Sterling's Damage and Geithner's U.S. Dollar Policy

Currencies / British Pound Jan 23, 2009 - 05:47 PM GMTBy: Ashraf_Laidi

Currency market participants are faced with increasingly diverse options amid the deepening erosion of risk appetite, persistent banking losses and deteriorating measures of corporate and household wealth. While yen-supportive strategies remain most prevalent amid the worsening risk-landscape, broad selling of the British pound and bearish stances in the commodity currencies (CAD, AUD and NZD) has also proven rewarding. The US dollar continues to emerge as a reliable companion to the yen in strengthening by default against the European and commodity currencies.

Currency market participants are faced with increasingly diverse options amid the deepening erosion of risk appetite, persistent banking losses and deteriorating measures of corporate and household wealth. While yen-supportive strategies remain most prevalent amid the worsening risk-landscape, broad selling of the British pound and bearish stances in the commodity currencies (CAD, AUD and NZD) has also proven rewarding. The US dollar continues to emerge as a reliable companion to the yen in strengthening by default against the European and commodity currencies.

USD-strength by default simply means the increase in value resulting from a slew of negative European issues (UK banking troubles and S&P sovereign downgrades of Eurozone nations). But as I have argued last week, golds upward trajectory manifests the ongoing fundamental woes in the US economy and currency (last weeks retail sales, falling CPI and todays soaring jobless claims). As retail investors realize gold's ability to hold above its 2-month trend line, their new zeal for the metal via ETFs may help propel the metal back to December's $890s.

Sterling Focus: From Davos to Rome

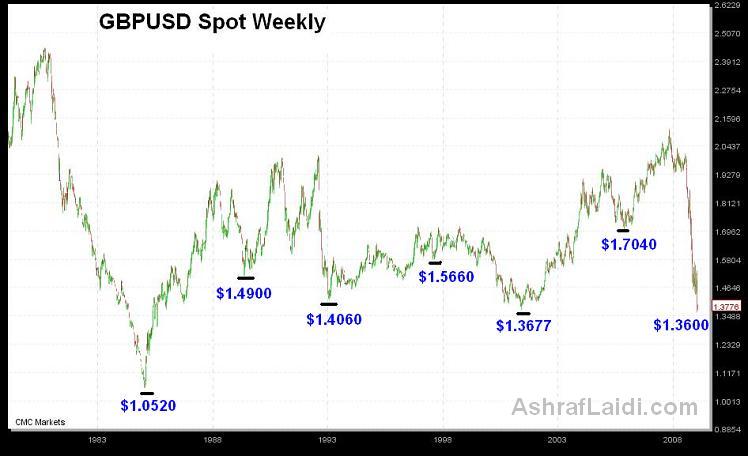

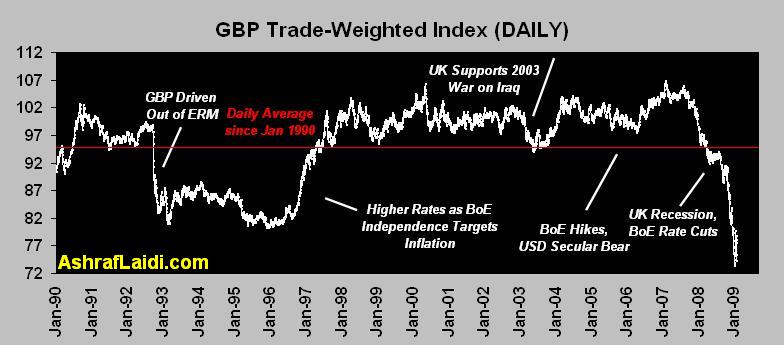

As French and German officials begin to express concern with the impact of the pound's rapid fall on their already sluggish economies, more swings are expected in the British currency, particularly, the parity-bound EURGBP exchange rate. Chatter is already circulating about a possible mention of the weak GBP in next month's G7 meeting in Rome. Over the last 6 years, G7 summits were a popular venue for policy makers to voice their concerns over a plummeting dollar, an artificially low Chinese yuan or Japanese yen. But with the current GBP plunge already dubbed as a currency crisis (23-year lows vs the USD and record lows vs EUR and JPY), the focus has clearly shifted and the stakes are higher. Consequently, we should expect more GBP volatility ahead of the G7 meeting, especially as the chorus of remarks from German and French officials about GBP intensifies. Currency swings will be especially pronounced as German and French tensions may be further countered by the approving from UK Treasury officials. After all, the weak pound is the only silver lining of the UK recession.

Next week's Global Economic Forum in the ski slopes of Davos should prove as a warm-up exercise for GBP-related chatter, speculation and verbal and intervention, leading to the Feb 14 G7 meeting in Rome. Having reached $1.3618, GBPUSD is increasingly expected to extend $1.30 in the medium term, a figure last seen in September 1985. Parity in EURGBP remains a more plausible target than $1.25 in GBPUSD.

Geithner's FX Message to Asia

Yesterday's remarks from US Treasury Secretary designate Tim Geithner expressing his views in favour of flexible exchange rate systems were largely targeted at China, but more of such remarks could be interpreted as his green light to allow the further declines in the USDJPY exchange rate, currently at 14-year lows. Geithner is familiar with FX matters at the NY Fed, including the notion of double standard policy espoused by the Bush administration in past years whereby US officials pressured Beijing against yuan-selling intervention while allowing Tokyo to engage in yen-buying interventions in 2002-2003 as both measures served the interests of the U.S. economy.

Geithner's allusion yesterday that China is engaging in currency manipulation would be a departure from the US Administrations repeated shrugging of the matter. In the event the Obama Treasury pressures China into further currency revaluation, the dollar/yen exchange rate would make the transition from falling to collapsing, especially if Beijing stonewalls Washington as it is likely to do considering its slowing economy.

Forex traders may reason that Geithners experience with international monetary affairs grants him the ability to attain successful coordination with European and Asian policy makers in stabilizing currency swings. But there is validity to the opposite argument stating that Geithners experience implies his awareness of the non-viability of currency intervention due to prevailing fundamentals. With US interest rates expected to remain at zero and UK interest rates have yet to reach that level, the downside for both USD and GBP is here to stayparticularly against JPY. Reiterating the notion of a high correlation between Fed tightening cycles and USDJPY , the exchange rate is expected to break below 80 and onto 72-73.

By Ashraf Laidi

CMC Markets NA

AshrafLaidi.com

Ashraf Laidi is the Chief FX Analyst at CMC Markets NA. This publication is intended to be used for information purposes only and does not constitute investment advice. CMC Markets (US) LLC is registered as a Futures Commission Merchant with the Commodity Futures Trading Commission and is a member of the National Futures Association.

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.