How Deflation Creates Hyper-inflation

Economics / HyperInflation Dec 15, 2008 - 09:57 AM GMTBy: Eric_deCarbonnel

I keep reading about the dollar being a "new multi-year bull market" and that the US is headed for "Japan style deflation". Frankly, it is a little tiring. The people making these arguments should know better.

I keep reading about the dollar being a "new multi-year bull market" and that the US is headed for "Japan style deflation". Frankly, it is a little tiring. The people making these arguments should know better.

Deflation Vs Hyperinflation

Yes, there is debt deflation, and the overall money supply is shrinking as a result. However, those calling for "multi-year bull market" for the US dollar are insane. These individuals need to review basic monetary theory . The money supply is only one of three factors that determine whether prices rise or fall. The other two are the changes in the velocity of money and the real output of the economy. The danger of hyperinflation lies in a dramatic increase in the velocity of money due to a loss of confidence, not in changes in the money supply.

Confidence and the velocity of money

When confidence in an issuing authority crumbles, money starts flowing through the economy at a feverish pace. For example, in normal, noninflationary times the money supply might be equivalent to three months of output, but in a period of hyperinflation it might drop to two weeks worth of output. Since increases in the velocity of money have the same impact on prices as increases in the money supply, a 1000% increase in the velocity of money (typical in any period of hyperinflation) is equivalent to a 1000% increase in the money supply. Due to its effects on the velocity of money, the ebb and flow of confidence have a much greater impact on the short-term trend of prices then changes in the money supply.

Deflation can create Hyperinflation

It is no accident that many of the worst periods of hyperinflation are preceded by deflation. In fiat currencies with high levels of government debt, severe cases of deflation cause a loss of confidence in the nation's currency by shrinking the economy and making the government's debt appear increasingly unsustainable. The loss of confidence then causes the flow of money to speed up as individuals become desperate to exchange cash for real goods as fast as possible, producing hyperinflation.

As an example of deflation leading to hyperinflation, consider the case of the Weimar Republic . In 1920, Germany experienced a deflationary collapse, with the average citizen finding it harder and harder to get enough money for necessities. Banks, short of money, could not honor checks, and businesses were strapped for cash to buy materials and meet payroll. Fearing a collapse that would throw millions of workers out on the street, the German government desperately printed money in an attempt to re-inflate the economy. During this period, despite the government's money printing, the mark actually gained in value against foreign currencies, so that prices of imported goods fell by some 50%.

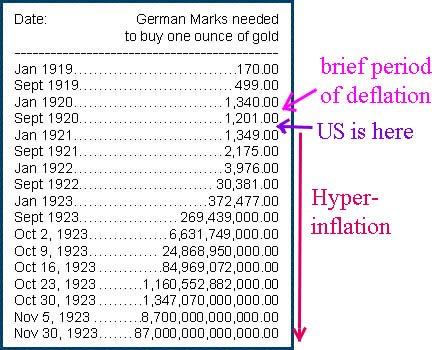

Eventually, as a result of the money supply's rapid expansion, the nation's massive foreign debt, and the shrinking economy, German citizens lost all confidence in their currency, and the Weimar Republic experience one of the worst cases of hyperinflation in modern economic history. Billions of hoarded marks came out of hiding and entered the marketplace. The chart below tells the rest of the story.

How deflation creates hyperinflation

1) Deflation slows the speed of money to crawl due to fears about the deteriorating economy. The public hoards cash, or, in the case of the US, short term treasuries.

2) The slowing speed of money and debt destruction force the government to create huge quantities of cash to prevent prices and the economy from collapsing. However, because the public is hoarding cash (or short term treasuries), most of the money doesn't reach the real economy, which leads the central bank to print even more money. In essence, cash hoarding acts as a dam, preventing the enormous quantities of printed money from affecting prices.

3) Deflation weakens economy until it leads to a loss of confidence. With doubts about the government's solvency growing, the velocity of money quickly picks up speed, and a flood of hoarded cash comes out of hiding, entering the marketplace all at once and creating hyperinflation.

US stands on the verge of hyperinflation

Gold Backwardation signals that the next phase of the economic crisis, a rapid acceleration in the velocity of money, is about to begin. Right now, the flow of money through the economy is basically frozen: everyone is panicking into treasuries due to deflation fears. Negative yields on the 3 month treasuries are a sign of this.

Despite the glacial rate money is moving through the economy, the dollar has started to fall again, and gold has begun to rally. As this continues, investors will begin to questions the safety of treasuries, and sell them off. The money coming out of treasuries will add fuel to gold's rise and the dollar's fall. Once the dollar hits new lows and gold breaks convincingly over $1000, Investors expecting deflation will begin to panic, and a flood of money will come out of treasuries. It is then that hyperinflation will begin in earnest.

By Eric deCarbonnel

http://www.marketskeptics.com

Eric is the Editor of Market Skeptics

© 2008 Copyright Eric deCarbonnel - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Eric deCarbonnel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.