Gold Price Performance During Recessions

Commodities / Gold & Silver Oct 27, 2008 - 01:25 PM GMTBy: Tim_Iacono

Someone recently wrote in a dismissive, almost pompous, tone something to the effect of, "Everyone knows gold doesn't do well in recessions". But, is that true? Well, it depends...

Someone recently wrote in a dismissive, almost pompous, tone something to the effect of, "Everyone knows gold doesn't do well in recessions". But, is that true? Well, it depends...

The author - whoever it was and whatever exactly it was that they wrote - could have done just a little research and quickly found an answer to the question they probably never really wanted an answer to, confident that what they felt in their gut was correct.

This is common amongst financial writers who believe that history began in 1982.

So, what do gold price movements during recessions depend on?

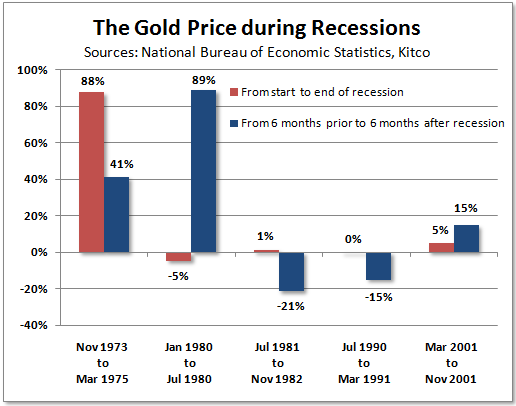

As shown above, the gold price has moved up and down during recessions, the important distinction between the two being that the direction has been decidedly UP during commodity bull markets and DOWN during commodity bear markets.

Over the last thirty-some years, since the price of gold was allowed to seek a market value, there have been two commodity bull markets, the first ending around 1980 or 1981 and the second beginning around the turn of the century. In recessions during both of those periods, the price of gold has risen.

During the long commodity bear market, from 1981 to 2000, recessions resulted in a lower gold price.

The chart above shows price changes during the NBER defined recessions as well as an expanded time period (six months on either side) which serves to reinforce the point made by using the standard definition.

Save for the 1980 transition period, the data seems to be pretty clear.

Where does that leave us today?

If the 1974-1975 period offers a good model for the current period - a pause during the middle of a 12-18 year run which is typical for these cycles - then gold investors have nothing to fear. Regardless of when the current recession officially began and when it ends, the gold price is likely to move higher.

If, on the other hand, the summer plunge in the natural resource sector is a 1980-like event, where prices for both gold and crude oil made multi-decade highs, then that's an entirely different matter.

For anyone who has looked closely at the question, it should be clear that the more valid comparison is the former and not the latter.

By Tim Iacono

Email : mailto:tim@iaconoresearch.com

http://www.iaconoresearch.com

http://themessthatgreenspanmade.blogspot.com/

Tim Iacano is an engineer by profession, with a keen understanding of human nature, his study of economics and financial markets began in earnest in the late 1990s - this is where it has led. he is self taught and self sufficient - analyst, writer, webmaster, marketer, bill-collector, and bill-payer. This is intended to be a long-term operation where the only items that will ever be offered for sale to the public are subscriptions to his service and books that he plans to write in the years ahead.

Copyright © 2008 Iacono Research, LLC - All Rights Reserved

Tim Iacono Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.