Financial Meltdown In the Credit Markets - Fingers of Instability Part Five

Stock-Markets / Financial Crash Sep 10, 2007 - 12:02 AM GMTBy: Ty_Andros

In This Issue – 3 Fingers

In This Issue – 3 Fingers

- Financial Meltdown, aka Systemic Heart attack !

- Con Game

- Bold Predictions: Destination 1200 S&P 500, 600 Russell 2000, Dow 10800

Series Introduction – Click Here

This is a tough edition of Tedbits to chronicle. I have watched markets since 1981 and read the tealeaves during that period. We are in for a storm that is rarely seen, it is why the “Fingers of Instability” series came back to the fore from last spring. It is hard to choose what to write about at this time as the actions from various markets are screaming for attention that you should know. Gold broke out this week signaling at least a 200 dollar move from current levels, but the implication of the breakout is a financial market “ARM”ageddon, securitized asset hell and a federal reserve that is behind the curve in what's unfolding and choosing precisely the wrong moment to try and extinguish the Greenspan put. Billions of dollars are vaporizing as you read this.

For greater insight into our publication, have a look at the Overview of Tedbits . It helps current and potential subscribers understand our mission in serving you. It also gives a broad description of what's unfolding globally and what you can expect from Tedbits as a regular reader.

The printing presses and computer creation of FIAT money cannot keep up with how fast it is disappearing (as outlined in Roach motel, see Tedbits archives at www.TraderView.com ). It is breathtaking to me what I am seeing; the dollar is set to go into freefall. The mandarins of Wall Street have pushed the fleecing of investors to imprudent levels and we are all going to pay the price for their GREED. Smart investors have positioned themselves to make this emerging volatility into an opportunity, have you?

Wall Street and Washington DC . are about to lose the CONFIDENCE that has been placed in them for as long as I can remember, and the regulators that MUST protect the status of the dollar as the worlds reserve currency have betrayed the people who have placed their trust in them. The regulators have been asleep at the wheel and their masters (Goldman, Merrill Lynch, Credit Swiss, UBS, Lehman brothers, Bear Sterns, Morgan Stanley, Citigroup, etc.) in New York have screwed us all. Do you notice attacks on these fraudsters? No, they own the regulators and Public Servants. Foreign creditors are set to pull the plug, thank you Washington DC .

Financial Meltdown, aka Systemic Heart attack !

It's hard to put lipstick on a pig, so I won't try to. The credit markets are dying, as off balance sheet SIV's (structured investment vehicles') and Conduits (SIV's with back up lending facilities) are sucking the life out of the banking system as the banks are forced to take the lending that used to come from the Asset backed commercial paper markets (ABCP) and put them back on their balance sheets. And because of Basel II, international accounting standards the banks may not have the money necessary to properly reserve against the assets they are now FORCED to be provisioning for. I am going to lay out the tea leaves for you. The Federal Reserve and their Ivory towered economists are about to get a lesson from the “MARKET” as to the differences between academia and REAL LIFE!

First we are going to outline the problem and it is Securitized asset backed products devised and marketed by Wall Street. In conjunction with the rating agencies who they developed these products with. Moody's, S&P, and Fitch devised products where absolute trash has been sold to investors who placed their faith in them. In classic Enron fashion when the ratings agencies continued to maintain ratings on Enron corporate debt until 4 days before bankruptcy, Billions of dollars of asset backed securities of one sort or another (CDO's, CMO's, CLO's) face the same fate. There is no shortage of money, but there is a shortage of confidence and faith between credit counterparties and it is unfolding into a disaster.

There are billions of dollars worth of these conduits and SIV's that are now being funded by back up lines of credit from the banks that sponsor them, as the ratings agencies downgrade the securities the reserve requirements balloon from 1.5% to 7% to 12% in reserve requirements. These conduits and SIV's are held off the banks balance sheet but is where they conduct their trading operations which are like hedge funds. As they have to deliver on their credit commitments they take these obligations onto their balance sheets, impairing their ability to make loans to others. The asset backed commercial paper markets are in freefall, having shrunk over 20% in 5 weeks.

As these markets plummet the corporations, SIV's and Conduits are forced to go to the banks and exercise back up lines of credit, but the banks that are counter parties to the loans through the libor window (London inter-bank overnight rate) DO NOT TRUST EACH OTHER, and are beginning to hoard funds rather then to lend them to each other into the overnight windows. These BANKS do not trust each other to return the cash. Look at how the Libor has exploded higher in the last 4 weeks:

This is a rocket shot, normally libor trades at the feds overnight rate, or the overnight rate of the central bank that issues the currency, this US chart is reflective of libor in Euros, British pounds, etc., they all are skyrocketing much higher than the overnight rate as illustrated in this dollar example. Banks will not lend to other banks unless they are paid handsomely for the additional RISK from the best counterparties on the planet. This is a direct reflection of those asset backed commercial paper falling onto the banks balance sheets.

This is a rocket shot, normally libor trades at the feds overnight rate, or the overnight rate of the central bank that issues the currency, this US chart is reflective of libor in Euros, British pounds, etc., they all are skyrocketing much higher than the overnight rate as illustrated in this dollar example. Banks will not lend to other banks unless they are paid handsomely for the additional RISK from the best counterparties on the planet. This is a direct reflection of those asset backed commercial paper falling onto the banks balance sheets.

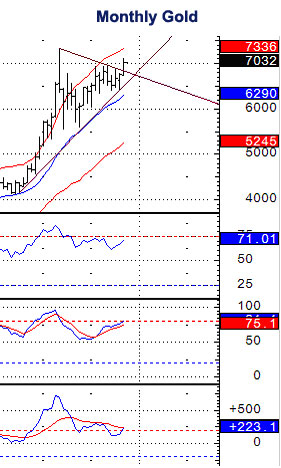

John Williams of www.shadowstats.com is reporting that reconstructed M3 (money and credit growth) is running close to 14%. In the past two weeks M2 has exploded over $113 billion, since mid May it has exploded over $202 billion dollars, an astonishing annual growth rate of over $800 billion dollars. Now gold is breaking out of its consolidation pattern dating back to the highs in May 2006. It projects gold $200 dollars higher and we know why, the toilet paper factory known as the US treasury is printing dollars as fast as they can, take a look at this monthly chart of gold:

The only thing that lies in front of us is more and more money creation, billions and billions of dollars of it. The asset-backed securities are radioactive waste and there is no marketplace to sell into (see roach motels in Tedbits archives at www.TraderView.com ). But the bigger problem is that there are over 8 trillion dollars of Asset backed securities that are mortgage related and there is 300-500 billion worth of bad mortgages embedded in them, but nobody knows which ones have the bad apples, so they are ALL bad now. Unmovable, as no one knows what's in these “Pandora's box” investments.

The Federal reserve has jury rigged the asset backed security markets by using the discount window for back up funding as the Euro zone must do as well, Germanys mid sized companies are frozen out of asset backed paper markets as well and short term cash flow is frozen, as no one will lend, they need the money for when their asset backed paper is downgraded and they need the additional reserves. But as the securities are downgraded the reserve requirements just grow and grow, freezing out more and more “QUALIFIED” borrowers. As they take in the trash of the securitized products they are kicking out their day to day banking clients.

Citigroup backs up 30% of all the SIV's and conduits in the world, a 2 trillion dollar bank is facing blistering expansion in reserve requirements as the ABCP markets continue to CRASH. Markets that decline 25% in 4 weeks are crashing and that is what is occurring in the ABCP markets in the G7 . Trillions of dollars of short term funding is provided by these markets for short term cash flow needs, receivables of all sorts of companies are pledged to the ABCP markets as companies wait for the normal flow of business revenues to arrive or be paid. This door is now closed and the accidental death of these companies could become enormous, and they are all top quality borrowers with thriving businesses of one sort or another.

Has anyone noticed the Muni bond markets are in freefall? That “supposedly” risk free municipal bonds are tanking? Why? Its simple, they are tanking because the companies that insure them are “out on a limb” from having insured these Asset backed securities and do not have the reserves necessary to pay the people who bought the insurance. You can't pay a policy holder if you are bankrupt, so their insurance is WORTHLESS!

As liquidity collapses you can expect the markets to do so as well. It appears that no one has put their finger on the problem: and that is the absolute absence of a CENTRAL marketplace for these securities to discover their price and value. This is not even being discussed by anyone that I can see, and I scour the world for financial and political news, all day every day. Over the counter will not work, what is a holder to do, call dozens of bank and wire house trading desks and ask for a bid, how absurd. There are hundreds of thousands of them. Panic hangs heavily over the holders of these asset backed securities, they haven't gone over the edge yet, but you can anticipate it happening any day now.

Con Game

The dollarization of the world's financial system has been one of the most astonishing things to emerge in the past 50 years. The United States used to be the most dynamic wealth producing capitalist economy in all of history. Their financial markets, Ce ntral bank, and treasury were widely recognized as some of the most fiduciary sound groups ever seen. But as socialism has crept into the US economy, financial growth has been substituted for real growth, as increasingly asset inflation and money printing substituted for policies of wealth creation.

Now the governments of the United States : Municipal, state and Federal CONSUME ½ of all the GDP of the United States , and that is a recipe for overpaid public servants, generous pensions, runaway government spending and over regulation to buy the votes of the constituents required for the next election. The only thing that the Public Servants and government discusses is expansion of its spending and the new taxes to pay for it. Feeding their “something for nothing” constituents beliefs in free lunches and government solutions to their problems.

Not one politician Republican or Democrat is talking of spending restraint and prescriptions for economic growth; they are talking about government solving all your problems, THROUGH MORE GOVERNMENT! Blissfully, ignoring the government's inability to solve any problem ever. Please show me one problem that has been solved and the outcomes are better through government, it is wishful thinking and faith in the tooth fairy. Public Servants banking on the stupidity of their public school dumbed-down constituents inability to think in any meaningful way!

Fiscal restraint in the United States is never discussed on any level of government. While the rest of the world is in competition to increase the competitiveness of their domestic business to compete in the global marketplace the US officials talk about punitive trade sanctions, currency devaluation against their competitors ( CHINA ) and higher taxes. Does anyone recognize this recipe? It is the recipe the IMF has used for two decades to destroy every economy it has ADVISED. It is a recipe for a debt crisis as wealth creation is destroyed, the ability to pay your creditors is destroyed, and keep in mind the US is the greatest debtor in the WORLD! It is a recipe for “disaster”, and since it's been promulgated by the socialist masters of the IMF, it reflects what the US government has become: Socialist dictators. It is a recipe for a currency collapse, ask Thailand , Argentina , Russia , and any who have tried this.

Little noticed and reported on is the tremendous momentum in the US congress to punish our competitors for their own inability to create the environments necessary for growth and wealth creation in the United States . Lowering taxes, increasing incentives for business creation and government spending restraints on programs that consume a dollar and produce a dimes worth of benefits are required to turn this floundering economy around. Look around you; do you see one public servant on either side of the aisle proposing these policies of growth? NO. Of course they never will do so short of a disaster as it would upset their SPENDING plans and reelection efforts. Public Servants living in Orwellian cocoons of their own construction as the economic consequences of their previous policies destroy the futures of their constituents.

Now our creditors have begun to catch on and the implications are ominous. Dennis Gartman of www.thegartmanletter.com is reporting that central banks foreign central banks have cut their US treasury holdings by $48 billion since July and by an additional $32 billion in the last 2 WEEKS!!! The tics data may be another shoe to drop in the coming weeks and months as people move out of the dollar at the margin, and that is where all big moves begin. The US must attract $3 Billion dollars a day of foreign capital to finance the budget and trade deficits, if this stops, interest rates will skyrocket as will inflation and the dollar will go BYE BYE! This is right in front of us, Got gold anyone?

Bold Predictions: Destination 1200 S&P 500, 600 Russell 2000, Dow 10800

As credit markets and Yen carry trades implode and liquidity recedes, liquidity to meet bank margin calls will be gathered from the areas that are the most liquid, and those are the EXCHANGE traded stocks and futures, the dominoes are falling and the financial authorities are way behind the curve of what's unfolding. In looking at all the sell offs in global markets that occurred in the time from mid-July to mid-August, one can see perfect Fibonacci re-tracements in both time and price in every stock market in the world. With the exception of the Chinese market which has now gone up over 200% in the last year, and it is ripe for a fall as Beijing 's ham handed management of liquidity sets the stage for it to crash as well. Can you say a ONE TWO PUNCH? Wealth is about to be vaporized on an enormous scale as panic drives investors to sell assets far below fair value!

I have looked at every major stock index in the world: the FTSE 100, S&P 500, Dow, Wiltshire 5000, Russell 2000, CAC, DAX, and many more, and they are saying one thing in CHORUS, and its BOMBS away. Using standard Fibonacci extension ratios of 1.618 times of the first wave move as a guide to what to expect on this next leg down it projects the S&P to 1200 (its at 1453), the Russell 2000 to 600 (780 now), the Dow industrials to 11,800 (13113 now), the Dax to 6004 (7447 now), the FTSE to 4857 (6187 now), I could keep going but you get the picture and its not pretty.

The Euro/yen cross which is a proxy for the Yen carry trade did a perfect .618 Fibonacci retracement as well off its July/August move, and failed precisely where it should have if it was a countertrend bounce, it crumbled again on Friday. So look for another leg of liquidation and the subsequent unwinding of the buy side to start on Monday. i.e. Stocks.

On Friday every Stock market outlined and many that I did not detail here broke their trend lines off the mid August lows and perfect ABC counter trend correction patterns can be seen. The analogs detailed in the last edition of “fingers of Instability” are unfolding (see Tedbit archives at www.TraderView.com ) as outlined, and the astrological picture is the same as can be seen during the 1987 and 1929 crashes. In view of the systemic financial system problems unfolding and the lack of a coherent policy response by the financial authorities and central banks this is a recipe for you know what?

In conclusion: The world's financial authorities are fighting the present financial instability as they have always done in the past by printing money! Bucket loads, plane loads, wheelbarrow loads are being thrown at the problem. It is apparent they have not identified the core problem of the loss of confidence and that the lack of a central marketplace for the Securitized products to go through a price discovery process and the ability to GET OUT is the problem. Until they do so they are not going to fix the markets problems. The plumbing in the financial system is inadequate to meet the needs of the holders of the OVER THE COUNTER derivatives (CLO's, CMO's, CDO's, etc.) and they are panicking in increasing numbers. As the ratings agencies downgrade the securities to limit the damage done by previous mislabeling of risky investments the pressure to sell them and lack of a place to do so will increase the pressure like a pressure cooker COOKS your food. It is cooking their investments in the same manner i.e: FAST. Ever see a pressure cooker BLOW UP?

Incredibly enough these problems are opportunities for prepared investors, are a portion of your diversified portfolios making money? Or losing it? Examine why? How can you prepare yourself to gather these opportunities? There are ways to do so, find them, examine them, learn about them, and then implement them. Bear funds, professionally managed alternative investments that can thrive in up and down markets, currency investments, precious metals, and many more, all offer different ways to turn today's concerns and volatility into opportunities! Government Bonds are temporarily seen as SAFE haven, until you realize the tremendous amounts of FIAT currencies that are being created with the flick of a computer keyboard and printing press to address the problems.

So as you experience the capital gains as they rally in perceived flights to quality, the value in them is sucked out at night by the central banks money printing, look for monstrous rallies then crashes in bonds as they are recognized for the certificates of confiscation they actually represent.

Don't miss the next installment of “Fingers of Instability”. Thank you!

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

Ty Andros LIVE on web TV. Don't miss Ty interviewed live by Michael Yorba from Commodity Classics. Catch Ty's interview every Wednesday at www.MN1.com or www.CommodityClassics.com at 4pm Central Standard Time .

By Ty Andros

TraderView

Copyright © 2007 Ty Andros

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.