Gold and Gold Stocks to Soar During 2009

Commodities / Gold & Silver Dec 11, 2008 - 11:17 AM GMT Here we discuss why gold will recover in 2009, and why gold is resisting the massive deleveraging in all markets better than most anything. Even though gold and the gold stocks especially have taken a hit, we expect them to recover significantly in 09. Here is why.

Here we discuss why gold will recover in 2009, and why gold is resisting the massive deleveraging in all markets better than most anything. Even though gold and the gold stocks especially have taken a hit, we expect them to recover significantly in 09. Here is why.

Overview of credit crisis and efforts to combat it

Well, Now that it's been a year and a half since Bear had its initial problems with those two hedge funds back around June 2007, its time to take stock and look at what happened. It's also time to ask what is happening, and what is going to happen in a year.

I think it's pretty clear, looking at the state of the credit markets that even after the US Fed has pledged up to $8 plus trillion fighting it, and the ECB maybe $5T, and all the other central banks are nationalizing their banks to stem bank runs, that things are definitely not working out. You can either look at the total absence of credit for businesses and individuals, the high credit spreads, zero interbank lending, or how about 533,000 US jobs lost in November alone?

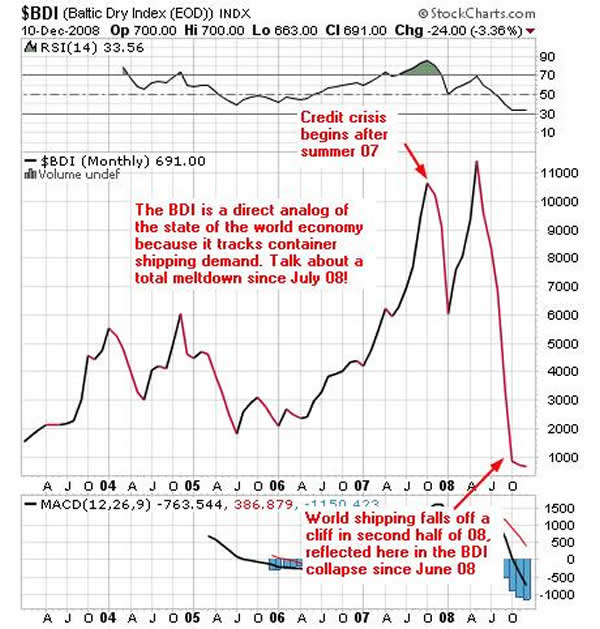

I mean, pretty much every economy in the world is hosed. Or consider the Baltic Dry shipping index, which was at 11,000 only a couple of months ago, and now is like 7 hundred something. Meaning that world shipping is literally at a standstill.

Without listing 50 pages in bullet form, of every collapsing economic sector, we pause here and ask what is going on overall?

Central banks trying everything but are failing

First of all, it's clear that the central banks have done practically everything they can think up to stem the collapsing economies and get lending going. and it is not happening. Pretty much every nation fears a world depression now, and they are doing anything possible to stop that from happening, and that is not working either. There are going to be millions of jobs lost in every major economy in 09, and this has already started in later 08. The fiscal deficits in every major economy are going to be huge in 09

Since the central banks and world treasuries are trying to stop the markets from deflating, and it's not working, then why are they all keeping up that effort? Surely they know that they will not succeed and are not succeeding. All that is happening is that they are massively increasing their public debts. They are using taxpayer money to bail out everything they can. It's a disaster, and rapidly doubling the national debts of the US, and others including the EU nations.

In fact, I was pondering the US debt increases alone. If you only look at the treasury and like bond indebtedness of the US, starting around July of 07 it was around $9 trillion. Now, in a mere year and a half, the US has added another $8 plus trillion to it with all the various bailout mechanisms. These numbers are added up in an LA Times article last week.

So, the US accumulates $9 trillion of national debt in 240 years, and in a mere year and a half, adds another $ 8 trillion? And for what? The credit markets are still frozen solid.

So, since the Fed and ECB and other central banks cannot be blind, why are they continuing to do more bailouts? All that is happening is they are rapidly heading their treasuries to bankruptcy….if they keep going, which appears to be the case.

Credit Crisis III

And, why are they doing this? In not a long time, the currencies themselves are going to start to be threatened, not just devalued. I suppose if they permit a world cascade of competitive devaluations, they can keep the money flooding out for another year before everything explodes into Credit Crisis III, which would be currency crises after the financial/bank crises.

And, since they seem to be going headlong into that path, saying they have no alternative, then what's next for currencies in 09?

First, if you look overall at what has happened, it's massive world deleveraging and debt deflation driving it. As we mentioned before, over $1000 trillion of leveraged markets are unwinding, and if you add up all the central bank efforts to loosen credit markets and do bank bailouts, it adds up to roughly 15 to 20 $trillion.

Well, $20 trillion is not near enough to stop $1000 trillion of markets deleveraging. So, the efforts are doomed to fail.

Currencies next

Once markets realize this, speculators are going to start attacking currencies. They already are in some cases, such as the Ruble, Won, etc. Even the Swiss Franc is under pressure, as the Swiss don't have quite a lot of foreign reserves, and the UBS debacle alone is wiping out their reserves with the bailouts, for example.

Korea and Russia both have problems coming due this month. Both of them have to roll over hundreds of $billions worth of short term corporate credit. And the trouble is, that market is collapsing too. So, the only solution so far has been using mainly their foreign reserves, and both their currencies are getting killed.

Lenders of last resort for –everything?

So, to get the overall picture, the world central banks are finding themselves to be lenders of last resort – for everything. And, fundamentally, that cannot work. The central banks cannot replace the economy. The economy has to function, or else all that happens is that CB money just gets thrown into a black hole. Just look at the still frozen credit markets for proof. And that proves that the central banks cannot replace the economy. After a year and a half of this bailout and lender of last resort stuff, corporate and private borrowing is still frozen, and the world economy is rapidly coming to a standstill.

US Treasury market nearing its limits

As we said, things are so bad that the currencies themselves are starting to feel it. What I am wondering is when the USD will really start to reflect this. Other major currencies are having problems, take the British pound for example, the Ruble, the Won and others. When the USD starts to reflect this failing bailout reality, it will start to drop. And the only weapon the US Fed seems to have is to offer more debt, to borrow more, and try to keep infusing $500 billion at a pop. This seems to happen every two weeks or so. And Obama is planning on up to another $1 trillion in fiscal stimulus in early 09. How much can the US Treasury market stand?

At some point, the bond markets will balk at buying the new US debt. Then the USD will suffer tremendously. I think we might see the beginnings of this in 2009.

‘If you can get it'

A few years ago, we said that at some point gold and silver would not be available at any price. Basically, if the USD was falling drastically, people would not sell their gold or silver for any price. They would hold onto it. This situation has appeared earlier than I thought.

The USD has not collapsed yet, but if you try to get gold or silver, you can't. If you order it online you are told it's a 2 month wait. And you have to pay upfront. If you go to coin stores they are out and say it's a 2 month wait. Financial writers are saying buy gold, ‘if you can get it'.

I think the simple answer for this is that gold and silver are already anticipating the currency crises coming in 09. Nominally, the USD is holding up compared to other currencies, and even strengthening. But, as we said, at some point the bond markets are going to do a thumbs down on new US treasury issuance, and when that starts to happen the USD will severely devalue in a couple of months.

I suspect gold and silver are already anticipating this risk, even though the USD is holding up at the moment because there is such a demand for cash in general (year end settlements, cash hoarding, etc.)

The disconnect between paper gold and bullion gold

The paper gold market is much larger than the usual gold bullion sales yearly. I would estimate the paper metal markets well over 100 times the size of the actual physical market. That is all the futures contracts and the many derivatives between banks and financial institutions compared to the actual bullion sales.

Since everything is deleveraging, the paper markets easily dominate the physical gold market. That explains the low spot prices, which are too low to encourage people sell their physical gold coins or whatever. Same for silver.

As long as deleveraging continues, paper gold prices can remain subdued.

But, interestingly, if you compared the gold price and the general commodity and energy complex, both considered inflation havens, gold has done much better in the last months since June 08. This is likely because gold and silver are the havens in currency crises. Here is a chart comparing the CRB commodity basket index and gold:

Since the world stocks have crashed in the last year, the CRB crashed too, and also oil (The CRB commodity basket index is heavily oil weighted). Gold has not crashed nearly as much, why is that? Basically every market is deleveraging.

Again, the answer is that gold is a central bank reserve asset and is money. Since most currencies are going to have trouble in 09, gold is anticipating that. It has even resisted the massive deleveraging forces in the paper gold market. No other market has resisted deleveraging.

In fact, the US Treasury bond market being so high is an example of deleveraging too, because there is flight to safety in US T bonds and such. In fact, the US just issued something like $30 billion of 4 week Ts at Zero this last week! Talk about a measure of the state of the world economy!

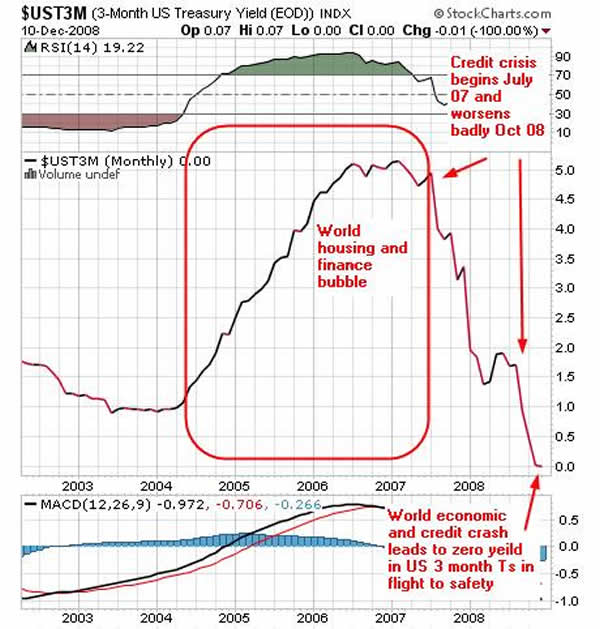

The US 3 month Ts are yielding practically zero too. They show the state of flight to financial safety:

Flight to safety will end up eventually in gold

When/if the confidence in the US treasuries starts to fail, flight to safety money will leave Treasuries and gold will skyrocket as the only remaining haven. At that point the US Treasury bond yields will begin rising with a vengeance.

Other currencies are not alternative havens

The other currencies are all going to weaken along with the USD with every central bank in the world desperately trying to stop deleveraging as all world markets collapse. This rules them out as alternative havens to the USD. This has already started in earnest in Oct 08 (actual economic collapse after credit collapse for a year and a half since Oct 07). The next question is when does the USD finally turn south, and T bond yields reverse falling. Again, if the other currencies are ruled out as havens, the only haven left is precious metals. People don't trust banks, US T bonds and maybe German Bunds are havens now but won't be later.

Energy and general commodities

It's doubtful that energy will be a haven like gold. Opec for example is having trouble keeping production limited, and falling oil prices encourage cheating. Russia too needs oil revenue, and energy generates something like 2/3 of their foreign exchange. So Russia will also resist production cuts and oil will stay lower in 09 because of that. A rapidly slowing world economy and layoffs are not going to help oil either.

World economy is hammering commodities

In case you doubt that oil will stay down, consider what this chart of the Baltic Dry shipping index shows about the world economy now:

In case you think oil is going to recover a lot in 2009, maybe you better consider what the BDI is saying-- meaning demand for shipping containers collapsed in the second half of 2008, which means the world economy is falling apart rapidly now. That will definitely put ongoing pressure on oil and commodity prices in 2009.

Gold stocks

Of course in all the deleveraging in stock markets, gold stocks took a big hit. But, as the prices of gold recover in 09, gold stocks should also recover, or even exceed their previous highs in 08. I know it's hard to take the gold stock volatility.

I am not saying this because I'm a blind gold bug. I say gold and gold stocks will recover in 2009 because the world is entering a phase of serious and widespread currency instability. That is going to be the next big story in 09. And, since other markets are not likely havens, such as energy or basic commodities, gold is the only remaining haven. After the US T bond market starts to fall (being a major haven now) then gold will skyrocket. Where else can one find a liquid haven except gold? And remember, gold is a Central bank reserve asset worldwide.

I would also like to point out that we warned subscribers of a general commodity sell off in April 08, because we called a USD bottom then. That has sure borne out as we anticipated. We expect the USD to start to turn in 09, probably by one year or so after it began its upturn. Gold and gold stocks will benefit immensely.

By Christopher Laird

PrudentSquirrel.com

Copyright © 2008 Christopher Laird

Chris Laird has been an Oracle systems engineer, database administrator, and math teacher. He has a BS in mathematics from UCLA and is a certified Oracle database administrator. He has been an avid follower of financial news since childhood. His father is Jere Laird, former business editor of KNX news AM 1070, Los Angeles (ret). He has grown up immersed in financial news. His Grandmother was Alice Widener, publisher of USA magazine in the 60's to 80's, a newsletter that covered many of the topics you find today at the preeminent gold sites. Chris is the publisher of the Prudent Squirrel newsletter, an economic and gold commentary.

Christopher Laird Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

damien

03 Dec 09, 17:28 |

my gold

i have a gold bracelet that is 7 ounces how would i find out what it is worth please ? |