NYSE Stock Market Crash Circuit Breakers No Help to Portfolios

Stock-Markets / Financial Crash Oct 25, 2008 - 07:06 PM GMT

The New York Stock Exchange will implement new circuit-breaker collar trigger levels for fourth-quarter 2008 effective Wednesday, October 1, 2008. Circuit-breakers represent the threshold levels at which trading is halted market wide for single-day declines in the Dow Jones Industrial Average (DJIA). Circuit-breaker levels are set quarterly as 10, 20 and 30-percent of the DJIA average closing values of the previous month, rounded to the nearest 50 points.

The New York Stock Exchange will implement new circuit-breaker collar trigger levels for fourth-quarter 2008 effective Wednesday, October 1, 2008. Circuit-breakers represent the threshold levels at which trading is halted market wide for single-day declines in the Dow Jones Industrial Average (DJIA). Circuit-breaker levels are set quarterly as 10, 20 and 30-percent of the DJIA average closing values of the previous month, rounded to the nearest 50 points.

In fourth-quarter 2008, the 10, 20 and 30-percent decline levels, respectively, in the DJIA will be as follows:

Level 1 Halt A 1,100-point drop in the DJIA before 2 p.m. will halt trading for one hour; for 30 minutes if between 2 p.m. and 2:30 p.m.; and have no effect if at 2:30 p.m. or later unless there is a level 2 halt.

Level 2 Halt A 2,200-point drop in the DJIA before 1:00 p.m. will halt trading for two hours; for one hour if between 1:00 p.m. and 2:00 p.m.; and for the remainder of the day if at 2:00 p.m. or later.

Level 3 Halt A 3,350-point drop will halt trading for the remainder of the day regardless of when the decline occurs.

Background: Circuit-breakers are calculated quarterly. The percentage levels were first implemented in April 1998 and are adjusted on the first trading day of each quarter. In 2008, those dates are Jan. 2, April 1, July 1 and Oct. 1.

Folks, do you think that these limits will stop the damage being done to portfolios? Letting the market decline 10% or more before taking any action is hardly reassuring.

Still more to come.

The lock-up of the stock futures market this morning should have been a warning of more to come. Instead, trading was halted until the open of the New York Stock exchange, while some serious money was likely injected into the futures market to cause the short sellers to run for cover. Buying interest dried up rather quickly and the markets have resumed their downward course. There is nothing positive about this market, even though the talking heads are all calling it a bottom. In my opinion, the market is too unstable for a bottom, although there will be one soon. Check out our videos on YouTube

The lock-up of the stock futures market this morning should have been a warning of more to come. Instead, trading was halted until the open of the New York Stock exchange, while some serious money was likely injected into the futures market to cause the short sellers to run for cover. Buying interest dried up rather quickly and the markets have resumed their downward course. There is nothing positive about this market, even though the talking heads are all calling it a bottom. In my opinion, the market is too unstable for a bottom, although there will be one soon. Check out our videos on YouTube

Will the rally continue?

Treasury prices jumped upward Friday, pushing short-term yields lower, as stock markets around the world plunged and resurrected the attractiveness of U.S. government debt as a relatively safe alternative. “ It's spreading around the globe and underscoring the point that what happens in the U.S. very much affects the rest of the world, both developed and emerging," said Kevin Flanagan, fixed-income strategist at Morgan Stanley Global Wealth Management. "Treasurys are all about the flight to quality, and that's not going away." What if they have to start selling the good stuff, too ?

Treasury prices jumped upward Friday, pushing short-term yields lower, as stock markets around the world plunged and resurrected the attractiveness of U.S. government debt as a relatively safe alternative. “ It's spreading around the globe and underscoring the point that what happens in the U.S. very much affects the rest of the world, both developed and emerging," said Kevin Flanagan, fixed-income strategist at Morgan Stanley Global Wealth Management. "Treasurys are all about the flight to quality, and that's not going away." What if they have to start selling the good stuff, too ?

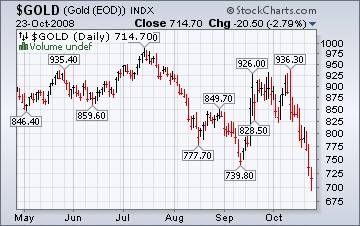

Gold is no safe haven.

Gold futures reversed losses Friday, closing up more than 2% on speculation that the precious metal, losing more than $190 in the previous 11 sessions, has been oversold. Gold had fallen in 10 out of the past 11 sessions since Oct. 8 on fund liquidation and a firmer dollar. It dropped to $681 earlier Friday, the lowest level since September 2007. This is further proof that the process of deleveraging is not over yet.

Gold futures reversed losses Friday, closing up more than 2% on speculation that the precious metal, losing more than $190 in the previous 11 sessions, has been oversold. Gold had fallen in 10 out of the past 11 sessions since Oct. 8 on fund liquidation and a firmer dollar. It dropped to $681 earlier Friday, the lowest level since September 2007. This is further proof that the process of deleveraging is not over yet.

Japan on the brink of a 26-year low

“Financial markets have crashed and are out of control,'' said Yuji Ogino , an executive director at Meiji Dresdner Asset Management Co., which manages the equivalent of $28 billion in Tokyo. ``This crash is different from anything I've experienced since getting into this business in the late 1980s and it's hard to find ways to ride out the situation.'' It appears that sentiment is changing in a way that indicates a bottom may be approaching.

“Financial markets have crashed and are out of control,'' said Yuji Ogino , an executive director at Meiji Dresdner Asset Management Co., which manages the equivalent of $28 billion in Tokyo. ``This crash is different from anything I've experienced since getting into this business in the late 1980s and it's hard to find ways to ride out the situation.'' It appears that sentiment is changing in a way that indicates a bottom may be approaching.

Government stimulus is backfiring for Chinese stocks

China's benchmark stock index fell for a third week, led by financial companies, on concern global financial turmoil may increase local losses on overseas transactions and slow corporate earnings growth. Bank stocks are being sold because the government is mandating lower interest rates and smaller down payments on home mortgages, cutting future profitability on home loans. In addition, banks have suffered massive losses on their overseas investments.

China's benchmark stock index fell for a third week, led by financial companies, on concern global financial turmoil may increase local losses on overseas transactions and slow corporate earnings growth. Bank stocks are being sold because the government is mandating lower interest rates and smaller down payments on home mortgages, cutting future profitability on home loans. In addition, banks have suffered massive losses on their overseas investments.

The dollar is strong, but falls against the Yen.

The U.S. dollar is down to its lowest level against the Japanese yen in 13 years, pressured by traders unwinding so-called yen carry trades and worries about a recession in the U.S. economy .

The U.S. dollar is down to its lowest level against the Japanese yen in 13 years, pressured by traders unwinding so-called yen carry trades and worries about a recession in the U.S. economy .

The dollar fell to as low as 90.89 yen Friday, the lowest since August 1995.

How can this be? All the bailouts have cheapened the dollar vs. the Yen. This will further deleverage the U.S. markets in ways that we cannot imagine.

Barack's plan won't help home prices.

The number of homeowners ensnared in the foreclosure crisis grew by more than 70 percent in the third quarter of this year compared with the same period in 2007, according to data released Thursday.

The number of homeowners ensnared in the foreclosure crisis grew by more than 70 percent in the third quarter of this year compared with the same period in 2007, according to data released Thursday.

Nationwide, nearly 766,000 homes received at least one foreclosure-related notice from July through September, up 71 percent from a year earlier, said foreclosure listing service RealtyTrac Inc. Barack Obama is floating a proposal for a 90-day moratorium on foreclosures. Click on the link t o learn why this is a bad idea.

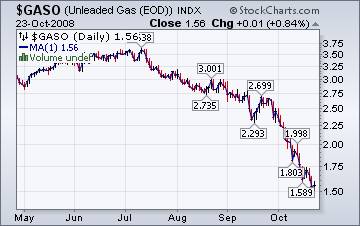

5 weeks of declining prices at the pump…keep it coming!

The Energy Information Administration reports that, “The U.S. average price for regular gasoline plunged another 23.7 cents to slip below $3 for the first time since February 11. At 291.4 cents per gallon, the price was the lowest since October 29, 2007 and 9.1 cents above the price this time last year. The national average price has now fallen for five weeks in a row, with a cumulative drop of more than 92 cents per gallon over this period, and a total of a 120-cent-per-gallon drop since the all-time high of 411.4 cents per gallon set on July 7.” It's about time!

The Energy Information Administration reports that, “The U.S. average price for regular gasoline plunged another 23.7 cents to slip below $3 for the first time since February 11. At 291.4 cents per gallon, the price was the lowest since October 29, 2007 and 9.1 cents above the price this time last year. The national average price has now fallen for five weeks in a row, with a cumulative drop of more than 92 cents per gallon over this period, and a total of a 120-cent-per-gallon drop since the all-time high of 411.4 cents per gallon set on July 7.” It's about time!

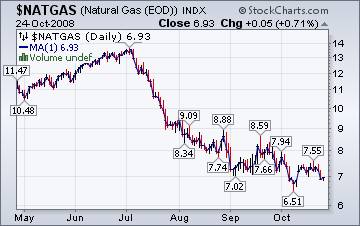

Energy prices going lower.

he Energy Information Agency's Natural Gas Weekly Update tells. “ Virtually all natural gas spot trading locations registered price increases on the week. These increases occurred in response to the arrival of cold weather in many areas of the country. Furthermore, significant price increases in the Southwest and in the Rockies likely were the result of numerous pipeline maintenance projects undertaken this week. Additionally, the slow recovery of the production outages in the producing areas of the Gulf of Mexico provided a further boost to natural gas spot prices.”

he Energy Information Agency's Natural Gas Weekly Update tells. “ Virtually all natural gas spot trading locations registered price increases on the week. These increases occurred in response to the arrival of cold weather in many areas of the country. Furthermore, significant price increases in the Southwest and in the Rockies likely were the result of numerous pipeline maintenance projects undertaken this week. Additionally, the slow recovery of the production outages in the producing areas of the Gulf of Mexico provided a further boost to natural gas spot prices.”

Greenspan Admits Mistake…or did he?

Badgered by lawmakers, former Federal Reserve Chairman Alan Greenspan denied the nation's economic crisis was his fault on Thursday but conceded the meltdown had revealed a flaw in a lifetime of economic thinking and left him in a “state of shocked disbelief.”

I find it hard to believe that a former follower of Ayn Rand could say such a thing. (Her books,) The Fountainhead and Atlas Shrugged… had attracted to Rand many readers who were strongly interested in the philosophical ideas the novels embodied and in pursuing them further. Among the earliest of those with whom Rand became associated and who later became prominent were psychologist Nathaniel Branden and economist Alan Greenspan , later Chairman of the Federal Reserve.

We're on the air every Friday.

Tim Wood, John Grant and I are back in our weekly session on the markets. The market has been a real roller coaster ride this week. You will be able to access the interview by clicking here .

New IPTV program going strong.

This week's show on www.yorba.tv is packed with information about the direction of the markets. I'm on every Tuesday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

mohit jain

26 Oct 08, 12:34 |

Useful information

thanks for giving me this information... |