Investing in Oil Stocks as Dividend Paying Currencies

Commodities / Oil Companies Jan 22, 2009 - 04:39 AM GMTBy: Oxbury_Research

The Holy Book tells us that there is a time to every purpose under heaven. Or was that the Byrds? In any event, these times have done an outstanding job of confounding all the investment world's beastly inhabitants, bull and bear alike. Just where the markets are headed a day or two from now is anybody's guess.

The Holy Book tells us that there is a time to every purpose under heaven. Or was that the Byrds? In any event, these times have done an outstanding job of confounding all the investment world's beastly inhabitants, bull and bear alike. Just where the markets are headed a day or two from now is anybody's guess.

The only clear item to emerge from this last week's trade is a decided shift in sentiment toward the pessimistic. Yet whether this shift has been large enough to be used by contrarians appears doubtful. There's not enough genuine fear, in our view, to justify taking a bullish stance at this time.

That said, it's not always the case that rallies are predicated upon dire pessimism, or that we need to see more of the rich and famous arranging early acquaintance with the Creator in order to take a long position in stocks. Wall Street will rally when it's good and ready – regardless the VIX and put-call readings.

For us at the Residual Income Report , the situation is somewhat less confusing because there are currently good opportunities to purchase established companies with healthy prospects (despite the global economic climate), who also throw off income – either as dividends from common or preferred shares or semiannually from their bonds.

Indeed, our urgency in recommending both corporate and high yield bond ETF's this fall has born fruit. If yield is a buffer against general market downturns, then yield that is oversold is an even greater buffer. And yield that is oversold and unqualifiedly secure offers the best chance of maintaining its value.

Though it's always our goal to catch such animals, they're not always so easily found.

A Look at Currencies on the Road to Dividend Riches

The European and American markets offer numerous dividend paying stocks that have much to commend them. But what of currency considerations? The U.S. Dollar was in a freefall until last summer and then did a rigid about face: the Euro now is in relative freefall against the buck. Shouldn't this weigh into our calculations?

No doubt, currency moves will have a dramatic effect on the profitability of any Euro-denominated stock pick. The question each investor must answer for himself is what kind of holding period he intends for the stock. For example, our November 11, 2008 recommendation of HSBC preferred “A” series – then selling at $17.01, now $16.56 – has maintained its value despite some significant gyrations in the value of the Dollar Index – and has paid subscribers over 9% to sit through those spikes and swoons. In short, it's been well worth it.

Yet what the future will bring in terms of the dollar is a little difficult to gauge. Over the long term – call it two to five years and longer – we have little hope the dollar will be able to survive as the world's reserve currency, let alone experience any sort of sustained appreciation in value. We have serious doubts, too, about its viability as a currency altogether, given recent events. In short, barring an unforeseen and miraculous economic turnabout, we see little reason to remain invested in American dollar denominated securities beyond roughly a year to eighteen months from now.

That said, the shorter term picture is very foggy. It could well be that recent strength in the Greenback continues through 2009, despite the current global economic malaise – and for the sole reason that America is the least bad of a slew of desperate first world economies: a sort of monetary kingship by default.

And if that's the case, certainly American shares will outperform their European counterparts over that period.

A Few Suggestions in a Time of Indecision

To begin, consider the following: there's nothing wrong with short term money. Over the past twelve years, three-month t-bill returns have beaten equities. And since we expect a steep rise in Treasury yields to accompany the Fed's efforts to hold back an Atlantic inflation wave now in the pipeline, you'll be more than happy to ride it out with short term money. Only a little patience is required until then.

As for income, take a look at the following two European based oil stocks, both of which will be household names to most:

British Petroleum , whose ADR trades as BP:NYSE , currently offers a 7.6% yield at a price of $44.21 per share.

While Royal Dutch Shell ( RDS.A:NYSE ) generates 6.32% and trades at $50.67.

Significantly, both of these stocks boast incredible earnings/share numbers and, therefore, rock solid dividend coverage figures. In the case of BP, dividend coverage is 2.6x, and with Shell, 3.1x. You will be hard pressed to find any company of this size in the financial world – not to mention the energy sector – whose dividend is as high, and whose cash flow secures it so well. Exxon Mobil, for comparison purposes, offers a mere 2.05% annual dividend.

Consider also:

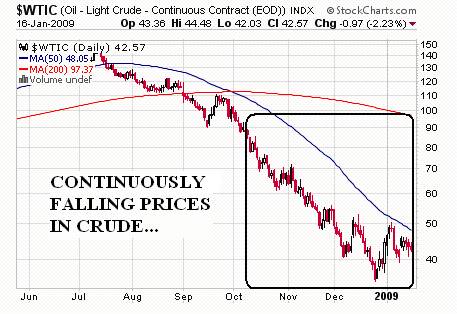

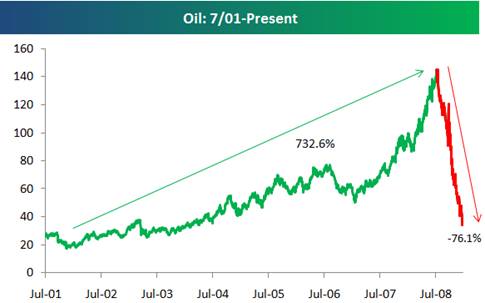

Though it has fallen steadily since August, from nearly $150 to the low $30 range, the price of crude has had little to no effect on oil shares since mid-October of 2008. The entire energy sector has been drifting sideways since then – even rising somewhat – despite the price contraction (see charts below).

Chances of a dividend cut on either of these shares is as remote as it is unnecessary – and would result in a devastating loss to share value. Management has no interest in this at this stage since it would make raising capital very expensive in an already expensive environment.

Both the magnitude and the velocity of the selloff in crude point to an inevitable retracement . The chart below shows a selling frenzy of sickly proportions.

Crude is due for a snapback. When and how much is anybody's guess, but it will be sharp and will be fed by significant short covering.

Finally, the value of the U.S. currency has little material effect on share prices here, as both companies are highly diversified multinationals and sell their production in U.S. dollars.

The Residual Income Report recommends equal weight purchases of British Petroleum and Royal Dutch Shell stock at $44.21 and $50.67 respectively.

And let commodity be your currency.

Matt McAbby

Analyst, Oxbury Research

After graduating from Harvard University in 1989, Matt worked as a Financial Advisor at Wood Gundy Private Client Investments (now CIBC World Markets). After several successful years, he moved over to the analysis side of the business and has written extensively for some of corporate Canada's largest financial institutions.

Oxbury Research originally formed as an underground investment club, Oxbury Publishing is comprised of a wide variety of Wall Street professionals - from equity analysts to futures floor traders – all independent thinkers and all capital market veterans.

© 2009 Copyright Oxbury Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Oxbury Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.