U.S. Treasury Bond Yield Observations

InvestorEducation / US Bonds Oct 27, 2009 - 02:05 AM GMTBy: Guy_Lerner

The only asset moving up over the last week has been longer term Treasury yields. This is odd especially in the face of equity market weakness and especially since demand for Treasury bonds has outstripped supply over the past year. So why are yields moving up now? Maybe yields are rising in anticipation of buyer fatigue as this week's record bond issuance comes to market.

The only asset moving up over the last week has been longer term Treasury yields. This is odd especially in the face of equity market weakness and especially since demand for Treasury bonds has outstripped supply over the past year. So why are yields moving up now? Maybe yields are rising in anticipation of buyer fatigue as this week's record bond issuance comes to market.

This is difficult to know until it happens, but I can say for sure that yields are not rising because of inflation concerns nor are they rising because of strength in the economy. Yields generally rise after an economic expansion is well under way and they generally rise when the unemployment rate falls. The last time I checked, the unemployment rate was still rising; the economy had stopped its free fall, but visibility was less clear; and deflation seem to be a bigger threat than inflation.

Over the past several months, lower Treasury yields did not confirm the strength in the stock market, and this has been a glaring divergence that I have noted on more than one occasion. Now with weakness in the equity markets imminent (but not guaranteed), yields start to move higher. Hmm. I hope this isn't the new normal?

Technically, long term Treasury yields have the characteristics of an asset that could undergo a secular change in trend. This has been a theme that I have been on for over 10 months now, but in all honesty, yields have yet to show real sustainable strength. The best that I can say about my analysis is that I have said to avoid Treasury bonds for anything but a trade.

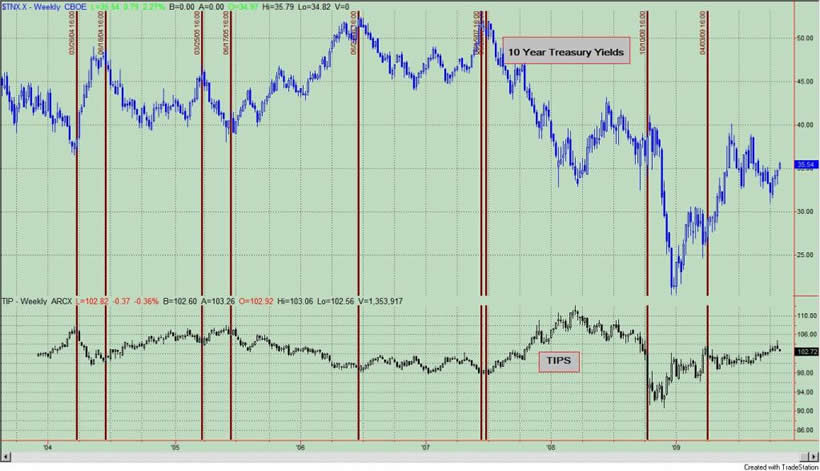

See figure 1, a weekly chart of the yield on the 10 year Treasury bond. The 10 year Treasury did trade to a yield of 4% back in June, but they fell back to 3.1% level before bouncing. Yields are above the prior weekly pivot high point at 3.437% and the down sloping black trend line, and it would be bullish for higher yields if there was a monthly close over the prior low pivot (on a monthly chart) at 3.432%. Yields appear likely to trade to the resistance zone between 3.856 to 4%.

Figure 1. $TNX.X/ weekly

Why yields should move higher has been a subject of much conjecture all year long. Nonetheless, increasing bond supply has been met by buyer demand, and the fundamental back drop (despite the stock market rally) really has not been conducive for higher yields. The technicals are at odds with the fundamentals.

Other observations are noteworthy. Figure 2 is a daily chart of the ProShares UltraShort Lehman 7-10 Year Treasury (symbol: PST), which seeks results that are twice the inverse of the daily performance of the Barclays Capital 7-10 Year U.S. Treasury index. The triple bottom is is quite noteworthy.

Figure 2. PST/ daily

Figure 3 is a daily chart of the ProShares UltraShort Lehman 20+ Year Treasury (symbol: TBT), which corresponds to twice the inverse of the daily performance of the Barclays Capital 20+ Year U.S. Treasury index. The double bottom is quite noteworthy, as indicated by the volume spike.

Figure 3. TBT/ daily

Another observation comes from the Treasury Inflation Protected Securities or TIPS market. As recently as last week, I was under the belief that yields were heading lower. Why? TIPS were headed higher. There is a very clear inverse relationship between TIPS and 10 year Treasury yields. This can be seen in figure 4. As TIPS go up; long term yields go down.

Figure 4. TIPS v. $TNX.X/ weekly

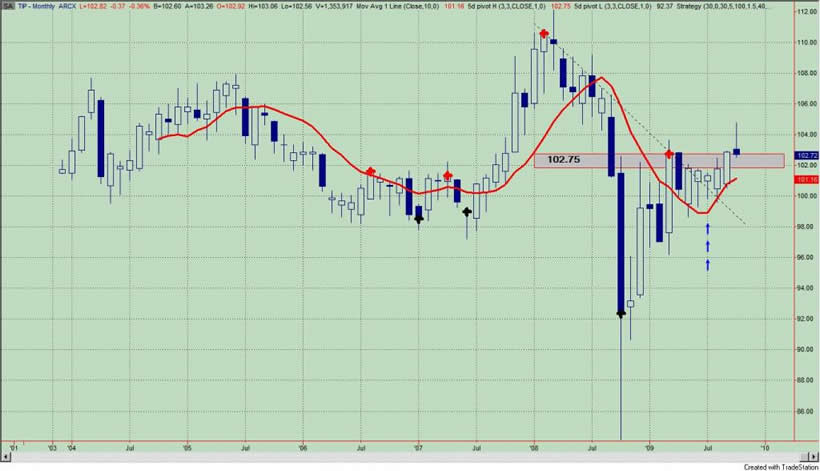

However, TIPS have not followed through (and I could be wrong!), but they haven't broken down completely yet. A monthly close below the pivot at 102.75 would be reason enough to abandon the notion of higher TIPS. See figure 5. A monthly close below this level would add credence to the notion of higher Treasury yields.

Figure 5. TIPS/ monthly

So let's summarize. There are lots of conflicting crosscurrents when it comes to yields on longer term Treasury bonds. Whether the current mini-lift in yields develops into a longer term sustainable trend is not certain as the fundamentals are at odds with the technicals. Nonetheless, betting on higher yields - because of the technical, secular tailwinds - may be the easier trade to make at this juncture.

By Guy Lerner

http://thetechnicaltakedotcom.blogspot.com/

Guy M. Lerner, MD is the founder of ARL Advisers, LLC and managing partner of ARL Investment Partners, L.P. Dr. Lerner utilizes a research driven approach to determine those factors which lead to sustainable moves in the markets. He has developed many proprietary tools and trading models in his quest to outperform. Over the past four years, Lerner has shared his innovative approach with the readers of RealMoney.com and TheStreet.com as a featured columnist. He has been a regular guest on the Money Man Radio Show, DEX-TV, routinely published in the some of the most widely-read financial publications and has been a marquee speaker at financial seminars around the world.

© 2009 Copyright Guy Lerner - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Guy Lerner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.