A Billion Hungry Mouths, China’s Grain Demand Could Explode

Commodities / Agricultural Commodities Oct 25, 2009 - 03:35 AM GMTBy: Sean_Brodrick

While most commodities have blasted off, agricultural commodities have lagged the rally. I think that’s going to change in a big way, thanks to a country with a billion hungry mouths and plenty of cash. I’m talking about China. And I have three picks to play China’s growing hunger.

While most commodities have blasted off, agricultural commodities have lagged the rally. I think that’s going to change in a big way, thanks to a country with a billion hungry mouths and plenty of cash. I’m talking about China. And I have three picks to play China’s growing hunger.

Why has agriculture lagged? It boils down to a couple of factors …

- Expectations of bumper crops in the U.S. and other countries.

- Fears that the global recession would weigh on demand for meat. Since it takes a lot of grain to feed pigs and cows, that in turn weighed on expectations of grain demand.

But now, with harvest season upon us, those two fears are fading. Weird weather is dragging down harvests in the U.S. and Australia. And signs of recovery in emerging markets like China are ramping up prospects of meat consumption again.

Another factor to consider is the United States is the Saudi Arabia of grain — exporter to the world. As the U.S. dollar slumps lower against other currencies, our grain becomes more affordable for deep-pocketed foreigners. That revs up grain sales … and prices.

And who is going to buy a lot of our agriculture products? China!

Here are some facts on China that are bullish for the long-term trend in prices …

- China is losing more and more farmland to desertification and urbanization. From 1950 to 1975, China lost an average of 600 square miles of arable land each year. By 2000, the loss of good farmland accelerated to nearly 1,400 square miles. Some of the best farmland has been plowed under to build skyscrapers, and only 28% of China’s remaining farm land is considered high-yielding.

- China suffers from low yields. For example, China’s corn yields are less than 80 bushels an acre, half the size of U.S. corn farmers’ yields. And China’s farm yields are only growing at 0.9% annually.

- China has to feed 7.3 times as many people per acre of arable land as the U.S., and three times as many as Europe. And the crisis is worsening because China has 22% of the world’s population and only 7% of its fresh water. What’s more, thanks to pollution, three-quarters of its river water are undrinkable or unfishable. Scientists say the aquifer under China’s northern plain — which produces half of the country’s wheat and a third of its corn — has been dangerously depleted by overpumping.

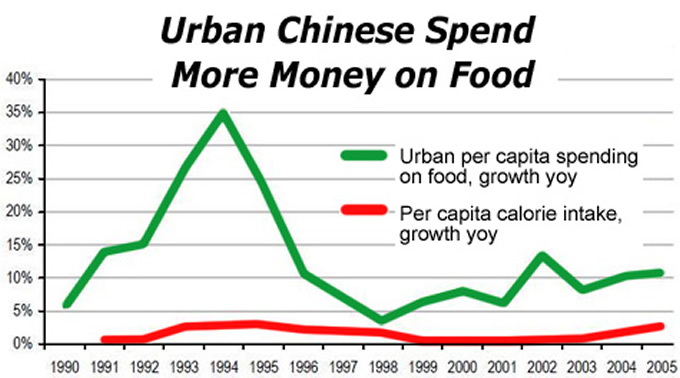

- China’s per capita grain demand is rising, especially in cities, and it will build a lot more cities. By 2025, China will have added 350 million urban residents to its population — about the size of the entire population of the U.S. today — and by 2030, should have 221 cities with more than 1 million residents. You can see the trend this is already having on food spending in this chart …

Source: UN FAO, UBS

The really interesting thing about this chart is that you can see the Chinese used to spend much more per capita on food. If that ramps up again, China’s food intake could soar.

Bottom line: According to a report from Societe Generale, if China follows the same path as South Korea, whose economy grew at an average rate of 6% between 1965 and 1989, China’s grain consumption would more than double to 812 million metric tonnes over the next 25 years.

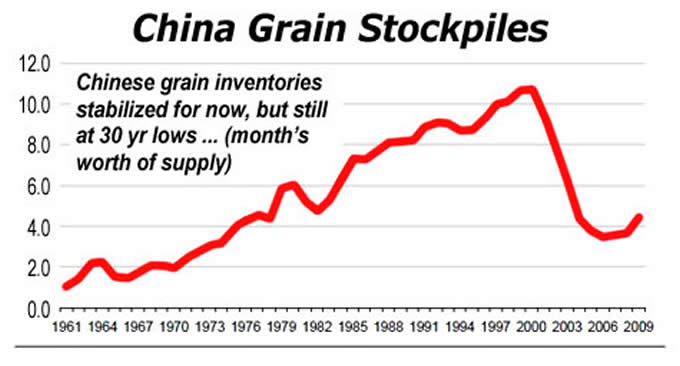

Where will this grain come from? China’s grain stockpiles are near 30-year lows …

Source: Societe Generale

So that leaves global grain supplies. While two years of bumper harvests have boosted global stockpiles, as measured by months’ worth of inventory, they still are lower than at any time since World War II.

Speaking of the world, it’s not just China that’s hungry. According to a report from the U.N. Food and Agriculture Organization earlier this year, more than 1 billion people across the world are hungry — an increase of 100 million people in just the last year. The difference between China and most of the rest of the world’s hungry people is that China has cash — lots and lots of money that we ship them every day in return for cars, toys, and lead-saturated toothpaste.

What do you suppose China will do if it needs grain? That’s easy — go shopping in Uncle Sam’s pantry.

China’s Grain Demand Could Explode

Going forward, all it will take is one bad harvest to tip China over the edge from low stockpiles to no stockpiles. If that happens, America’s grain prices and farm-related stocks could blast off.

So, China’s booming appetite should be good news for U.S. farm stocks.

Three Ways to Trade This

You can buy individual stocks, and there are some bargains out there. But unless you’re going to do a lot of research, it’s best to stick to funds. Three easy ways to trade the coming move are …

The PowerShares DB Agriculture Fund (DBA) tracks a bunch of agricultural commodities. To comply with CFTC dictates, the DBA recently expanded from its four holdings of corn, wheat, soybeans and sugar. It revised the fund and added Cocoa, Coffee, Cotton, Feeder Cattle, Kansas Wheat, Lean Hogs, and Live Cattle futures to the mix.

The iPath Dow-Jones AIG-Grains ETN (JJG) tracks soybeans, wheat and corn. Be careful, however — there’s not a lot of volume in this one so entries and exits can be tricky.

The Market Vectors Agribusiness ETF (MOO) tracks a basket of agriculture-related companies including Archer Daniels Midland, Monsanto, Potash, Mosaic, Wilmar and more.

Do your own due diligence in anything you buy, and make sure it’s right for your investing style.

Two of the above-mentioned funds are already racking up gains in Red-Hot Commodity ETFs, and I’ll be firing off more picks soon to make the most of the next big surge in prices. If you’re ready to trade, it’s time to climb onboard the profit train before it leaves the station. Check out Red-Hot Commodity ETFs today.

Yours for trading profits,

Sean

P.S. Be sure to check out my blog at http://blogs.uncommonwisdomdaily.com/red-hot-energy-and-gold/ for daily updates and charts on gold, oil, agriculture and more.

This investment news is brought to you by Uncommon Wisdom. Uncommon Wisdom is a free daily investment newsletter from Weiss Research analysts offering the latest investing news and financial insights for the stock market, precious metals, natural resources, Asian and South American markets. From time to time, the authors of Uncommon Wisdom also cover other topics they feel can contribute to making you healthy, wealthy and wise. To view archives or subscribe, visit http://www.uncommonwisdomdaily.com.

Uncommon Wisdom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.