In Defense of Stock Market Bears

Stock-Markets / Stocks Bear Market Jan 13, 2010 - 12:42 AM GMTBy: Graham_Summers

It’s difficult, darn difficult to be a bear right now.

It’s difficult, darn difficult to be a bear right now.

The whole world has begun acting as though the period from late 2007 to early 2009 never happened. For one thing, financial newsletter writers are currently MORE bullish than they’ve been since October 2007 (the absolute peak in stocks). Similarly, the American Association of Individual Investors survey shows only 23% of individual investors are bears, while 49% are bulls: an HIGHLY slanted view.

On top of this the VIX (a measure of investor sentiment) shows complacency at PRE-2008 levels. Again, it’s as though the Financial Crisis never happened. The markets have completely forgotten it. The whole AIG situation? Completely overblown. Fannie and Freddie nationalized? Not a problem. The big banks begging for handouts so they don’t all disappear? That was all based on a dare. They didn’t REALLY need the money.

The only problem with all of this is that this current stock market is neither healthy NOR normal. In fact, it’s like a market from another planet. Indeed, according to Robert McHugh, a famed technical analyst, 80% of the market gains occurring since March 2009 have come on just 30 Mondays. Put another way, you could have bought stocks on Friday afternoon, sold them on Monday at noon, and ignored the rest of the week and roughly mirrored the S&P 500’s blistering performance.

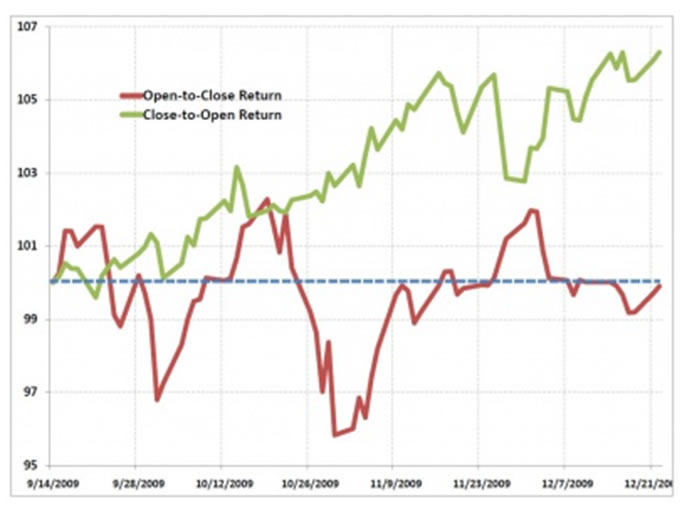

Tyler of Zero Hedge also points out that the market actually hasn’t produced a gain since September during the 9:30-4PM trading session. Instead ALL and I mean ALL of the gains produced between that time and year-end occurred during the overnight session in the futures markets:

Of course, neither of the above indicate a healthy bull market where investors in increasing numbers buy into the rally. Instead, they both reek of manipulation.

And yet investors are bullish, confident, AND complacent. Except for corporate insiders of course. They’re selling as much stock as they possibly can: $62 in sales for every $1 in purchases to be specific. By the way, this includes guys like Bill Gates and Warren Buffett.

I see all of this, and I cannot understand how people are bullish. Honestly, does no one else notice that the market explodes higher at the open and then does NOTHING for the rest of the day?

On a final note, I wish to point out stocks are currently only about 4% above the October ’09 highs. That is not a typo. I know the bulls like to act as though somehow the market has exploded into the stratosphere, but the reality is that even with this level of manipulation, the S&P 500 is only 4% higher than it was in October: that’s roughly a return of 1+% a month

Looking at all of this, I don’t see any reason to be insanely bullish right now. If anything I see huge red flags and multiple reasons to be cautious. Everyone and their mother are bullish right now. And stocks have only risen 4% in three months or so.

Something doesn’t add up.

Good Investing!

Graham Summers

PS. I’ve put together a FREE Special Report detailing THREE investments that will explode when stocks start to collapse again. I call it Financial Crisis “Round Two” Survival Kit. These investments will not only help to protect your portfolio from the coming carnage, they’ll can also show you enormous profits.

Swing by www.gainspainscapital.com/roundtwo.html to pick up a FREE copy today!

Graham Summers: Graham is Senior Market Strategist at OmniSans Research. He is co-editor of Gain, Pains, and Capital, OmniSans Research’s FREE daily e-letter covering the equity, commodity, currency, and real estate markets.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2010 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.