Federal Reserve and Central Banking Responsible for Inflationary Booms and Busts

Economics / Global Financial System Dec 22, 2008 - 03:45 PM GMTBy: Rob_Kirby

Whether Or Not We Like It - In the past, I've written papers where the following quotation was included at the end of the treatise as an “exclamation point”: “We shall have World Government, whether or not we like it. The only question is whether World Government will be achieved by conquest or consent.” – James Paul Warburg , whose family co-founded the Federal Reserve - while speaking before the United States Senate, February 17, 1950

Whether Or Not We Like It - In the past, I've written papers where the following quotation was included at the end of the treatise as an “exclamation point”: “We shall have World Government, whether or not we like it. The only question is whether World Government will be achieved by conquest or consent.” – James Paul Warburg , whose family co-founded the Federal Reserve - while speaking before the United States Senate, February 17, 1950

Today, I feel that I've finally got it “the right way around” with this important quote – where it should be – at the beginning of, and in fact the subject of, a treatise of its own.

First, for the uninformed, in America the name “Warburg” is and always has been synonymous with Central Banking. The Warburg family name is inextricably linked to ‘old world banking' in Europe as well as being one of the prime architects of the formulation and passage of the Federal Reserve Act in 1913;

“Paul Warburg became known as a persuasive advocate of central banking in America, in 1907 publishing the pamphlets "Defects and Needs of Our Banking System" and "A Plan for A Modified Central Bank". His efforts were successful in 1913 with the founding of the Federal Reserve System. He was appointed a member of the first Federal Reserve Board by President Woodrow Wilson, serving until 1918.”

Second, after careful analysis and consideration, it is very apparent that the dogmatic pursuit to inflict private, for profit, Central Banking upon the masses is consistent with [if not synonymous with] the clearly stated goal of Paul Warburg; that of World Government.

A Deeper Look At Central Banking Through The Private U.S. Federal Reserve

When we stop to consider that the Federal Reserve is no more “federal” than Federal Express and they have no “reserves” – owing to the fact that they create money ‘out of thin air' – the name “Federal Reserve” itself is a misnomer and purposely given this moniker as a deceptive means; to make its creation more palatable to lawmakers since the framers of the U.S. Constitution [and the spirit of the document itself] were dead-set against the institution of Central Banking.

It would appear that the Constitution's framers deep distrust of Central Banking was well founded too – since the stated goal of its chief advocates is to usurp both the Declaration of Independence and the Constitution itself, in pursuit of World Government.

The means by which Central Banking exerts control over the populace is through their monopoly power in the issuance of irredeemable fiat currency [debt] for interest [usury].

The history of irredeemable fiat currencies clearly illustrates that the compounding of accumulated debt always denigrates into bondage and ultimately to the conquest of complete debt-slavery.

In a recent interview between two notable market commentators, Dr. Robert McHugh, a former banker, explains to Jay Taylor exactly how this insidious process is enacted on a naïve and unsuspecting populace;

Taylor : I was greatly impressed by an insightful article I found back in 2005 on the Internet titled, "The Feds Are at It Again. What Do They Fear?" It was written by Dr. Robert McHugh, who was, just as I was, once a banker before he became a newsletter writer. Unlike your writer, who worked for well-established foreign multinational banks in New York , Robert actually founded a local community bank in Eastern Pennsylvania that ultimately became known as Main Street Bancorp . Talk about a "ground floor" opportunity; as one of the founders of the bank, Robert was one of 13 employees when it started. From zero deposits, the bank grew to $3 billion in deposits and had 500 employees when management chose to sell out in 2000 because they believed the economy looked like it was ready to head south.

McHugh, after acknowledging that government manipulates metals markets, goes on to explain,

McHUGH: Well, I'm a renegade banker. I have sat in at meetings where the Federal Reserve came in, sat down and "said stop lending, we think there is a recession coming." The very fact that we were told to stop lending caused a recession. That happened in 1990-1991. Word of that finally hit the mainstream media and one of the first acts Clinton did was that he grabbed the regulators by the throats and said, "why don't you let the bankers start lending again." The next time they came in, they told us to start lending.

They have that kind of power. They decide when recessions and depressions happen. They decide when hyperinflation happens.

They can do it through a lot of different tools. The hidden one is the regulatory agencies where they come in and intimidate bankers and tell them what to do. They have a lot of power. They can have the boards of directors of banks thrown in jail. They can have people fired. They use those powers behind the scenes, nobody knows about them. As a banker, I have seen the dark side of the Fed. I have watched them rate good loans as bad loans, and charge off loans when in fact, customers were fine, the loans were fine. We are in a bit of that environment again now. What happens is, the last thing these government agencies want to happen is that they get called on the carpet before Congress. So they become overzealous, overcautious at precisely the wrong times. There is a lot of action by the Fed that messes with the normal business free market cycles that would prevent excesses. A lot of the publicity in today's market is that there wasn't enough government intervention, there wasn't enough regulation and that is true too, they got too far in one extreme, but they create imbalances and create these problems by overacting as well.

It seems that McHugh isn't the only market commentator to espouse such an informed, but negative view of the Fed. In a recent treatise written by Walter Williams, Central Banks Are Villains , published in the Pittsburg Tribune-Review – Williams helped focus a spotlight on the true workings of the Fed:

“The justifications for Federal Reserve Act of 1913 was to prevent bank failure and maintain price stability. Simple before-and-after analysis demonstrates that the Federal Reserve Bank has been a failure. In the century before the Federal Reserve Act, wholesale prices fell by 6 percent; in the century after they rose by 1,300 percent. Maximum bank failures in one year before 1913 were 496 and afterward, 4,400. During the 1930s, inept money-supply management by the Federal Reserve Bank was partially responsible for both the depth and duration of the Great Depression.

That being the case, who is responsible for inflation? It's not you or I because if we privately increased the supply of money to finance profligate spending, we would be charged with counterfeiting and go to prison. The Federal Reserve Bank, our central bank, is the only entity legally permitted to increase the supply of money, to finance Congress' profligate spending. The Federal Reserve Bank is supposed to be independent but it typically accommodates the wishes of Congress and the White House.

Central banks are villains in most countries; ours is just not as bad as others. In 1946, Hungary 's central bank gave it the world's highest inflation rate. Prices doubled every 16 hours creating an annual inflation rate of 13 quadrillion percent. Last October, Zimbabwe 's central bank produced history's second-highest rate of inflation. Prices doubled every 25 hours, giving it an annual inflation rate of 80 billion percent. By comparison, Germany 's inflation rate, which brought about the social disruption responsible for Hitler's rise to power, was a mere 30,000 percent that saw prices doubling every four days. You say, "Williams, that couldn't happen here." Except during the Revolutionary War and the War of 1861, our inflation has never exceeded 20 percent, but keep in mind that any hyperinflation was once 20 percent.”

Is A Central Bank Necessary?

“Knowing the dangers posed by central banks, we might ask whether our country needs the Federal Reserve Bank. Whenever I'm told that we need this or that government program, I always ask what we did before. It turns out that we did without a central bank from 1836, when President Andrew Jackson closed the Second Bank of the United States , to 1913 when the Federal Reserve Act was written. During that interval, we prospered and became one of the world's major economic powers…..”

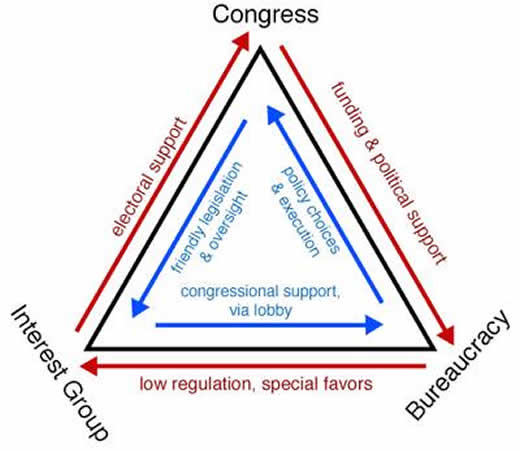

Enforcement and the Iron Triangle

So how does one go about perpetuating such a flawed regime? The answer to this question becomes apparent when one gains an understanding of the relationship between Central Banking and the Military Industrial Complex [MIC]. Because all wars are fought with “borrowed money” or are debt financed – Central Banking and the MIC make perfect bed-fellows and exert enormous influence on public policy:

To understand the insidious nature of this relationship, we need look no further than President Eisenhower's Jan. 17, 1961 farewell address :

…We face a hostile ideology -- global in scope, atheistic in character, ruthless in purpose, and insidious in method. Unhappily the danger is poses promises to be of indefinite duration. To meet it successfully, there is called for, not so much the emotional and transitory sacrifices of crisis, but rather those which enable us to carry forward steadily, surely, and without complaint the burdens of a prolonged and complex struggle -- with liberty the stake. Only thus shall we remain, despite every provocation, on our charted course toward permanent peace and human betterment…

…Until the latest of our world conflicts, the United States had no armaments industry. American makers of plowshares could, with time and as required, make swords as well. But now we can no longer risk emergency improvisation of national defense; we have been compelled to create a permanent armaments industry of vast proportions. Added to this, three and a half million men and women are directly engaged in the defense establishment. We annually spend on military security more than the net income of all United States corporations….

…In the councils of government, we must guard against the acquisition of unwarranted influence, whether sought or unsought, by the military industrial complex. The potential for the disastrous rise of misplaced power exists and will persist….

The military-industrial complex has no greater champion than the parasitic institution of banking, and for painfully obvious reasons; the staggering amount of money spent on this edifice – more than the net income of ALL U.S. corporations - is exclusively BORROWED .

Forever mortgaging our children's futures further entrenches the blood-sucking dominance and control that finance exerts over the productive or real economy until finally, left unchecked, the parasite kills the host. [more for subscribers]

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is the editor of the Kirby Analytics Bi-weekly Online Newsletter, which provides proprietry Macroeconomic Research. Subscribers to Kirbyanalytics.com are benefiting from paid in-depth research reports, analysis and commentary on rapidly unfolding economic developments as well as recommendations on courses of action to profit from chaos. Subscribe here .

Copyright © 2008 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.