UPDATE: America’s Second Great Depression (Part 1)

Economics / Great Depression II Apr 28, 2010 - 08:37 AM GMTBy: Mike_Stathis

Overview - Washington, Wall Street and their partners in crime, the media, have continued to spread the myths of an economic recovery since late summer 2009.

Overview - Washington, Wall Street and their partners in crime, the media, have continued to spread the myths of an economic recovery since late summer 2009.

In response to the propaganda, the stock market has continued to rally. But most individual investors have been left out of this tremendous rally.

But that was NOT the case for subscribers of the AVAIA newsletter, as can be seen here (examine the market forecasting section; ever since my public recommendation to buy into the Dow at 6500, I have kept subscribers in the market since then for about 90-95% of the gains since then).

Yet, the economic data paints a different picture than the media presents. Make no mistake, we are seeing the early stages of what will written in history books as America’s Second Great Depression, just as I predicted in America’s Financial Apocalypse (2006).

Who are you going to trust? The media and their government hacks who have been wrong over and over, or someone who has been right about virtually everything over the past five years?

Who are you going to trust, people with clear political and financial agendas, or someone with neither?

Ever since the implosion of the largest real estate and credit bubble in history, I have published numerous unfortunate realities.

Since then, I have not altered these views.

With the national debt approaching $13 trillion, no real improvements to the worst and longest recession since the Great Depression, blue chips slashing dividends for the first time in history (eg. DOW), century-old financial institutions now in bankruptcy (Lehman Brothers, Bear Stearns, Washington Mutual), trillions of dollars in bailouts, the largest year-over-year decline in GDP, state tax revenues and housing starts since the Great Depression, over 7 million foreclosures, an additional 7 million more foreclosures over the next 2 to 4 years, more than 8 million lost jobs with about 32 million Americans out of work, more than 40 million Americans on food stamps, a healthcare crisis that has not been addressed, a continuing trend of excessive inflation for food, energy and healthcare, and consumer spending coming to a halt…you can be assured of many things over the next several years:

- Several more stimulus packages (which won’t offer any permanent assistance)

- Soaring consumer loan defaults

- Soaring commercial real estate defaults

- Several million additional foreclosures

- Rapidly rising and high interest rates

- Muted real wage growth

- Declining job quality

- Lingering high unemployment for several years

- Significant downside in the U.S. stock market

- Continuation of employee benefit cuts

- Continuation of healthcare inflation with millions more medical bankruptcies

- A deepening of the entitlement crisis

- Excessive inflation over an extended period OR massive inflation that will be countered by double-digit interest rates

- A long period of muted consumer spending

- Much higher taxes (not just income, but all taxes)

- A worsening of America’s Second Great Depression, with up to two lost decades.

- World War III

At best, the U.S. will continue to experience economic malaise for well over a decade. As the nation progresses through this treacherous period, any of the small improvements will be offset by longer-term issues that are virtually impossible to overcome.

- Most of the 80 million baby boomers will never be able to fully retire. They did not have adequate retirement savings even before the economic collapse. Now they are in much worse shape. As a result, they will not only pull out of the stock market much faster as a means to survive, but they will be dead consumers.

- Most states will continue to struggle with budget gaps for many years. This will lead to even more cuts to vital programs.

- The entitlement tsunami will engulf Washington’s budget, causing a sustained period of massive deficits. This will be addressed by further cuts to benefits and premium hikes to Medicare and Medicaid.

- The massive national debt will continue to threat the solvency of the U.S. This will lead to a long period of high interest rates even after the approaching interest rate surge, expected to mount within a couple of years.

A Broad Look at the Economy

Now let’s examine some facts about the economy.

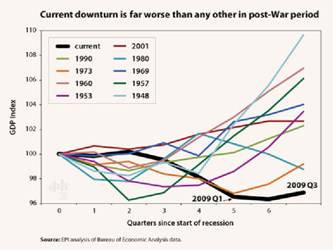

The current recession is not only the most severe since the post-war period, but is or was (according to official statements that it has ended) the longest in duration, as illustrated by the first chart.

Furthermore, the “previous” recession (which is still in progress although Washington claims it is over) registered the worst year-over-year decline in GDP in decades.

At the close of January 2010, Washington reported GDP growth of 5.7% (revised down from 5.9%) for Q4 2009. This represents the biggest increase since 2003, which coincided with the market bottom of the previous recession.

This data is unreliable and has been inflated by debt spending. I have discussed the problems with GDP previously.

But where is the economic growth?

There is none.

Real Estate

Surely by now, real estate has started to pick up, right? Have a look at housing starts.

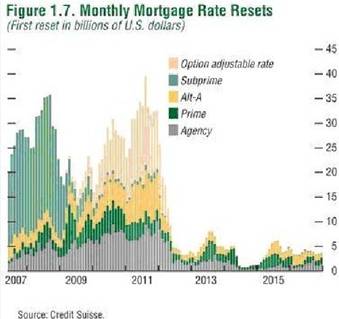

Now have a look at the mortgage resets. As you can see, the mortgage reset avalanche is gaining steam and will peak in early fall of 2011. This is going to flood the market with millions of additional homes as I have discussed on numerous occasions.

While I had forecast a bottom in median residential real estate prices in 2009 (the price decline which was consistent with my original estimate of a 30% to 35% decline first made in America’s Financial Apocalypse), this by no means a recovery in the real estate market.

For a variety of reasons, the climb back up to the previous highs reached in 2006 will take at least another ten years, as stated previously. See here.

Keep in mind that as interest rates rise, this will mute a good portion of any gains in real estate price appreciation.

Furthermore, as more foreclosures hit the market, prices will plunge, erasing any gains made.

In fact, the only places where the real estate market is doing well are the same places that didn’t get stuck holding Wall Street’s toxic assets; namely China, (although it did suffer some losses, especially from Citigroup) Hong Kong, Brazil, Australia and Canada.

As a reflection of the skepticism of the GDP data, the market sold off hard. Over a short period, the Dow approached a critical support at 9900 in early February.

Even Wall Street cheerleaders and economic hacks are admitting these latest numbers are not sustainable. They realize that they can no longer continue to spread the myth of a recovery while unemployment remains high, with no signs of trailing off for many years.

Since then, the Dow has staged an impressive rally as the propagandists worked overtime to keep the sinking ship afloat.

With the Dow now over 11,000, the “establishment” is still in control of the game. While there is likely to be a bit more upside in the market for 2010, investors should be looking for position exits rather than entries.

I do not have a crystal ball, but I do know a few things for certain. Even if the market holds current levels or even rises further (which appears to be likely), once interest rates begin to rise, the market will get hit hard. As you can imagine, this has adverse implications for the bond market exclusive of any further issues.

Why do I say this?

Because rates must rise by a large amount over the next few years, if not before.

Of course there are many other things that could send the market plummeting. Rising interest rates is just one example that we know will surface for sure. How much the market declines will depend on when and by how much rates are raised.

Another thing you should bank on is that the Federal Reserve will do all that it can to mitigate the downward market momentum as a result of interest rate hikes.

Why? Because, unlike the case with the European Central Bank which is focused on preventing inflation, the Federal Reserve’s priority remains with Wall Street. But as we have seen, what’s good for Wall Street is usually bad for Main Street.

Employment Data

The latest unemployment numbers came in at 9.7% (U-3). However, as I have discussed previously, this number really does not tell the full story. There are many assumptions that serve to boost U-3 data, such as the birth/death adjustment.

It is likely that if current unemployment data was properly adjusted for this highly inaccurate assumption alone, the real U-3 would stand at over 10.3%. But of course there are many other erroneous assumptions and deletions that make this data unreliable.

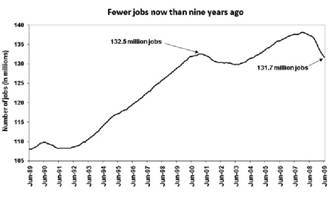

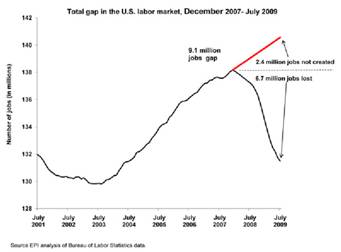

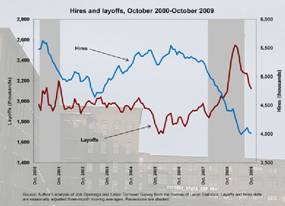

Layoffs peaked during Q1 of 2009, averaging 2.5 million in each of the three months, or 119,000 each business day! Think about that number for a minute.

Does that sound to you like a recovery is in place?

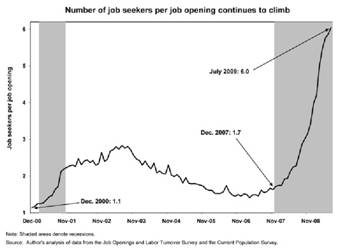

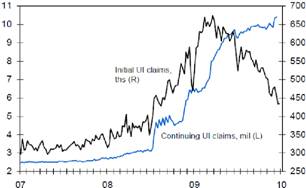

What makes the employment data even worse is the fact that new hires have continued to decline since reaching a peak in late 2006. What that means is that the total number of unemployed has continued to increase, as the following charts illustrate.

In December 2007, there were 5.1 million new hires. In October 2009, there were only 4.0 million new hires, representing a decrease of 22%.

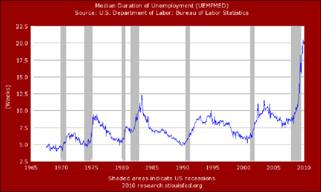

What this data does not reveal is the duration of unemployed workers. As the next chart shows, this number has skyrocketed well beyond previous highs since the inception of recorded data in the late 1960s.

Layoffs slowing but No Hiring

Furthermore, it is much more important to consider the U-6 data. This number accounts for marginally employed (workers who are working part-time but want full-time work) and discouraged workers. While official U-6 data is also understated due to erroneous assumptions, it still provides a better indicator of the employment situation.

You should note that neither of these unemployment metrics factor in the number of work hours per week. As I have stated, employers typically reduce work hours during recessions.

Accordingly to government data, the number of unemployed Americans stands at around 16 million, with the U-6 population of unemployed and underemployed at nearly 26 million. My own estimates for U-3 and U-6 are 18 million and 32 million respectively.

Now let’s have a closer look at the most recent employment data. The following tables show the percentage unemployed for each duration. The first table shows the percentage of unemployed for 15 weeks or more.

As the first table shows, 60.5% of unemployed Americans have been out of work for 4 months or longer.

The next table shows the percentage of unemployed who have been jobless for 4 to 6 months. As you can see, it’s 16.4%. So now, after looking at the first table and the second table, it’s easy to see what’s going on. More people are remaining unemployed for longer periods.

The final table reveals that 44.1% of unemployed have been jobless for 6 months for longer. Notably, there was a huge jump from February to March.

The next chart illustrates this worrisome trend of duration of unemployment.

The problem with being out of work for an extended period (besides the immediate financial problems it creates), is that the longer one remains out of work, the higher chance that they will have to change careers.

And it’s not likely that a career-change will lead to the same wages as the person earned in their previous career since they are starting fresh. That’s the big problem with the unemployment picture that no one seems to get. What does this mean? It simply adds more fuel to America’s long period of declining living standards.

In addition, because much of the stimulus will not be dispersed for a few years, and due to the continued trade deficit, as well as the mounting liabilities for entitlements and interest on the national debt, massive annual deficits will persist throughout the next decade. My own estimates are considerably larger.

GDP and Employment

Next, let’s have a look at the connection between employment and GDP.

In order to get the unemployment rate down by just 1%, GDP would have to grow by at least 5% by 2010. This goal is going to be virtually impossible short of a miracle, even with the massive spending by Washington.

I’ll give you some assistance here. In the BEST of scenarios, based on current spending projections, I would estimate that over the next ten years, GDP will grow by an average of 3.5%. A more realistic number might be closer to 3.0%.

Even assuming the more optimistic GDP estimate for a 5-year period, the U.S. economy would need to grow by about 5% annually for the remaining 5 years in order to bring unemployment down to around the “fully employed” level of around 5.0%.

I can tell you now this scenario is EXTREMELY unlikely, UNLESS we see many additional stimulus packages.

Using debt for additional stimulus packages will be like trading hand grenades for ballistic missiles because more debt spending will hamper the long-term growth of the economy for an extended duration.

GDP growth really doesn’t matter unless you adjust for debt-spending. The U.S. could grow by 5% for five years if Washington borrowed tens of trillions of dollars to pump into the economy. What is needed is real growth, not debt-fueled growth. Without real growth, you have an illusion, just like the growth after the dotcom bubble burst.

Even without further spending, the nation’s entitlements threaten to send America into bankruptcy within the next 20 years. This is another issue I addressed in America’s Financial Apocalypse at great length, unlike other books that only focused on the small picture.

As you can imagine by now, what this means is a lost decade at best. Fifteen years more likely, while two decades is very possible.

Previously, I discussed the fact that there would be no real recovery for most Americans.

You should also note that about 65% of the 5.7% GDP growth was from industrial production; not to meet consumer demand, but to rebuild inventories.

So the next leg is for consumers to deplete inventories so that production will continue. This isn’t going to happen. You should expect to see Q1 2010 GDP data much lower and I expect even worse data for Q2 2010.

This article continues here.

Those who read America's Financial Apocalypse (2006) and Cashing in on the Real Estate Bubble (2007) were not only alerted to the catastrophe we see today, but were provided with SPECIFIC ways to profit that have yielded over 100% gains since then. Click here for some examples.

If you want access to institutional-level research, analysis and investment guidance, subscribe to the AVA Investment Analytics newsletter today. www.avaresearch.com

By Mike Stathis

www.avaresearch.com

Copyright © 2009. All Rights Reserved. Mike Stathis.

Mike Stathis is the Managing Principal of Apex Venture Advisors , a business and investment intelligence firm serving the needs of venture firms, corporations and hedge funds on a variety of projects. Mike's work in the private markets includes valuation analysis, deal structuring, and business strategy. In the public markets he has assisted hedge funds with investment strategy, valuation analysis, market forecasting, risk management, and distressed securities analysis. Prior to Apex Advisors, Mike worked at UBS and Bear Stearns, focusing on asset management and merchant banking.

The accuracy of his predictions and insights detailed in the 2006 release of America's Financial Apocalypse and Cashing in on the Real Estate Bubble have positioned him as one of America's most insightful and creative financial minds. These books serve as proof that he remains well ahead of the curve, as he continues to position his clients with a unique competitive advantage. His first book, The Startup Company Bible for Entrepreneurs has become required reading for high-tech entrepreneurs, and is used in several business schools as a required text for completion of the MBA program.

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher. These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Requests to the Publisher for permission or further information should be sent to info@apexva.com

Books Published

"America's Financial Apocalypse" (Condensed Version) http://www.amazon.com/...

"Cashing in on the Real Estate Bubble" http://www.amazon.com/...

"The Startup Company Bible for Entrepreneurs" http://www.amazon.com...

Disclaimer: All investment commentaries and recommendations herein have been presented for educational purposes, are generic and not meant to serve as individual investment advice, and should not be taken as such. Readers should consult their registered financial representative to determine the suitability of all investment strategies discussed. Without a consideration of each investor's financial profile. The investment strategies herein do not apply to 401(k), IRA or any other tax-deferred retirement accounts due to the limitations of these investment vehicles.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.