Crude Oil surging! Resource countries flying!

Commodities / Crude Oil Jul 10, 2007 - 11:06 AM GMT Martin here with an urgent update on the latest surge in oil, its many causes and its far-reaching consequences.

Martin here with an urgent update on the latest surge in oil, its many causes and its far-reaching consequences.

After months of meandering without direction, oil markets are jumping back into the limelight.

They're bursting with new activity … moving quickly toward the highest price levels of all time … and setting off a rapid-fire chain reaction of events that most investors are missing.

In London, the lighter, Brent North Sea oil has surged past $76 per barrel for the first time in a year — within easy striking distance of $78.65, its record high set in August 2006.

In New York, light sweet crude hit $72.94 — also the highest level since last August.

Why?

Nearly Everywhere You Look, You Can Readily See the Causes …

Venezuela , with the largest petroleum reserves in the Western hemisphere, is a basket case in the making, its oil industry deliberately turned upside down by firebrand dictator Hugo Chávez.

Last month, Chávez seized control of four foreign-owned oil ventures. And last week, twin giants ConocoPhillips and Exxon Mobil announced they're pulling out of the country altogether.

There was some hope that Total SA, Europe's third-largest oil company, would take over their operations. But on Saturday, the news was clear: They won't touch it with a ten-foot pole.

Iran , the world's fourth-biggest oil exporter, is inching closer to

- a broader conflict with the United States over Iraq, plus

an all-out confrontation with the United Nations over its nuclear program.

Just yesterday, the Iranian foreign ministry complained bitterly about the treatment of five Iranian officials detained by U.S. forces in northern Iraq. American officials countered with jibes about U.S. citizens jailed in Iran.

This great Persian Gulf time bomb has not been diffused. It's still ticking. It could blow up at almost any time.

Nigeria, one of the world's largest sources of light crude oil, is in turmoil.

Just last week, in a new, twisted escalation of their war on the foreign-owned oil industry, militants kidnapped a 3-year-old British girl.

Meanwhile, a whopping one-fifth of Nigeria's oil production is shut down due to militant protests, attacks and sabotage. As much as one-half is vulnerable to future attacks. And nearly all of Nigeria's production could come to a standstill in a not-unlikely civil war.

Iraq, with some of the world's largest oil reserves, is in chaos.

Despite the most massive oil industry rescue effort of all time, its oil exports are still stuck below the 1.7 million barrels per day exported under Saddam Hussein. And in the event of a political collapse, even that level will be tough to maintain.

The United States, the world's largest consumer of energy, is doing practically nothing to curtail its ravenous appetite for more.

The U.S. summer driving season, which began at the end of May, is in full throttle. The U.S. skies, already near capacity, are jammed with fuel-hungry aircraft.

China and India, the fastest-growing energy guzzlers of the world, are doing even less.

And …

The entire world , desperate to be able to secure another big source of oil, wouldn't know what to do with it even if they could.

Reason: The global shortage of refining capacity.

In almost every gasoline-producing nation, refineries have been stretched to their limits … setting off a relentless series of equipment breakdowns … reducing output … and, in turn, driving refineries to take even bigger risks of breakdowns.

On every continent, gasoline prices are going up. Yet, also on every continent, demand for gasoline continues to rise.

And Nearly Everywhere You Look, You Can Also See the Consequences …

Consequence #1. Other natural resources, driven higher by many of the same forces driving oil, are starting to surge again. Last week …

- The price of lead rocketed to the highest level in history.

- Copper jumped a whopping 4%, reaching a new, 2-month high, making a beeline for another historic record.

- Zinc, aluminum and tin — plus nearly all the base metals that make the industrial world go round — followed a similar upward path.

Consequence #2. The U.S. dollar is getting killed, and foreign currencies — especially those supported by abundant resources — are going through the roof. Also last week …

- The euro came close to its highest level in history …

- The British pound surged to a new 26-year high and …

- The Canadian dollar jumped to a new thirty -year high!

And just since the beginning of the year …

- The Australian dollar is up nearly 9% …

- The Indian rupee is up over 9% …

- The Canadian dollar is up more than 10%, and …

- The Brazilian real, the strongest among all actively traded currencies, has surged by over 12%.

Stop for a moment to consider the magnitude of these moves:

We're not talking about an individual stock or even an entire index. We're talking about the money of entire nations — countries with giant populations and/or vast territories.

Or think about it this way: On January 1, if you made the simple move of shifting some of your savings from a 5% U.S. dollar bank CD … to a 5% Canadian dollar CD, look at what that would have meant for your overall return:

Let's say that, in the first half of this year, you could have earned 2.5% in interest in an ordinary CD in a U.S. bank.

And, let's assume that a Canadian dollar CD would have yielded the same.

But with the Canadian dollar, you'd also have a 10% appreciation in the currency, giving you a total return of 12.5%! In other words …

For each $1 of interest you got in the U.S., you could have made FIVE dollars in total return on the same kind of instrument in Canada!

This simple example teaches not just one — but two — unforgettable lessons:

- If you move some of your money from a weak currency to a strong currency, it can have a huge impact on your returns!

- And when the value of a country's money itself is falling or rising, it can also have a dramatic impact on virtually every aspect of that economy.

Consequence #3. The fate of virtually every economy on the planet is now beginning to revolve around a single question:

Is it mostly a resource consumer? Or is it mostly a resource provider ?

If it's the former, it may have some serious hurdles to overcome. If it's the latter, it's likely to be flying high.

For countries like the U.S., that means more obstacles to economic growth. But for resource countries like Brazil, Canada, or Australia — it means more boom.

Last week, I told you about Brazil. And soon, Sean will write you again about Canada and Australia. But today, let's look at a country virtually no one is covering …

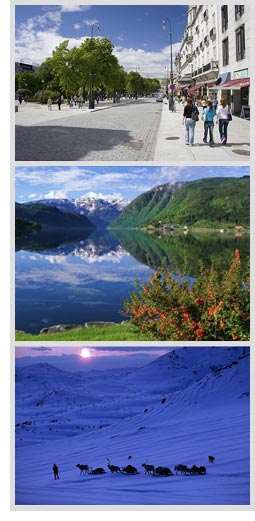

NORWAY: Leading the Entire World in Key Metrics of Growth and Prosperity!

Norway's reaping huge benefits from the oil boom. But it's success is not just about oil.

Among major industrial nations, Norway's income per capita — $72,306 per year — is the highest in the world, far ahead of the United States, with just $44,190.

Among all nations surveyed by The Economist , Norway ranks #1 on the Global Peace Index — the least crime and the most security.

And among all nations of the world, large or small, Norway also ranks #1 on the Human Development Index (HDI), a standard used by the United Nations to evaluate life expectancy, literacy, education, economic development, and the overall quality of life.

The Norwegian Kroner, like the foreign the currencies I just told you about, is up sharply against the U.S. dollar — 7% this year alone.

And Norway's economy is booming.

Only a couple of smaller nations have lower unemployment than Norway's 1.7%.

Only Saudi Arabia and Russia export more oil than Norway's 2.8 million barrels per day.

Perhaps most important, no other nation is saving as much as Norway for the day when its primary resource, oil, runs out. Their primary vehicle: The huge Norwegian Government Petroleum Fund, now valued at $335 billion.

You don't need a Ph.D. to see for yourself what all this means.

Just stroll down Oslo's Karl Johans Gate.

Just travel to lakes Mjøsa, Røssvatnet or Femunden.

Or visit the Arctic north.

And everywhere, observe the full range of generations — their spirit, their confidence and their determination.

Then you will understand.

Unfortunately, there are no ETFs dedicated to Norway. But there are quite a few Norwegian stocks that trade on U.S. exchanges — like Norsk Hydro, Smedvig, Petroleum Geo-Services, or Saga Petroleum.

We are watching them carefully for an opportune time to recommend them in our services. We suggest you do the same.

Stars in Alignment! No More Time to Wait!

More often than not, the markets of the world flash unclear signals. But this is not one of those times. Right now …

- The U.S. domestic sectors that Mike Larson has been warning you about — housing and mortgages — are sinking. (To hear my latest radio interview on this subject, click here .)

- The foreign markets that we've been highlighting — like Brazil and China — are going through the roof. (For the details, see my News Alert: Brazil and China Trump Dow! Again !)

- The foreign currencies we said would be strong are now the strongest in the world; the one we said would be weak (the U.S. dollar) is now the weakest.

- And now, on top of all this, vital resources like oil are taking off … helping to pull the dollar down even further … making our favorite economies even richer … and driving their currencies even higher .

So if you have aligned your investments with these megatrends, I think you're clearly on the right track.

If you haven't, what are you waiting for?

Get out of U.S. sectors that are vulnerable to a spreading real estate disaster — home builders, mortgage lenders, residential investments, commercial property and Real Estate Investment Trusts (REITS).

And get into investments that are linked to the megatrends of our era.

I'll tell you about the two greatest megatrends — and how to harness them in your favor — with my online video briefing this week.

For free and immediate registration, call 1-800-291-8545. (Or to read more about it, see my Saturday update .)

Good luck and God bless!

By Martin Weiss

This investment news is brought to you by Money and Markets . Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com .

Money and Markets Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.