Gold and Commodities Technical Charts Analysis

Commodities / Commodities Trading Jun 14, 2010 - 02:20 PM GMTBy: Steve_Betts

"Throughout history, it has been the inaction of those who could have acted; the indifference of those who should have known better; the silence of the voice of justice when it mattered most; that has made it possible for evil to triumph"- Haile Selassie

"Throughout history, it has been the inaction of those who could have acted; the indifference of those who should have known better; the silence of the voice of justice when it mattered most; that has made it possible for evil to triumph"- Haile Selassie

There are some things that only a politician could dream up. The State of New York, in its infinite wisdom, needed to make a US $6 billion payment to their employee’s pension fund. Since the State doesn’t have the money, and no one is willing to buy their debt, lawmakers voted to allow the State and municipalities to borrow US $6 billion from the same pension fund in order to pay their obligations! If you wanted to have budget cuts, simply withhold all the wages for the politicians until they come up with a real solution!

Meanwhile the State of Illinois has tried to avoid making the tough decisions with respect to budget cuts so Fitch downgraded their credit rating on Friday. Illinois had US $6 billion in unpaid bills and another US $7 billion coming due on July 1st. In an effort to put a band-aid on the hemorrhage, Obama is trying to convince Congress to approve a US $50 billion package designed to help states and cities. Finally, this morning it was announced that Freddie Mac and Fannie Mae will more than likely require US $1 trillion to clean up their mess. The bailout has clearly failed so the administration is like a junkie in denial, always asking for just one more fix.

Now I want to debunk a couple of myths. I continue to hear about the bull market in commodities and analyst after analyst comes out with recommendations to buy oil, cotton, or whatever the flavor of the day is. Yet I see a number of commodities that have made new lows for the year over the last month and here are some examples:

DATE COMMODITY PRICE

June 11 Lumber 204.00

June 07 Copper 2.72

May 10 Sugar 13.00

June 07 Cotton 75.80

May 25 Oil 67.15

June 9 Wheat 425.40

June 7 Corn 335.40

May 17 Oats 188.20

It’s hard to imagine the economy taking off with oil, copper and lumber making new lows for the year! As an investor I participated heavily in the run-up in commodities prices that ran from 2002 to mid-2008 so I know what a bull market looks like. From the July 2008 top we saw a sharp decline in commodities prices as the CRB declined from 615 to 322 just six months later. Like the Dow we saw a recovery of 62% and since then the CRB has traded sideways to lower. Now it appears that the trend down seems to be accelerating of late as you can see below:

Finally, I have been watching the deterioration of the Baltic Dry Index (not shown) over the last month and it seems to be gaining speed as it has fallen from 4,200 to just above 3,100, in just over a month. Last night the BDI closed below its 200-dma triggering a sell signal. If in fact we are about to embark on another leg higher, the markets are certainly going about it in a very strange way. I take the contrarian view and look at the sideways movement as distribution in preparation for another leg lower in commodities prices.

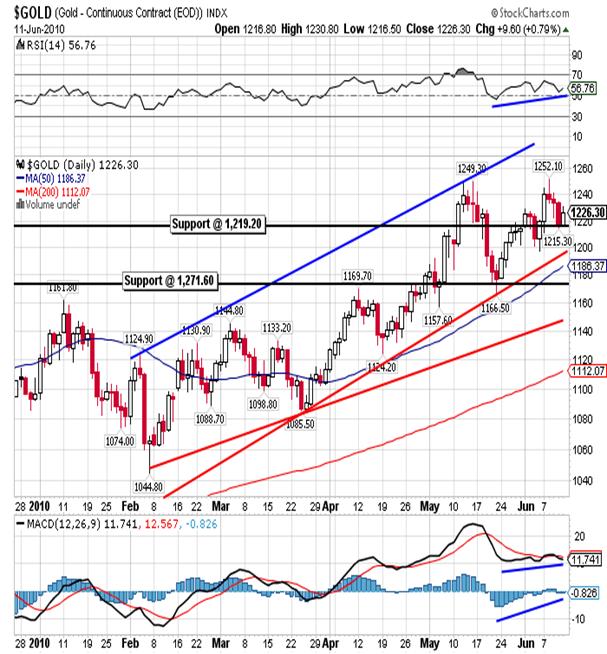

What is interesting is that commodities have declined steadily throughout the year, the dollar has rallied throughout the year, and yet gold has clawed its way higher month after month. This dispels the myth that gold can’t rally with the dollar or will not move higher in a deflationary environment. Take a look at the following daily chart for gold and you’ll see what I mean:

During the night we saw gold trade in a relatively tight range and then it sold off as soon as New York opened for business. As I type at 11:40 am EST the August gold is trading around 1,220.00 and so far it’s holding well above last week’s intraday low at 1,212.10. We have seen this time and again where someone comes in and sells the market early on and then it slowly moves back higher. Interestingly enough the July silver is acting well as it trades up 23 cents at 18.46, and it’s been up all morning. Silver appears to be shaping up for another run at the 18.94 strong resistance and I would not be surprised to see silver move above it later in the week. If in fact silver is taking the lead in the move higher, it would be a bullish development for all the precious metals.

Finally I want to take a look at the HUI which is also holding up quite well in spite of the decline in gold’s price this morning:

Here you can see the development of a familiar pattern whereby the HUI is being compressed into a tighter and tighter trading range, and every time we’ve seen such a formation over the last year, it has broken out to the upside. That’s what happens in a bull market, the breakouts almost always go to the bulls. The HUI is up against good resistance at 459.13 and then again 473.50, so there is some congestion in the area. A formation like we are seeing now is what’s needed if you want to break through that congestion. I wouldn’t be the least bit surprised to see that breakout later this week or early next week. At the risk of sounding like a broken record, you should hold on tight to your current positions in gold, silver, and gold stocks.

PORTFOLIO SUMMARY (thru June 10th)

CONTRACT ACTION # INITIAL PRICE CLOSING PRICE GAIN

Sept Dow Short 2 10,210 10,087 2,460

Mini-SepDow Short 1 9,850 10,087 -1,185

Dec Gold Long 1 1,219.0 1,230.2 1,120

July Copper Short 1 293.0 290.0 150

*Sept Bond Short 1 124.08 123.28 341

*Position closed

[Please note that the new website at www.stockmarketbarometer.net will become operational this week. Also, note that you can contact us at our new e-mails, info@stockmarketbarometer.net (general inquiries regarding services), team@stockmarketbarometer.net (administrative issues) or analyst@stockmarketbarometer.net (any market related observations).]

By Steve BettsE-mail: analyst@stockmarketbarometer.net

Web site: www.stockmarketbarometer.net

The Stock Market Barometer: Properly Applied Information Is Power

Through the utilization of our service you'll begin to grasp that the market is a forward looking instrument. You'll cease to be a prisoner of the past and you'll stop looking to the financial news networks for answers that aren't there. The end result is an improvement in your trading account. Subscribers will enjoy forward looking Daily Reports that are not fixated on yesterday's news, complete with daily, weekly, and monthly charts. In addition, you'll have a password that allows access to historical information that is updated daily. Read a sample of our work, subscribe, and your service will begin the very next day

© 2010 Copyright The Stock Market Barometer- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

ted plottner

16 Jun 10, 01:49 |

yo

I FIND YOUR INFO TO BE VERY VERY HELPFUL |