Central Banks Detonate the Quantitative Easing Monetary Nuclear Option

Interest-Rates / Quantitative Easing Mar 19, 2009 - 11:45 AM GMTBy: Gary_Dorsch

Desperate times call for desperate measures. As the global “credit crunch” has grown increasingly severe, central bankers are examining the Great Depression of the 1930's for possible parallels that are relevant to today's situation. Most worrisome, is the synchronized meltdown of the global stock markets, which had wiped-out $32-trillion of wealth, on top of another $10-trillion in losses in real estate.

Desperate times call for desperate measures. As the global “credit crunch” has grown increasingly severe, central bankers are examining the Great Depression of the 1930's for possible parallels that are relevant to today's situation. Most worrisome, is the synchronized meltdown of the global stock markets, which had wiped-out $32-trillion of wealth, on top of another $10-trillion in losses in real estate.

Many of world's largest banks have become “zombie banks,” and are no longer able to survive on their own without artificial life support from the federal government and the taxpayers. Banks are holding hundreds of billions of dollars of toxic assets in their vaults, with no idea how much they are worth, and this uncertainty has stopped banks from lending to businesses and individuals, resulting in the most severe credit crunch since the 1930's Great Depression.

Lessons from the bursting of the Nikkei-225 bubble in the early 1990's, and Japan 's “decade of lost growth,” focuses on the need to avoid deflation and intensifying deflation expectations. With the threat of a deflationary spiral and double-digit unemployment looming on the horizon, central banks throughout the world are now engaged in a race to the bottom on interest rates.

Furthermore, central banks are turning to the weapon of last resort, the so-called Nuclear Option, - or “Quantitative Easing,” (QE) in order to keep credit flowing to the private sector. Central banks are pegging overnight interest rates near zero-percent, and pumping huge amounts of cash into the money markets, by buying commercial paper, corporate and government bonds, alongside mortgages.

If done on a massive scale, QE is as a powerful stimulus, and ultimately can stabilize an economy, and buy time for the financial system to recover. Among the Group of Seven industrial nations, the European Central Bank is the most hawkish, targeting its overnight loan rate, at a paltry 1.50%, but its reluctant to cross the Rubicon, by pegging interest rates near zero-percent, and purchasing huge blocks of government bonds, in order to force long-term interest rates lower.

In a flash of déjà vu , Japan 's Nikkei-225 index fell to the 7,000-level this month, its lowest since 1982, after the Dow Jones Industrials briefly slumped to a 12-year low. Tokyo 's financial warlords, the world's most brazen interventionists, are threatening to set-up a government body that will buy as much as $200-billion of exchange-traded funds and shares directly on the Tokyo stock market, to artificially prop-up prices, Finance chief Kaoru Yosano warned on Feb 24 th .

Bank of England Experiments with QE

A prolonged climate of deflation is a central banker's worst nightmare, - it tends to deter consumers from spending until prices become even cheaper, and there is a risk that deflation could become so deeply embedded in consumer psychology, that it can lead to a prolonged period of falling prices and chronically weak company profits. Deflation, or falling prices over a long period of time, increases the cost of servicing debt as cash inflows are squeezed. Matters are made worse by falling wages and job losses, which can led to widespread defaults on auto and credit card loans.

Although the UK-economy has been spared the trials of deflation since 1947, the Bank of England is worried that British households with high debts could fall prey to the “debt-deflation” trap this year . Britain is a nation of borrowers rather than savers, and it was a combination of falling prices and soaring debt burdens that plagued the US-economy in the 1930's . Britons' total personal debt – the amount owed on mortgages, loans and credit cards, stands at £1.46-trillion, up 165% since 1997, and each household now owes an average of about £60,000.

Although the UK-economy has been spared the trials of deflation since 1947, the Bank of England is worried that British households with high debts could fall prey to the “debt-deflation” trap this year . Britain is a nation of borrowers rather than savers, and it was a combination of falling prices and soaring debt burdens that plagued the US-economy in the 1930's . Britons' total personal debt – the amount owed on mortgages, loans and credit cards, stands at £1.46-trillion, up 165% since 1997, and each household now owes an average of about £60,000.

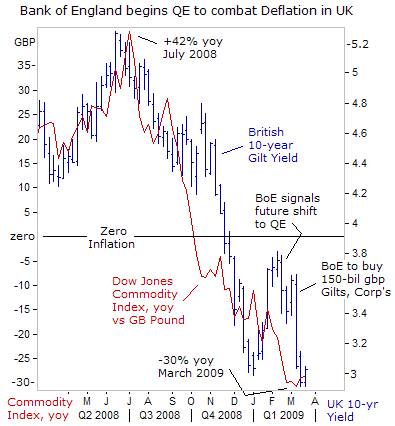

Thus, the BoE's monetary policy going forward is expected to be geared towards combating the scourge of deflation. Alongside a half-point rate-cut to 0.50% on March 5 th , the BoE unveiled its nuclear weaponry, aiming to purchase £100-billion of British gilts, and £50-billion earmarked to buy corporate bonds and commercial paper. Some £75-billion will be disbursed over the next three-months. BoE chief Mervyn King commented, “Nothing in life is ever certain. These measures, we think, will work in the long run. I can't be sure how long it will take.”

“We are now towards the end of what is pretty clearly going to be a first quarter in which national output falls very sharply,” said BoE member Kate Barker on March 13 th , “I strongly support the move to quantitative easing, and once it became necessary, it was important to act in a decisive manner. To gauge the effect of the purchases, I will be looking for a flatter gilt yield curve, narrower corporate bond spreads, and other positive effects on a range of assets. The bank may need to reverse these gilt purchases quickly, once they have their effect,” she said.

The BoE's shift to QE jolted the British gilt market, driving benchmark 10-year yields below the December lows of 3%, and into closer alignment with the slumping Dow Jones Commodity Index, which is hovering -30% lower than a year ago, measured in local currency terms. Although the UK-government's official inflation rate is elevated in positive territory, it's widely expected to turn negative in the months ahead, mirroring the sharp slide in the global commodities markets.

The lessons learned from the Great Depression, and Japan 's post-bubble economy in the 1990's, has moved several central bankers into shocking the system with QE, trying to arrest deflationary expectations and reduce the real burden of debt. The Bank of England has moved boldly, aiming to resurrect the devil of inflation. Whereas the Japanese spent around 5% of their GDP on QE, or printing money to buy JGB's, the BoE on the other hand, has committed to spending just over 10% of GDP.

The lessons learned from the Great Depression, and Japan 's post-bubble economy in the 1990's, has moved several central bankers into shocking the system with QE, trying to arrest deflationary expectations and reduce the real burden of debt. The Bank of England has moved boldly, aiming to resurrect the devil of inflation. Whereas the Japanese spent around 5% of their GDP on QE, or printing money to buy JGB's, the BoE on the other hand, has committed to spending just over 10% of GDP.

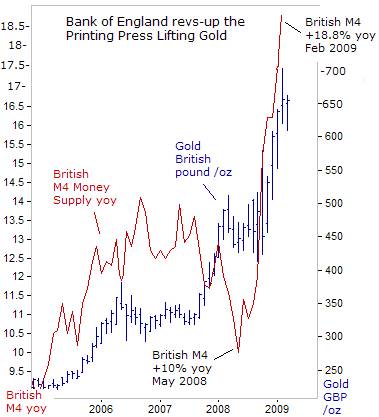

This comes at a time when the UK's M-4 money supply is already expanding at a record +18.8% annualized clip, and could soon rival the growth rates seen in third world countries. But with a record 2-million Britons signing on for unemployment benefit last month, the BoE has no interest in defending the principles of sound money. "Most of us come from the generation that grew up believing that mass unemployment and world recession were things of the past, relevant to the history books but not the textbooks,” declared BoE chief Mervyn King on March 17 th . “That assumption is under threat,” he warned.

Federal Reserve begins Monetization of Government debt,

Over the course of the past decade, the BoE and the Fed have usually steered their monetary policies in the same direction. But in a strange twist, the two Anglo central banks appeared to be moving in opposite directions since January. Bond traders noticed that the Fed's balance sheet had shrunk by 17% from a record $2.3-trillion in December, - signaling a subtle tightening of monetary policy.

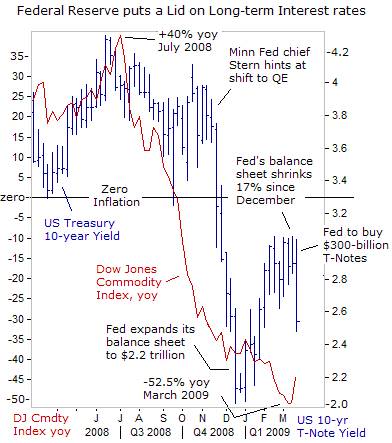

Traders blamed a recent 1% up-tick in US Treasury 10-year yields on a massive supply of debt that is swamping the market. During the first five-months of fiscal 2009 (Oct ‘08 thru Feb ‘09), the US federal budget deficit had tripled compared to the same period a year ago, growing from $265-billion to a whopping $765-billion, the largest ever. The five-month deficit is already 70% bigger than the full-year deficit of $459-billion for fiscal 2008, weighing heavily on T-Note prices.

Traders blamed a recent 1% up-tick in US Treasury 10-year yields on a massive supply of debt that is swamping the market. During the first five-months of fiscal 2009 (Oct ‘08 thru Feb ‘09), the US federal budget deficit had tripled compared to the same period a year ago, growing from $265-billion to a whopping $765-billion, the largest ever. The five-month deficit is already 70% bigger than the full-year deficit of $459-billion for fiscal 2008, weighing heavily on T-Note prices.

Treasury yields were rising in January and February, even as the Dow Jones Commodity Index was skidding to a -52% loss in March from a year ago, telegraphing a severe bout of deflation in the months ahead. Rising interest rates and falling prices is a dangerous cocktail for any economy. Corporate bond yield spreads compared with Treasuries widened in a vicious cycle, with bond investors demanding higher yields as compensation for the risk of company defaults.

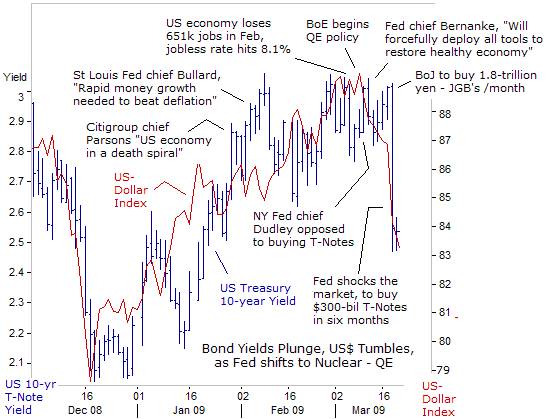

However, on March 7th , Fed chief Ben “Helicopter” Bernanke, speaking at a ceremony naming Exit-190 of Interstate Highway-95 in his honor, vowed to use all of the Fed's weapons to stabilize financial markets and pull the economy out of recession. “ At the Fed, we will continue to forcefully deploy all the tools at our disposal as long as necessary to restore financial stability and the resumption of healthy economic growth,” he said, a clear hint at a future shift to “nuclear-QE.”

On the morning of March 18 th , global bond investors were anxiously waiting to hear if the Fed would follow in the footsteps of the BoE and the Bank of Japan, - and begin monetizing a huge chunk of the Treasury's debt, in order to put a lid on longer-term yields. For the past six-weeks, US Treasury 10-year yields had found stiff resistance at the psychological 3% level, where traders speculated the Fed would prevent yields from rising any further. The BoE's ability to manhandle the gilt market, driving British yields sharply lower, was also a supporting factor for US T-Note prices.

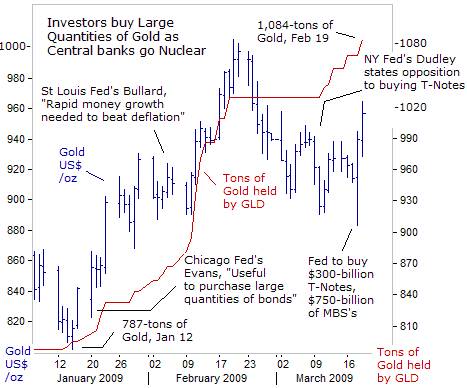

At the end of its two-day policy meeting on March 18 th , the Bernanke Fed unleashed its most powerful weapons, saying it would monetize $300-billion of the Treasury's debt over the next six-months, with maturities ranging from three to ten-years. At the same time, the Fed said it will buy an additional $750-billion of mortgage-backed securities guaranteed by Fannie Mae and Freddie Mac, bringing its total purchases of these securities to $1.25 trillion. The Fed's decision caught many traders off guard.

At the end of its two-day policy meeting on March 18 th , the Bernanke Fed unleashed its most powerful weapons, saying it would monetize $300-billion of the Treasury's debt over the next six-months, with maturities ranging from three to ten-years. At the same time, the Fed said it will buy an additional $750-billion of mortgage-backed securities guaranteed by Fannie Mae and Freddie Mac, bringing its total purchases of these securities to $1.25 trillion. The Fed's decision caught many traders off guard.

Treasuries rallied furiously, with the yield on the 10-year T-note plunging 54-basis points, to as low as 2.48%, a record single-day decline. While the Fed is prepared to grow its balance sheet further if needed, “We have to be very careful in deploying our arsenal,” said Dallas Fed chief Richard Fisher on Feb 23 rd . “T he Fed must avoid appearing to monetize the exploding fiscal deficits, as this could undermine confidence in the central bank's commitment to price stability. We must be very careful not to inflate unsustainable and disruptive distortions (ie. Bubbles) in the Treasury market, through any extraordinary efforts beyond our normal balancing operations,” Fisher warned.

The Fed's version of “shock and awe,” triggered an immediate and broad sell-off in the US dollar's value, its biggest one-day loss against a basket of currencies since at least 1985, after traders learned the Fed intends flood the world markets with greenbacks. The dollar's appeal as a “risk aversion” currency melted away, as global markets zoomed higher. In a Twilight Zone episode, Russia 's central bank grabbed the opportunity to intervene in the forex market, buying dollars at 38.90 roubles.

The March 13 th edition of Global Money Trends and other recent issues, informed its subscribers that the Fed was aiming to enforce a ceiling for the 10-year Treasury yield in the 3% to 3.25% range, and warned of a downturn in the US$ Index, after the US “Plunge Protection Team” unleashed another potent weapon on March 10 th , with greater manipulative power than QE, that squeezed short sellers in the stock market. The upcoming March 20 th edition will focus on ways to maneuver in the markets in an environment of global QE in the months ahead.

Chinese Central bank Engages in Money printing to revive Economy,

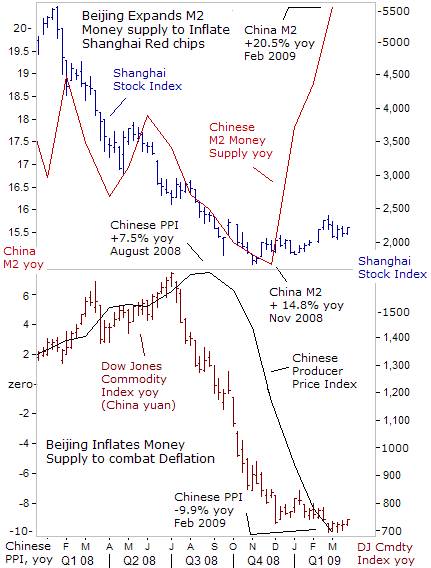

Beijing is already several steps ahead of the G-7 central bankers, in jumping on the QE bandwagon. The People's Bank of China (PBoC) has been very busy inflating its M2 money supply, from a +14.8% annualized clip in November, to as high as +20.5% in February. Under the command and control of Beijing 's Politburo , China 's state owned banks have already extended 4.9-trillion yuan of new loans in the first two-months of this years, up 35% from the same period a year ago.

Beijing is expanding the Chinese M2 money supply to achieve three key goals, - to prevent an appreciation of the yuan against the dollar and other key currencies, to combat deflation which is already seeping into China's economy, and a determined attempt to re-inflate the Shanghai stock market, by artificial means. “Confidence is more important than gold or money,” Wen declared.

Beijing is expanding the Chinese M2 money supply to achieve three key goals, - to prevent an appreciation of the yuan against the dollar and other key currencies, to combat deflation which is already seeping into China's economy, and a determined attempt to re-inflate the Shanghai stock market, by artificial means. “Confidence is more important than gold or money,” Wen declared.

“We face unprecedented difficulties and challenges,” Wen told delegates to China 's parliament in Beijing on March 5 th . “The nation needs to reverse the economic slide as soon as possible,” he warned. China 's export reliant economy has slowed to a 6.8% growth rate , compared with 13% for all of 2007, and has already cost the jobs of 20 million migrant workers, adding to the risk of widespread social unrest. Beijing will increase its spending by 22% this year to 7.62 trillion yuan ($1.1 trillion), on new infrastructure and social programs, to cushion the economy.

On a February visit to Beijing , US Secretary of State Hillary Clinton tried to convince Chinese premier Wen to keep investing in US Treasuries in order to help finance the bailout of failing US-banks and pay for a $787-billion US stimulus package. Clinton warned that if the US-economy collapsed China would pay a steep price as well. “It would not be in China 's interest, if we were unable to get our economy moving. Our economies are so intertwined. The Chinese know that in order to start exporting again to its biggest market, the United States has to take some drastic measures with the stimulus package. We have to incur more debt,” Clinton said.

“We are truly going to rise or fall together. By continuing to support American treasury instruments, the Chinese are recognizing our interconnection,” she said. But China 's foreign minister, Yang Jiechi, dodged a question as to whether Beijing would continue buying the US notes. Chinese critics argue that Beijing 's exposure is too great and too dangerous. Global investors are keeping a close eye on the mounting risks, but few expect the Treasury bond bubble to explode soon.

Beijing now owns an estimated $1.7-trillion in US-dollar assets, $900-billion of Treasury bonds and short-term bills, $550-billion in agency bonds, $150-billion in corporate bonds, $40-billion in US-equities, and $40-billion in short-term deposits. The State Administration of Foreign Exchange (SAFE), part of the People's Bank of China, manages the bulk of Beijing's $2-trillion FX reserves, while, China's state banks and sovereign wealth fund, oversee $250-billion.

Spelling out China 's dilemma, any effort by Beijing to unload a significant part of its massive Treasury and agency holdings could flood the market and trigger a selling panic, with devastating impact on the value of its foreign currency reserves . If China stops buying them, it needs to worry about the Fed monetizing the debt, which could lead to hyper-inflation and a bond market rout, once the US-economy stabilizes.

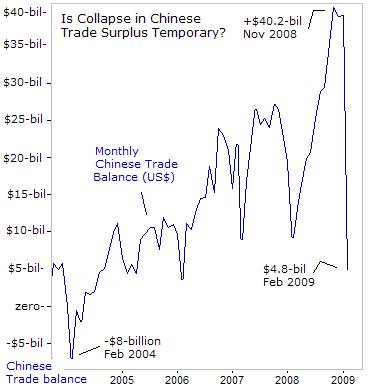

Ironically, the US economic slump has already caused a massive drop in American purchases of Chinese goods. Chinese exports plunged 25.7% in February from a year earlier, slashing the country's trade surplus from a record $40.2-billion in November to $4.8 billion in February. A continuation of this downtrend means Beijing would earn fewer dollars to recycle into US-dollar bonds. Therefore, the Fed felt compelled to fill the void, as the buyer of last resort for the Treasury's IOU's.

Bank of Japan raises the Nuclear Threshold,

The Japanese banking crisis of the 1990's and early 2000's had roots similar to the American crisis, - a stock market and real estate bubble that burst, leaving banks holding $450-billion in loans that were virtually worthless. Japan 's “lost decade,” of growth, provides powerful evidence of the danger of allowing deflation to emerge and persist - profits shrink, investment dries-up, and consumers spend less in anticipation of even further cuts in prices.

Japanese wholesale prices were -1.1% lower in February, than a year earlier, the first annualized decline in six-years, putting Japan on course for its second bout of deflation, since the late 1990's - mid-2000's. Japan 's economic output contracted at an annualized 12.1% rate in the fourth quarter, its fastest rate of decline since the 1974 oil shock, shrinking about twice as much as the United States and the Euro zone, due to its heavy reliance on exports, and the sharp rise of the Japanese yen.

After a stunning 10% drop in industrial output in January, a similar GDP contraction in the January-March period is expected, as the global downturn intensifies. Fearing that a sliding stock market will erode the capital of the Japanese financial sector, the Bank of Japan has devised a dual scheme to buy 1-trillion yen of stocks directly from banks, and a separate plan to buy 1-trillion yen ($10-billion), of subordinated bank debt, in order to bolster their capital bases, and prevent a drought in lending to companies and households in need of cash.

After a stunning 10% drop in industrial output in January, a similar GDP contraction in the January-March period is expected, as the global downturn intensifies. Fearing that a sliding stock market will erode the capital of the Japanese financial sector, the Bank of Japan has devised a dual scheme to buy 1-trillion yen of stocks directly from banks, and a separate plan to buy 1-trillion yen ($10-billion), of subordinated bank debt, in order to bolster their capital bases, and prevent a drought in lending to companies and households in need of cash.

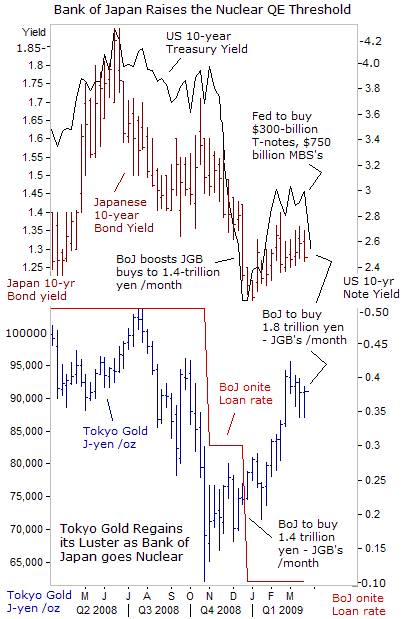

On March 18 th the Bank of Japan, the original QE pioneer, raised its nuclear threshold, signaling its plan to monetize a record 1.8-trillion yen ($18.3-billion) of government bonds (JGB's) each month, up from 1.4-trillion yen previously. Effectively, the BoJ will monetize two-thirds of Japan budget deficit, projected at 33-trillion yen for the upcoming fiscal year, as the government prepares more spending to cushion the country's worst recession since World War II.

Not surprisingly, the BoJ held its overnight interest rates steady at 0.1%, squarely within the Fed's targeted range of zero to 0.25% for the fed-funds rate. Most importantly, throughout this decade, the BoJ has displayed its virtual mastery over the world's second largest bond market, with $8.7-trillion of JGB's outstanding, by locking the 10-year Japanese yield within a very tight range between 1.20% and 2.00%, much to the dismay of Japanese fixed income investors.

One of the biggest out-growths of the BoJ's fixation with the hallucinogenic QE drug and ultra-low interest rates, was the spawning of a $7-trillion “yen-carry” trade, which vastly inflated global stock markets worldwide, and in the end, boomeranged on the BoJ, when the carry-trade unwound, - propelling the Japanese yen to 16-year highs against the dollar, and driving the Nikkei-225 index to 26-year lows.

Another unintended consequence of the BoJ's overdosing on the QE-drug, has been the multi-year bull market for Tokyo gold, which tripled in value in yen-terms. Repeating the same mistakes of the past, the BoJ has slashed its overnight loan rate back to 0.1%, and is boosting its JGB purchases by a third. Right on cue, the Tokyo gold market rebounded from 70,000-yen /oz in October to as high as 90,000-yen today, compliments of the BoJ's money printing machine.

With increasing regularity, central bankers are engaged in the most extraordinary currency devaluations ever witnessed. The results of these interventions could be heightened currency volatility and stock market instability. While the Fed can afford to open the monetary flood gates now, when the economy does recover, it puts a great deal of weight on hard-core inflationists to know when to tighten again.

With increasing regularity, central bankers are engaged in the most extraordinary currency devaluations ever witnessed. The results of these interventions could be heightened currency volatility and stock market instability. While the Fed can afford to open the monetary flood gates now, when the economy does recover, it puts a great deal of weight on hard-core inflationists to know when to tighten again.

They were supposed to do something similar in 2003-05, but instead, former Fed chief “Easy” Al Greenspan, kept interest rates submerged too-low for too-long. The Greenspan Fed's decision to open the monetary spigots inspired a global commodity boom unlike any since the 1970's. A massive housing bubble also developed, feeding the sub-prime mortgage debt bubble, which ultimately burst, and led to the worst financial crisis and economic contraction since the Great Depression.

Wall Street sees the Fed's re-inflation efforts as a quick-fix to ease debt burdens and perhaps stabilize housing values. Congress and the White House see a way to issue $2-trillion of debt without having to pay the penalty of sharply higher interest rates. But gold bugs are focused on the big picture, and are steady buyers of the yellow metal. The gold-backed exchange-traded fund, the SPDR Gold Trust, symbol GLD, said its holdings rose to a record 1,084-tons, up 37% from eight weeks ago.

Peter Munk, chief of Barrick Gold, explained on March 18 th , “I happen to be very optimistic right now about gold prices. I think they are going to be significantly higher than last year. As the world becomes less and less secure in terms of normal investments, and people lose faith and confidence in bonds, stocks, secured debt instruments, people turn to gold. It automatically attracts people in direct proportion to their fear, and that is fear of losing their money,” Munk said.

There are also geopolitical developments brewing beneath the surface, which can jolt the commodity, gold, and global stock markets in the months ahead, and will be highlighted in the upcoming March 20 th edition of Global Money Trends. The February 6 th edition of Global Money Trends presented a safer way to receive a double-digit return from a stable or higher copper market.

This article is just the Tip-of-the-Iceberg of what's available in the Global Money Trends newsletter, for insightful analysis and predictions of (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, and grains, (3) Foreign currencies (4) Libor interest rates and global bond markets (5) Central banker "Jawboning" and Intervention techniques that move markets.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2009 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.