BRIC Emerging Stock Markets Relative Performance Analysis

Stock-Markets / Emerging Markets Feb 02, 2009 - 05:37 PM GMTBy: Richard_Shaw

Emerging countries have been increasingly important to developed economies. How are their stock markets doing lately?

Emerging countries have been increasingly important to developed economies. How are their stock markets doing lately?

Let's look at the BRIC countries (Brazil, Russia, India and China) over the past year through their indices.

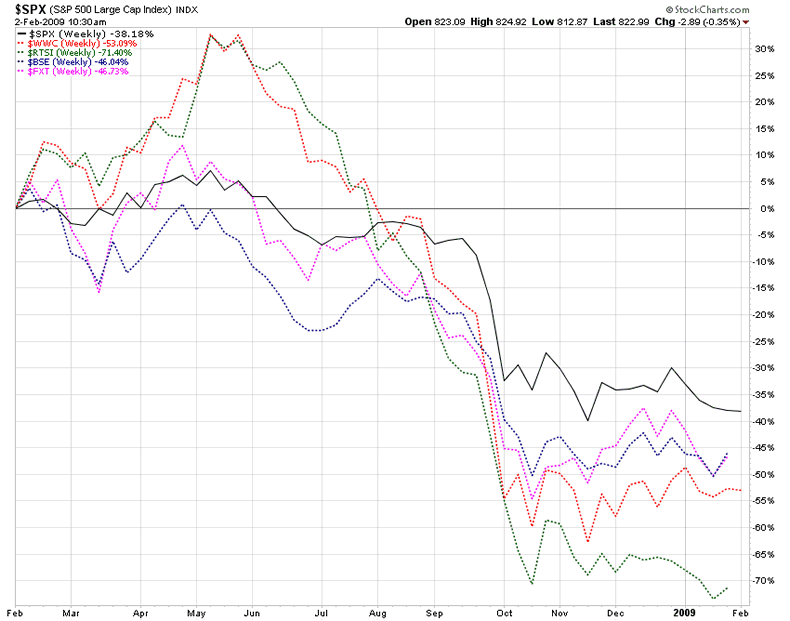

China and India are at about the same level of 1-year performance at approximately -47% and -41% respectively.

Brazil is behind China and India at approximately -53%, and Russia is the laggard at approximately -71%.

The S&P 500 index is down approximately 37% over the same period.

BRIC Indices vs S&P 500 Index (1-year weekly)

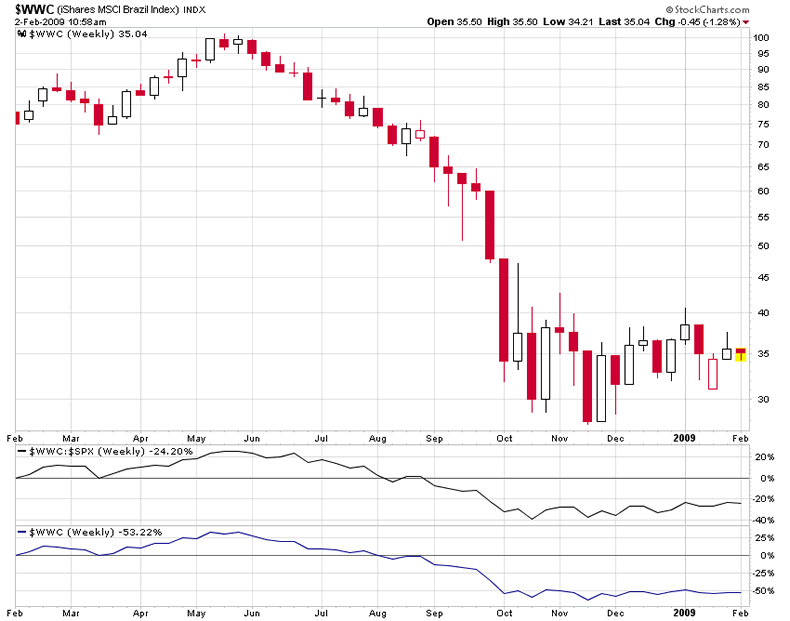

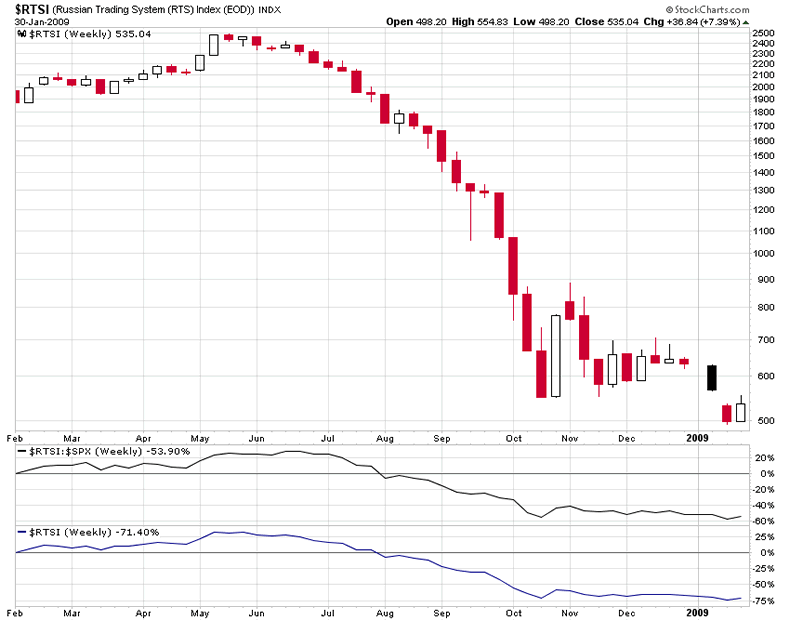

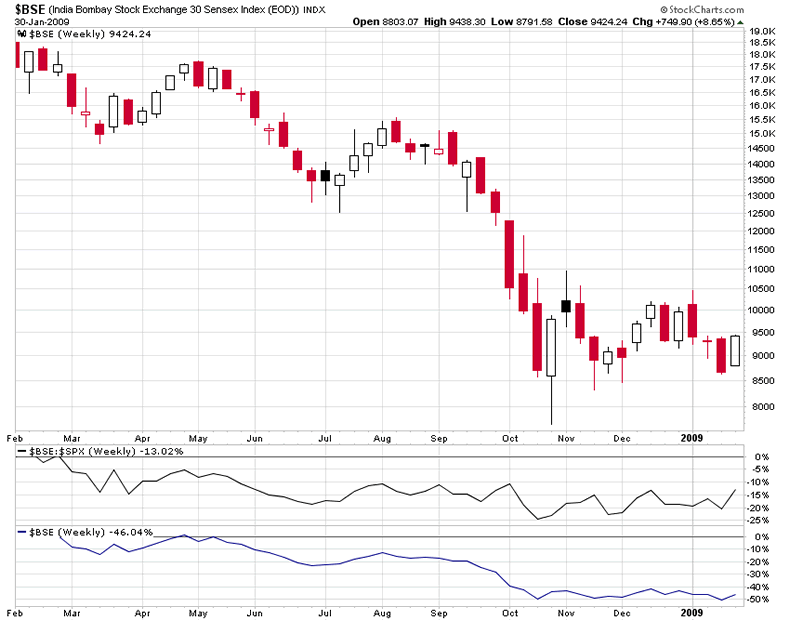

The stock charts below show the index in candlestick format, with price performance relative to the S&P 500 index immediately below, and absolute price performance in the bottom frame.

Brazil (MSCI Brazil Index)

Russia (Russian Trading System)

India (Bombay SENSEX)

China (Xinhua 25)

Some of the Investable proxies for the four indices include:

- Brazil: EWZ

- Russia: RSX

- India: IFN

- China: FXI

The Barclay's ETN (INP) was once a good vehicle for India, but due to the credit quality problems with banks, including Barclay's, we caution against investing through any ETN (single issuer debt instruments) during this troubled economic period.

While Russia provided outstanding recent past returns, we are biased against investing there at this time due to apparent integrity problems in dealing with foreign capital — particularly the effective expropriation of oil company interests. We are also concerned about its handling of gas flows to Europe during this and last winter, it's credit default about ten years ago, it's conflict with Canada over undersea oil assets, it's handling of political opposition, and it's dubious democracy. Basically, we think the rule of law and property rights are likely to be stronger in Brazil, India and China than in Russia in the intermediate term. Russia may bubble again, and may be a trading market, but we don't think it is a reliable long-term investment market.

The economies of all four countries are impacted negatively by the world economic decline. Brazil as a natural resource exporter may recover earlier than India and China which are natural resource importers. Australia (proxy EWA) is also an important natural resource exporter which may recover early during an economic recovery as well.

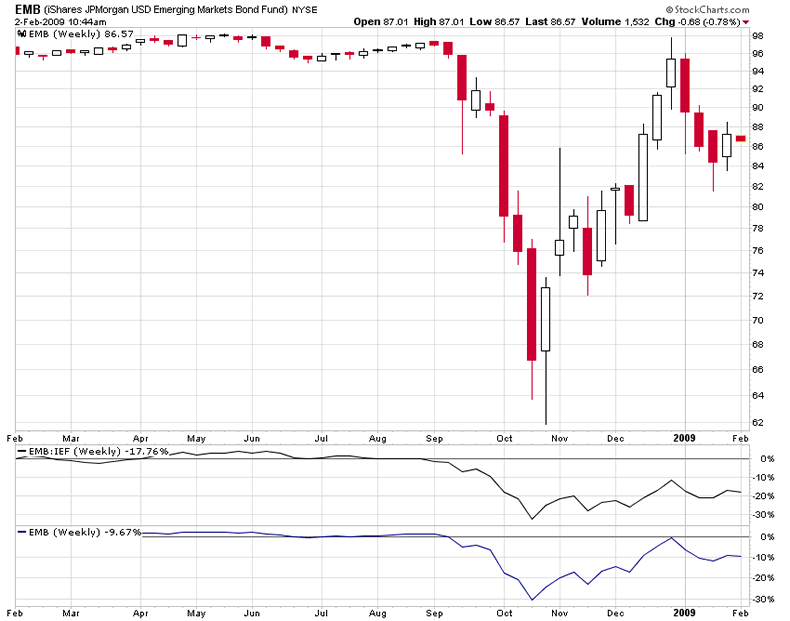

The sovereign and quasi-sovereign debt of emerging countries overall has recovered to a great extent from the Q4 2008 credit problems experienced around the world. While they have not done as well as US Treasuries, they have come back substantially from Q4 losses.

The bond fund chart below shows the fund in candlestick format, with price performance relative to the 7-10 year US Treasury fund (IEF) immediately below, and absolute price performance in the bottom frame.

Emerging Markets Gov't/Agy Debt vs US Intermediate Treasuries

(proxies: EMB and IEF)

Emerging markets deserve close watching. They will likely surge again. The growth of wealth and global economic significance of emerging economies will likely continue in the long-term, the current world economic problems notwithstanding.

The famous investor, John Templeton, said that bull markets are born in pessimism, grow on skepticism, and die in euphoria.

We certainly have pessimism, but unfortunately don't know whether we are near maximum pessimism. At some point, emerging markets should be an extraordinary investment opportunity.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2009 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.