Pep Talk for Panicky Gold Investors

Commodities / Gold & Silver 2009 Feb 27, 2009 - 08:46 AM GMTBy: Jim_Willie_CB

SUDDEN SHIFT, FICKLE FOLKS - What a difference one week makes! With a gold price daring the $1000 mark in defiance, boldness prevailed, investors took heart, analysts cheered, and the establishment cringed. This week, with a very ordinary selloff in consolidation, optimism has vanished in what can only be characterized as silly. Gold & silver will take over the globe as anchors in a sea of shifting sands, all in time. We have seen the crude oil price fall from $140 something to $40 something, the Dow Jones Industrial stock index fall from 14,000 something to 7000 something, the housing price index fall every month by over 10% on an annual basis, and hundreds of billion$ vanish in bank equity.

SUDDEN SHIFT, FICKLE FOLKS - What a difference one week makes! With a gold price daring the $1000 mark in defiance, boldness prevailed, investors took heart, analysts cheered, and the establishment cringed. This week, with a very ordinary selloff in consolidation, optimism has vanished in what can only be characterized as silly. Gold & silver will take over the globe as anchors in a sea of shifting sands, all in time. We have seen the crude oil price fall from $140 something to $40 something, the Dow Jones Industrial stock index fall from 14,000 something to 7000 something, the housing price index fall every month by over 10% on an annual basis, and hundreds of billion$ vanish in bank equity.

But gold falls from $1000 to $940 or $950, and suddenly the precious metal story is repudiated? Utterly absurd! The currencies of the world are one by one being discredited. Gold and only gold can take the mantle within the financial sector. Gold and only gold can grab the reins of the horse team run wild. Watch as crude oil and energy supply generally takes a different mantle within the barter arena of the commercial sectors. They will bypass the corrupted commodity price discovery system. New currencies have already been agreed upon. Their inception requires only the passage of time. They will be launched amidst the growing crisis whose script has been written.

CONSOLDATION AT THE HANDLE OF THE CUPThe gold price broke above the 980 resistance level. Doing so technically did not come convincingly though. The U-shaped reversal pattern is clear, nicely rounded, enough to warrant the name ‘Cup & Handle' from the charting lexicon. The top of the cup is 980 on the left side and 1000 on the right side. The positive bias is bullish. Notice all moving averages are in bullish mode, having crossed over. The bull run in gold has come from a bottom of roughly 700 up to 1000. The corrections in December and January were not small. Now the February correction might not be small. But they are fit within the bullish scenario. The MACD cyclical still looks healthy and strong. Support in the current pullback and consolidation appears to be in the 900 to 925 ribbon range. THE GOLD CHART IS CARVING OUT THE RIGHT SIDE HANDLE IN THE CUP & HANDLE REVERSAL PATTERN. From there, a breakout comes.

Never lose sight of the fact that a slightly lower gold price continues to attract foreign investment funds. The Chinese, Arabs, Japanese, Koreans, Russians, and Germans all sit on vast USTreasury Bond holdings. They are nervous. They are converting to gold gradually. They will demonstrate some patience. Don't expect them to wait for anything lower than 900. My expectation is for 900-925 to act as a powerful oppositely charged magnet, and repel gold upward. The next leg for gold will easily surpass the important $1000 mark. Its leg will start close enough to $1000 in order to put some distance behind it. Some day in the future, and not too distant, the gold price will look at the $1000 mark as far below its current price.

GOLDMAN SACHS LIQUIDATESA small news item appeared in the press this week, one which gathered almost no attention. If Morgan Stanley expects gold to slide all year, and silver to slide all year, like down to $11 per ounce in a corporate research forecast, then maybe they should tell Goldman Sachs. The kings of insider trading, taking full advantage of both USGovt implemented policy and politically managed commodity indexes, Goldman Sachs made an important move. They covered their remaining 69 short gold futures positions on the Tokyo Commodity Exchange (TOCOM). They have reduced their position to zero. In May 2006, the GSax position reached 52,000 short gold contracts. Now it is zero. TOCOM is unique, unlike the corrupted US commodity exchanges, since it requires all parties to post and publish their positions in a public manner. So Goldman must know something about the hugely positive prospects of gold. How about the new currencies to arrive by the stork in about one year time will all contain a gold component??? The simplest statement one can make about Wall Street is that traders became traitors.

INVESTMENT DEMAND SOARSThe establishment that embraces fiat currencies prefers to announce that jewelry demand is down in India, down in general globally, due to price reactions. How about telling the other story? That would be how the gold investment demand and silver investment demand has soared 400% in the last year or so. The data is astounding, but such a story would go counter to the belief that gold is a commodity. Gold is money, and fiat currencies are essentially denominated debt. Investment demand has soared since debt destruction has exposed currencies to be universally deficient, unmasked as debt instruments. The global banking system has been ruined by virtue of both the ridiculous growth in debt and the indefensible foundation of currencies. Furthermore, the coin shortage is touching all corners of the globe, as investment demand reaches levels to alarm officials. Maybe the USMint will close a few days per month, just like the California government agency offices.

MINING SUPPLY FADESFor two consecutive years, maybe three years, the global output of gold has fallen. This took place against a backdrop of rising price. Each year the gold output has fallen in what should truly shock most analysts. Yet the story appears on back pages. This testifies to Mother Nature working to exacerbate the mining firm corrupt cash management schemes, enough to verify empirically what my analysis has mentioned for four years. The gold price is inelastic on the supply side, as less output comes from a higher price. Mother Nature screams that deposits are harder to find, deeper to mine, narrower in concentration, fraught with worker risks, and subject to the vagaries of local struggles like South African electricity availability. On the cash management side, covering short positions on oversized hedges has drained their working capital. Operations are impeded by lack of adequate funds at a time when bank capital is not readily available. When demand soars, and supply reduces, the prescription for a powerful price response upward is not only evident but to be realized.

MORGUE & CEMETERIES

The USDollar has been stuck at the morgue in recent months, lying on a cold metal table. It owns a toe tag for easy identification. Its powerful counter-trend rally is testament to something, to be sure. The establishment prefers to claim that the USDollar is stronger than other currencies, that the USEconomy will emerge from the crisis before other nations, that the US banks will respond sooner than foreign banks. This is all rubbish. Furthermore, the US central bankers have been without any doubt whatsoever the stupidest analysts on the planet during the entire introduction, entrenchment, and advance of the crisis. They have missed every single call and pronouncement. Lost central bank integrity begins within the US. To claim the Untied States is first to emerge goes counter to its inept leadership in the banking sphere. No! The USDollar is stuck at the morgue, which quack team doctors struggle to produce falsified evidence that it can return to the playing field. The arrival of new strong global reserve currencies is the death knell to the USDollar. Their arrival is due in January 2010, but expect a struggle (possibly with a military component) to force a possible delay. When in place, they will come with bylines of the USDollar finally being moved to its proper destination, the cemetery. Ironically, the longer the process takes to send it to the cemetery, the higher the gold price will achieve in the preliminary stage before the USDollar loses its monopoly in usage, or one should say its privilege to be abused in a profound hegemony that history will tell.

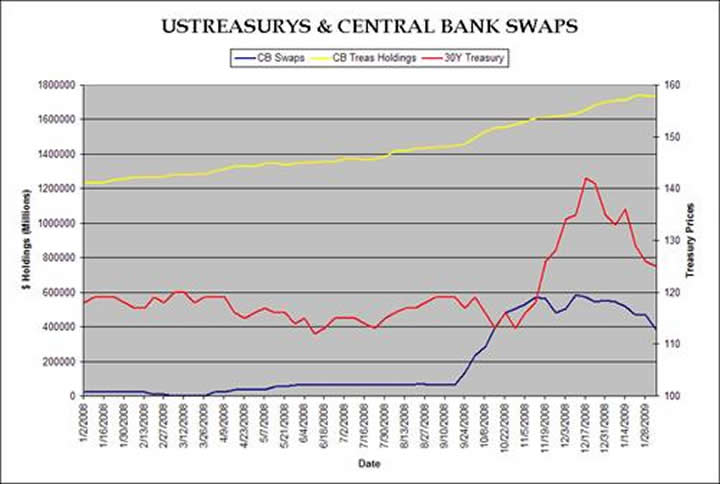

One highly experience contact mentioned the hilarious story of his own experience when young, working as an orderly in a hospital. The male patients who die often boast a powerful erection immediately upon death, a strange phenomenon indeed, as the blood supply finds a path of least resistance. The current situation is no different, as the foreign central bankers show their newest ledger item, the dollar swap. See the rise in USTBond holdings (in yellow), fueled by a strong rise in CB dollar swaps (in blue) just since last autumn when the official swap was announced. Foreign bankers remain on the defensive. The US$ demand is not from commerce or normal banking. It is from emergency measures to fund liquidation demands. The chart provides ample evidence. Zombie banks require powerful energy in order to keep them erect and standing. Just yesterday the Federal Deposit Insurance Corp head Sheila Bair announced that 252 banks were in danger on the official at risk list. That is the most ever. If truth be known, the FDIC is no longer in the business of protecting depositors or ensuring a strong bank system, its official charter. It has become an agent for mergers that enable Wall Street banks to raid bank assets. See the JPMorgan mergers that enabled it to scarf up bank assets from Washington Mutual, access to $140 billion in assets for a mere $2 billion. Bair has become a true harlot for Wall Street, well-paid to be sure. In fact, the FDIC is the real dealmaker now in a real investment banker sense. They might soon be forced to revert to their original role, to liquidate dead banks and protect deposits. Doing so will reveal the FDIC fund is depleted.

DESCREASING RELEVANCE OF USDOLLAR TO GOLD

A recent past article argued the disconnection between the USDollar exchange rate and the gold price. That is the biggest gold story beyond basic price in the last few months. Even hack analysts have noticed, the dullest bulbs on the media light fixtures. This means that all foreign currencies have the opportunity, possibly fully taken, to lift the gold price. The gold price in US$ terms has been the last one to break out. It has not yet broken out to new highs. Gold has broken out to new highs in every major currency in powerful fashion. The longer it takes to do so in US$ terms, the more powerful it will be, since foreign investors will pile on in what should become a global confirmation love fest. Never under-estimate gold fever.

FUTURE USDOLLAR ALTERNATIVES

The Arabs, Russians, and Germans have already made decisions for new global reserve currencies. They will not only have a gold component, but a crude oil component as well. They might have other commodity components such as iron or copper. Include cotton too, which is needed to make the paper! The objective is to seek stability in both the banking sector and commodity price sector. Due to US$ foundation, and US$-based trading, the banking sector has been rendered insolvent and the commodity price arenas have been rendered fallacious. That cannot stand. For now, the new global reserve currencies have been shoved in a drawer at a guarded conference table. What are they waiting for? Simply stated, they are waiting for the US$ to die a horrible death, for the global US$-based banking system to demand an alternative amidst crisis, for the political interference to fade from the passage of time and the expedience of need. The foreigners need not act, since nature is taking its course. The liquidation process underway inside the US is painful and inexorable, yet certainly unstoppable.

A certain analyst (unnamed here, named in newsletter) has been on the job within the economic and political spheres, even military aspects of the war and its costs. He summed up very well the impact of the lost custodial role of the USDollar. My claim has been that the Untied States will enter an isolated corner best known as the Third World. He concurs in eloquent style, when he writes: “If the dollar loses its reserve currency role, foreigners will not accept dollars in exchange for real things. This event would be immensely disruptive to an economy dependent on imports for its energy, its clothes, its shoes, its manufactured products, and its advanced technology products. If incompetence in Washington, the type of incompetence that produced the current economic crisis, destroys the dollar as reserve currency, the ‘unipower' will overnight become a third world country , unable to pay for its imports or to sustain its standard of living. How long can the US government protect the dollar's value by leasing its gold to bullion dealers who sell it, thereby holding down the gold price? Given the incompetence in Washington and on Wall Street, our best hope is that the rest of the world is even less competent and even in deeper trouble. In this event, the US dollar might survive as the least valueless of the world's fiat currencies.”

OF CURRENCY AND 0%

To expect that any currency can recover from 0% interest rate policy is absurd, anathema to modern science, and an insult to the intelligent among us. Japan proved that 0% rendered their nation to lose a decade of prosperity, with emergence only long enough for its biggest trading partner to back itself into a 0% corner. Refer to the Untied States, which would be lucky to find itself in just a corner. It actually finds itself in a global penalty box due to exported fraud, realized as a banking straitjacket, and probably a financial prison. The zero percent option is a one-way ticket to at least a lost decade, and at most a kick down the staircase into the Third World. Japan was able to buy more time, since it owned a powerful factory industry, since it had no burden of a military millstone around its neck, since it had savings. The US has none of these, and therefore will slide into a Third World location with much uncertainty remaining on details. Removal of credit lines and rising prices are the most vivid rules of life within the Third World. The US has already announced it will rely more heavily, if not totally (eventually), upon the printing press. So has every other Third World nation, and in doing so, has seen the advent and crippling effects of hyper-inflation. The US will be no different.

INDUSTRY IN RATHOLE

A quick look around will expose the destructive and powerful downward momentum to industry generally. The car industry is the most important for finished products, and steel the most important for factories. The car industry is in shambles, as inventory occupies open fields, loading docks, huge factory lots, and even test tracks. It is the most vertically integrated of all, and most visible. Bailouts of the car industry will have to be unending to prevent their bankruptcy. Ironically, a bailout of all major car suppliers must occur in order to prevent the failure of General Motors, Ford Motors, and Chrysler. Look further to see hundreds of thousands of retail stores have shut down, the laughable foundation of the USEconomy built atop consumption. Where are the analysts now who claimed a consumer economy was healthy?

Where are the analysts now who claimed the USEconomy and its mindless consumption basis could sustain itself, let alone foreign economies? The banking system and credit markets enable capital formation for industry. It has broken. It cannot be put back together without a new foundation. To think otherwise is heresy, but then again, heresy is the stock and trade of central bankers. Just today the Gross Domestic Product for the USEconomy was announced in estimated preliminary form. The 4Q2008 GDP was minus 6.2%, enough said. The 3Q2008 GDP was around minus 4%, and we were told that it would grow no worse. My forecast of economic disintegration is coming true, not a recession. The stimulus needed will be catastrophic! Gold will respond powerfully!

OF GOVERNMENTS & FUTILE STIMULUS

The policy set forth by the USGovt, at the end of the last administration and at the beginning of the current administration, is clear in seamless fashion. Support dead banks, reimburse worthless bonds, nationalize credit derivative black holes, and provide stimulus way off the mark loaded with pork. Also, make the initiatives ten times smaller than necessary, in order to manage the political backlash. Tragically, they are trying to put a bubble back together, an utter impossibility. Some call it fighting deflation. My view has steadily been that inflation decisions will continue to meet deflation forces, as each rise in power and intensity. The USGovt has embarked upon a path to preserve jobs in dead corporations rather than to encourage creation of new viable corporations. The USGovt has embarked upon a path to reward fraud and mismanagement, rather than to sweep aside the felons who continue to direct both policy and dispensation of funds. Capital is not going toward healthy promising enterprise, period!

In Banana Republics, the government seizes oil fields or mineral fields. In the case of the Untied States, the nation took over the dead banks and financial institutions. Worse, it took over legal obligations for financial entities that are burdened by significant, colossal, and unknown future costs from credit derivatives like credit default swaps and interest rate swaps. Watch Fannie Mae, Citigroup, and American Intl Group, whose demands for money will be as great as it will be unending. Fannie just asked for more money. Citi is the big news item today, as nationalization seems obvious to all those not making announcements. In the US Banana Republic, the government owns the acid pits.

Heck, the US Federal Reserve still will not reveal how the TARP funds have been disbursed, and actually claim trade secrets would be violated. Lawsuits might reach the US Supreme Court steps, but might not enter the front door. Slowly, crime syndicate activity is revealed, and more. The USGovt has embarked upon a path to abuse capital itself, by channeling it down the same failed pathways. The only change that the Obama Admin has shown is in the names of the players and the colors of their jackets. In my view, most are turncoats to the US Constitution. As long as these paths are continued, the USEconomy will deteriorate further, the stimulus and rescue initiatives will be in greater need, the banking system will turn from insolvency to bankruptcy, and the USDollar will take steps to the cemetery. Gold will respond powerfully to continuation of the current paths.

BLACK HOLES

A truly astounding event has taken place in the last several years. The public, the captains of industry, and the investment community have been exposed (if not victimized) by a great financial black hole. Of course, the bond industry has been at its center, selling securitized debt as bonds, laced with fraud, improperly linked to property titles, blessed by false debt ratings. Focus instead on the Collateralized Debt Obligation, a leveraged instrument with a bond core. The CDO has been a remarkably destructive device acting like a black hole in more perfect form than anything seen in modern history. It took future financial revenue streams, locked them into a bond security, leveraged it up five-fold, slapped on a few credit derivatives like inadequate bandaids and bandages, and sold them as CDO bonds.

The credit derivatives served only to fool the public, and satisfy the debt rating agencies, enough to approve with a ‘AAA' rating. The streams of revenue came from mortgages, as well as other diverse businesses, like from car loans, aircraft leases, and even from movie box offices. So the CDO bond sucked in future revenue, enabled vast bond trades, doled out hefty fees to Wall Street, and contributed to the financial sector destruction. The wealth and value of corporate entities that once were in possession of these future revenues streams have been lost. Their lack of liquidation means the drainage continues from future revenue, and future wealth continues to be destroyed. The active CDO trading bought a lunch, a paycheck, and a bonus for a corrupt Wall Street employee. Until liquidated, the CDO bonds continue to act, sucking value from the future. THINK BLACK HOLE! The fight against such a powerful force will send gold upward in price, not downward. The deflationist knuckleheads have it backwards, and have failed to notice that gold has risen in price since November.

A new black hole has been exposed. It is the USGovt devotion to Wall Street and the banking elite. In the process, gigantic zombie banks are being constructed and provided with intravenous lines. Their characteristics are considerably weaker than those constructed in Japan, aided by strong keiretsus (conglomerates). The funds made available by the USCongress have gone into the Wall Street black hole. They claim their deal flow has improved. Show me! Meanwhile the fifty states have announced a $350 billion deficit. The federal system has shown itself to be a subservient tool to the financial elite, ever since Goldman Sachs took the role of managing the USDept of Treasury. Robert Rubin was the founding father of financial failure. Now his protégé Tim Geithner is Treasury Secretary, and the states find themselves in ruin. At least twenty of them have begun to serve notice to the federal agencies in the form of the Tenth Amendment.

THE CHAOS FACTOR

The factor not yet integrated into gold price forecasts is from chaos. How will the gold price respond to further deterioration of the USEconomy, enough to qualify as a slow gallop from unemployment to chaos? People have begun to object to USGovt support of the owners of failed mortgages, a step beyond their derision of fraud kings on Wall Street. Soon, people might not pay mortgages or car payments or credit card bills. Their knowledge of video games is surely greater than the work of Henry David Thoreau, a hero of mine. His Walden Pond in Concord outside Boston was once a frequent spot by me for hikes and swims in a majestic setting after a bicycle ride to the idyllic location. Households exercising civil disobedience might strive to be rescued themselves. How will the gold price respond to further deterioration of the system from public defiance? Foreign creditors have served notice to the USGovt, to control its debt and to defend its USDollar currency. The nation can do neither. The US Secretary of State as a post has been demoted into an emissary for the Dept of Treasury. How will the gold price respond to greater isolation? The answers are easy. The gold & silver prices will rise and rise and rise, first from lack of proper policy toward remedy, and then from foreign imposition of a remedy, in the form of new global reserve currencies, three of them. Don't lose heart by the slowness of the pace toward remedy. Take advantage of it.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

At least 30 recently on correct forecasts regarding the bailout parade, numerous nationalization deals such as for Fannie Mae and the grand Mortgage Rescue.

“You seem to have it nailed. I used to think you were paranoid. Now I think you are psychic!” (ShawnU in Ontario)

“Your analysis is of outstanding quality, the best I have read. In particular, as a person on the spot, I can confirm the accuracy of your bleak assessment of our prospects in the UK.” (JanB in England)

“Your unmatched ability to find and unmask a string of significant nuggets, and to wrap them into a meaningful mosaic of the treachery-*****-stupidity which comprise our current financial system, make yours the most informative and valuable of investment letters. You have refined the ‘bits-and-pieces' approach into an awesome intellectual tool.” (RobertN in Texas)

“Your reports scare the hell out of me every month, probably more so over time, since so many of your predictions have turned out to be very accurate. I am afraid you might be right that by the end of 2008, we are in a pretty severe situation, with civil unrest and severe financial stress on Main Street.” (GeorgeC in Minnesota)

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.