Gold Backwardation Crisis: Seperating Facts from Fiction

Commodities / Gold & Silver Dec 08, 2008 - 04:20 PM GMTBy: Rob_Kirby

An important piece of academic research was published last week [ Dec. 5, 2008 ] by Professor Antal Fekete, titled, Red Alert: Gold Backwardation!!! In this article, Professor Fekete reasoned that Dec. 2, 2008 was a landmark date in the saga of the collapsing international monetary system;

An important piece of academic research was published last week [ Dec. 5, 2008 ] by Professor Antal Fekete, titled, Red Alert: Gold Backwardation!!! In this article, Professor Fekete reasoned that Dec. 2, 2008 was a landmark date in the saga of the collapsing international monetary system;

“on December 2 nd , at the Comex in New York , December gold futures (last delivery: December 31) were quoted at 1.98% discount to spot, while February gold futures (last delivery: February 27, 2009 ) were quoted at 0.14% discount to spot. (All percentages annualized.) The condition got worse on December 3 rd , when the corresponding figures were 2% and 0.29%. This means that the gold basis has turned negative, and the condition of backwardation persisted for at least 48 hours.”

Fekete also claimed this was the first time this had happened in history while acknowledging that on previous occasions,

“there was [ has been ] a slight backwardation in gold at the expiry of a previous active contract month [ to an adjacent non-delivery contract month ], but it never spilled over to the next active contract month, as it does now [ then, into the Feb., 2009 contract ].” [ Italics RK emphasis ]

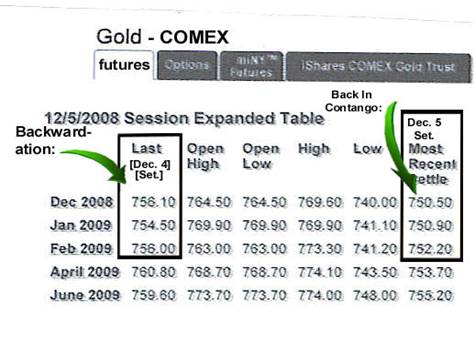

Fekete noted that Silver is [was] also in backwardation, with the discount on silver futures being about twice that on gold futures. Here's how COMEX gold futures finished the day on Friday, Dec. 5, 2008 :

When we speak of Backwardation and Contango, we are really speaking of “ basis ”. The basis is the difference between the futures price and the spot price. When futures are in backwardation, they are said to have a “negative” basis, while in contango – a “positive” basis.

So, we can clearly see that the “backwardation” which first manifested itself on COMEX gold futures Dec. 2, 2008 – remained through Dec. 3 and Dec. 4 - but these subject futures settled “in contango” at the close of business Friday, Dec. 5, 2008.

So What Does All This Mean?

According to Professor Fekete, if gold goes into permanent backwardation the implications are as follows:

“that gold is no longer for sale at any price , whether it is quoted in dollars, yens, euros, or Swiss francs. The situation is exactly the same as it has been for years: gold is not for sale at any price quoted in Zimbabwe currency, however high the quote is. To put it differently, all offers to sell gold are being withdrawn , whether it concerns newly mined gold, scrap gold, bullion gold or coined gold.”

Whether or not gold futures move back into or remain in a state of permanent backwardation will no-doubt now be watched and scrutinized by many in the days and weeks going forward. It would be foolhardy to dismiss Professor Fekete's words in this regard; particularly in light of many anecdotal reports of increased investment demand and shrinking physical supply – particularly in retail amounts – all over the world.

Professor Fekete's siren “Red Alert” article was first published on Friday, Dec. 5, 2008 . It ALARMED many. It will be interesting to note, going forward, whether market data might surface suggesting that “interested parties” [or conspiring parties, perhaps?] perhaps cajoled the COMEX gold futures at the close of business Friday, Dec. 5, 2008 to create a favourable close – painting the tape - lowering the level of concern?

Would the Plunge Protection Team engage in such hi jinx?

We shall see?

A Misguided Attempt to Refute the Importance of Gold Backwardation

An odd thing occurred on Friday Dec. 5, 2008 , after I became engaged in discussions about the importance of Professor Fekete's newly published article; I was made aware of another article – published a few days earlier by Brad Ziegler, titled, Gold In Backwardation? Not So Fast .. - downplaying the significance of “gold forward rates” flirting with, or in some cases achieving backwardation over the past couple of weeks. The article was forwarded to me by a compatriot asking me to comment on it. Here is my response which began with a short primer on gold forward rates [compliments of my astute friend Rhody ]:

Why are forward rates important? Who cares you say?

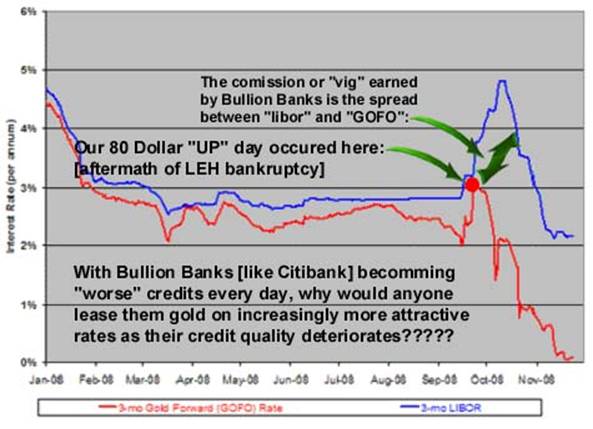

The forward rate is the interest rate charged by central banks when they lend bullion to bullion banks. The bullion banks, in turn lend it on to the market at LIBOR.

Libor is about 2.2%, so the profit to the bullion bank is now pretty generous.

So why do central banks lend gold to the market, through bullion banks at next to nothing? I mean, why would they do that?

Answer: they are providing cheap bullion to be sold into the market to suppress the price. Since this LEASED metal is not reported, it is essentially a form of invisible selling by the central banks. Most gold and silver is leaked into the markets in this way. Why? Gold up means fiat currency down. They do this to support the value of their phony money.....

Now, let's look at a few sections of the article, Gold In Backwardation? Not So Fast .. [my comments in red] :

….Sense can be made of negative forward rates once you understand how the metal is traded in the lease market. Just as changes in supply and demand affect metal prices, so too do changes in borrowing demand and lending affect lease rates. If gold is readily available, lease rates will be low; if the supply of borrow-able metal is tight, rates will rise accordingly. Remember, though, we're talking about gold in the lease market here, not the cash metal marketplace….

[Here, the author makes no mention that while lease rates have been plummeting recently – this does not compute with the reality that institutions who do the leasing are typically BULLION BANKS – like Goldman Sachs, Citibank, Deutsche Bank, J.P. Morgan etc. Some of these bank names have rapidly become candidates for BANKRUPTCY in recent weeks? What about COUNTERPARTY RISK ? Lowering gold forward rates for deteriorating credits is INCONGRUENT if the leasing entity has any desire to have their gold bullion returned to them?]

…..Backwardation, though, isn't the novelty that many observers claim it to be. At least in the short end of the forward curve. The forward market, in fact, inverted earlier this year as gold peaked, then began to slide. In late January, the one-month gold price implied by the forward curve spiked above three-month gold and was offered at a premium until April….

[Misdirection, the author is speaking of “gold forward rates” here - not gold futures prices. According to Prof. Fekete: “The gold basis is the difference between the futures and the cash price of gold . More precisely it is the price of the nearby active futures contract in the gold futures market minus the cash price of physical gold in the spot market. Historically it has been positive ever since gold futures trading started at the Winnipeg Commodity Exchange in 1972 (except for some rare hiccups at the triple-witching hour. Such deviations have been called ‘logistical' in nature, having to do with the simultaneous expiry of gold futures and the put and call option contracts on them. In all these instances the anomaly of a negative basis resolved itself in a matter of a few hours.)”

…Bullion lenders are trying to encourage gold borrowing now, particularly in the short maturities. Central banks are liquefying their gold reserves to stimulate aggregate demand.

[This is innacurate – Central Banks are liquefying their bullion hoards to make fiat look good]

…Rates have gone negative at the short end because demand for gold shorting has dwindled (since gold borrowing necessarily results in the short sale of metal to raise investment funds for the borrower)...

[Understand, the writer is talking about lease rates going negative here – these are in fact “inducements” being paid by Central Banks to Bullion Banks to encourage them to make bullion loans at Libor.]

Gold Lease Market

…..The chart above illustrates that the gold "carry trade" has become more profitable as the financial markets melt down….

[What the author refers to as the “gold carry trade” is inherently DANGEROUS. Leasing, then selling physical gold bullion in the hopes that one can replace it some day in the future is VERY RISKY when mine supply is contracting and investment demand is booming. So, it's only more profitable from the standpoint that greater inducements had to be offered to get banks to participate in this dangerous pursuit]

The spread between LIBOR and forward rates widened by nearly 200 basis points (2%) in just one month's time at the front end of the crisis…..

[ Incorrect : The Sub Prime crisis began back in Aug. 07 – made this chart to show reality]:

This goes a long way to explain why gold didn't reach new highs during the crisis…..

[This is a false statement. The author has done NOTHING to refute the importance of a permanent backwardation in gold futures and quite possibly MISSTATED the importance and ramification of what is occurring in the gold lease rate complex.]

In conclusion: There is a great deal of truth to what Professor Fekete is saying. The widening of the “vig” being paid to bullion banks is an act of necessity [if you're a Central Banker dead set on saving a failing fiat regime] and DESPERATION !!!

The balance of this article consists of further insightful analysis of Professor Fekete's article and more and it is available to subscribers at Kirbyanalytics.com .

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is the editor of the Kirby Analytics Bi-weekly Online Newsletter, which provides proprietry Macroeconomic Research. Subscribers to Kirbyanalytics.com are benefiting from paid in-depth research reports, analysis and commentary on rapidly unfolding economic developments as well as recommendations on courses of action to profit from chaos. Subscribe here .

Copyright © 2008 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.