Obama Failed Economic Policy, No Recovery Without Job Creation

Economics / US Economy Jul 12, 2010 - 06:02 AM GMTBy: Mike_Shedlock

There will be no recovery without jobs, and there will be no net job creation if small businesses, especially startups, do not lead the way.

There will be no recovery without jobs, and there will be no net job creation if small businesses, especially startups, do not lead the way.

Please consider The Importance of Startups in Job Creation and Job Destruction by Tim Kane, PhD, and Senior Fellow in Research and Policy at the Kauffman Foundation.

Current Jobs PictureA relatively new dataset from the U.S. government called Business Dynamics Statistics (BDS) confirms that startups aren’t everything when it comes to job growth. They’re the only thing.

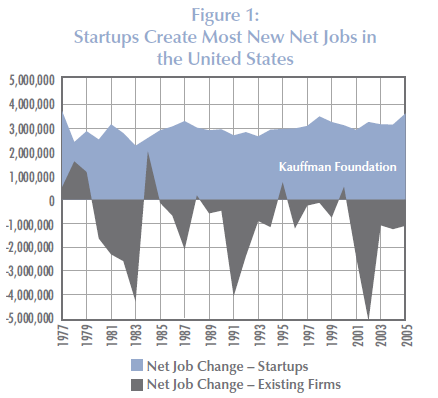

Put simply, this paper shows that without startups, there would be no net job growth in the U.S. economy. This fact is true on average, but also is true for all but seven years for which the United States has data going back to 1977.

Figure 1 presents summary data from the BDS,1 showing that firms in their first year of existence add an average of 3 million jobs per year. By construction, the BDS defines an existing firm—age one up to age twenty-six and beyond—such that it can both create and lose jobs. In contrast, a startup, or age zero firm, only creates jobs because it experiences no gross job destruction. We might anticipate that the net job gain also would be positive at existing firms, but that is decisively not the case during most years on record. Notably, the figure shows that, during recessionary years, job creation at startups remains stable, while net job losses at existing firms are highly sensitive to the business cycle.

On balance, existing firms lose more jobs than they create. But once Deaths are set aside, Survivors usually create more net jobs than startups do. Among Survivors, so-called gazelle firms are certainly more important still.

In sum, the new firm-level summary data in Figure 1 reveal that startup firms are responsible for all net job creation during most years, while existing firms (aged one year and older) are usually net job losers. To be fair, startups have a definitional advantage because they can’t lose jobs, and some of their created jobs will surely be lost by next year’s age one firms.

What Figure 1 doesn’t reveal then is the gross flows within the firm age categories, which is the inspiration for this study. We would like to know whether age one firms are net job creators. Ideally, we would like to pinpoint the transition year when firms become net job destroyers, or find if a consistent pattern even exists. ...

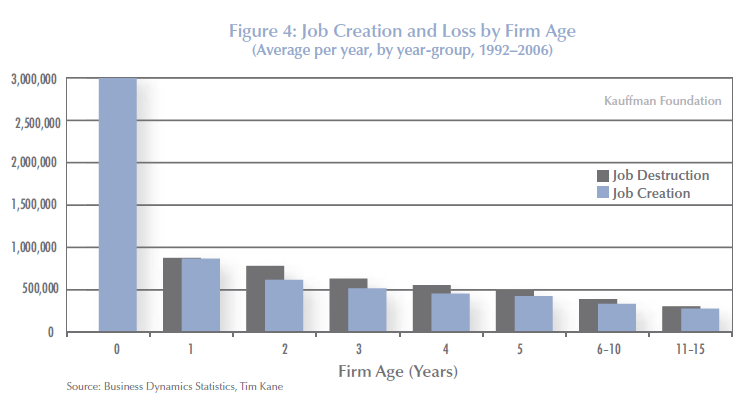

[Figure 4] paints a picture surprisingly different from what informed, conventional wisdom presumably imagines.

Analysis

Startups create an average of 3 million new jobs annually. All other ages of firms, including companies in their first full years of existence up to firms established two centuries ago, are net job destroyers, losing 1 million jobs net combined per year. Patterns of job growth at startups and existing firms are both pro-cyclical, although existing firms have much more cyclical variance.

The implication of this finding could, and perhaps should, shift the standard employment policy paradigm. Policymakers tend to reflect common media stereotypes about job changes in the economy, which is to say a focus on the very large aggregate picture (such as the national or state unemployment rate) or on news of very large layoffs by individual companies. That attention is almost certainly misplaced.

Nationwide measures are a blunt tool for analysis, and net employment growth reveals little that policy can affect.

Similarly, the common zero-sum attempts to incentivize firm relocation are oblivious to the important pattern of gross job creation revealed by the BDS. States and cities with job creation policies aimed at luring larger, older employers can’t help but fail, not just because they are zero-sum, but because they are not based in realistic models of employment growth.

Job growth is driven, essentially entirely, by startup firms that develop organically. To be sure, Survivors create zero to 7 million net jobs (half of which are at establishment births), while Deaths account for a net loss of 4 million to 8 million jobs, which are large flows for the context of the steady job creation of 3 million startup jobs. But, in terms of the life cycle of job growth, policymakers should appreciate the astoundingly large effect of job creation in the first year of a firm’s life. In other words, the BDS indicates that effective policy to promote employment growth must include a central consideration for startup firms.

The official unemployment rate is 9.5%. However, that number does not include 2.6 million "marginally attached" workers who wanted a job but were not counted as unemployed because they had not searched for work in the last 4 weeks.

It also does not include students who stay in school piling on debt because they cannot find a job, and it does not include people working part time who want to work full time.

More realistic measurements incorporating those things show that unemployment is closer to 17% than 9.5%.

Unfortunately, things are not improving. Let's take a look at the conditions, then the reasons why.

Bleak Outlook For Small Businesses

Please consider Jobs outlook for small businesses may be getting bleaker.

For the recovery to gain steam, most economists believe small businesses need to be strong enough to hire new workers. But according to one measure, the employment picture in this sector is weakening.

Intuit Inc., which provides payroll services for small employers, says the nation's tiniest companies had fewer new hires last month than any time since October.

The slowdown in hiring is particularly troublesome, experts say, because small businesses typically hire first during a recovery. A reluctance by little companies to add positions could mean that the big firms, which typically lag behind, will add jobs even more gradually.

To calculate its estimate of national hiring, Intuit uses payroll information from its 56,000 small-business customers. The company defines small businesses as those with fewer than 20 employees.

Intuit's data show that small businesses hired just 18,000 additional workers last month. That's still positive territory, but it's less than a third of the 60,000 that were added in February, when it seemed that an employment recovery was imminent. Additional hiring dropped steadily during the spring, to 40,000 in April and 32,000 in May. Another payroll company, Automatic Data Processing Inc., painted an even gloomier picture, saying that small businesses lost 1,000 jobs nationwide in June.

"It's disappointing," Woodward said. "Considering how many unemployed people there are, it's disheartening."

To understand the oversized importance of these little businesses to the U.S. jobs picture, consider that the smallest firms — those with fewer than 20 employees — employ more than one-sixth of the nation's workers. But so far this year, these companies have provided about one-third of all new private-sector jobs, said Brian Headd, an economist with the Small Business Administration. So any cutbacks would be felt disproportionately throughout the economy.

"Small-business hiring is right at the heart of it because small businesses usually are the engine of job creation in the U.S.," said John Challenger, president of the employment consulting firm Challenger, Gray & Christmas. "It's small businesses that drive the unemployment rate down, and if the small businesses are faltering, that suggests that the risks of recession are growing."Failed Policy

Those two articles highlight where and how Obama is going wrong.

Specifically, Obama is focused on "saving jobs" rather than creating a business environment that fosters the creation of new jobs and new businesses.

- Administration policies waste money with makeshift projects such as repaving roads that do not need to be paved

- Administration policies waste money protecting the jobs of overpaid bureaucrats and public union workers.

- Administration policies, especially healthcare, have added to small business startup costs

- Administration policies have raised taxes increasing the risk (lessening the risk-reward scenario to start a new business)

Business Profits - the Catalyst for Starting a Business

Why start a business? Profits of course! Yet, if government makes it too difficult to make profits, then ... Why start a business?

Please consider the following email from Robert J. Kecseg at Las Colinas Capital Management.

Folly of Targeting JobsHello Mish

Business profit is the real catalyst for new jobs. That is why tax reduction works so well. Lower taxes help businesses make profits. More profit means more capital investment and more innovation.

Reduced taxes across the board gives everyone an equal chance. In contrast, targeted government spending is always poorly allocated.

This is where people like Krugman have it all wrong. Please emphasize the power of profits.

Robert J. Kecseg

Las Colinas Capital Management,

Thanks Robert.

Targeting jobs, is exactly what I railed about in Obama Hails New Solar Energy Jobs at Taxpayer Price Tag of $1,333,333 Each

Interestingly, I received several emails demanding I issue a retraction because Obama made loans not grants. So what? Those businesses may fail and if they do, taxpayers will be on the hook.

The key point however, is government ought not be picking winners and losers. Providing money to Abengoa Solar and Abound Solar Manufacturing may mean the failure of competing, perhaps even better businesses.

Certainly, the government's track record at picking winners and targeting stimulus is pretty miserable. Ethanol from corn, and various housing proposals that have all failed are good examples.

Corporate Tax Policy Encourages Jobs Flight

US tax policy allows deferral of corporate profits on taxes overseas. Tat policy practically begs large multinational to move jobs overseas and to keep profits there as well. Moreover, the policy gives unfair advantage to large corporations which can shelter profits vs. small corporations and startups that cannot.

President Obama cannot be blamed for this given the policy has been in place for years. Yet, no one seems inclined to want to do anything about it.

One common complaint I hear is "the Bush tax cuts did not create a lot of jobs". Fair enough, I certainly agree. Moreover, I have absolutely no love for President Bush. That said, one reason the Bush tax cuts did not work is Bush wasted trillions of dollars in Iraq and other war-mongering policies. That negated some of the benefits of lower taxes. Another reason is President Bush inherited an economic mess caused by the Greenspan Fed.

Obama inherited the same economic mess of course, but has also made matters worse by inept policies that have cost jobs and will continue to cost jobs.

How to Create Jobs

- Slash corporate income taxes.

- Scrap Davis Bacon and prevailing wage laws. Please see Thoughts on the Davis Bacon Act for more on the insanity of prevailing wage laws.

- Privatize jobs held by public unions. Firing Public Union Workers Creates Jobs.

- Require competitive non-union bidding on all projects involving Federal funds.

- Legalize hemp for use in bio-fuels and clothing.

- Kill crop subsidies

- Allow drug imports from Canada

- Simplify the tax code

- Open up medical insurance across state lines

- Stop attempting to be the world's policeman

Those are 10 easy things we can do that will foster job creation over the long haul (directly in some cases, indirectly in others buy putting more money in people's pockets). In general, government needs to get the hell out of the way and reduce taxes so people and businesses have more money to spend.

Instead, the Obama administration supports higher taxes, more government, and the status quo on existing overpaid public union workers. Is it any wonder the outlook for small business and startup hiring is bleak?

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.