Stock Market Volatility VIX Forecasts Trends

Stock-Markets / Volatility Jan 28, 2009 - 08:09 AM GMTBy: Marty_Chenard

Does a down moving VIX always mean that the market will move up?

Does a down moving VIX always mean that the market will move up?

As you are well aware, the market is often in conflict with opposing conditions.

Take the VIX and the S&P's Relative Strength for instance.

If you look at yesterday's VIX (Volatility Index), you would see that it appeared to be moving down with a nice lower tick. Then, if you looked at the S&P, it had a nice up tick that gave the appearance of a new short term move to the upside.

So, is this a nice, clean condition for a short term upside move?

One important indicator to consider is the Relative Strength ... especially when it appears to be in opposition.

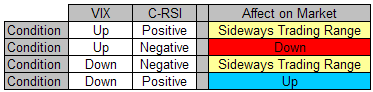

The combination mix of movements with the VIX vs. the C-RSI is what is important ... not the VIX by itself. Below is a chart of the possible VIX/C-RSI combinations and their affect on the market:

So, let's look at today's VIX and C-RSI reading.

At the close yesterday, the VIX was moving down, and the C-RSI was NEGATIVE. If we look at the chart above, the affect on the market is traditionally neutral which gives the market a "sideways, trading range" condition.

What that means ... is that the market can go higher on the short term, but within the extremes of the trading range.

As long as the VIX is moving down, and the C-RSI is moving up while in Negative Territory , then the S&P will move up on an intra-day basis ... and do so within its trading range. If the VIX is moving down, and the C-RSI starts moving down, then this opposing force neutralizes intra-day up movement attempts.

"Trading Range" conditions are volatile and unstable conditions because there is no upside or downside trend in place. Instead, there are up an down moves within the upper and lower boundaries of the trading range.

FYI: What's a C-RSI? It is a version of the standard Relative Strength Index. On the C-RSI, a value of 50 is subtracted from the RSI so that the Relative Strength will "show a zero reading when neutral".

This allows one to easily see when the Relative Strength is positive or negative due to its position above or below the horizontal line.

________________________________________________

*** Feel free to share this page with others by using the "Send this Page to a Friend" link below.

By Marty Chenard

http://www.stocktiming.com/

Please Note: We do not issue Buy or Sell timing recommendations on these Free daily update pages . I hope you understand, that in fairness, our Buy/Sell recommendations and advanced market Models are only available to our paid subscribers on a password required basis. Membership information

Marty Chenard is the Author and Teacher of two Seminar Courses on "Advanced Technical Analysis Investing", Mr. Chenard has been investing for over 30 years. In 2001 when the NASDAQ dropped 24.5%, his personal investment performance for the year was a gain of 57.428%. He is an Advanced Stock Market Technical Analyst that has developed his own proprietary analytical tools. As a result, he was out of the market two weeks before the 1987 Crash in the most recent Bear Market he faxed his Members in March 2000 telling them all to SELL. He is an advanced technical analyst and not an investment advisor, nor a securities broker.

Marty Chenard Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.