In Search Of Economic Common Sense

Politics / Recession 2008 - 2010 Mar 12, 2009 - 03:57 AM GMTBy: Mike_Shedlock

I have been seeking economic common sense in high places. It's very difficult to find on either side of the Atlantic. And in the ever escalating displays of lack of common sense, the UK introduces quantitative easing to aid economy .

I have been seeking economic common sense in high places. It's very difficult to find on either side of the Atlantic. And in the ever escalating displays of lack of common sense, the UK introduces quantitative easing to aid economy .

The Bank of England bought £2 billion ($2.8 billion) of government bonds Wednesday as the UK introduced quantitative easing to kickstart the ailing economy.

The move comes after the bank cut interest rates from one percent to 0.5 percent last week -- a drop of five percent since October last year and the lowest in the bank's 315-year history.

Central banks worldwide including the Bank of England have tried to encourage spending and lending during the current downturn by cutting interest rates -- with limited success.

Rates can now not fall much further -- hence, the Bank of England believes, the need for another strategy.

Quantitative easing is often described as "printing money" -- although no new notes and coins are actually created.

Instead the Bank of England will "create" more money on its balance sheet, then use this to buy banks' assets such as home loans and government bonds, thereby pumping extra cash into the system.

Japan has already proven that Quantitative Easing does not work (see 'Groping In The Dark' With Quantitative Easing for details) so it takes a genuine pea-brain to expect the results to be any different this time.

Common Sense Lacking In China

Economic common sense is lacking in China as well. Let's build the case starting with China New Yuan Loans More Than Quadruple on Stimulus .

China's new loans more than quadrupled in February from a year earlier after the government pressed banks to support a 4 trillion yuan ($585 billion) stimulus package for the world's third-biggest economy.

Banks extended 1.07 trillion yuan of local-currency loans, the central bank said on its Web site today. M2, the broadest measure of money supply, climbed 20.5 percent from a year earlier, the fastest pace in more than five years, after growing 18.8 percent in January.

The lending, which adds to a record 1.62 trillion yuan of new loans in January and a surge in investment, may help to revive growth as an export collapse closes factories and eliminates millions of jobs. Chinese banks, which have side-stepped the toxic assets that crippled lenders in the U.S. and Europe, risk an increase in bad loans this year in a weakened economy, according to Fitch Ratings.

“The pace of lending in January and February is certainly unsustainable and dangerous to the health of the financial system,” said Sherman Chan, a Sydney-based economist at Moody's Economy.com. “Lax credit assessment right now may lead to a surge in delinquencies in the years to come.”

China's Exports Collapse

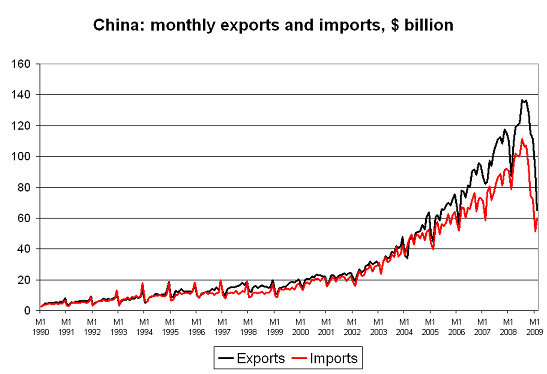

Inquiring minds are noting The fall in China's exports has now caught up with the fall in China's imports .

After soaring for most of this decade — the pace of China's export growth clearly turned up in 2002 or 2003 and then stayed at a very high pace — China's exports are falling back to earth. The surge in China's exports could prove to be as unsustainable as the rise in US (and some European) home prices. They might end up being mirror images … as Americans and Europeans could only import so much from China so long as they could borrow against rising home prices.

Where's the common sense in increasing investment and production at a time when export business is collapsing along with falling US and global demand?

You Can't Spend Your Way Out of the Crisis

With the Fiscal Insanity Virus Rapidly Spreading The Globe I had nearly given up hope of finding common sense at a high level anywhere. Nonetheless, I am pleased to report that I found an amazing display of honest to goodness common sense in New Zealand.

Kohn Key, New Zealand's prime minister, says You Can't Spend Your Way Out of the Crisis .

"We don't tell New Zealanders we can stop the global recession, because we can't," says Prime Minister John Key, leaning forward in his armchair at his office in the Beehive, the executive wing of New Zealand's parliament. "What we do tell them is we can use this time to transform the economy to make us stronger so that when the world starts growing again we can be running faster than other countries we compete with."

That idea -- growing a nation out of recession by improving productivity -- puts Mr. Key and his conservative National Party at odds with Washington, Tokyo and Canberra. Those capitals are rolling out billions of dollars in stimulus packages -- with taxpayers' money -- to try to prop up growth. That's "risky," Mr. Key says. "You've saddled future generations with an enormous amount of debt that then they have to repay," he explains. "There is actually a limit to what governments can do."

Mr. Key's program focuses first on personal income tax cuts, which -- given that the new top rate, as of April 1, will be 38% -- are still high, especially when compared to Hong Kong and Singapore. "We just think it's good tax policy to lower and flatten your tax curve," he says. "People will move in labor markets and they look at their after-tax incomes."

Much of Mr. Key's reform agenda hinges on his belief that he has to prepare his country to compete in the global economy. "The world, whether we like it or not, will become more and more borderless," he says. That means Wellington is planted firmly behind free trade. "The sooner Doha is completed," Mr. Key says, referring to stalled global trade talks, "the better from our point of view."

Mr. Key chuckles when I ask him about the "Buy American" provision tucked into the Obama administration's stimulus package. The previous government's "Buy New Zealand" campaign got a "lukewarm" reception, he recalls. "There are so many component parts manufactured in different parts of the world, you're chasing your tail the whole time about where something's actually made."

Key's Common Sense Platform

- Cutting Taxes

- Embracing Free Trade

- Reducing Regulation

- Understanding there is a limit to what government can do

Meanwhile back in the US, there is good news of sorts.

The Proposed Budget Is Lacking Votes

In the "Good News Unlikely To last" category I note that Obama needs more votes for his budget .

The Democratic chairman of the Senate Budget Committee says that President Barack Obama lacks the votes to see his budget plan for next year passed by Congress, at least in its current form.

Sen. Kent Conrad of North Dakota tells reporters that situation might change once lawmakers meet to discuss compromises for the plan.

Having met Wednesday with Obama in the White House, Conrad says that the president realizes Congress will insist on changing his ambitious plan for the budget year that begins in October.

Unfortunately, it is highly likely that enough spineless Republicans will eventually join forces with the "If I Only Had A Brain" Democrats and this senseless budget will pass.

With the notable exceptions of Rep. Ron Paul of Texas and Senator Shelby of Alabama ....

When it comes to knowing how to deal with this recession and having the courage to carry out the plan, Congress is displaying the common sense of an earthworm attempting to climb a tree along with the backbone of a bowl of jello minus the bowl.

Senator Shelby, it's clear you have the common sense, so please muster up the courage to filibuster the budget monstrosity as well as any additional taxpayer funded bailouts that are proposed.

Contact Your Senators And Legislative Representatives

Please contact your representatives and tell them to stop the madness and start displaying some common sense. Here is the Online Directory For The 111th Congress .

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.