The Decline And Fall Of The American Empire

Politics / US Debt Jul 30, 2009 - 06:34 AM GMTBy: James_Quinn

"The decline of Rome was the natural and inevitable effect of immoderate greatness. Prosperity ripened the principle of decay; the causes of destruction multiplied with the extent of conquest; and as soon as time or accident had removed the artificial supports, the stupendous fabric yielded to the pressure of its own weight." - Edward Gibbon – The Decline and Fall of the Roman Empire

"The decline of Rome was the natural and inevitable effect of immoderate greatness. Prosperity ripened the principle of decay; the causes of destruction multiplied with the extent of conquest; and as soon as time or accident had removed the artificial supports, the stupendous fabric yielded to the pressure of its own weight." - Edward Gibbon – The Decline and Fall of the Roman Empire

After ruling much of the known world for centuries, Rome fell due to a number of factors that, historians believe, would not have been fatal in isolation, but that proved terminal in combination. Military overspending and overreach, an untenable economic system, and currency debasement all played a role. As has been well documented, the Roman emperors attempted to distract the populace from the increasingly dire reality of their situation by providing bread and circuses. But entertainments could not stop the nation-state from yielding to the pressure of its own weight.

There are numerous parallels between the end of the Roman Empire and the path the 226-year-old American republic is now on. One difference in these fast-moving times is that empires can rise more rapidly, but are also likely to decline more rapidly.

Conquest & Overreach

“The decay of trade and industry was not a cause of Rome’s fall. There was a decline in agriculture and land was withdrawn from cultivation, in some cases on a very large scale, sometimes as a direct result of barbarian invasions. However, the chief cause of the agricultural decline was high taxation on the marginal land, driving it out of cultivation. Taxation was spurred by the huge military budget and was thus ‘indirectly’ the result of the barbarian invasion.”

Arthur Ferrill – The Fall of the Roman Empire: The Military Explanation

The Roman Empire’s economy was based on the plunder of conquered territories. As the empire expanded, it installed remote military garrisons to maintain control and increasingly relied on Germanic mercenaries to man those garrisons.

Ultimately, as its territorial expansion waned and began to contract, less and less booty became available to support the empire’s widespread ambitions and domestic economy. The outsourcing of the military and the cultural dilution from the bloated empire led to lethargy, complacency, and decadence amongst the formerly self-reliant and hard-working Roman citizenry.

In the modern context, as the only major power whose productive capacity was not destroyed during World War II, the American Empire emerged from the ashes of that conflict.

The parallels with Rome do not repeat, but they do rhyme.

Rather than plunder, the U.S. used its unique status to dictate terms that made the U.S. dollar the world’s de facto reserve currency and positioned its robust new manufacturing sector to supply the world with the cars, machinery, appliances, and electronics it so desperately needed. The U.S. trade surplus with the nations of the world led to escalating U.S. wealth and prosperity.

Meanwhile, the U.S. military, about which I’ll have more to say in a moment, was increasingly asked by the nation’s politicians to take on the role of the world’s policeman, leading to action in dozens of conflicts. And even where no direct military role was taken, the U.S. has shown a keen willingness to exert coercive power – including threats, sanctions, and even assassinations – if it was seen to advance American interests.

Simply, in the 20th century, the U.S. became an empire in all but name.

Bread and Circuses

“Already long ago, from when we sold our vote to no man, the People have abdicated our duties; for the People who once upon a time handed out military command, high civil office, legions — everything, now restrains itself and anxiously hopes for just two things: bread and circuses.”

Roman Poet Juvenal – 77 AD

British historian Andrew J. Toynbee convincingly argues that the Roman Empire had a rotten economic system from its inception and its institutions steadily decayed over time.

The government didn’t have proper budgetary systems, and so it squandered resources maintaining the empire while producing little of value. When the spoils from conquered territories were no longer sufficient to cover its many expenses, it turned to higher taxes, in effect shifting the burden of the immense military structure onto the back of the citizenry. The higher taxes forced many small farmers to let their land go barren. To distract its citizens from the worsening conditions, Roman politicians played the populist card by providing free wheat to the poor and entertaining them with circuses, chariot races, and other entertainments.

The American Empire has reached the point where it now faces similar structural imbalances, but to pay its bills, it has largely chosen to borrow from foreign countries in recent years. And the bills are large.

The $765 billion of annual military expenditures by the United States equals the military expenditures of the rest of the world combined.

The social safety net put in place over the decades by politicians attempting to get reelected has resulted in a large number of Americans now almost totally dependent upon the almighty state for their well-being. Threatening to rip apart the country’s social fabric, the “new American” will vote for anyone who promises to sustain his dependency even as the nation increasingly struggles under the weight of $56 trillion of unfunded liabilities.

The non-farm workforce in the United States totals 133 million people. Of that number, the government directly employs 22.5 million. Millions more are employed by industries heavily dependent on government spending, such as defense, construction, and healthcare. The annual maintenance cost of the country’s safety net now costs American taxpayers hundreds of billions.

- Medicare and Medicaid annual spending $682 billion

- Social Security annual spending $612 billion

- Food stamps & other food programs $ 60 billion

- Federal unemployment payments $ 45 billion

America has evolved from a nation of savers to a nation of consumers with a throw-away mentality and driven by little more than the desire for instant gratification. Worse, large segments of our society are convinced that they are owed something. To most, civic duty has become a quaint, outmoded concept. Happy to accommodate – in exchange for a reliable vote come election time – the government keeps the public satiated and sedated by providing them with an ever-increasing list of “public services.”

Roman poet Juvenal described how the Roman citizens abdicated their duties to the state and turned to bread and circuses. The programs listed above represent just some of the bread that American citizens now feel entitled to.

Here in America, we know how to provide circuses on a grand scale. Roman citizens were satisfied with a good chariot race. In these modern times, Americans can find entertainment and distraction with 24-hour-a-day cable TV, the Internet, iPhones, iPods, Blackberries, 1.1 million retail stores, 1,100 malls, 17,000 golf courses, Britney Spears, Kim Kardashian, Housewives of Orange County, New York, Atlanta, and New Jersey, American Idol, Survivor, Rock of Love, Flip That House, 660 stations with nothing on, Las Vegas, Disney World, MLB, NFL, NBA, NHL, WWF, porn, and mega-churches all competing to fill the void in people’s lives.

There isn’t enough time in the day to take in all of the circuses, but with what little spare time we have available, we are now able to check our email anywhere on Earth and stay in constant contact with the office even in the middle of the night or, more typically these days, in the middle of dinner. And we can text and twitter our every thought to our circle of friends and followers, providing next to no lasting purpose or benefit to anyone.

Approximately 12% of the U.S. population (36 million people) is considered poor, and many of them are totally dependent upon the state. Yet that term seems out of sync with the fact that many of those individuals have cell phones ($500/yr.), cable TV ($900/yr.), Internet access ($500/yr.), cars ($5,000/yr. lease), houses ($6,000/yr.), eat fast food ($1,000/yr.), and can smoke a pack a day ($1,500/yr.).

How can this be?

For the answer, look no further than Alan Greenspan, Ben Bernanke, and the Federal Reserve, in cahoots with the financial geniuses on Wall Street, who made it standard practice to create money out of thin air and encourage anyone with a heartbeat to avail themselves of it in the form of low-cost loans – no proof of income or assets required.

The arrangement worked just fine until the banks could no longer hide the bad debt or sell it to the greater fool. Now it has collapsed onto the backs of American taxpayers.

Debasement

The supply of foodstuffs in the cities declined. The people in the cities were forced to go back to the country and to return to agricultural life. Consequently, the emperors made laws against this movement. There were laws preventing the city dweller from moving to the country, but such laws were ineffective. As the people did not have anything to eat in the city, as they were starving, no law could keep them from leaving the city and going back into agriculture. The city dweller could no longer work in the processing industries of the cities as an artisan. And, with the loss of the markets in the cities, no one could buy anything there anymore.

Ludwig von Mises – Human Action

Economist Ludwig von Mises argued that flawed economic policies played a key role in the impoverishment and decay of the Roman Empire. He contended that interventionist economic policies, including price controls that resulted in prices substantially below their free-market equilibrium levels, ultimately led to inflation.

Further, Rome was spending more than it could afford. The free food rations for the poor of Rome and Constantinople – as well as the many entertainments – were costing a fortune. The purchasing of exotic spices, silks, and other luxuries from the Orient bled Rome of its gold… gold that didn't return. Soon Rome didn't have enough gold to produce coins. And so it debased its coins with lesser metals until there was no gold left.

To cover the trillions it is spending each year propping up its empire, the U.S. government is now increasingly forced to rely on printing and borrowing the funds to do so, steadily debasing the currency in the process.

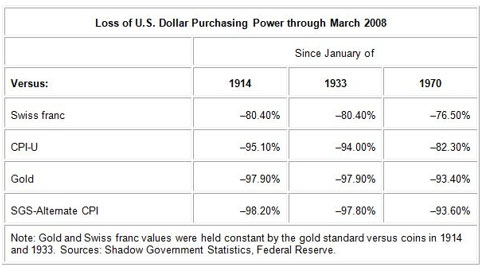

But the nation’s currency debasement is nothing new. Rather, it began in 1913 with the creation of the Federal Reserve. It accelerated when FDR confiscated all the gold in the country in the 1930s. When Richard Nixon took the U.S. off the gold standard in 1971, the show really got on the road, as that freed the Federal Reserve to print unlimited amounts of dollars. As a result, the dollar has lost 93% of its value versus gold since 1970.

The Military Complex

Lessons from ancient Rome regarding the cost of maintaining a far-flung empire have been ignored. Today, U.S. boots stomp on the ground of over 117 countries. Even the use of mercenaries, in the form of thousands of Blackwater guards and other private contractors filling roles formerly left to the military, has become commonplace.

Using military assets to pursue political goals, as is the norm in empire building, has led to unintended consequences and wasted opportunities.

One of the most egregious of those lost opportunities came following the bankruptcy and collapse of the Soviet Union. The United States had won the Cold War, but failed to recognize the cautionary signs on the path ahead.

As the only remaining superpower on earth, America fell into the same trap that has befallen previous empires. Instead of concentrating on proactively confronting domestic challenges, such as unfunded Social Security and Medicare liabilities, and developing a comprehensive energy plan to wean ourselves off Middle East oil, we continued to intervene in costly foreign adventures.

Including, among many others, supplying both Osama bin Laden and Saddam Hussein with weapons and money during their fights against our enemies, leading to unintended consequences we live with to this day.

Seeking to maintain its widespread interests and to defend itself from the many enemies created by building and protecting those interests, the American military complex has grown to the point where it now spends an amount equal to 44% of all taxes collected from its citizens.

Since 1991 alone, the U.S. has interceded in Kuwait, Somalia, Bosnia, Sudan, Afghanistan, and Iraq, among others. In no case has Congress fulfilled its obligation of declaring war. Instead, it has delegated sole responsibility for waging war to the president, weakening the structure of our three-branch government. Over that period of time, the U.S. has spent $7 trillion on defense.

The National Debt in 1991 was $3.2 trillion. Today, it is $11.6 trillion, a 360% increase in eighteen years. In 2001, spending on defense was 17% of the government budget. In 2008, defense, Homeland Security, and war spending accounted for 26% of government spending.

Collapse

Economic history books will likely mark 1980 as the year that the rapid phase of the decline of the American Empire began. That’s when the first wave of the Baby Boomer generation reached the age of 35 and turned its attention to living the American dream – on borrowed money. Since that year, household debt has surged from $1 trillion to $14 trillion, while the savings rate has plunged from 12% to below 0%.

There are many ways to use credit, some quite intelligent and practical. Rotating credit card debt to buy the latest non-necessity does not fall into that category. Today in America, there are $956 billion of credit card debt outstanding, or $9,000 per household. The average American has nine credit cards. A credit card allows every person to live above their means for awhile... just as did the home equity loans taken against artificially elevated house prices anchored on mortgages people couldn’t afford.

This is where reality and fantasy meet. People can only borrow and spend if the Federal Reserve and bankers provide the funds to do so, and without asking a lot of questions about suitability. By creating money out of thin air and handing it out to people with no legitimate means of repaying it, the financial elite and their friends in Washington have played an essential role in bringing the U.S. and even the global economy to its knees.

Yet, for all the evidence, a large swath of Americans still believes the nation hasn’t gone off course. These people consider borrowing in order to live beyond their means a rational choice. They expect the government to save them when they get into trouble and think that taxing the rich to pay for a bigger and bigger safety net is a reasonable idea.

In a truly free-market society, this sizable segment of the public would have already learned a brutal lesson they’d remember for the rest of their lives. Instead, the brutal lesson is being learned by people who played by the rules and didn’t take ridiculous risks, but who are now being coerced by the government to pay for the misdeeds of the over-indebted fools who did.

The crushing levels of debt resulting from decades of excess; the far-reaching military presence; the politically motivated social safety net and other popular but unaffordable programs have now reached the point that the economic decline of the American Empire is a foregone conclusion.

The current downturn is not going to be like previous recessions that lasted on average 16 months. Even as the government responds by trying to borrow and spend the country back to prosperity, there is no ignoring that the economic base has been gutted and the future social program liabilities have essentially bankrupted the country.

As was the case in the final stages of the Roman Empire, the unsustainable military, social, and political excesses have reached the point that, in combination, they are now likely to prove catastrophic.

A Final Thought

For over a thousand years, Roman conquerors returning from the wars enjoyed the honor of a triumph – a tumultuous parade. In the procession came trumpeters and musicians and strange animals from the conquered territories, together with carts laden with treasure and captured armaments. The conqueror rode in a triumphal chariot, the dazed prisoners walking in chains before him. Sometimes his children, robed in white, stood with him in the chariot, or rode the trace horses. A slave stood behind the conqueror, holding a golden crown, and whispering in his ear a warning: that all glory is fleeting.

George C. Scott as Patton

Which begs the question, who is now standing behind the current political leadership, reminding them that their elevated positions are temporal? Unfortunately, the excesses they have created, and the dislocations caused by those excesses, will be with this country for generations.

Reprinted with the permission of Casey Research. Sign up for the free Daily Dispatch for more great insights.

To join the discussion of how to take back our country from the banking cartel and government central planners, go to www.TheBurningPlatform.com.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2009 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.