Gold, Crude Oil and Stock Market Technical Charts

Stock-Markets / Financial Markets 2010 Jul 07, 2010 - 06:12 PM GMTBy: Chris_Vermeulen

It’s been a short but exciting week so far. Investors and traders are have been scratching their heads the past few days as stocks continued to bounce around giving mixed signals. But today was a clear day of short covering from this much oversold market condition.

It’s been a short but exciting week so far. Investors and traders are have been scratching their heads the past few days as stocks continued to bounce around giving mixed signals. But today was a clear day of short covering from this much oversold market condition.

Below are a few charts showing what I’m currently thinking will unfold in the near future.

Gold Futures Trading – 2 Hour Chart

In the past couple weeks we sold our position in gold at $1255-60 area in anticipation for this sharp drop. The market was kind enough to show us though its price and volume action that a nasty drop was just around the corner. Currently we are in cash waiting for the down trend momentum to stall and reverse before taking another long position in gold. I feel it could still drop one more time, but the chart is giving mixed signals when reviewing the short term charts.

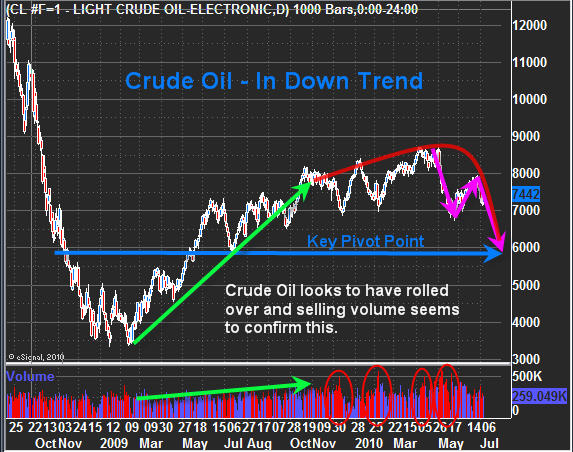

Crude Oil Futures – Daily Trading Chart

Crude has seen a shift in the trend over the past 2-3 months. Selling volume over took the buyers and are now pulling prices down into bear flag pattern which means lower prices still.

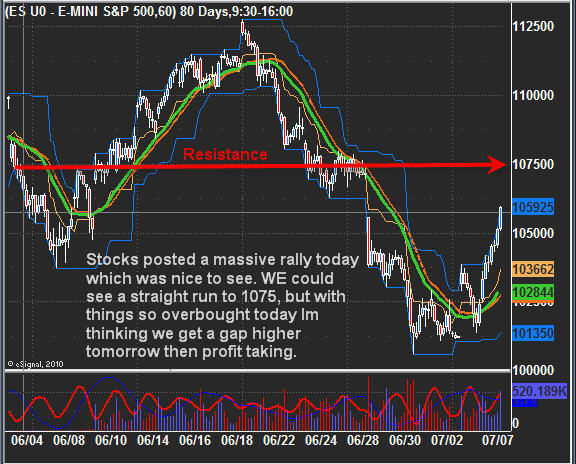

SP500 Futures – 60 Minute Trading Chart

SP500 and other major indexes have been selling down the past couple weeks. Tuesday we saw the market gap up very big then sell off. But that surge higher was an early warning sign that the selling momentum was slowing for the time being.

1075 on the SP500 is a key resistance level and a point which many traders will be taking profits and trying to short the market. That will create a lot of selling pressure at that level and only time will tell if we can clear it.

Mid-Week Commodity and Index Trading Conclusion:

It looks as though we are getting the over due bounce in the stock market everyone has been anticipating. The large rally today (Wednesday) has covered most of the ground as it has moved up over 3% today. Overhead resistance looks to be only 2% away before sellers step back in and try to pull the market back down.

If the market goes up for another couple days then gold should have a small pullback to test support. When the equities market starts to drop again money should flow back into gold and send it higher as the safe haven of choice.

Crude oil broke down late last week and this week it bounced back up to retest the breakdown level. This is common and once complete oil should continue to drop.

The market is still in a strong down trend on an intermediate basis so be sure to lock in profits once your investments reach key resistance levels. If you don’t the market has a way of taking back those gains very quickly in the current market condition.

If you would like to receive my Real-Time Trading Signals & Trading Education check out my website at http://www.TheGoldAndOilGuy.com

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.