Will Central Banks Start Consficating Gold?

Commodities / Gold & Silver 2009 Aug 08, 2009 - 08:08 PM GMT As part of a series we first look at this question: "If the U.S. decides to confiscate gold in the future, what impact might that have on Gold Shares and the COMEX Gold Futures prices?"

As part of a series we first look at this question: "If the U.S. decides to confiscate gold in the future, what impact might that have on Gold Shares and the COMEX Gold Futures prices?"

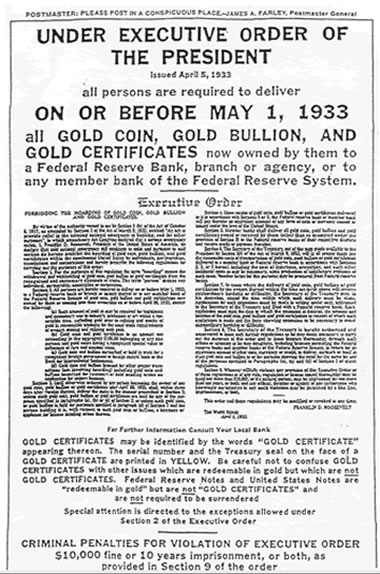

We assure you, this is not a fatuous question. Is it possible you may well ask under what circumstances did this happen in 1933? [We will answer that more fully in a later part of the series]. What we can confirm is that in 1933 the U.S. government banned the ownership of gold by U.S. citizens and purchased all but rare gold coins from the U.S. Public They did this, at $20 an ounce. Two years later they revalued gold to $35 an ounce, a 75% revaluation. So, there is a precedent! [In a later part of the series, we will examine the reasons behind this first confiscation and compare these with today to see if we can expect the same in the months to come?]

We assure you, this is not a fatuous question. Is it possible you may well ask under what circumstances did this happen in 1933? [We will answer that more fully in a later part of the series]. What we can confirm is that in 1933 the U.S. government banned the ownership of gold by U.S. citizens and purchased all but rare gold coins from the U.S. Public They did this, at $20 an ounce. Two years later they revalued gold to $35 an ounce, a 75% revaluation. So, there is a precedent! [In a later part of the series, we will examine the reasons behind this first confiscation and compare these with today to see if we can expect the same in the months to come?]

So we continue this part on the basis that a confiscation will take place. And we further assume that the rare gold coins [trading at a large premium to the gold price] are excluded. This means that high caratage gold bars and coins trading at close to the gold price will have to be handed over to the Fed and sent to a place like Fort Knox.

Gold Share Markets.

It may sound strange to say this, but investors in gold Exchange Traded Funds will concur but gold shares have little to do with the gold price, except to define what a gold mining company will earn from its gold production. Buyers of gold shares don't expect to influence the gold price when buying gold shares. They are buying equities only, with all the risks of any corporation. The way the gold price affects them is through the price received over the space of the half year and year when the results are published. This makes the average gold price of prime importance to these shares. Of course there are many who based on their forecasts of the average gold price will discount this average and reflect it in the price of the shares. Many believe that gold shares are six months ahead of that average.

Now imagine a regime where U.S. owned gold is confiscated. It may well be as last time that the gold is paid for at a fixed price. It may well be that gold mines in the U.S. are paid that gold price and no more. Then the average gold price achieved from that mine will be the new "fixed" price of gold. One will then be able to measure the earnings of a gold mine and allow some part of the price for the risks attendant on a corporation [management, balance sheet, etc]. Gold mines, where the gold price earned is entirely different from that inside the U.S., will trade at different levels commensurate with these different gold prices. [We will discuss different global prices in a later part of the series]. The price of gold mining company's shares will therefore be very different than those in the U.S. It could be that foreigners will buy U.S. gold mines shares to get a higher price or U.S. investors will buy foreign gold mine shares to get their higher gold prices? There will be a separation of the two for sure.

We do expect that investors of any kind will continue to be allowed to invest in gold mines no matter where they are in the world. If foreign gold mine shares are trading at different price and higher ones at that, then the U.S. will benefit to the extent that dividends flow into the country. You can be sure that the U.S. will encourage this. After all the objective of a confiscation of gold will not, at this stage, be to restrain foreign investment, but to bring gold into the hands of government. It all depends on what Capital or Exchange Controls attend the confiscation of gold.

Futures and Option markets.

This is where life changes for an investor. If there is no free gold market inside the States [due to the continuous purchase of gold by the U.S. Fed] there will be no gold market on which to base the futures and option market inside the States. Perhaps the U.S. regulators will feel that that is an unavoidable cost justified by the reasons they confiscated the gold in the first place.

But the financial world is far too sophisticated to allow such a draconian result. We have absolutely no doubt that London or Paris or Shanghai or Moscow or TOCOM will step into the gap and widen their own Futures and Options market in gold or accept new business into their already established futures and options markets. After all, many, many foreigners buy futures and options on COMEX. Where will they go?

Will U.S. investors have access to these markets?

Again we have to understand why gold will be confiscated in the first place. It would seem likely that the acquisition of gold will be their purpose, no other, so why prevent U.S. citizens from going overseas to invest in a futures and options market when they can go to invest in any other markets there. It is possible that at some stage the U.S. would instruct that U.S. owned gold held abroad be repatriated, forcing delivery first. But this would be at a later stage only, we feel.

The only reason this would not be allowed would be because full scale exchange Controls would have been imposed on U.S. investment overseas. Usually these are not prevention measures but added cost measures. In the U.K. in 1971 two types of currencies were used, one for international trade and one for international investment [Dollar Premium]. At its worst the international investment currency stood at a 31% discount to the 'commercial' currency. This translated into the export of around 50% more Pounds for investment than for commerce. The U.S. could experience this in a $ meltdown.

Subscribers only

Gold Forecaster regularly covers all fundamental and Technical aspects of the gold price in the weekly newsletter. To subscribe, please visit www.GoldForecaster.com

![]()

By Julian D. W. Phillips

Gold-Authentic Money

Copyright 2009 Authentic Money. All Rights Reserved.

Julian Phillips - was receiving his qualifications to join the London Stock Exchange. He was already deeply immersed in the currency turmoil engulfing world in 1970 and the Institutional Gold Markets, and writing for magazines such as "Accountancy" and the "International Currency Review" He still writes for the ICR.

What is Gold-Authentic Money all about ? Our business is GOLD! Whether it be trends, charts, reports or other factors that have bearing on the price of gold, our aim is to enable you to understand and profit from the Gold Market.

Disclaimer - This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Gold-Authentic Money / Julian D. W. Phillips, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; Gold-Authentic Money / Julian D. W. Phillips make no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Gold-Authentic Money / Julian D. W. Phillips only and are subject to change without notice.

Julian DW Phillips Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.