Market Trends Generated By Jubilee 2016 Will Continue Into 2017 And Beyond

Stock-Markets / Financial Markets 2017 Dec 28, 2016 - 06:48 AM GMTBy: Jeff_Berwick

There were numerous trends established or maintained in 2016. In fact, the seeds planted in 2016 from Jubilee Year are bound to sprout in 2017 or 2018 with the kind of chaos and economic destruction that will give rise to further globalism.

There were numerous trends established or maintained in 2016. In fact, the seeds planted in 2016 from Jubilee Year are bound to sprout in 2017 or 2018 with the kind of chaos and economic destruction that will give rise to further globalism.

Gold, silver and bitcoin as we have regularly commented, are the assets to consider as we approach grimmer times. (A little more on repercussions at the end of this analysis.)

By remaining disciplined in our approaches, we were able to enjoy significant returns for our own portfolio and hopefully for yours. In fact, it was quite a year at TDV. From the very first day of 2016 gold and silver rocketed higher.

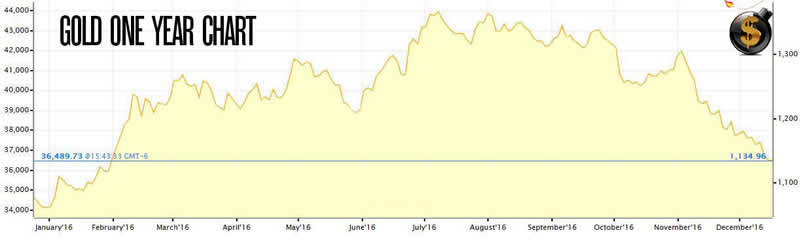

Gold ended 2015 at $1,061.30 and moved higher until July 7th when it hit $1,366.54 for a gain of 28.7% in the first seven months of 2016. It’s been all downhill from there and is currently near $1,134 for a year-to-date gain of 6.68%.

6.68% is still an excellent annual return, especially in today’s 0% and negative interest rate environment, but is well off its highs this summer.

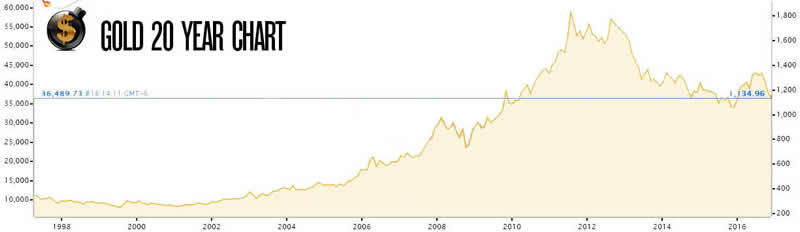

Still, gold has been one of the best performing assets since the start of the millennium and a look at the long term chart seems to indicate a bottom has been put in late last year.

The big story though was bitcoin.

Bitcoin ended 2015 at $430.05 and is now at $932 for a gain of 116%. Bitcoin’ performance is what we might expect from an accepted alternative currency at a time when faith in regular currencies is markedly diminished.

Part of the reason for the performance of bitcoin has to do with the so called War on Cash which took firm hold in 2016 and continues unabated to this day. In fact, it’s getting worse. India and Venezuela are especially hard hit with the poor in both countries either eating what they can find on the streets or starving to death.

The War on Cash is all about control, especially central bank’s control and it’s just one aspect of Jubilee Year developments. Others have yet to be fully realized though we certainly got a foretaste in 2016.

Both Brexit and Trump, as of this writing, are still opposed institutionally in their respective countries. A cross-section of British politicians and academic and industrial leaders oppose Brexit and as a result, Brexit has moved very slowly into law. Britain is still part of the EU for now.

In the US, Trump has won the general election but has been confronted after-the-fact, first by challenges to the election itself in various states and a campaign to remove Electoral College delegates from his majority. Both failed, however, Trump’s tenure is bound to be a rocky and even catastrophic one given the forces arrayed against him.

Trump has made a point of opposing many internationalist solutions and as a result, once the challenges to his election subside, he will be held up as an agent of “populism” – and thus racism and protectionism. As such, he and his administration and ultimately the government he leads will be attacked by the forces he supposedly opposes.

What we’ve pointed out in the past is that much of Trump’s positioning is rhetorical and this seems to be proven by recent administration picks. He’s chosen such men as Rex Tillerson, Rick Perry and Ryan Zinke for his cabinet.

JUBILEE YEAR HAS BUILT DISASTER

The Jubilee Year was ultimately a time of building, as mentioned at the beginning of this analysis. A variety of elements were created that when triggered will make what is already a considerable catastrophe even worse.

Tensions between the US and Russia and China will rise, the European Union will subside under a variety of crises and the Middle East may become even more warlike and chaotic. Brexit, perhaps even Donald Trump, will provide justifications for creating further wars and economic difficulties. The idea will be that populism is the wrong direction; wise globalist leaders are needed after all.

It is perhaps the economic issues that provide the most worrisome near-term trends.

US government debt continues to skyrocket out of control and is currently at $19.8 trillion. It was “only” at $19 trillion in February of this year. And was “only” at $10.6 trillion the first day Barack O’Bomber entered the oval orifice.

This is completely unsustainable and once that bubble pops everything will come down with it.

Generally speaking, 2016 was a year that started badly with a series of market crashes that boosted gold considerably before the Jubilee year itself began to further build out the individual imbalances.

2017 will begin to realize the results of some of these imbalances as the market strains to return to lower and more normal numbers. If the market doesn’t realize these numbers fully and catastrophically in 2017, then 2018 will make the reckoning even worse.

It is possible, nonetheless, that the economic and military trends that have been set in play via Shemitah and Jubilee will sustain themselves a while longer before total collapse. But eventually war, economic disaster and sociopolitical chaos will be let loose on the world in a kind of biblical apocalypse. These are trends seeded by Jubilee 2016.

SPECIAL YEAR END OFFER

For this reason, more now than ever, you need to ensure you get the best information, advice and analysis to protect yourself and profit from the ongoing collapse.

For this reason and only until the end of the year, we are offering deeply discounted prices to our newsletters, reports and network.

In fact, for the first time ever, we are offering everything we provide for only $1. But only until midnight Eastern time on December 31st.

Take advantage of it now by clicking here and ensure you are prepared and in the best position to profit from the ongoing chaos.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2016 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.