Gold & Stock Market Indexes Melt Up Into Earnings?

Commodities / Gold and Silver 2010 Apr 01, 2010 - 03:17 AM GMTBy: Chris_Vermeulen

Gold and the stock market continue to trade within a tight range this week. While the long term trend for both stocks and metals are up, and the charts look bullish I am not buying at this level because the market is over bought.

Gold and the stock market continue to trade within a tight range this week. While the long term trend for both stocks and metals are up, and the charts look bullish I am not buying at this level because the market is over bought.

Chasing prices higher especially after a run this large is not the right move in my opinion. I did mention last week that we could see stocks continue to grind higher going into earning season which is about 2 weeks away still. I think that could happen, and if the same thing happens which we saw last January with great earnings (which I think we will see again) then watch out for another drop.

In short, if earning are good which they have been and everyone is expecting the same this April, then the typical Buy on Rumor (pre-earnings rally) which is what we have now, and Sell on the Good News in April then all the suckers thinking the market should rally will provide some liquidity for the smart money to sell at a premium.

That being said, if the earning are not good, then people will sell on that news also because the market is just waiting for news to sell… It’s the exact same situation as last time, that’s how I am feeling about it.

Trading Bottoms in the Broad Market

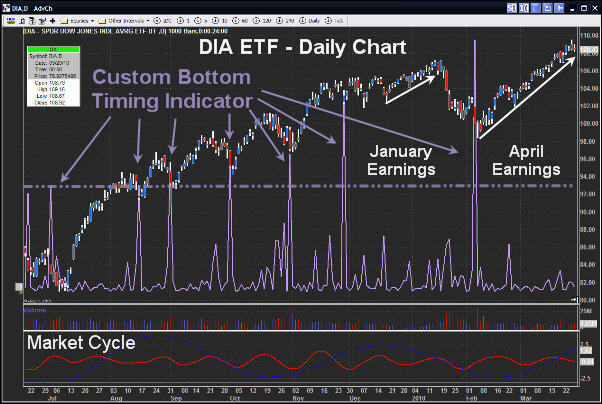

The past few months I have been really focusing on buying dips in the broad market after I see a mini 3 wave correction. I use a mix between price patterns, volume, market sentiment, and market internals and of course years of watching how the market moves and evolves during times of economic expansion and contractions. This is represented on the chart below as the purple line.

This chart below shows one of my custom indicators which have successfully timed intermediate market bottoms 1-2 days before everything started to rally higher. This is one of the reasons we bought into the selling on Feb 5th and again on Feb 25th using ETF’s.

Because this is a new etf trading strategy and type of trading signal to be used in a bull market I still have to fin tune it a little more because I want to be sure we don’t get shaken out of positions to early which is what happened to a couple ETF’s we got into Feb 5th.

What happened was were buying when EVERYONE was bearish and panicking out of positions making it an extremely emotional time for traders and myself to buy into the market. This is not an easy task… I still have trouble pulling the trigger on these days and some times I just sit back in my chair and with one quick poke from my finger I hit the enter button to buy. My heart pounding just from that… but add few thousand followers on the pile relying on quality analysis and you start to understand what im going though. Not to mention the hundreds of emails with people telling me the market is about to crash, we should be shorting etc…

Crazy times for sure

Anyways, I will be provided these new signals for subscribers which is very exciting. Because my focus is on managing risk and keeping it as low as possible this will be a learning curve as I apply it to the service and set protective stops which is very difficult to do during a time of high volatility in the market. We can see the market move 2-4% in one day during these times so if we are trading the TNA 3x leveraged Russell2000 fund we could see our position drop 12% in one day. Bigger risk, bigger rewards as they say.

GLD Gold ETF – Daily Chart

Gold and silver are currently trading in limbo at the moment. It’s tough to say what’s going to happen here which is why I continue to wait for something with a high probability of winning before putting any money to work.

The daily chart clearly shows a multi month bull flag, ABC retrace, Reverse Head & Shoulders, and wedge. All of which are very bullish. It’s just a waiting game as I do not jump the gun on any move because the market has the tendency to catch everyone off guard and I don’t want to be one of them. Been there, done that to many times….

Mid-Week ETF Trading Signals Conclusion:

Keeping things short and simple, I think the stock market is in a major bull market. I am not buying anything until we get a pullback of some type. If the market unfolds properly we could have a great shorting opportunity (profit from a falling market) happening any day now, so that is my main focus at this time.

If you would like to receive my free weekly trading reports please visit at: TheGoldAndOilGuy

Hello, I'm Chris Vermeulen founder of TheGoldAndOilGuy and NOW is YOUR Opportunity to start trading GOLD, SILVER & OIL for BIG PROFITS. Let me help you get started.

To Your Financial Success,

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.