Inflation Beating Savings: Gimmick or a Good Deal?

Commodities / Savings Accounts Aug 24, 2007 - 09:13 AM GMTBy: MoneyFacts

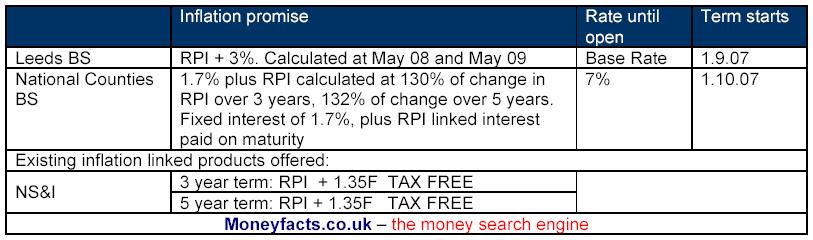

Rachel Thrussell, Head of Savings at Moneyfacts.co.uk – the money search engine, investigates:“A new breed of savings accounts has emerged over the last month with Leeds BS and National Counties offering products that promise to beat inflation. But how do they fare in the current market? Are they a good deal or just a gimmick?

“Savers may be fooled into thinking these inflation beating accounts offer something special over and above a standard savings account, but if inflation remains under tight control (within 1% either way of the official 2% target), a best buy fixed deal could offer an equal or better return in the longer term.

“Assuming RPI remains at its current level of 3.8%, the Leeds Bond would offer a rate of 6.8% gross. The National Counties Bond with a fixed return of 1.7% plus a bonus of 4.94% / 5.02% offers 6.64% or 6.72% depending on the term chosen. With best buy rates currently for fixed rate savings currently at 6.70%, the rates on standard savings accounts are currently in line with the inflation beating deals. As it is unlikely that inflation will be allowed to rise too much further in the short term without interest rates increasing, savers have a choice. With very little difference between these deals at the moment, the choice really comes down to whether the saver believes inflation will fall or rise over the term of the deal.

“Savers looking to protect against inflation should also consider NS&I bonds, which offer a lower margin but have the benefit of being tax free.

“You must look to protect your savings against inflationary pressures, but to do this you don’t have to limit yourself to inflation linked accounts. These accounts often have complex rate calculations, which can make it difficult for the saver to assess how their rate may change over time.

“Savers should look to secure a gross rate of at least 4.75% if their net return is at least to match the current RPI figure, and with rates in excess of 6% easily found in either variable or fixed rate savings, this can be easily achieved.

“Choosing an inflation linked account means that your return will be at the mercy of the economy, and regulated by a third party – the Bank of England’s Monetary Policy Committee. So with many more influences at play the future of your return is far from certain. What is a certainty is that more choice and product innovation is good news for savers.

It is also worth bearing in mind that if inflation starts to increase, monetary policy is likely to force base rate to rise, and the whole savings market will naturally move upwards. Fixed, inflation linked, or variable – which is the best deal will depend on your preferences and future expectations, and getting the best return will always be a bit of a gamble.”

www.moneyfacts.co.uk - The Money Search Engine

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.