The Stock Market Train Left the Station Years Ago, Now What?

Stock-Markets / Stock Market 2017 Dec 22, 2017 - 10:04 AM GMTBy: Submissions

Chad Champion writes:The S&P 500 hit record highs 53 times this year. The Dow Jones Industrial Average (DJIA) had 70 record closes this year.

Chad Champion writes:The S&P 500 hit record highs 53 times this year. The Dow Jones Industrial Average (DJIA) had 70 record closes this year.

It’s tempting to jump in.

Here’s 2017 summed up by the Wall St. Journal in yesterday’s piece, This Year in Review:

A global stock-market surge powered by corporate earnings and economic growth sent major indexes to repeated records this year, defying predictions that the rally would peter out.

At the start of 2017, a group of 18 Wall Street strategists expected the S&P 500 would rise about 5.5% for the year on average, according to an analysis by Birinyi Associates.

Instead, the popular investment vehicle has climbed 20% so far this year — hitting record highs 53 times — as profits have grown at companies ranging from computer-chip makers to bulldozer builders.

But wait, there’s more!

Many investors and analysts say shares can’t keep climbing at this pace in 2018.

“What I’m worried about is that things are so good that it’s become the consensus expectation,” said Dan Miller, director of equities at GW&K Investment Management.

Yet few see reasons for the eight-year bull market to end anytime soon.

Confused yet?

Shares can’t keep climbing. But few see the bull market ending anytime soon.

Which is it?

The bottom-line is I don’t think it’s prudent for an investor to go from 0% to 100% stocks right now.

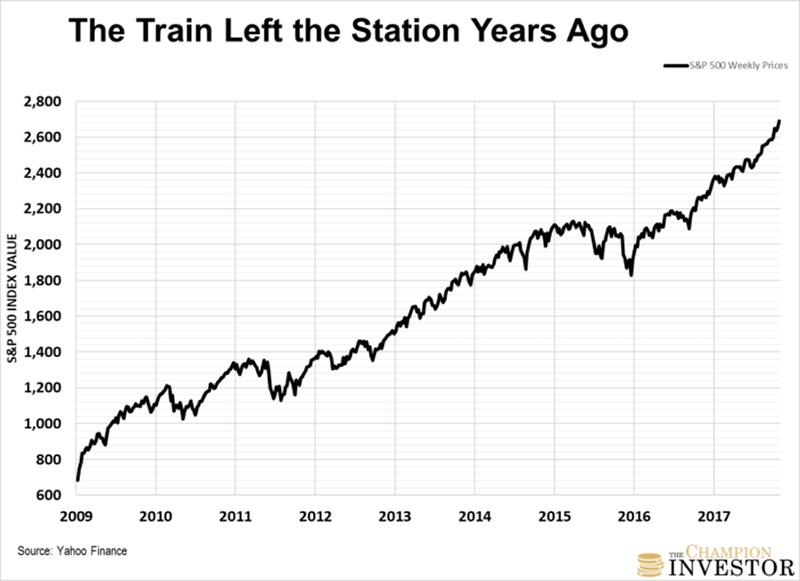

The train left the station years ago. Here’s a chart of the S&P 500 from when the stock market bottomed back in early 2009 until now…

Anyone who buys now is buying at record highs.

Unfortunately, many individual investors stayed on the sidelines for this record run. The reason…

Many saw their investments and 401k’s cut in half from the global financial crisis. Some lost everything.

I remember talking to a guy a few months ago. He was lucky enough to sell his 401k investments before the crash in 2008-2009.

But he’s been sitting in cash ever since. Meanwhile, the S&P 500 is up close to 300% since the market bottomed back in early 2009.

Now, investors see the indexes setting record highs and want to jump back in.

The timing is bad. It’s buy high, sell low thinking. When the key is to buy low, sell high.

Let’s think about the potential upside right now…

Let’s say the S&P 500 and the DJIA could double from here. Which implies a target of around 49,000 for the DJIA and around 5,200 for the S&P 500.

It would also mean that the bull market keeps setting records and roars on for another few years. So, if you bought either one of those indexes you could double your money.

Sounds great. But what’s the risk?

The risk is that we are in the second longest bull market in history. As I explained here, the market is due for a correction. Whether that’s 5%, 10% or more, no one knows.

If an investor wants to buy stocks now, then they should consider buying a little each month. Dip one foot in the water. I sure as heck wouldn’t jump in with both feet.

The downside risk is too big. The market has been going up for so long. The slightest bad news could trigger a selloff. Which could trigger panic selling from the herd who just bought stocks at record highs.

A better strategy to allocate money into stocks now is to buy when the market pulls back. I’ve talked a lot about Peter Lynch’s book, Beating the Street, the past few days.

He said, “The best way not to get scared out of stocks is to buy them on a regular schedule, month in and month out.”

401k’s are an easy way for investors to do that. You’re can set them so you’re buying when prices are up and when prices are down.

It’s called dollar-cost averaging. The investor buys more shares when prices are low and less shares when prices are high.

This allows investors to invest over time. Instead of jumping in all at once with one lump sum amount. (Like some investors want to do now.)

The advantage of this is that you don’t have to worry about buying at the top of the market. Or timing when to buy at the bottom.

This kind of strategy gives the investor a better average price per share over time. They don’t miss bull markets. They buy at cheap prices during bear markets.

Remember, take the time to think about your asset allocation. This is an ideal strategy to combine with the power of asset allocation. (You can read more about it here.)

If you’re not in a stock market index fund or ETF right now, then you could consider nibbling away at one. If you want to buy a few individual stocks, then look for stocks that haven’t done well over the past several years.

The commodity and resource sectors are a good place to start. So are single country ETFs (Stock markets other than the U.S.).

These are places where you can make mean reversion your friend. Sell what’s expensive and buy what’s cheap.

Look, this isn’t about doom and gloom. It’s about being a smart investor.

I’m not saying the market can’t go higher from here. But I am saying investors should be selective and think about the risk versus reward.

By Chad Champion

http://thechampioninvestor.com

Chad is the Founder and Chief Investment Strategist at The Champion Investor. He’s focused on giving the individual investor the good, the bad and the ugly on stocks, the markets and the economy.

You can sign up for his free investment letter, Cut to the Chase, to learn how to make money in any market, create a second income stream, make more money and be a better investor.

He has a Finance and Investment Management background with a Master’s Degree focused in Investment Management and Financial Analysis and a Masters of Business Administration focused in Financial Management.

He spent the past couple of years working as the lead analyst at The Casey Report and as a research analyst for Bill Bonner at Bonner and Partners.

© 2017 Copyright Chad Champion - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.