Economic Recovery Follows Stealth Stocks Bull Market, BlogosFear Cry's Manipulated Markets

News_Letter / Financial Markets 2010 Apr 11, 2010 - 01:05 PM GMTBy: NewsLetter

The Market Oracle Newsletter

The Market Oracle Newsletter

April 4th, 2010 Issue #20 Vol. 4

Economic Recovery Follows Stealth Stocks Bull Market, BlogosFear Cry's Manipulated MarketsDear Reader The economic recovery continues to manifest itself in the real world as this week both UK GDP was revised higher to 0.4% for Q4 2009 and Fridays U.S. Jobs reported 162k of new Jobs added to the economy, the economic recovery has long since been led by the stocks stealth bull market that has risen by more than 70% since the March 2009 low. Even this positive economic data is NOT convincing the blogosFear and Perma-crowd that there is in actual fact an economic recovery underway, instead the reasoning is that the markets and economic data are manipulated into an illusion of recovery, this to me sounds like wishful thinking in wanting stocks to revisit the March lows because they missed the boat. However this ship sailed over a year ago and isn't returning to pick up new passengers at Dow 6,470! There is no point crying market manipulation because, YES the markets ARE manipulated! This is something that has been apparent to me from very early in my trading career, in fact the day after the 1987 crash (19 Oct 2007 - How a Newbie Beat the Great Crash!), so probably also for many, many decades before then. So what ? In fact it makes it easier to arrive at firm conclusions such as that March 2009 was the TIME to buy BECAUSE the markets ARE manipulated, it IS because the SMART money (the dark pools of capital) which is doing the manipulations, however they CANNOT hide their manipulation from the price charts which is why one can rely on experience and on going analysis to GUESS as to why markets will enter into a bull market, but the reasons only become obvious AFTER the market has risen by more than 50%, as I warned off in Mid March 2009 - (15 Mar 2009 - Stealth Bull Market Follows Stocks Bear Market Bottom at Dow 6,470). Q. How can you be bullish on stocks and bearish on the Economy. A. The markets move ahead of the economy, whilst I don't profess to know the EXACT reasons of why they will move AHEAD until that becomes apparent AFTER the market has already moved, however I do have some reasoning in that INFLATION, Zero Interest Rates (Forcing savers / financial institutions to take risks) Quantitative Easing (money printing), and HUGE Fiscal stimulus packages that are laying all of the ground work for the next bubble regardless of how bad things appear as any outcome that prevents another Great Depression will be seen as bullish! i.e. even a low growth high inflation stagflationary environment WILL be seen as a positive outcome against the present day data that points to a collapse of global demand on a scale not seen since the Great Depression. The governments HAVE learned the lessons from the Great Depression and WILL succeed in inflating the asset prices and ignite the next perhaps even bigger bubble, meanwhile the stealth bull market will continue which by the time everyone realizes what's going on stocks will already by up by perhaps more than 50% from the low. I see much of the above recently being mentioned by many BlogosFear sites such as ZeroHedge after the markets have risen, though tainted with conclusions that it is unsustainable, however missing the whole point that the rally in asset prices is in actual fact the TRIGGER for the economic recovery as the above indicates. So dear reader, Yes, not just the markets, but EVERYTHING that involves human activity is MANIPULATED, EVERYTHING, that is how we have grown to number 7 billion manipulators across the globe, it is imprinted in our genes to manipulate our environment either as individuals or groups, countries, continents and even the sum of the whole through mechanisms that humans have put into place. Where humans are concerned there is no natural order, natures law, we have long since left environmental pressures that impact on other Earth creatures long since behind and live in a bubble of human created reality. Realise this and you will stop worrying about the obvious such as why Gold prices are not already at $5,000, because there is a greater weight of human manipulation depressing Gold prices than that countered by gold bugs wanting to manipulate gold prices higher through their own propaganda and buying pressure. We take mainstream press, media and politicians manipulating public opinion as a done deal, but market manipulation is still vague and the most are blind to the recent development of the manipulation from the internet BlogosFear, it is not good nor bad, it is human nature. Rather than perpetually cry market manipulation, the only thing one can do is to try and ride the coat tails of the manipulated mega-trends. Back to the economy, My in depth analysis in the Inflation Mega-Trend ebook concluded towards above trend growth for 2010 as a strong economic recovery manifests itself with a series of surprises coming to the upside. The secret to successful investing is to arrive at FIRM CERTAIN conclusions and then put your own money on it, if your right keep adding, if your wrong the market will throw you out of your positions. None of this bear market rally nonsense where a trader is perpetually looking to sell on EVERY correction that MUST be the END of the rally, when in fact investors should be focused on only being wrong ONCE! I.e. when the trend ends you want to give up some of your gains as the market throws you out of your positions as stops are hit... more on this in a future ebook, perhaps titled How to Trade Manipulated Markets ? Stock Market - The Dow closed up on the week at 10,927, the trend over the past month has been characterised by two factors, 1. NO technical sell signals, and 2. A steady as she goes rally that is not pushing the market into a technically overbought state. According to the my last in depth analysis (23 Mar 2010 - Stocks Stealth Bull Market Trend Forecast Into May 2010 ) we have by now entered into the time window for a short-term correction that targets a correction from about Dow 11k to Dow 10,650, ahead of trend continuation higher into Mid May that targets Dow 12k. Short-term Trading- The short-term trend STILL remains UP, Last Close 10,927, BUY Trigger 10,957 Targets 11k resistance, nearest SELL Signal is at Dow 10830, that targets 10,550. Fridays Positive Jobs report implies that the Buy trigger looks set to be taken out Monday therefore targeting Dow 11k as most probable early week trend. GOLD - I have received a few emails to update my Gold analysis for 2010 - Ebook / Feb 2010 article (Gold Analysis and Price Trend Forecast For 2010) 1. That the current correction is targeting $1050 to be achieved during February 2010 2. That Gold is targeting an Impulse Wave 5 into late 2010 peak of at least $1333 which remains as per the original forecast of 1st November 2009. Nothing has changed as the inflation mega-trend continues to manifest itself as commodities such as Gold continue to work their way out of the Feb correction bases, i.e. Gold $1050 floor with subsequent strong support area between $1,075 and $1,100 holding the most recent correction. Gold continues to target $1,333+ this year. Your bottom line trend investing and trigger trading analyst. Source: http://www.marketoracle.co.uk/Article18392.html By Nadeem Walayat Copyright © 2005-10 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved Featured Analysis of the Week

Most Popular Financial Markets Analysis of the Week :

By: Andrew_G_Marshall The western nations of the world have built their great wealth and societies on the exploitation and plundering of the people and resources of the rest of the world. The wealth, freedom, and structures of our societies have been built on the starvation, robbery, deprivation and murder of millions upon millions of the world’s people, both historically and presently.

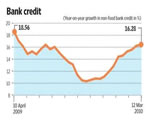

By: Gary_Dorsch “I guess, I should warn you. If I turn out to be particularly clear, you’ve probably mis-understood what I’ve said,” former Federal Reserve chief Alan Greenspan was fond of saying, when he controlled the Fed’s money spigots. For many Fed watchers, it was a great relief when “Easy” Al finally retired from the Fed, since there is nothing more vexing - than correctly interpreting Green-speak.

By: Steve_Betts You’ll notice that Bush never spoke when Cheney was drinking water; check it out!" Robin Williams We are seeing some interesting developments in the markets so I want to jump right into it and save all the social and political commentary for the end. I would first like to focus on the US dollar since it is the hot topic of conversation in the media, and its price movement is subject to a lot of misinterpretation. The general line of thinking espouses a new bull market for the greenback given the fact that the US economy is on the mend.

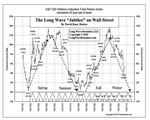

By: David_Knox_Barker A Special Update for Market Oracle Readers The long wave debate rages on. Meanwhile, the global debt berg, the chief product of crony state capitalism, has begun to block the profligate paths of listing ships of state. The confident captains of crony state capitalism are at the helm, sailing into the foggy financial abyss of cascading sovereign debt defaults. The growing black hole of sovereign debt threatens to pull the global economy into its collapsing vortex, the quintessential black swan event. Coming out the other side of the black hole of collapsing debt beyond 2012, we suspect the world will be a very different place. A new golden age will dawn.

By: Douglas_V._Gnazzo The big news this week was the rise in interest rates, especially on the long end of the yield curve: 10 year yields were up 16 basis points to 3.85%; and 30 year rates added 17 basis points to 4.75% (see charts in the bond section). What’s behind this sudden move?

By: Nadeem_Walayat All countries are on the path towards bankruptcy, to measure where a country stands along this path it is critical to look beyond official statistics that focus primarily on public sector net debt and the annual budget deficit in terms of % of GDP.

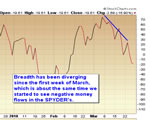

By: Jim_Willie_CB I’m going to start off with a few breadth charts. The NYSE new highs – new lows chart is now on a sell signal as both the slow and fast average have rolled over and are accelerating downward.

By: INO Gold has had some dramatic moves in the last eighteen months and we expect it will have some equally dramatic moves in the future, but not right now. While I recognize that gold is one of the few commodity markets that people are really passionate about; the purpose of this article is not to take sides either with the gold bugs or those who reject the argument that gold is forever. Rather, I want to discuss my interpretation of the markets cycle.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone [FORWARD] To update your preferences [PREFERENCES] How to Unsubscribe - [UNSUBSCRIBE]

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.