Baby Boomer Demographics, Household Formation and the Hoax Economy

Economics / Demographics Jan 11, 2010 - 02:16 AM GMTBy: Mike_Shedlock

Following is a collection of Emails from a few key friends regarding household formation, baby boomer and millennials demographics, the labor participation rate, trends in unemployment, and debt deflation.

Following is a collection of Emails from a few key friends regarding household formation, baby boomer and millennials demographics, the labor participation rate, trends in unemployment, and debt deflation.

One of the emails is from Steve Keen, a noted economist.

The Emails were part of a discussion regarding Jobs Contract 24th Straight Month; Unemployment Rate Stays At 10.0%.

First a little background ...

According to the BLS, the civilian Labor force was 155 million in May, falling to 153 million in December, a labor force reduction of 2 million in a mere 7 months.

In a normal recovery, the labor force should be expanding by at 100,000 to 120,000 jobs a month, minimum. The total discrepancy is at least 2,700,000.

Moreover, one would expect to see some of the 2.5 million marginally attached workers attempt to re-enter the workplace. Marginally attached workers are those who want a job but have not looked in the last 4 weeks.

Are boomers suddenly dying in mass? If not, what is happening to the labor force?

Labor Force Status

From my friend "BC" in regards to Labor Force Status ...

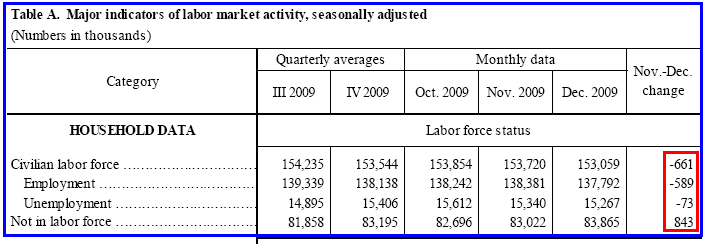

Table A

Those "Not in labor force" is growing at an annualized rate of 10% since Sept., and 12-13% annualized in Dec. Were it not for the decline in the labor force participation, the official U rate would be closer to 10.7-10.8%.

At the trend rate of labor force and population growth (and the unprecedented effect of Boomers permanently leaving the labor force involuntarily or otherwise), and given the depth of the contraction in employment to date, we will likely not see a period of sustained year-over-year growth of civilian employment until after '16-'17.

This secular period of little or no growth of employment, investment, real GDP, and government receipts will coincide with government elder transfer programs becoming 45-50% of government spending and experiencing continuing declines in payroll receipts at the same time outlays will grow at double-digit rates.

Assuming no overt fiscal insolvency, elder social transfers (Social Security, Supplemental Security Income, Medicare, Medicaid, etc.) will account for 1-1.25% of nominal GDP and increase on a rate of change basis inexorably between now and the late '10s to early to mid-'20s before a plateau from the late '20s to late '30s and early '40s.

The period of wealth consumption now underway will resemble from a demographic context the period '67 to '81-'86. However, this time around the Boomer cohort is much larger as a share of the population and persisted 35-40% longer on a peak basis than the "GI Generation" whose birth peak occurred in the early to mid-1920s; and the same applies to the Boomers vs. the peak "Millennials" (born '78 to '90-'93) who make up half the size of the population vs. Boomers.

The other obvious difference today is the massive debt overhang occurring concurrently with peak Boomer peak demographic drag effects AND Peak Oil.

There is no historical or demographic precedent in modern western history for what we face. One has to go all the way back to the Middle Ages to find anything remotely similar in terms of scale of combination of resource depletion, population constraints, risk of large-scale pandemics, and climate change.

Moreover, the level of economic, social, and political complexity (and cost) was a fraction of what we have today.Regarding The Labor Pool Contraction and Census Hiring

My friend "HB" commented ...

Clearly this is an example of how government is fudging the numbers. I just don't believe this massaging down of the labor pool is in any way credible.

In regards to census hiring, the whole idea that an economy can get 'jump-started' like a dead car battery is of course complete nonsense. Yet, it is widely believed.

Moreover, it could mislead a great many people into thinking that 'things are getting better', which could influence decision-making at various levels negatively.

Boomers and Millennials Effect on the Participation Rate

In response to Fudging The Labor Pool "BC" countered ...

If Boomers are leaving the full and part-time labor force voluntarily or otherwise at the historical percent of past cohorts going back to the early to mid-20th century, and Millennials' participation rate holds to the historical average, the labor force may grow no faster than ~0.3-0.4% hereafter, which would mean no more than 460,000-620,000 net job entrants per year.

However, there is the risk that people under 30 will continue to suffer disproportionately higher joblessness, as is the case at this stage in a secular depression.

If the unemployment rate for the cohort ages 16-19 and 20-24 persists at the average 15-16% to 29-30% today, the underutilized youth labor situation will mean that the decline in Boomers' participation in the labor force will approximate the percent of young workers entering the labor force and finding employment, suggesting that the labor force will not grow much for years, if at all.

Note that Japan's labor force has been shrinking for a decade.

Mish Replies: Think of the effect on household formation if people under 30 will continue to suffer disproportionately higher joblessness. How pray tell will student loans be paid back let alone anyone start buying homes?

We will not only have structurally high unemployment for a decade, but we will have structurally low household formation. More people in their early to mid-30's will be living at home, sharing homes or sharing apartments.

The impact on home prices and demand for goods to furnish those homes is surely not priced into any existing economic models on housing starts, home prices, or the stock market.

What Happens to GDP if the Economy Adds 150,000 Jobs a Month?

Regarding GDP and Taxes, "BC" commented ...

- Federal unemployment taxes are now down 10% yoy and 17-18% yoy for the fiscal YTD.

- Corporate income taxes have collapsed 94-95% yoy and down 15-16% yoy for the fiscal YTD.

- However, for the first time since the recession started, withholding income and employment taxes are up a modest ~3% yoy (against the easy comparisons) but still down 7-8% yoy fiscal YTD.

- Dec. '08 to Dec. '09, unemployment taxes were down 24-25% yoy and down 17-18% yoy fiscal YTD.

- Corporate income taxes were down 10-11% yoy and down 12-13% yoy fiscal YTD.

- Withholding taxes were down 7-8% yoy and 8-9% yoy fiscal YTD.

From the payroll trough of '02-'03, payroll growth averaged 150,000 to 180,000/month through '04 and '05-'06.

Were the US economy to somehow manage to create 150,000 payroll jobs/month over the next 12-24 months, the trend rate of real GDP yoy from Q3-Q4 '09 would likely not exceed 1.3-1.5%, which would mean real GDP will be no higher in '10-'11 than in late '07 to early '08.

Stock speculators have likely gotten it so very wrong.CPI Adjusted M3

On a slightly different note my friend "HB" commented on money supply...

John Williams notes that both nominal and real (CPI-adjusted) M3 are now declining year-on-year, and historically such declines have without exception either been followed by a recession or worsened an already in train downturn. This suggests that the economy is likely to do a '1931' in 2010. Note also, statistically the second year of a presidency is the worst year for the stock market overall.

Comments From My Blog

For good measure here are a few choice comments from my blog ...

2Banana: Massive state and local government layoff are coming as the Obama slush fund peters out. I have been amazed how states with massive deficits have yet to make any or significant layoffs. Tax revenue continues to shrink to local and states governments and this will not change.

Bam-Man: The ongoing rise in temporary workers (and declines in practically everything else except 'health care') bears an eerie similarity to what has been going in Japan for the past 20 years. Temporary/contract workers now make up over 30% of their labor force. It sure looks like we are following right in those footsteps.

James Cole: All this proves Mish is that we truly are now a "Hoax Economy" one big hoax. Nothing is real anymore. If it takes that many workers to count 300+ million Americans, then we have reached Soviet Union levels of efficiency here in the USA.

Jekyll Island: In Prechter's report this month: "this week's closing high brings the index to a 53% retracement of wave 1, which is nearly the same percentage as the 52.3% registered by the countertrend rally following the crash of 1929. The Dow fell 85% over the next 27 months." Like him or not, I think he's one figure you ignore at your own peril in today's environment.

Bileaf: When "fly-by-night" unaccredited "colleges" are advertising "a great medical career degree in just 12 months", you know a bubble has formed.

Mish: Indeed. There is a massive bubble in education classes but it will probably get bigger yet. These colleges (and the Obama administration) both perpetuate the idea that we can train laid off welders to become productive Java programmers, and laid off Java programmers into productive welders. Want to become a "chef"? The Art Institute of Chicago says it is easy. OK but who will hire you when you complete the course?

Consumer Credit Drops Record $17.5 Billion

Finally, in response to Consumer Credit Drops Record $17.5 Billion; Steepest Declines Since WWII Australian economist Steve Keen chimes in with ...

Yes, this is the main game Mish, as you and I have both been arguing for some time, you most recently in Fictional Reserve Lending And The Myth Of Excess Reserves.

A massively over-leveraged private sector is deleveraging, and the spending power this subtracts from the economy will at worst overwhelm, and at best neutralize, government attempts to "pump-prime".

This is especially so if the Powers-That-Be continue to believe in the empirically falsified "money multiplier" model of how money is created, and give the money directly to banks rather than debtors.

In current circumstances, this model is frankly impossible--because if money was created this way, then borrowers would have to be willing to take on an additional $9 trillion in debt for every $1 trillion pumped into the banks by The Fed. Instead, as the figures show, they're running a mile from debt now, and with good reason.

So the government's stimulus money will sit unlent in banks, whereas if it were given to the debtors, they at least would either spend it or repay their debts.

Thus Obama's current strategy, advised by Geithner, Summers and other neoclassically-trained economists, is ensuring that the government's rescue efforts get even less bang for the buck than they could get.Fed Spreadsheet Error

By the way, it is not precisely clear how much Consumer Credit really dropped. I received an email on Saturday from "Ivan" who caught an error in the Fed's G.19 spreadsheet.

Ivan writes:

Last night I commented on your "Consumer Credit Drops Record $17.5 Billion..." post, under the nickname Coyote on Rocket Skates. The subject of my comment was that I found a spreadsheet error in a sheet available at the Fed's download page for G.19.

The published data for June-November 09 repeats exactly the data for June-November 08, and appears to affect the gross total (non seasonally adjusted) numbers from which the headline (seasonally adjusted) numbers are derived.

Assuming that the data over a five-month period did not repeat itself exactly for five months, exactly one year later, one has to conclude that the Fed's auditing and reporting is sloppy, even on important releases. Conspiracy and manipulation are plausibly deniable, bad auditing, less-so.

Next, I sent an email to 'Tyler' over at Zero Hedge, and he soon posted an entry on the subject, here: http://www.zerohedge.com/article/blatant-data-error-federal-reserve

This morning, I availed myself to Ron Paul via email, in the hopes that this might add some straw to the camel's back about the Fed's audit procedures.Ivan

Regardless of how the consumer credit report is revised, a tip of the hat goes to Steve Keen, one of the few economists in the world who understands just how flawed the "money multiplier" theory is.

You can bookmark Steve Keen at Steve Keen's Debtwatch: Analysing the Global Debt Bubble.

Thanks to all for your Emails and comments.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.