Extreme Silver Price Trends

Commodities / Gold & Silver Nov 23, 2008 - 04:44 AM GMTBy: Roland_Watson

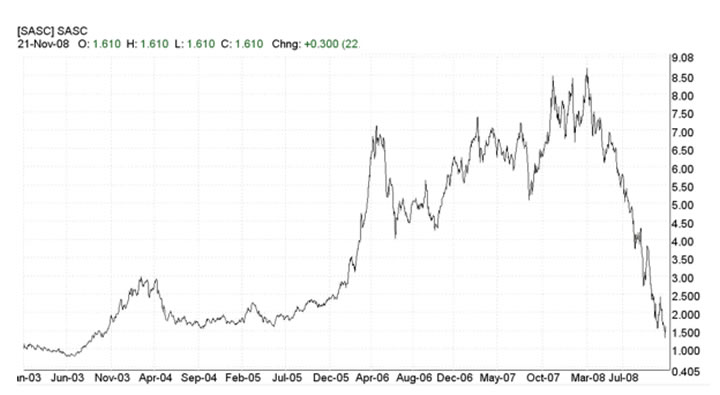

I don't think silver watchers need to be reminded of what has happened to silver in the last 8 months. The only answer they are looking for is when will we see a bottom to this carnage? As I look at my 14 member silver stock index, it has dropped from a high of 8.69 on the 3rd March 2008 to a new low of 1.31 as of last Thursday. That is a drop of 85% - cataclysmic by any standard of investing. Subscribers who followed my lead and exited all silver stocks positions on 31st March were spared this unnecessary suffering.

I don't think silver watchers need to be reminded of what has happened to silver in the last 8 months. The only answer they are looking for is when will we see a bottom to this carnage? As I look at my 14 member silver stock index, it has dropped from a high of 8.69 on the 3rd March 2008 to a new low of 1.31 as of last Thursday. That is a drop of 85% - cataclysmic by any standard of investing. Subscribers who followed my lead and exited all silver stocks positions on 31st March were spared this unnecessary suffering.

The silver stock index was 7.11 on that day. Anyone who had a $10,000 portfolio spread across those 14 silver mining stocks would have seen their portfolio drop to $1,842 as of Thursday. Those who got out on the 31st March saved $8,158 ready for a double/triple or more play on the upcoming rally - not bad for a $115 subscription. Note I say rally, as I do not think the longer term correction is over yet. So far we have stayed out of this market since March (apart from buying some palladium a few weeks back) and the graph below makes me mighty glad I have.

The graph of our silver stock index tells the tale - it has nearly recouped all of the 2003-2008 bull market. Such is the downside leverage of silver stocks to silver metal. But just how extreme is this correction? Let us look at it in the context of the last 45 years.

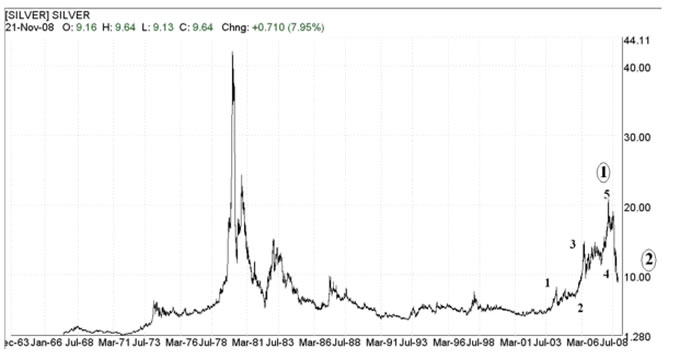

As you can see it is only really outdone by the 1976-1980 spike. You will also note the Elliott wave count that along with another indicator got us out at the end of March. The larger 5 year wave 1 is complete and we wait for the panning out of the wave 2 correction. The Elliot wave counts for this current correction have been given to subscribers as well as projections for where any rally is going to take us. The rally could be quite high with the potential to at least reach the old $21 highs or it may fall appreciably short of that goal.

I fully expect gold to take out its $1032 high but do not at this stage expect $1600 or higher. It's a rally and as you may have deduced from the high demand for silver bullion - the rally has potential to go fast and high. However, there is also caution to be exercised here. The liquidity that drove silver and other commodities higher has largely dried up during the credit crunch. There are vast amounts of cash sitting on the sidelines but the leverage it can buy when it re-enters will not be so readily available.

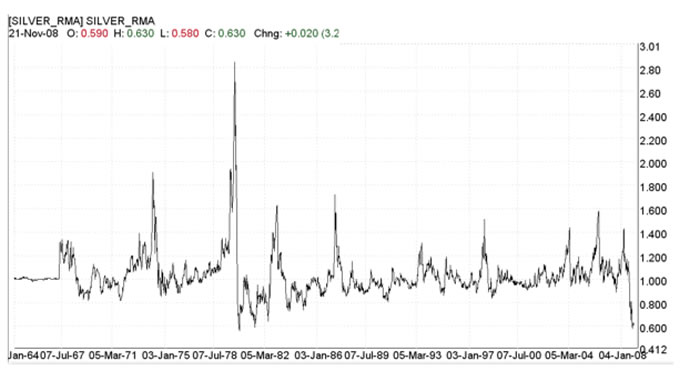

Another sign of this extreme behavior is the long term chart of the silver price divided by its 200 day moving average (or RMA). This brings up an interesting observation. Note that this RMA has hit a 45 year low. It hit a low of 0.56 in May 1980 but has also hit a low of 0.56 on the 27th October to match the extremities of the 1980 crash. Does this mean silver has hit a bottom? Perhaps but I am sure if we looked at the data for the 1920-1932 silver bear when it dropped from $1.34 to $0.25 we may see even lower values for the RMA.

So where do we stand with silver and its stocks? Is the wait over or is there more pain to come? People will note the HUI put in a gigantic 27% leap on Friday. Does this signal the end of the massacre? Perhaps but I note that when the HUI put in a leap of 19% on the 8th October it lasted for all of two days before new lows were made. Volatility is the name of the game just now as investors try to catch the falling knife. The swings in our silver stock index have increased in the last month to nerve wracking levels.

Many investors may get in at the bottom but will they once again ride the wave up only to see themselves crash down with it because they had price expectations greater than the market's own infallible pronouncements? You may get in - but don't overstay your welcome!

By Roland Watson

http://silveranalyst.blogspot.com

Further analysis of the SLI indicator and more can be obtained by going to our silver blog at http://silveranalyst.blogspot.com where readers can obtain the first issue of The Silver Analyst free and learn about subscription details. Comments and questions are also invited via email to silveranalysis@yahoo.co.uk .

Roland Watson Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.