Are We Trending Towards Deflation or in It?

Economics / Deflation Jul 13, 2010 - 05:19 AM GMTBy: Mike_Shedlock

Paul Krugman is worried we are Trending Toward Deflation.

Paul Krugman is worried we are Trending Toward Deflation.

Inflation has been falling, but how close are we to deflation? I found myself wondering that after observing John Makin’s combusting coiffure, his prediction that we might see deflation this year.

Here’s the thing: the usual way inflation is measured is by looking at the change from a year earlier. But if inflation is trending lower, that’s a lagging indicator — if prices have been falling for the past few months, but were rising before that, inflation over the past year will still be positive. On the other hand, monthly data are noisy. So what to do?

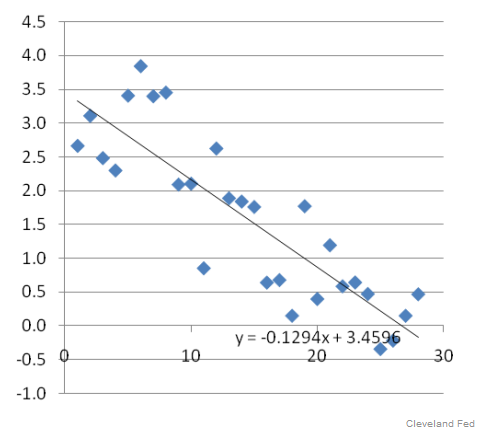

Well, a crude approach would be simply to fit a trend line through those noisy monthly numbers. Here’s what happens when you do this for the Cleveland Fed’s median consumer price inflation number. On the vertical axis is the monthly inflation at an annual rate, on the horizontal axis months with Jan. 2008=0:

...

What I take from this is that deflation isn’t some distant possibility — it’s already here by some measures, not far off by others. And of course there isn’t some magic boundary effect when you cross zero; falling inflation is raising real interest rates and making debt problems worse as we speak.

There is a second chart and further discussion in Krugman's article.

The Rising Threat of Deflation

The article Krugman referred to is The Rising Threat of Deflation. Here are a few snips highlighting Makin's and Krugman's concern over prices.

U.S. year-over-year core inflation has dropped to 0.9 percent—its lowest level in forty-four years. The six-month annualized core consumer price index inflation level has dropped even closer to zero, at 0.4 percent. Europe’s year-over-year core inflation rate has fallen to 0.8 percent—the lowest level ever reported in the series that began in 1991. Heavily indebted Spain’s year-over-year core inflation rate is down to 0.1 percent. Ireland’s deflation rate is 2.7 percent. As commodity prices slip, inflation will become deflation globally in short order.

Meanwhile in Japan, while analysts were touting Japan’s first-quarter real growth rate of 5 percent, few bothered to notice that over the past year Japan’s gross domestic product (GDP) deflator had fallen 2.8 percent, reflecting an accelerating pace of deflation in a country where the price level has been falling every year since 2004. As of May, Japan’s year-over-year core deflation rate stood at 1.6 percent.Consumer Prices Least of Bernanke's Worries

Note the concern over the CPI by Krugman and Makin. Is that what Bernake is most worried about?

I doubt it.

Bernanke is far more likely to be worried about home prices and commercial real estate prices, neither of which are is in the CPI. Next up, Bernanke is seriously concerned over falling bank credit and marked-to-market valuations of debt on the balance sheets of banks. Those are not in the CPI either.

No doubt Bernanke is also very concerned over the falling yield curve which signals risk avoidance. Of course Bernanke is very concerned about jobs.

I do not know how to rank those concerns other than to say everyone of them is far more important to the Fed than whether the CPI drops an essentially meaningless point from here.

The CPI is meaningless because we are already back in deflation. I say "back" because we were in deflation in 2007 and 2008.

Devil is in the Definition

Whether or not we are in deflation or trending towards it depends on how it is defined.

For example, monetary purists worried about money supply alone are under the preposterous notion that we are trending towards hyperinflation.

The problem with using money supply alone as a measure of inflation is it looks (and is) damn silly. Home prices have never fallen in hyperinflation and never will. Short-term yields have never been at 0% in hyperinflation and never will. The list does on and on.

Given that we have a fiat-based credit system, it is equally silly to discuss inflation/deflation without paying attention to credit. After all, the Fed can print but it cannot force banks to lend or consumers to spend.

Credit expansion is the key to inflation in a fiat-credit system. Those focused on prices or money supply alone, and those worried that Fed printing and excess reserves will soon spark inflation have missed the boat.

Please see Fictional Reserve Lending And The Myth Of Excess Reserves and also Fiat World Mathematical Model for a rebuttal to the notion that monetary printing will soon have the inflation genie flying out of the bottle.

Practical Definition of Inflation and Deflation

My definition of inflation is much more practical given that it incorporates credit and marked-to-market concerns that affect banks' willingness to extend credit.

I define inflation as a net expansion of money supply and credit, with credit marked-to-market. Deflation is a net contraction of money supply and credit, with credit marked-to-market.

Given that consumer credit is plunging at unprecedented rates, given that credit dwarfs money supply creation, and given that marked-to-market valuations of credit on the balance sheets of banks is again falling, I propose we are back again in deflation.

My model suggests part of 2007 and all of 2008 were deflationary years. Inflation returned in 2009, and the economy is back in deflation now.

Proof is in conditions one would expect to see in deflation.

Humpty Dumpty on Inflation

In Humpty Dumpty on Inflation I proposed a series of conditions one might expect to see in deflation. Let's take a look at the current state of those conditions.

- Falling Treasury Yields - Yes

- Falling Home Prices - Yes, as measured by Case-Shiller

- Rising Corporate Bond Yields - Not substantially - Yet. However sovereign credit spreads are widening

- Rising Dollar - Yes

- Falling Commodity Prices - Yes as measured by the $CRB from the beginning of 2010

- Falling Consumer Prices - Yes (or at least close) as measured by the CPI. My preferred measure would directly include home prices and that would/will tip the CPI negative soon enough. I consider housing (but not the land it sits on) a consumer good.

- Rising Unemployment - It is high and essentially steady. My model suggests no improvement at best, and far more likely new highs above 11%

- Falling Stock Market - Yes as measured since the start of the year

- Falling Credit Marked to Market - Yes, most assuredly

- Spiking Base Money supply as Fed fights Deflation - This depends on your timeframe, but charts sure show a spike - Another spike is likely

- Banks Hoarding Cash - Falling consumer loans - Declining bank credit - Yes, Yes, Yes

- Rising Savings Rate - Yes. The US savings rate rose to an 8-month high in May

- Purchasing power of gold rising - Yes

- Rising numbers of bank failures - Yes

Nearly every condition one would expect to see in deflation is happening, The few that aren't are close at hand and likely. If those are the things one would expect to see in deflation, and the scorecard is close to unanimous, I suggest that those who say this is not deflation have the wrong definition.

Note that I expect gold should wise in deflation. I say that on the basis that Gold is Money and gold in the senior currency has historically increased in value in deflationary times. Other deflationists, some very notable ones, definitely got this wrong.

Bernanke's Deflation Prevention Scorecard

In case no one is keeping track, Bernanke has now fired every bullet from his 2002 “helicopter drop” speech Deflation: Making Sure "It" Doesn't Happen Here.

Bernanke's Scorecard

Here is Bernanke’s roadmap, and a “point-by-point” list from that speech.

1. Reduce nominal interest rate to zero. Check. That didn’t work...

2. Increase the number of dollars in circulation, or credibly threaten to do so. Check. That didn’t work...

3. Expand the scale of asset purchases or, possibly, expand the menu of assets it buys. Check & check. That didn’t work...

4. Make low-interest-rate loans to banks. Check. That didn’t work...

5. Cooperate with fiscal authorities to inject more money. Check. That didn’t work...

6. Lower rates further out along the Treasury term structure. Check. That didn’t work...

7. Commit to holding the overnight rate at zero for some specified period. Check. That didn’t work...

8. Begin announcing explicit ceilings for yields on longer-maturity Treasury debt (bonds maturing within the next two years); enforce interest-rate ceilings by committing to make unlimited purchases of securities at prices consistent with the targeted yields. Check, and check. That didn’t work...

9. If that proves insufficient, cap yields of Treasury securities at still longer maturities, say three to six years. Check (they’re buying out to 7 years right now.) That didn’t work...

10. Use its existing authority to operate in the markets for agency debt. Check (in fact, they “own” the agency debt market!) That didn’t work...

11. Influence yields on privately issued securities. (Note: the Fed used to be restricted in doing that, but not anymore.) Check. That didn’t work...

12. Offer fixed-term loans to banks at low or zero interest, with a wide range of private assets deemed eligible as collateral (…Well, I’m still waiting for them to accept bellybutton lint & Beanie Babies, but I’m sure my patience will be rewarded. Besides their “mark-to-maturity” offers will be more than enticing!) Anyway… Check. That didn’t work...

13. Buy foreign government debt (and although Ben didn’t specifically mention it, let’s not forget those dollar swaps with foreign nations.) Check. That didn’t work...

Bernanke has failed. "It" has happened.

Now What?

I wrote about Bernanke's Deflation Prevention Scorecard in April 2009.

Regarding points 8 and 9 above: the Fed did purchase treasuries and agencies, but admittedly without an explicit ceiling.

The Fed has stopped those purchases but is likely to start again.

Would Flattening the Curve Help?

Many propose that the Fed is likely to flatten the yield curve by setting explicit yield targets on the high end. Will that help? How?

I see no credible reason it would cause banks to go on a lending spree or consumers to go on a buying spree. Indeed, I do not see how forcing down the yield curve with massive treasury purchases will do much of anything but making a bigger exit problem for the Fed at some point down the road.

Moreover, it looks like the yield curve is falling nicely on its own accord!

Consumer Credit Inflection Point

The key problem for Bernanke is we have reached the Consumption Inflection Point - No One Wants Credit; Consumer Spending Plans Plunge

Keynesian Policies Fail

Keynesian stimulus measures have failed and will continue to fail. Please see Three Mish Segments on Tech Ticker, on Stimulus, Retail Sales, the Markets, Alternatives for details and an online interview.

We have wasted $2 trillion fighting deflation. It has not produced any jobs.

The correct way to spur growth is by fostering an economy that supports economic growth. For details, please see Bleak Outlook for Small Businesses and Job Creation; Where Obama Went Wrong, and What to do About It.

Keynesian Cures Worse than the Disease

Krugman has the wrong definition and the wrong worry. However, he is correct in his call for deflation. Unfortunately, this will lead to a bunch of "I told you so" kinds of posts from Krugman, in spite of the fact his cures are worse than the disease.

Indeed, Keynesian "cures" are one of the reasons this economy is in the mess it is in.

The final analysis shows that the real threat is not of deflation, but of absurd Keynesian and Monetarist attempts to prevent it. The Greenspan-Bernanke housing bubble (and subsequent crash), and decades of futility in Japan should be proof enough.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.