G20 U.S. Dollar Fiat Currency Smoke and Mirrors Manipulation

Stock-Markets / Articles Apr 03, 2009 - 02:22 PM GMTBy: Rob_Kirby

Humpty-Dumpty Fiat Sat on the Wall….You Know the Rest! - We've heard much over the past number of days, weeks and months as to what lays at the root of our economic and financial woes. We've been made painfully aware of sensationalized storylines; like a Made-off-ian styled Ponzi -fraud, a real head-scratcher when you consider that 64 billion in proceeds is alleged to have vanished into the ether without a trace; Bear and Lehman styled collapses where, in the confusion, 50 odd billions were created out of thin air – only to be quickly buried like bones in ‘rover's clover'; and perhaps the most egregious of all, visibly, to date – the 180 billion and growing “black hole” of Darth Vader Ponzi-finance – AIG.

Humpty-Dumpty Fiat Sat on the Wall….You Know the Rest! - We've heard much over the past number of days, weeks and months as to what lays at the root of our economic and financial woes. We've been made painfully aware of sensationalized storylines; like a Made-off-ian styled Ponzi -fraud, a real head-scratcher when you consider that 64 billion in proceeds is alleged to have vanished into the ether without a trace; Bear and Lehman styled collapses where, in the confusion, 50 odd billions were created out of thin air – only to be quickly buried like bones in ‘rover's clover'; and perhaps the most egregious of all, visibly, to date – the 180 billion and growing “black hole” of Darth Vader Ponzi-finance – AIG.

These sordid tales are all headline grabbers for sure; but convenient side-show deceptions none the less. They are all sub plots of the $10 trillion+ central bank and government guarantees and subsidies that have been doled out in taxpayer's names and at their expense – a bigger story that receives little or no press.

If, as and when the learned mainstream financial press turns up the lights on the bigger 10+ trillion debacle they'll still be missing what's at the root of what is poisoning our financial system, which is the “best before date” or shelf life of fiat money itself.

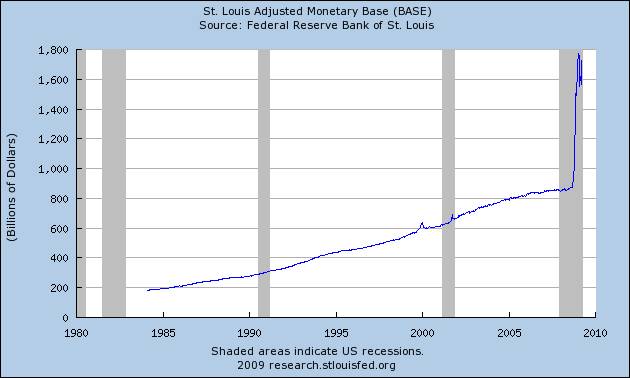

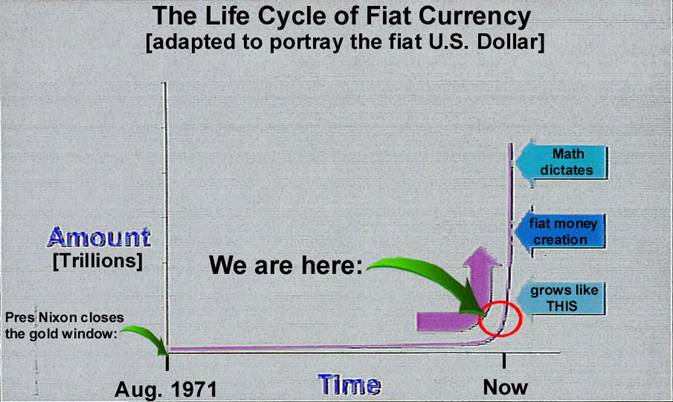

The following chart is excerpted from chapter 3 of an audio visual presentation in Chris Martenson's Crash Course.

Explanation: Fiat currencies are all lent into existence - but only in a manner that provides for re-payment of principal, not interest. Thus fiat systems require that the money supply grow – at a minimum rate known as “usury” or interest, in order to pay back the earlier loans plus the interest.

In effect, fiat money or in the vernacular, the US dollar (but really all fiat currencies) is "THE BIGEST PONZI GAME" on the planet. As Martenson points out; the geometric growth curve eventually results in a parabolic "up" phase no matter how low the growth rate is – the only determinant before this outcome results is - TIME.

The premeditated financial fraud and economic tom-foolery we've witnessed in recent years; rigging of the price of strategic commodities particularly gold, falsification of inflation data together with obscene amounts of interest rate derivatives to provide cover for engineered lower interest rates in the bond market have only bought time – delaying the point in time when we reach the inflection point where money growth goes PARABOLIC.

Ladies and gentlemen, our TIME is UP! Just take a look at the St. Louis Fed recent report regarding the U.S. monetary base:

Does the graph above look vaguely familiar?

Gordy's Big African Swindle

The “Great Gordini” [Brown] delivered the G20 communiqué at the conclusion of meetings in London Thursday, April 2, 2009 . Besides confirming that heavily indebted member nations were already committed to 5 Trillion, largely borrowed, in planned fiscal stimulus, Brown revealed that the predatory I.M.F [International Monetary Fund] would be granted an additional USD 1 Trillion in new funding. Of course, the real nugget of this new orgy of spending, buried under a blizzard of money printing with the auspices of SDRs, was a pledge that the I.M.F. gold would begin selling some of its gold bullion reserves, perhaps as much as 400 tonnes, to establish a 50 billion fund to help the developing world – primarily Africa . Here's what happened as Mr. Brown took to the airwaves:

How about a big [or let's just say whatever $20 buys] round of applause for the Great Gordini?

Everyone should understand that the learned Gordon Brown has a history when it comes to meddling in the “allegedly free” international gold bullion markets.

….Between 1999 and 2002 Chancellor Brown sold off 395 tonnes of Britain 's gold reserves at rock-bottom prices and only made £1.88 billion ($3.48 billion). He sold the whole lot off at an average of about $265 per ounce .

It gets worse. He flooded the market and sold it in 25 tonne batches, and in a depressed market he depressed the price further and lost £495 million even at the current rates at that time (rumours of price fixing abounded).

It gets worse. 395 is the official figure, but checking through HM Treasury financial reports shows that he actually sold off 451 tonnes.

In 1999 Britain had 746 tonnes of gold reserves. Brown has sold 451 tonnes leaving us with only 295 tonnes….

Gordy's Golden Garage Sale

Ladies and gentlemen, in 1999, then Chancellor Gordon Brown recklessly sold sovereign British gold bullion despite being counseled in this manner :

….Gordon Brown had decided to sell off more than half of the country's centuries-old gold reserves and the chancellor was intending to announce his plan later that day.

It was May 1999 and the gold price had stagnated for much of the decade. The traders present — including senior executives from at least two big investment banks — warned that Brown, who was not at the meeting, could barely have chosen a worse moment.

In the room, just behind the governor's main office, they cautioned that gold traditionally moved in decades-long cycles and that the price was likely to increase. They added that even if the sale were to go ahead, the timings and amounts should not be announced, as the gold price would plunge.

“ The timing of the decision was ludicrous. We told them you are going to push the gold price down before you sell,” said Peter Fava, then head of precious metal dealing at HSBC who was present at the meeting. “We thought it was a disastrous decision; we couldn't understand it. We brought up a lot of potential problems at the meeting.”

Gordy's Sham Exposed

Rumored at the time of these bullion sales was that an American Bank was “short” a great deal of gold and was being squeezed by the unforeseen gold price rise.

A couple of weeks prior to ole Gordo's 1999 gold dump, when he “pulled the trigger”, looting the British Treasury of its bullion – he had requested that the I.M.F. sell $10 billion worth of its gold. His request was denied.

Interestingly, Gordy's great-gold-give-away was even cause, at the time, for Bank of England Governor, Eddie George and Sir Peter Tarpsall to question loudly about the price her Majesty had to pay in order to save a major U.S. bank by fire selling it's gold reserves at rock bottom prices.

Years later, Gordon Brown was asked at a dinner party why he had sold 60% of the country's gold reserves? His answer was rumored as this:

"We stared into the abyss and were concerned that a sharply rising gold price would alert the world to the crisis that the world was facing. That is why we sold our gold".

Regarding the notion of selling gold bullion to benefit Africa , in 2005 I had the occasion to interview and collaborate with Mr. Anthony Harding – then Deputy Director in the Mineral Economics Directorate of South Africa's Department of Minerals and Energy. In Mr. Harding's words ,

“The South African gold mining industry is more than a century old. Gold has played a pivotal role in developing the South African economy both directly through monetary earnings from bullion sales, which at one stage supplied the international banking system with the bulk of its reserve of last resort, and indirectly through spin-off effects which generated the birth of other important domestic sectors in the economy, such as financial services and manufacturing….

…. Many sub-Saharan countries fall into the heavily indebted category and thus intervention in the gold market through an event, such as IMF bullion sales, could have unintended consequences for those countries at the critical juncture of relying on the performance of their gold mining industries to encourage sustainable economic growth. Released from an inextricable debt burden or not, under a falling gold price scenario they would be unable to reap the hard won fruits of their economical aspirations in the future.

The most progressive of Africa 's newly liberated economies, most of which are also the most democratic in outlook depend a great deal on gold to advance the cause of their economic development. That these economies should be seriously thwarted in attempting to elevate their economical and political performances to ever higher levels in an era favoring rampant globalization is therefore definitely not a desideratum.

It seems to me that Africa's developing economies having exploitable gold resources in the ground to call upon would benefit more by extracting and selling this gold in a market characterized by a rising gold price than from handouts received as a result of central bank gold sales, which may well restrict further upward mobility in the price. African countries should be allowed to develop their economies independently depending on their own new found strengths rather than be expected to rely on the largesse of the IMF which is mainly controlled by first world countries that have long neglected the economic problems plaguing the African continent.”

Mr. Brown, your statements regarding yours and the I.M.F.'s concern for the plight of Africa have been exposed for what they truly are – a SHAM designed to provide cover for bombing the gold price so as to fool us all into believing that the fiat U.S. Dollar, lynchpin of the Anglo-American Central Banking Cabal, still has value. Isn't it about time these shenanigans stopped?

You see folks, there has been so much collusion and so much fraud committed by our learned leaders – in vain attempts to preserve and prolong the life span of fiat money – that they simply cannot ‘come clean' and tell us the truth. The acknowledgement of such would be too indicting for those who currently hold power.

Society in the West – with the U.S. fiat Dollar as the worlds' reserve currency – is NOW on that parabolic phase of the money growth curve. This is why so much money is being created. This money creation is going to continue because is must, or the whole system collapses! Central Bankers are frantically trying to keep this fiat money “WHICH MUST BE CREATED” out of the hands of the commoners. Historically, they have been advocates of various schemes designed to do this; like very expensive wars, off balance sheet derivatives skullduggery and other assorted financial ponzi debacles where obscene amounts of fiat money can “disappear” - without a trace.

Really folks, are we to believe that Bernie Madoff's 64 billion disappeared into the darkness without a traceable paper trail; while in the wake of the horrendous 9/11 attacks, we were supplied minute details of who wired mere thousands to pay rents, for flight lessons, meals and entertainment?

Ladies and gentlemen, the learned Central Bankers KNOW that historically, fiat currencies have a life span of around 40 years, maximum. The U.S. closed the gold window in 1971 – 38 years ago. This is why the dollar is long in the tooth. This is why all of the king's horses and all the king's men – ultimately, will not be able to put the humpty-dumpty-Dollar back together again.

Federal Reserve ENGINEERED credit contractions like we are currently experiencing will continue to inflict great pain on humanity and in the end, this will at BEST – buy time, meager as it may be.

That's why you want to be a “learner” instead of “learned” – and own gold [and silver]. Their value as money and a store of wealth will always represent the same or similar quantity of human labor to extract it from the ground, which is really all that money is or was ever meant to be, and this is why it is called precious.

"In times of change, learners inherit the Earth, while the learned find themselves beautifully equipped to deal with a world that no longer exists." ~ Eric Hoffer

By Rob Kirby

http://www.kirbyanalytics.com/

Subscribers to Kirbyanalytics are learners, educating themselves; not only about the merits of ownership of gold and precious metals - but valuable know-how on the merits of different forms of ownership as well as tips and guidance on the acquisition of physical precious metal. In the members only section you'll find other subscriber only articles and the balance of this article with sections titled, Physical Bullion Buyers Guide, More on Madoff and Is War in the Cards?

Copyright © 2009 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.