a wake up call for many diehard Bitcoin $1+ million proponents, as all of their models FAIL to delivery that which they had so carefully penciled in for the Bitcoin price.

Alternative Scenarios

a, That the bitcoin price fails to fall and thus no buy limit orders are triggered in which case it's to move on to less risky opportunities and leave the crypto gamblers and miners with their blockchain toy.

b. That the bitcoin price does fall but that $64k was THE peak and thus the best could be Bitcoin to be stuck in trading in a range of $30k to $40k for many years. This scenario would still yield a profit if upto 100% on an average buy price around 19k, which is another reason to only buy at a discount to bitcoins current trading range.

c. That bitcoins goose is already cooked, how? USDT leverage evaporates along with this scam stable coin, i.e. it could be that all of the run up over $20k was due to leverage and in fact THAT is Bitcoins ceiling price rather than $64k or $128k. In which case an average buys at below $20k would still allow one to at least break even.

d. That bitcoin is now obsolete, i.e. it's going to deviate and under perform against Blockchain 2.0 and 3.0 crypto currencies which means one should be diversified in better blockchain technologies than bitcoin.

Bitcoin Price trend forecast Current state

The updated graph shows a volatile sideways trend with an upwards bias. Most recent price action is showing significant deviation to the upside where I expect the Bitcoin price to soon start rolling over in time for the main thrust lower for the final leg down for this bear market in advance of which the Bitcoin price should converge with my forecast which means BTC should be heading lower during September.

Now imagine if you had been a Patron 2.5 months ago for that is when this analysis was published, you would have had advance warning of a probable run higher towards BTC $50k BEFORE the real bear market was expected to begin during late September!

Anyway it's not long now before we find out if BTC converges towards my trend forecast or not.

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $3 per month that is soon set to increase to $4 per month for new Patrons, so a short window of opportunity exists to lock in at $3 per month. https://www.patreon.com/Nadeem_Walayat.

My Crypto Bear Market Investing Strategy

1. BTC & ETH - My primary focus will be on building positions in BTC and ETH that will target approx 80% of my crypto portfolio, the balance spread between a number of Alt Coins such as Cardano and Pokadot.

2. Hold BUSD and USDC - In advance of buying crypto's I am funding my accounts (mainly Binance) with approx 50% of my target position size to as to capitalise on a high GBP exchange rate, converting into BUSD and USD whilst also correcting my initial error of holding USDT.

3. Place limit orders on approx half of the funds on account across the target crypto's in relatively nearby levels compared to the more distant levels i.e. BTC $21,500 and ETH $1400. Whilst my initial limit orders are far distant from the actual crypto prices as I am anticipating a decline in prices. However over time my orders will gravitate towards being nearer to the actual spot price i.e. over the next 6 months and where I could even be buy crypto at spot rather than with limit orders depending on what transpires over the remainder of this year due to various dynamics such as the Ravencoin halving due in Jan 2022 etc in advance of which I want to have a significant holding of raven coins.

4. INTEREST - With the remaining 50% of USDC and BUSD placed in short-term 7 day fixed deposits that earn 5.31% (APR) with Binance, re-evaluating every 7 days whether to continue fixing or place more limit orders with i.e. as crypto's begin to sell off.

5. Account Funding - As the limit orders are triggered I will then look to fund my accounts with more fiat.

At the moment my focus is on using Binance, however I hope to eventually be able to fund Coinbase so as to spread the risk between exchanges, else it is likely Binance will remain the primary means of building my crypto portfolio.

Crypto 1 - Ethereum (ETH) $2600

Ethereum will be my largest holding at 41.6% of my crypto portfolio. Why such a large holding of Ethereum? We'll because it is by far the most liquid and active in terms of developments, with so many layers it's mind boggling, that I can't see how any of the newer competitor crypto's can ever catch upto, especially given the eventual move to ETH 2.0 sometime during 2022. Therefore it is highly probable that ETH will replace Bitcoin as the dominant cryptocurrency.

The following chart shows all of my buying levels for ETH that range from a high of $2080 all the way down to $560, which is set against the current price of $2600. The chart also shows the area where I will be seeking to place most of my limit orders to buy at between $1400 and $600 i.e. I anticipate about 90% of my limit orders will be in this price range.

Crypto 2 - Bitcoin $40,375

My bitcoin buying levels range from $29,000 all the way down to $12,000 for an anticipated allocation of 37.8% of my crypto portfolio. I will be placing 90% of my bitcoin limit orders in the range $20,500 to $14,000, with remaining 10% at between $22,000 and $20,500.. So if Bitcoin fails to fall to at least $20,500 then my exposure to bitcoin is going to very light and thus left to mostly accumulate via that which I mine via GPU's.

Crypto 3 - Ravencoin $0.078

Raven halving takes place in January so I aim to have 4.4% invested in this crypto by then that has already fallen hard when compared to the likes of Bitcoin and Ethereum and so I have already bought a small amount of Ravencoin. Whilst I expect to place 80% of my limits at between $0.02 and $0.035.

Crypto 4 - Cardano $1.59

Cardano (ADA) is a third gen blockchain, a competitor and backup to Ethereum that is a 2nd gen blockchain. Cardano looks set to create it's own ETHesk ecosystem and currently has obvious advantages in terms of gas fees i.e. about 16 cents per transaction. Therefore I will be looking to invest 3.5% in ADA. I aim to place 90% of my limit orders between $0.46 and $0.17.

Crypto 5 - Pokadot $25

Pokadot / DOT about to be listed on Coinbase Pro so a coming of age alt coin, another Ethesk eco system such as Cardano. Price rise from $7 at the start of the year to a high of $50, currently trading down 50% at $25. I aim to invest 3.3% in DOT, with 90% of limit orders in the range of $8 to $4.

Crypto 6 - ChainLink $26

An ERC20 token that attempts to bridge the gap between the blockchain and the rest off the world. Proponents of Chainlink expect the crypto to literally skyrocket to the moon with daft targets of $1000. The crypto peaked at $52 and has fallen by about 50% to currently trade at $26. I am aiming to invest 3.1% in a price range of between $4 and $10 for about 90% of holdings.

The breakdown of the remainder of my target crypto holdings is -

- Lite coin $178 - 2.4% - at sub $84

- Nucypher $0.31 - 1.7% - at sub $0.19

- Stellar Lumens $0.34 - 1.1% - at sub $0.25

- GRT $0.71 - 1% - at sub $0.45

Creating The Perfect Crypto

Wondering about the perfect crypto that I would embrace has got me thinking about considering creating my own crypto coin, probably as a BEP20 or ERC20 token, with key difference against the likes of Bitcoin and Ethereum being a mechanism to add intrinsic value to the crypto, and that store of value will not be depreciating fiat currency but say the Top 5 or 6 AI stocks in my portfolio. This would effectively create a crypto with all of the upside and little of the downside risk as the coin would have intrinsic value and thus a floor that would rise with the stock price of the AI stocks. In fact it is possible that at times when other crypto's are under going a blood bath that this crypto could continue to trade towards new highs.

It costs roughly $5k to create a crypto coin, though adding intrinsic value would multiply that cost several fold and then how to maintain value as the market cap of the coin increases. A project to work on in the background, but such a crypto would offer the best short, medium and long-term store of value and be far less volatile than any of the other crypto's.

How to Invest in Crypto Without Getting SCAMMED

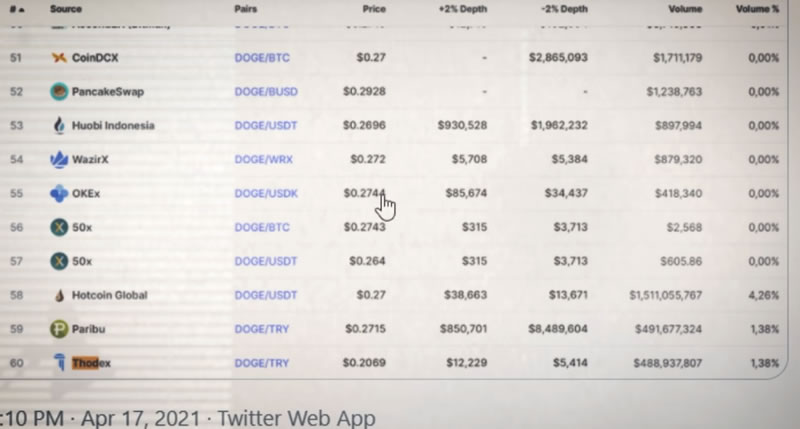

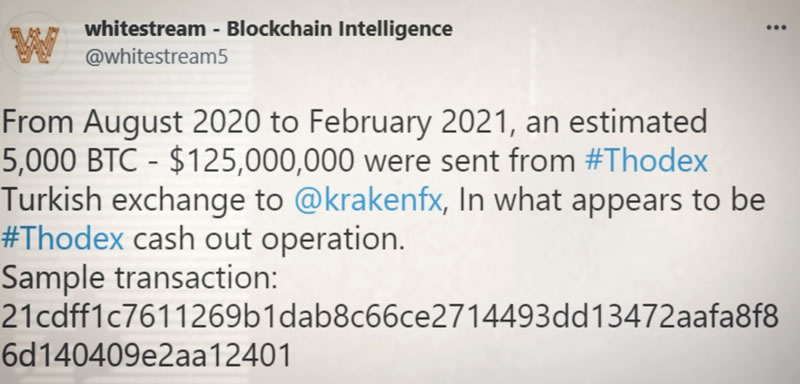

Firstly there are a lot of crypto exchanges out there most of which CANNOT BE TRUSTED with any significant amount if holdings where basically the smaller the exchange the greater the risk of your holdings being stolen either through phony hacks i.e. the exchange says boo hoo we were hacked and x% of your holdings have gone OR the exchange out and out runs off with your crypto, disappears into cyber space for ever and it happens a LOT! For instance it happened only a few weeks ago, Theodex a crypto exchange based in Turkey disappeared with $2.2 billion over night. Where the scam was centered on dog shit coin called DOGE, selling DOGECOIN at well BELOW market value as the following illustrates where Theodex was selling Doge at $20 cents when the market price across other exchanges for the poop coin was 27cents thus sucking in a huge amount of volume of trading, the final victims of Theodex's scam operation.

As is is the case with most scams the operation was underway for well over a year before the scam exchange disappeared.

And there are many more crypto coin and crypto exchange scams out here. So the message is clear pick your exchanges carefully, don't get seduced into any of the freebie and special discount offers that the smaller exchanges come out with to entice unsuspecting victims with because it is JUST NOT WORTH THE RISK!

So it should be much safer to have holdings at the largest exchanges hence why I had high hopes for Coinbase, unfortunately it is a poor trading platform and it's charges are VERY HIGH, so the bulk of my crypto will not be bought through Coinbase but rather Binance, yes it is higher risk than Coinbase, so the strategy will be to buy with Binance and then probably seek to move the bulk off Binance into a hard wallet, probably just most of my Bitcoin and Ethereum holdings only.

CHIA SCAM COIN

A sure fire red flag for a SCAM COIN is when a huge number of coins have been PRE-MINED held by the insiders who released the crypto onto the unsuspecting gullible mining public, case in point being CHIA as I covered in my following video of why it is a SCAM for ordinary folks designed to profit from a potential $100 billion IPO.

Binance vs Coinbase

Coinbase is designed to extract as much fees from customers as possible i.e. despite jumping through several hoops to get verified the only way to deposit funds onto Coinbase is by buying BTC which incurs a 3.8% FEE! And then to transfer to a stable coin such as USDC in preparations for placing limit orders I would incur another 0.5% fee, and then another 0.5% fee for when the limits are triggered. This results in a 4.8% fee incurred to achieve my objective of buying crypto via limit orders!

Compare this to Binance that charges NO deposit fee if done via a bacs transfer and where the fee charged is 0.1%. Thus again depositing sterling and convert to BUSD, place limit orders, when triggered the total fee will be 0.2%, less than 1/20th that of Coinbase!

For example Bitcoin is trading at $36,000. The effective bid offer spread allowing for the transaction fees to deposit into BTC with Coinbase results in an equivalent buying price 37368, and 35820 to sell. Whilst for Binance it is 36,038 to buy and 35,964 to sell. So you can well understand that my starting deposits have gone to Binance and that is before we cover the quality of the trading platforms. Coinbase's standard platform is garbage, Coinbase Pro is an improvement but limited in functionality, Binance on the other hand is what I would consider over kill for what's needed to invest in Crypto's i.e. MARGIN, FUTURES, OPTIONS, even something called P2P, and much, much more. Be under no illusion, if you invest in crypto with margin then you will be magnifying your risk in already an high risk market with a high probability of losing all of your money invested on margin. No matter how clever you think you are margin investing WILL come back to BITE YOU!

For a better understanding of the two platforms I posted a video of my experience of using Coinbase and Binance and why Binance is the clear winner, if only it were regulated! So users of Binance should steer clear of the risky trading instruments by sticking to investing without margin. For instance imagine if one bought Bitcoin at say $20k, and then see it spike down to $14k, and where if one is unable to meet the margin call ones positions will automatically be closed and any other assets sold to repay the margin loan which of course also incurs a financing fee and interest. So do not even contemplate investing on margin. Same goes for Options, steer clear, crypto's are high risk enough without X10'ng your risk!

And here's how to make the Binance low transactions fees even lower. Signup to Binance with this discount code Z728VLZ and you get 10% OFF your trading fees.

Signup to the Coinbase platform for managing crypto's. Whilst for GPU mining with your desktop PC use Nicehash. (affiliate links).

Also note that my conclusions are based on my experience as a Brit, and it appears that the US version of Binance is less robust with fewer options and higher fees, so a case of do your own research to find that which works best where you reside. Where for me in the UK Coinbase sucks and the clear winner is Binance.

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $3 per month that is soon set to increase to $4 per month for new Patrons, so a short window of opportunity exists to lock in at $3 per month. https://www.patreon.com/Nadeem_Walayat.

My analysis schedule includes:

- Silver Price Trend Analysis, AI Stocks Portfolio Update - 50% Done

- Stock Market Trend Forecast September to December 2021

- How to Get Rich! - 90% done - This is a good 6 month work in progress nearing completion.

- UK House Prices Trend Analysis, including an update for the US and a quick look at Canada - 15% done

- US Dollar and British Pound analysis

- Gold Price Trend Analysis - 10%

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $3 per month that is soon set to increase to $4 per month for new Patrons, so a short window of opportunity exists to lock in at $3 per month. https://www.patreon.com/Nadeem_Walayat.

Your crypto bear market investing analyst.

Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.