How to Avoid Getting Ripped off When Exchanging Your Holiday Foreign Currency Money

ConsumerWatch / UK Banking Jul 31, 2007 - 08:37 PM GMTBy: MoneyFacts

Lisa Taylor from Moneyfacts.co.uk – the money search engine investigates: “With the children’s summer holidays well underway and the UK weather showing little sign of improvement, many of us will be jetting off overseas in the next few weeks. With so many things to get ready, like shopping for your new bikini, sun tan cream and flip flops, no doubt these will all take preference to shopping for the best deal on your foreign money.

“This year travelers will find an abundance of commission free currency deals, with only a handful of branch and telephone services now charging an up front commission fee. This is great news, as travelers will avoid paying these fees, which previously ranged between two and three percent of the order. However this now makes the exchange rate the key factor in determining the best deal. It is something that is not easily searchable without trawling individual providers’ website's or, even more time-consuming, making phone calls or visits to the branch.

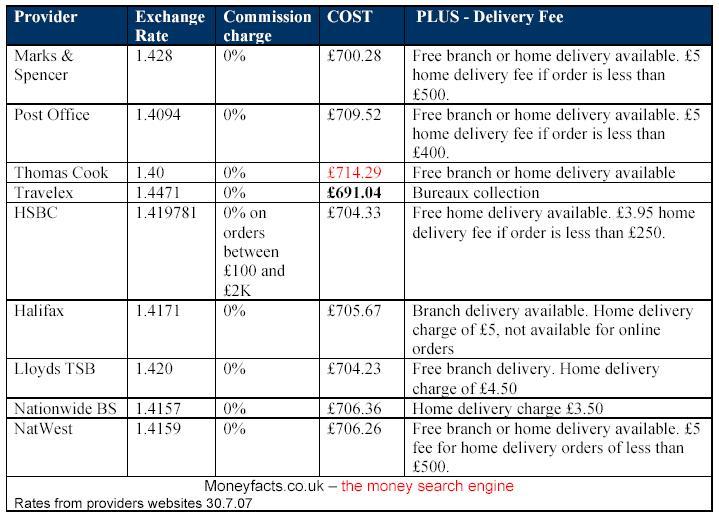

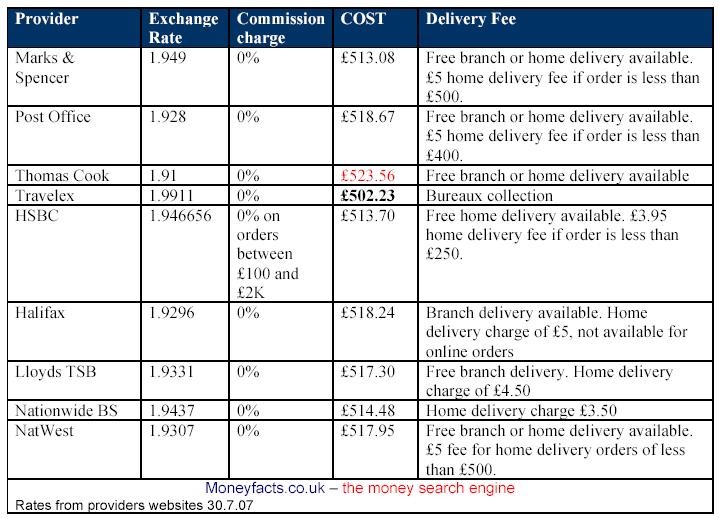

“Moneyfacts.co.uk latest travel money mystery shop takes a look at the online rates available at some of largest travel money providers. The tables illustrate the total sterling equivalent you would need to pay for either €1,000 or US $1,000.

“By choosing carefully from the providers listed below, savings of over £20 can be made. And of course the more money you take, the larger the saving can be.

“Moneyfacts.co.uk – top five tips to getting the best deal on your foreign money:

1. Look beyond your own bank or travel agent and take the time to shop around at least a few providers

2. Don’t leave it to the last minute: purchasing at the airport will normally include a premium for the convenience

3. Watch out for delivery charges – these can be as much as £5.50 in some cases

4. Many providers will still charge a commission fee for sterling travelers cheque's, which typically ranges between 1% and 1.5%. So check out the commission rates too.

5. If you pay with your credit card you will be charged a cash handling fee, which will more than wipe out any savings made by getting the best exchange rate

30.7.07

1000 EURO

1000 US DOLLARS

www.moneyfacts.co.uk - The Money Search Engine

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.