Bitcoin, Crypto Market Black Swans from Google to Obsolescence

Currencies / Bitcoin Aug 01, 2021 - 03:33 PM GMTBy: Nadeem_Walayat

Dear Reader

This is part 3 of my extensive full spectrum analysis of the crypto markets, of what I expect to happen over the next 6 months in terms of a Bitcoin price trend forecast, and the strategy I am deploying to capitalise on as well as 5 potential black swans that could collapse the crypto markets where Stable Coins such as USDT are what could be imminent catalysts for. (Part 1 Investing in the Tulip Crypto Mania 2021, Part 2 Bitcoin Halvings Price Forecast and Stock to Flow Analysis)

Bitcoin Bear Market Trend Forecast 2021 and Model Crypto Portfolio Buying Levels

Topics covered in this analysis:

- Investing in the Tulip Crypto Mania

- Bitcoin Price Trend Forecast Review

- Lessons Learned

- Cathy Crypto Wood's View on Bitcoin

- BITCOIN HALVINGS TREND TRAJECTORY

- Stock to Flow Infinity and Beyond!

- Bitcoin, Crypto's and the Inflation Mega-trend

- Black Swan 1 - Will Crypto's Get Banned?

- Black Swan 2 - GOOGLE

- Black Swan 3 - USDT Tether Un-Stable Coin Ponzi Schemes!

- BLACK SWAN 4 - Bitcoin 51% Network Attack by China?

- Black Swan 5 - Bitcoin is Already Obsolete

- US Trending Towards Hyperinflation

- BITCOIN TREND ANALYSIS

- Bitcoin Bear markets analysis - How low could she blow?

- Bitcoin Trend Forecast

- Bitcoin Long-term probable Next bull market price target

- Alternative Scenarios

- My Crypto Bear Market Investing Strategy

- Crypto 1 - Ethereum (ETH) $2600

- Crypto 2 - Bitcoin $40,375

- Crypto 3 - Ravencoin $0.078

- Crypto 4 - Cardano $1.59

- Crypto 5 - Pokadot $25

- Crypto 6 - ChainLink $26

- Crypto's 7 to 10

- Creating The Perfect Crypto

- How to Invest in Crypto Without Getting SCAMMED

- CHIA SCAM COIN

- Binance vs Coinbase

- Have ARK Invest Funds Bottomed?

The whole this extensive analysis has first been made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

BITCOIN BLACK SWAN EVENTs

DISCLAIMER - Investing in Crypto's is VERY HIGH RISK, all the way from putting funds on deposit with exchanges to the actual holding of crypto coins Therefore the analysis in this article is a matter of opinion provided for general information purposes only and is not intended as investment advice. Using Information and analysis derived from sources and utilising methods believed to be reliable, but I cannot accept responsibility for any trading or investing losses that may be incurred as a result of this analysis. Individuals should always consult with their personal financial advisors and do their own research before engaging in any investing or trading activities.

Will Crypto's Get Banned?

Whilst we can all get carried away projecting into the future based on past trends, comfortable in the reliability of calculations. However, there are always black swans lurking out of sight that could result in that panic event that few see coming. And where Bitcoin and the crypto's are concerned is if the Governments decide to BAN trading and investing in crypto's.

I know the crypto bugs will come out with statements such as it is impossible to ban decentralised crypto currencies.

However, bitcoin / crypto's threaten the fiat currency banking system that effectively the worlds central banks have a monopoly over.

So this could go one of two ways or spectrum of each.

1. The governments embrace Bitcoin and effectively nationalise it by making it an reserve asset.

2. The governments seek to outlaw crypto's and also seek to supplant the block chain technology with their own for instance the US Fed Coin, which is centralised banking. So that bitcoin and crypto's remain largely relegated to the sidelines and never achieve the dominance that crypto bugs assume as inevitable.

Cannot happen? Well India is doing that today, seeking to outlaw bitcoin!

Turkey banned crypto payments.

Thailand has ordered crypto exchanges to delist meme coins such as Doge coin.

At this point in time what is most likely to happen is a mixture of the two.

1. Bitcoin becomes a reserve asset if not for the banks then for corporations.

2. The Fed and other central banks implement their own block chain centralised crypto currencies's backed by the tax payers of the state. These coins will be palatable to the bulk of citizens of each nation.

For instance most moms and pops are going to be scared shitless when told that if you send you coin to the wrong address it is gone forever or you forget your password all your coins are lost for good!

Whereas a centralised banking system based coin offers the safety of a transaction chain so that errors can be undone which given that most people are not engaged in illegal activities will be happy with, so they get access to the benefits of crypto currencies without the risks of price volatility and perhaps as they become more educated in they will begin to use exchanges such as Coinbase that acts as a middle man that stores their crypto in various currencies in a sort of safe place as compared to personal wallets which if lost one loses all their Bitcoins on the block chain.

Whish is why I view the likes of coinbase stock as a good long-term investment as the masses have yet to awake fully to what the block chain has to offer with a lot of innovation to follow in this field over the coming years that Coinbase will profit from.

So understand this the governments will seek to make bitcoin less desirable then their fiat currencies and coming block chain versions of fiat currencies such as the US dollar. The government has a multitude of options to play with such as various taxes when people try to transact with crypto currencies i.e. buying cars or property.

The only way to capitalise on bitcoin / crypto's is to keep transactions outside of the financial system, as soon as it enters the financial system by means of a transaction that involves fiat currency then it becomes trackable and taxable. Which is why I spend the little bitcoin I mine on services paid for in bitcoins.

For me the only way a traditional bitcoin investment could work is if it can be held it within a tax free wrapper such as a SIPP or ISA. Unfortunately the government has been locking down that loophole for instance the UK has banned the holding of bitcoin / crypto funds within ISA's and SIPPs. Hence options such as Coinbase stock is so valuable in terms of gaining tax free exposure to crypto currencies.

As a reminder in the UK one can invest tax free upto £20k per year into a Shares ISA PER adult. And a total of just over £1 million in a SIPP, though effectively one would want to stop investing in a SIPP once the SIPP value gets to about half the limit, so currently about 550k. Which combined should be more than enough for most investors, especially couples. And of course any increase in the value of the home you live in is tax free.

Black Swan 2 - GOOGLE

The stock to flow model to is too easy and that Bitcoin halving can do what it does to pump the price ever higher, but what happens if next time that does NOT HAPPEN where instead bitcoin pricing rising it FALLS! If the biggest bullish case for Bitcoin turns out to be FALSE then that crypto is heading towards $1 rather than the stock to flow models $1 million plus coins.

So yes, it worked last time, and could work next time. However, on it's own it has to be coin flip, and eventually those coins are going to flip TAILS - GAME OVER!

Which means don' get sucked into such hype and make sure not to over commit to the crypto casino i.e. Even at maximum exposure I am not going to spend MORE than 1% of my total fiat on crypto's. One has to be prepared for assets that have no intrinsic value to reflect that lack of intrinsic value so keep exposure small.

I am skeptical of the S2F model, reeks of Elliot wave theory and how its all hunkey dory in hindsight but actually going forward it's basically a coin toss which is how I expect the model to play out, nothing is certain so yes there WILL be a halving where the stock to flow model FAILS, which is not something you are going to hear anywhere else because the vested interests have bought into their own hype. Still I cannot ignore that a stock to flow pattern exists, but am fully aware that next time it could FAIL!

So what could kill the stock to flow model and bitcoin and most of the others crypto's along with it?

GOOGLE!

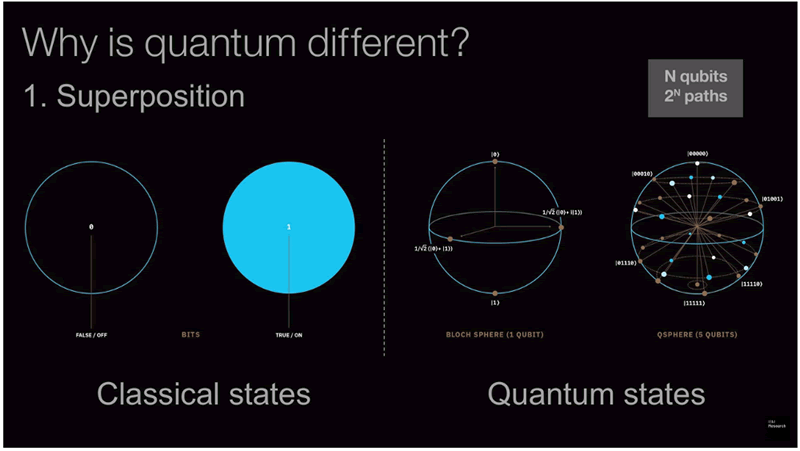

Well okay maybe not Google itself but what it and the other tech giants and several nations are working on could, namely Quantum Computers!

The problem is this, the most important aspect of the block chain is SECURITY of transactions and records of which public key holds what with the private keys kept safe and secure to authorise transactions. All's well as long as the private keys cannot be generated from the public keys which using regular computers, even super computers is practically impossible given that each new blocks hash is generated with reference to the preceding block hence the block chain.

In step Quantum Computers and their super position ability to solve exponential equations.

What does this mean for bitcoin and most crypto currencies?

That they effectively have a shelf life, of what? 10 years? 12 years? Before Quantum Computers make them obsolete. Though there will be realisation long before that day arrives that Bitcoin's goose is cooked that will result in a max exodus from Bitcoin with the price rather than being worth $325 billion per coin will be more like 3.25cents per coin, making their Bitcoin tulips pretty much worthless.

And with the mad rush to exit Bitcoin so will all other crypto's collapse towards zero in the greatest crypto crash blood bath in history, especially if that realisation comes in the run up to a mania peak! If it's during a bear market that is well underway than maybe some sanity will come to the rescue of the block chains as workarounds to secure block chains against quantum computers will be developed., but during a bubble mania Quantum Computers would be the needle that pricks the crypto blockchain bubble. Which will see what happened to the price of Tulips replicated to what happens to the Price of Crypto's falling from $1 million to under $10 within days. That's the state of the crypto world today, a case of stock to flow plain sailing to Bitcoin $1 MILLION+

All whilst the Quantum clock quietly tick tocks all the way towards EXPLODING the blockchain, your Crypto Black Swan event.

Black Swan 3 - USDT Tether Un-Stable Coin Ponzi Schemes!

To get my crypto bear market investing ball rolling I recently opened an account with Binance (10% trading fees discount link). Deposited £3600 sterling that I quickly converted into USDT so as to initiate my initial limit orders on mainly BTC and ETH, aiming to add more funds and limit orders over the next few weeks. Unfortunately on taking a closer look at USDT Tether stable coin which probably holds true for most of the other so called stable coins, I find that USDT is NOT backed 1 for 1 by that which it seeks to represent i.e. from what I have gleaned at best USDT is backed by 75% of dollar 'safe-ish' assets with most of the remaining 25% may not even exist i.e. PRINTED MONEY! Likely to cover losses incurred to date such as the $800 million USDT's parent company lost some years ago etc,. So USDT's true value is somewhere between 15% and 25% LESS than that of the US Dollar given it's actual reserves as I covered in my recent video, and the backing could be far worse as exchanges use USDT to allow traders to trade on margin and thus are vested interests in perpetuating this scam..

The black swan event here is clearly that USDT and the other Stable coins could spectacularly FAIL and trigger a collapse in the crypto markets as investors see their USDT values evaporate overnight whilst those who's exit plans relied on stable coins in times of market panic are left, well panicking as they are stuck in crypto's so panic even more as they fear exchanges imploding along with their crypto balances.

Stable coins current market cap is $104 billion, most of it in USDT $64 billion and USDC $22 billion, thus are more than capable of creating a financial crisis 2008 style event for the crypto markets. That should they collapse would result in a loss of confidence in all crypto which could easily take Bitcoins price down by 85% from it's peak to say back under $10,000 with worse for the other crypto's! A true bursting of the crypto bubble in spectacular style, a risk that most crypto maniacs with their DIAMOND HANDS HODL mantra remain oblivious to.

Furthermore printing money i.e. USDT allows for MARKET MANIPULATION! as USDT can just print dollars out of thin air then buy crypto to send prices soaring and thus generate artificial profits with printed US Dollars used to push up the price of crypto holdings, it may have worked during the 2021 bull run, but it is an ultra case of the "Emperor has No Clothes" all whilst the crypto fanatics talk about Crypto's being safer than Fiat currency that is being constantly devalued via central bank money printing. In fact Tether is behaving just like a CENTRAL BANK for the exchanges i.e. prints currency (USDT), unredeemable, manipulates market prices, allows traders on exchanges to leverage themselves upto their eyeballs upto X100, so much for crypto's being decentralised finance!

In fact Tether exploding is not a question of IF but rather WHEN! And the exit door is going to be pretty small. So at the very least understand that there are NO STABLE COINS, they are UN-STABLE COINS! No matter what they state on their websites etc they are ALL UNSTABLE due to the fact that if USDT fails then they will ALL FAIL, just as when Lehman Brothers failed ALL the banks FAILED! And this time there isn't going to be any central bank stepping in to bailout out the crypto world. IN FACT, I would be surprised if the central bankers are not already aware of this and could be game playing a collapse of the crypto space so that they can step in and seize control of the crypto markets through strict regulation to prevent anther Tether style collapse of the market.

Meanwhile all of the exchanges use the Stable coins as a means of sucking fiat currency into FAKE unstable equivalents which gives retail investors the illusion that they are holding for instance dollars when they are in fact holding something akin to mortgage backed securities and we all know what happened to those!

Seriously folks the more I look under the hood of Tether the more I am convinced that a chain reaction of events could result in a sudden loss of confidence in USDT that would result in a collapse of the whole crypto market within a matter of hours.

USDT is 9-11 for Central Banks

The central banks cannot allow independant currencies to circulate in any meaningful amount regardless of the advantages of the blockchain. SO, turning a blind eye to the USDT ponzi scheme on expectations that it WILL implode and thus allow the central banks to step in and REGULATE the exchanges and to some degree crypto currencies in the name of preventing such ponzi schemes in the future form collapsing crypto markets explains why USDT has got away with it to the extent it has. The central banks full well understand what's going to happen and so are turning a deliberate blind so that in the aftermath they can wage their war on crypto without much resistance from a devastated crypto market and without any cost as unlike the banking system they do NOT have to bailout the crypto shadow banks i.e. a collapse of Tether will have NO effect on the banking system so let it grow until it takes down the crypto markets. Which is a another reason to be careful in how much one has deposited on exchanges and not just held in USDT. Investing in crypto's IS VERY HIGH RISK!

BLACK SWAN 4 - Bitcoin 51% Network Attack by China?

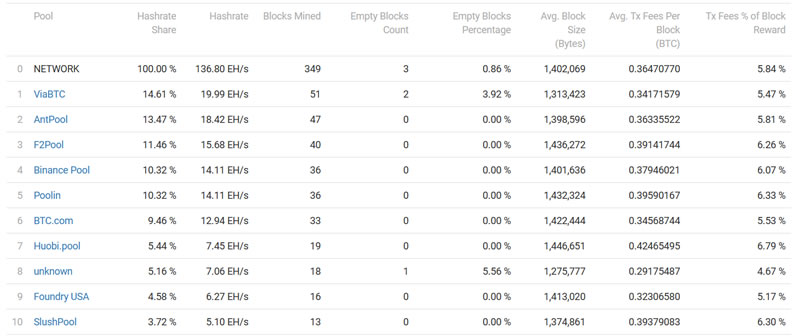

A 51% attack is when a mining pool controls 51% or more of the computational power of a network which can then create fraudulent blocks of transactions for themselves while invalidating the transaction of others on the network. Whilst we are a long way from such an event i.e.here are the top 10 pools and their percentage share of the BTC compute power (hash rate share).

However, the problem is that there will be fewer block rewards and less transaction fees which means fewer miners hence larger pools couple that with services such as Nicehash that sell hash power which means an orchestrated 51% attack for a short period of time, say an hour or so is possible where the waters have been further murkied by hash rate derivatives, you know the likes of which caused the financial crisis of 2008, so whilst on the surface bitcoin may seem safe and secure, however under the surface we have no idea of what is bubbling away only to become aware during an Lehman's moment!

Meanwhile those who state that a 51% attack could never happen need to understand this that today over 60% of bitcoin mining is done in CHINA, and that the chinese government is hell bent on outlawing bitcoin in CHINA due to the fact that -

a. Mining consumes immense amounts of energy.

b. That china is in the process of circulating it's own centralised digital currency so does NOT want an decentralised competitor to it in circulation.

Therefore the Chinese government has it in it's means to orchestrate a 51% attack by commandeering Chinese mining operations and effectively KILLING bitcoin and along with it most of the crypto markets that I am sure western governments in secret will by more than happy to see happen.

Black Swan 5 - Bitcoin is Already Obsolete

Bitcoin is first generation blockchain, Ethereum is 2nd Gen with the likes of Cardano being 3rd gen blockchain tech. Bitcoin has already faded as a currency because it just does not work i.e. given transaction fees, number of transactions per second and the amount of time taken to complete transactions which is why most of the crypto business is actually done in Ethereum, which is working towards a major update in ETH 2.0. The clear danger here for prospective bitcoin investors is that we may already have seen peak Bitcoin as speculative and block chain technological interest continues to drift towards other crypto currencies leaving Bitcoin as a relic / dinosaur with no real reason for anyone to hold other than for the greater fool, that someone will step forward to pay a higher price for something that does not have any real value or any purpose anymore.

So all those proclaiming that Bitcoin will replace the likes of the US dollar do not have a clue about Bitcoins block chain technology which is already obsolete. Yes they can tinker around smart contracts to place layers on top of bitcoin holdings, but there are much better blockchain alternatives to invest in.

So Bitcoin could just fade into the background much as the likes of Ford, GM and GE have, that were once stock market giants but are now just background noise, the same is more likely than not to happen to Bitcoin where the clear warning sign will be when crypto prices start to diverge, i.e. crypto's such as Ethereum rises whilst Bitcoin significantly under performs,. failing to follow the fantasy stock to flow and halving models that the bitcoin maniacs cling onto to deliver this $1.4 million per bitcoin targets.

The bottom line is there are plenty of black swans lurking in the background 5 of which I have mentioned above which means that investing in crypto's even Bitcoin the so called gold of crypto's is very high risk. Any of these coins could at best stagnate and worst go to zero, so a warning NOT to get carried away with the ALT coins and to be ultra careful of holding ANY of the so called STABLE coins! And, well only invest what you are prepared to LOSE! It is definitely NOT easy money as many will experience WHEN the likes of Tether EXPLODES!

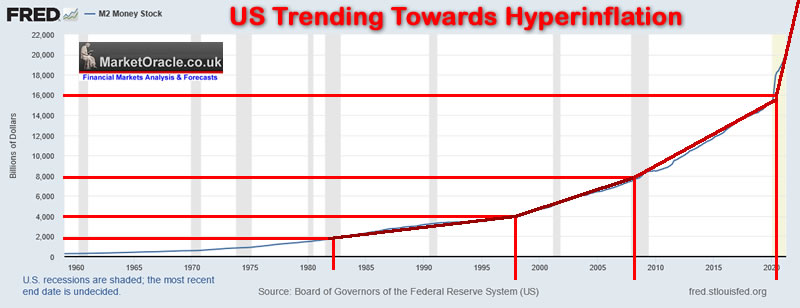

US Trending Towards Hyperinflation

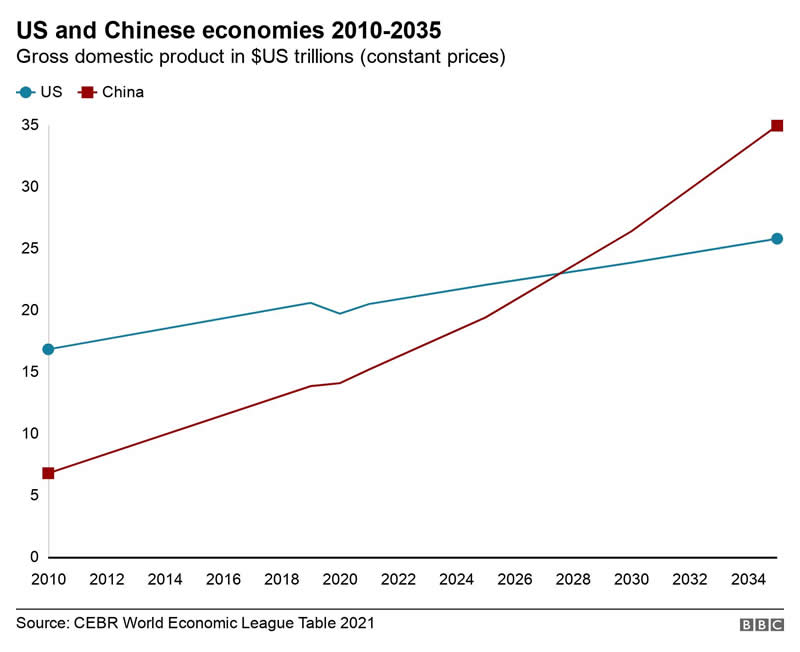

At it's core the reason why the US government has so far gotten away with printing money even to the extent that clueless politicians are proclaiming a new nirvana of perpetual money printing without consequences is all due to the fact that the US Dollar is the worlds reserve currency. However that is only because of the US economy and military being dominant where the perpetual money printing machine without inflationary consequences is due to the fact that excess dollars are being soaked up by the global economy which has a fly in it's ointment namely CHINA!

ECONOMIC AND MILITARY POWER DETERMINES RESERVE CURRENCY STATUS

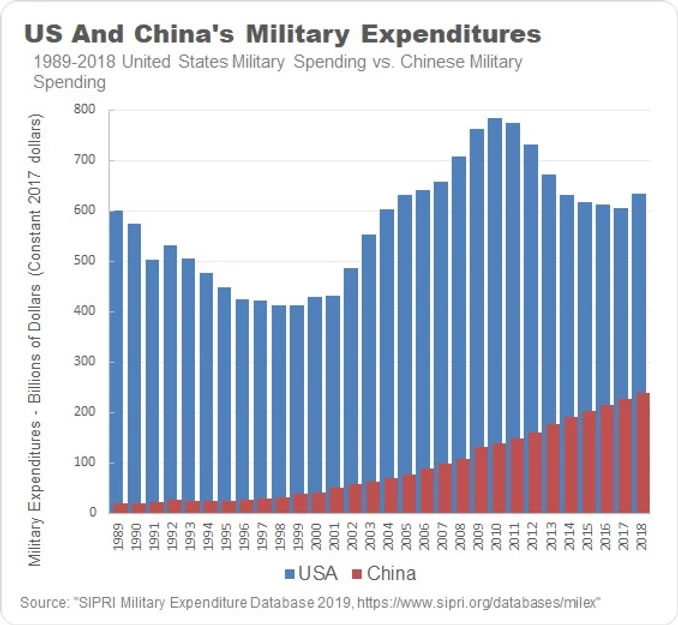

We are fast approaching the point where China becomes the worlds dominant economy.

However for now the US still far out spends China in terms of military spending thus looks set to remain dominate for at least another decade or so.

Which is why I think outright military conflict which China is inevitable as I voiced in my in-depth analysis of late 2016 that a conflict will take place probably centered in the South China sea and likely see the use of nuclear weapons by the early 2030's especially as China's official statistics probably under report the true extent of chinese military spending by the emerging Chinese empire that could actually be double that reported.

- 27 Dec 2016 - The Trump Reset - Regime Change, Russia the Over Hyped Fake News SuperPower (Part1)

- 28 Dec 2016 - US Empire's Coming Economic, Cyber and Military War With China (Part 2)

In terms of crypto's the central banks probably see stable coins such as USDT as a means of printing even more money without themselves doing the printing i.e. it's not on the Feds balance sheet. And printing money is the name of the game right now, all the way to it's final destination - HYPER INFLATION. Note this is not a forecast that hyperinflation is imminent or likely in 2022 or even 2023, but that the US and UK and most others are trending towards an hyperinflation panic event as there is no free lunch to giving out stimulus checks and ever expanding deficit spending that so far has been allowed to persist due to US dollar reserve currency status that is time limited!

It's a MESS! And at the end of the day no matter what we do we are all going to lose at least some capital no matter what we put our money into to try and protect it. Which is one of the reasons why I am spending time and energy investing in crypto's, not because I think I am going to get rich on them X10 or more etc, but that if one buys and sells them without getting caught up in the hysteria that surrounds them then they could protect one from ongoing rampant central bank money printing, so another tool in ones arsenal in addition to safe AI stocks, housing and precious metals etc. But usually there are no winners during hyperinflation, it's a case of limiting the damage done, i.e. don't get left with a wheel barrow full of thousand dollar bills, or in my case a barrow full of worthless British £1000 pound notes.

SO hyperinflation is not a question of IF but rather WHEN, for which we will see signs of in high 'real' inflation and not the fake CPI statistic, upto the point panic sets in when trillions of euro dollars (nothing to do with the Euro) come home to roost, domestic and foreigners seeking to ditch the their dollars for any asset they can get hold of, all whilst the Feds money printer goes ballistic in attempts to keep monetization exploding government debt to cover deficit spend, that is your Hyperinflationary panic event that like the covid waves of 2020 just keeps getting worse over time until the purchasing power of the currency is completely destroyed.

Another inevitable consequence of the gradual loss of confidence in the Dollar is that the Fed will be forced to RAISE interest rates but more on that in a future article.

The rest of this extensive analysis has first been made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Bitcoin Bear Market Trend Forecast 2021 and Model Crypto Portfolio Buying Levels

- Investing in the Tulip Crypto Mania

- Bitcoin Price Trend Forecast Review

- Lessons Learned

- Cathy Crypto Wood's View on Bitcoin

- BITCOIN HALVINGS TREND TRAJECTORY

- Stock to Flow Infinity and Beyond!

- Bitcoin, Crypto's and the Inflation Mega-trend

- Black Swan 1 - Will Crypto's Get Banned?

- Black Swan 2 - GOOGLE

- Black Swan 3 - USDT Tether Un-Stable Coin Ponzi Schemes!

- BLACK SWAN 4 - Bitcoin 51% Network Attack by China?

- Black Swan 5 - Bitcoin is Already Obsolete

- US Trending Towards Hyperinflation

- BITCOIN TREND ANALYSIS

- Bitcoin Bear markets analysis - How low could she blow?

- Bitcoin Trend Forecast

- Bitcoin Long-term probable Next bull market price target

- Alternative Scenarios

- My Crypto Bear Market Investing Strategy

- Crypto 1 - Ethereum (ETH) $2600

- Crypto 2 - Bitcoin $40,375

- Crypto 3 - Ravencoin $0.078

- Crypto 4 - Cardano $1.59

- Crypto 5 - Pokadot $25

- Crypto 6 - ChainLink $26

- Crypto's 7 to 10

- Creating The Perfect Crypto

- How to Invest in Crypto Without Getting SCAMMED

- CHIA SCAM COIN

- Binance vs Coinbase

- Have ARK Invest Funds Bottomed?

Including access to most recent extensive analysis Chasing Value with Five More Biotech Stocks for the Long-run

- RISK RATINGS

- HIGH RISK STOCK BUYING LEVELS\

- Bxxxxxxxxx - Bxxxx -- Risk 3

- Cxxxxxxxxxxxx- Cxxx - - Risk 5

- Txxxxxxxxxx - Txx - - Risk 1

- Bxxxxxxxxxxxxx- Bxxx - Risk 8

- Axxxxxxxxxxx - Axxx -- Risk 10

- High Risk Stocks Portfolio Buying Levels

- Netflix - FAANG a Buy, Sell or Hold?

- Trending towards Hyperinflation!

- Delta Variant!

- Solar CME MULTIPLE Black Swans

And where machine learning predicts AI stock price valuations 3 years ahead- AI Predicts AI Tech Stock Price Valuations into 2024, Time to Buy Chinese Tech Stocks?

- AI Stocks Value Forecaster (ASVF).

- How I Use ASVF6 - Percent Upwards Pressure (PUP)

- AI Stocks Buying Levels Plus ASVF & PUP

- AI Stocks Portfolio Buying Levels

- Dow Stock Market Trend Forecasting Neural Nets

- Pattern Recognition

- Trend Analysis Preprocessing

- Crossing the Rubicon With These Three High Risk Tech Stocks

- Cheap Chinese Tech Stock 1

- Cheap Chinese Tech Stock 2

- Cheap Chinese Tech Stock 3

- CME Black Swan

And my analysis evaluating the prospects for a Financial Crisis 2.0 THIS year - Investing in a Bubble Mania Stock Market Trending Towards Financial Crisis 2.0 CRASH!

- You Don't Know How Big of a Bubble Your in until AFTER it BURSTS

- Stock Market Summer Correction

- REPO Market Brewing Financial Crisis Black Swan Danger

- Margin Debt Bubble

- US Bond Market Long-term Trend

- Michael "Big Short" Burry CRASH and HYPERINFLATION WARNING!

- Michael Burry's Track Record

- Michael Burry's Portfolio

- Investing During Uncertainty

- AI Stocks Portfolio Buying July Levels Update

- HEDGING AI Stocks Portfolio

- Crypto Bear Market Accumulation State

- Bitcoin Bull / Bear Indicator

- Market Oracle AI Coin Thoughts

- Biotech Brief

My analysis schedule includes:

- Stock Market Trend Forecast Analysis

- UK House Prices Trend Analysis - 10% done

- How to Get Rich! - 75% done

- US Dollar and British Pound analysis

- Gold and SIlver Price Analysis

Again for immediate access to all my work do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.\

And lastly a reminder of probable Black Swan that could end up being worse than the 2020-21 Pandemic

Your biotech stocks investing financial crisis de-risking analyst.

Nadeem Walayat

Copyright © 2005-2021 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.