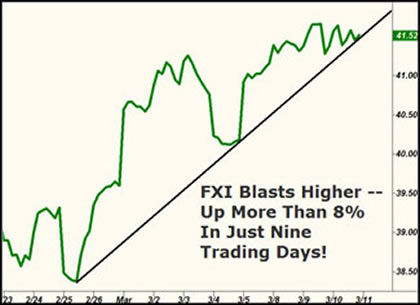

China FXI ETF Blasting Higher!

Stock-Markets / Chinese Stock Market Mar 17, 2010 - 03:44 PM GMTBy: Larry_Edelson

In just the last nine trading sessions, my favorite investment to capitalize on China’s blistering economic growth iShares FTSE/Xinhua China 25 ETF (FXI) — has soared more than eight full percentage points, thrusting through the $41 level.

In just the last nine trading sessions, my favorite investment to capitalize on China’s blistering economic growth iShares FTSE/Xinhua China 25 ETF (FXI) — has soared more than eight full percentage points, thrusting through the $41 level.

And in the past month, this China-focused ETF is up more than 13%!

|

So if you think China’s economy is another bubble in the making — as so many others seem to think — or if you believe that Beijing is deliberately going to slam on the brakes, think again.

A. China’s economy has enough built-in demand and potential to continue its near double-digit economic growth for years to come.

B. While Beijing will try to manage that growth, authorities in China will never do anything to squash it.

Take it from me. I visit China at least twice a year, with an open mind, and my list of contacts in tow.

And based on what I’ve seen recently, there’s no doubt in my mind that China’s economic growth is not only for real, but set to accelerate higher in 2010, and continue for the foreseeable future.

Let’s start by taking a detailed look at just some of the recent economic figures from China …

![]() China’s December imports hit a new all-time high of $112.9 billion, a 55.9% increase over December ‘08, and a whopping 18.8% increase over the month prior, November.

China’s December imports hit a new all-time high of $112.9 billion, a 55.9% increase over December ‘08, and a whopping 18.8% increase over the month prior, November.

![]() Crude oil imports recently soared to an all-time record high of 21.26 million metric tonnes, up an amazing 24.2% from November, and a whopping 47.9% year-over-year.

Crude oil imports recently soared to an all-time record high of 21.26 million metric tonnes, up an amazing 24.2% from November, and a whopping 47.9% year-over-year.

And last month, China imported 18.51 million tonnes of crude oil, fully 58% more than in the same month of last year.

![]() China’s iron imports soared more than 21% for November, and 80% year-over-year, while for all of 2009, imports of iron ore by China soared 42% to a record 628 million tonnes.

China’s iron imports soared more than 21% for November, and 80% year-over-year, while for all of 2009, imports of iron ore by China soared 42% to a record 628 million tonnes.

![]() Copper imports soared 27.3% in December, while scrap copper imports soared an amazing 46.7%.

Copper imports soared 27.3% in December, while scrap copper imports soared an amazing 46.7%.

More recently, in February, China’s exports exploded 46% higher … money supply growth surged an incredible 25.5% … retail sales soared 22.1% … and urban fixed-asset investment gained an amazing 26.6%!

Meanwhile, China’s gross domestic product (GDP) is expected to be at least 8.7% for all of 2010, a conservative figure, I think, based on the economy’s performance in just the last two months.

All told, China is now …

![]() The world’s largest exporter of manufactured goods, surpassing Germany. And it puts China on track …

The world’s largest exporter of manufactured goods, surpassing Germany. And it puts China on track …

![]() To surpass the size of Japan’s economy this year and become the world’s second largest economy!

To surpass the size of Japan’s economy this year and become the world’s second largest economy!

More importantly, and most surprising to most pundits who continually get China wrong, Chinese consumption is exploding higher.

|

| China is now the world’s largest exporter of manufactured goods. |

And it’s not just in the urban, eastern seaboard cities where China’s economic growth is cooking. It’s also in the rural countryside, where in 2009, consumption jumped an estimated 15.5% over 2008, outpacing full-year urban spending for the first time ever (versus full-year urban consumption of 15.2%).

It’s critical to understand the importance of the consumption figures in China. Because for years now, every pundit under the sun claimed that China is merely a savings nation.

Ergo, they’ve said over and over again, the Chinese are not big consumers, and therefore, China’s economy would never make it into the big leagues.

But the above figures prove the pundits dead wrong. Indeed, the proportion of China’s economy now driven by consumption increased dramatically in 2009 — to a full 51% of GDP, up from 48.6% in 2008, a giant single year gain by any measure.

Moreover, China’s share of global consumption is also dramatically increasing. Credit Suisse has forecast that Chinese consumption will explode more than 400% higher over the next 11 years, soaring from its current 5.2% of global consumption to 23.1%.

That will put China on track to easily surpass the U.S. as the largest consumer market in the world, spending almost $16 billion a year!

Is it any surprise then that China surged past the U.S. to become the world’s largest automobile market in 2009, with annual vehicle sales at 13.64 million units, up 46.15% over 2008? Hardly!

Or that China’s nationwide housing starts rose a staggering 194% year-over-year in November 2009? Or that new home prices jumped 9.1% in December compared to the same month last year?

Or that China’s new housing starts surged by 37.5% year-on-year in January-February, three times the rate of a year ago?

Again, hardly!

Five Reasons Why Chinese Consumption Is Exploding Higher

|

| China is on track to surpass the U.S. as the largest consumer market. |

First, two years ago, the authorities in Beijing saw the handwriting on the wall: If they didn’t bring economic growth to the rural areas of China, where more than 1 billion people reside, the economy would not continue to grow, and instead, there would be rising social unrest.

Therefore, they started pumping money into the rural areas. Into construction projects … schools … hospitals … a slew of infrastructure improvements … and on the supply side, tax breaks … new laws improving private property rights … and more.

The result: Rural incomes have soared, rising more than 6% in each of the last two years, and quickly gaining traction on urban income levels.

Second, Chinese banks, unlike those in the West, are doing everything they can to support growth by issuing 95.3% more loans in 2009 than in 2008. That’s almost $1.35 trillion in new loans.

And as noted previously, despite some slowing in bank lending, money supply growth in China surged 25.5% higher last month!

As a result, money supply growth in China is also on the fast track, with annual growth last year of nearly 28%. And the new money is, again, unlike the West, flowing into virtually every sector of the economy.

Third, fixed-asset investment is soaring, giving jobs to millions of people temporarily sidelined by the financial crisis. Indeed, China’s urban fixed-asset investments grew a whopping 31% year on year in 2009, the first time the figure has exceeded 30% since 2000.

Fourth, the manufacturing sector is also firing away on eight-cylinders. Thanks to massive government stimulus … record bank lending … and the industrious nature of the Chinese people, China’s manufacturing sector has improved for 10-straight months in a row, and is now nearly back to pre-crisis levels.

Fifth, Beijing is raking in the dough. In the West, especially the U.S., the private sector is largely broke, and so is the government. So no matter how much Washington throws at the economy, private consumption is falling sharply.

Not so in China.

As noted previously, private consumption is soaring. And one of the reasons has to do with Beijing. Because not only is Beijing putting more money into China’s economy than the West is putting into its own, in terms of the percentage of GDP, but psychologically important, Chinese consumers are not worried their government is going broke.

So Why All The Skepticism From Wall Street And The Media On China’s Blistering Economic Growth?

The answer is simple: They don’t understand the country, either because they don’t travel there and put their boots on the ground …

… or because they don’t pay attention to important details that make a huge difference on how other cultures not only conduct business, but also how they see the world.

My Suggestions:

Although pullbacks in China’s stock markets are inevitable, I see no reason to be anything but long-term bullish on China and would look to increase exposure to China’s economy and markets on any pullback.

Specifically, I like positions that offer broad-based exposure to China such as the iShares FTSE/Xinhua China 25 ETF (FXI) … and mutual funds such as the U.S. Global Investors China Region Fund (USCOX).

I also like exposure to some of China’s giants, like China National Offshore Oil Corp (CEO) … and Sinopec (SNP).

Best wishes,

Larry

P.S. For more detailed analysis of today’s global economy … the financial crisis … natural resources like gold and oil … booming economies like China … and for razor-sharp timing recommendations for your core portfolios …

I strongly recommend you consider a subscription to my Real Wealth Report. At a mere $99 per year, it’s one of the best bargains of all time.

This investment news is brought to you by Uncommon Wisdom. Uncommon Wisdom is a free daily investment newsletter from Weiss Research analysts offering the latest investing news and financial insights for the stock market, precious metals, natural resources, Asian and South American markets. From time to time, the authors of Uncommon Wisdom also cover other topics they feel can contribute to making you healthy, wealthy and wise. To view archives or subscribe, visit http://www.uncommonwisdomdaily.com.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.