Financial Crisis a Crime Story?

InvestorEducation / Resources & Reviews Sep 19, 2009 - 11:43 PM GMTBy: Nadeem_Walayat

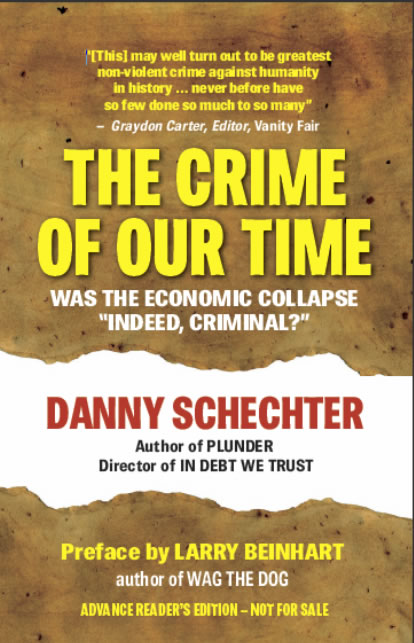

Asks Danny Schechter in his new book THE CRIME OF OUR TIME, Was The Economic Collapse “Indeed, Criminal?” which reveals how an ongoing crime built up on pervasive subcrime mortgage fraud, predatory securitization, unchecked leveraging, and phony insurance scams that lost trillions, cost millions of families their homes, devastating financial markets and western economic security. Schechter argues “We need a jailout, not a bailout.”

Comments on The Crime of Our Time

“Regulations have always been the mechanism used by societies to prevent flagrant abuses of power, the enslavement of the working class and the rise of a parasitic power elite. The erosion of regulations, as Danny Schechter makes clear in his book, permits the powerful to legalize crime. Theft, fraud, deceptive advertising, predatory lending, debt sold to investors as assets become the currency of a false economy. And when this ficticious economy crashes those who engaged in these crimes, because they have hijacked the reigns of power, are able to loot the U.S. Treasury in the largest transference of wealth upwards in American history. There are many forms of terrorism. And this economic terrorism, as Schecter writes, is perhaps even more dangerous to the nation than the attacks of 9/11.” – Chris Hedges, author of Empire of Illusion: The End of Literacy and the Triumph of Spectacle

“Regulations have always been the mechanism used by societies to prevent flagrant abuses of power, the enslavement of the working class and the rise of a parasitic power elite. The erosion of regulations, as Danny Schechter makes clear in his book, permits the powerful to legalize crime. Theft, fraud, deceptive advertising, predatory lending, debt sold to investors as assets become the currency of a false economy. And when this ficticious economy crashes those who engaged in these crimes, because they have hijacked the reigns of power, are able to loot the U.S. Treasury in the largest transference of wealth upwards in American history. There are many forms of terrorism. And this economic terrorism, as Schecter writes, is perhaps even more dangerous to the nation than the attacks of 9/11.” – Chris Hedges, author of Empire of Illusion: The End of Literacy and the Triumph of Spectacle

“Danny Schechter is the people’s economist. The clairvoyance of his opus transcends mainstream statistics-gatherers because he examines the real world, reporting the American condition as told to him by the real people who live it everyday. The Crime of Our Time combines Schechter’s signature bold passion, keen analysis, and solid empathy for those caught in the cross-fires of the financially powerful and politically connected. Like Schechter’s other works, The Crime of Our Time is ahead of its time, and we could all learn from Schechter’s astute, heartfelt, and exceedingly accurate observations and predictions.” – Nomi Prins, former Managing Director at Bear Stearns and Goldman Sachs, author It Takes a Pillage

“Excellent investigative journalism like Danny Schechters in The Crime Of Our Time actually protects capitalism against the cancer of white collar crime by educating law enforcement, businesses, investors, anti-fraud professionals, and the public about schemes used by criminals who victimize our economic system for their own personal gain.” – Sam Antar, Convicted White Collar Criminal

“Danny Schechter brings both the needed economics expertise and the media credentials to the important task of exposing and analyzing the elements of crime and corruption woven deep into the fabric of our economic system’s current crisis. Plunder and The Crime of Our Time are important contributions toward understanding an historic moment of change in the economy and society of the United States.” – Richard D. Wolff, Professor of Economics Emeritus, University of Massachusetts, Amherst, Visiting Professor, Graduate Program in International Affairs, New School University, New York

“Did the current economic crisis result simply from market forces, misjudgment and greed? Or was it a deliberate criminal manipulation of markets to extract wealth from the masses? In The Crime of Our Time, Danny Schechter turns his polished investigative and reporting skills to exploring the theory that it was a crime. In veteran journalist prose, he establishes the crime’s elements, identifies the players, and exposes the weapons that have turned free markets into vehicles for mass manipulation and control. – Ellen Brown, a Los Angeles area-based attorney, is the author of Web of Debt and other books and articles on economic issues.

“Danny ranges wide over the political and cultural landscape, pointing fingers, naming names and holding no sacred cows in his quest to determine what went wrong with our economy and who was responsible. His work is the antidote to to a biased, compromised and sclerotic mainstream media.” – Aaron Krowne, editor of Ml-implode and related websites on the mortgage and banking crisis.

“With The Crime of Our Time, Danny Schechter has made himself the clean-up hitter in the line-up of investigative journalists. He has continued his pioneering work on how the actual existing real world of capitalism works – not the fairy tale version that dominates solitical and media discourse. This book is truly revelatory and must reading for anyone trying to understand the financial currents that have run the economy into the ditch. With The Crime of Our Time, Danny Schechter has smashed the ball 500 feet over the centerfield fence. Robert W. McChesney, co-author, The Death and Life of American Journalism

For more on this book accompanying film: www.Newsdissector.com/plunder

Dissector@mediachannel.org

Published by NewsDissector.org with ColdType.net - $19.95

By Nadeem Walayat

http://www.marketoracle.co.uk

Copyright © 2005-09 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis specialises on the housing market and interest rates. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 400 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.