Confirmed: U.S. Fiscal Woe Is Worse Than Greece

Interest-Rates / US Debt Jul 27, 2010 - 03:41 AM GMTBy: Dian_L_Chu

Reading the annual Long Term Budget Outlook by the Congressional Budget Office (CBO) has become an increasingly depressing experience in recent years. This year seems even more so than ever.

Reading the annual Long Term Budget Outlook by the Congressional Budget Office (CBO) has become an increasingly depressing experience in recent years. This year seems even more so than ever.

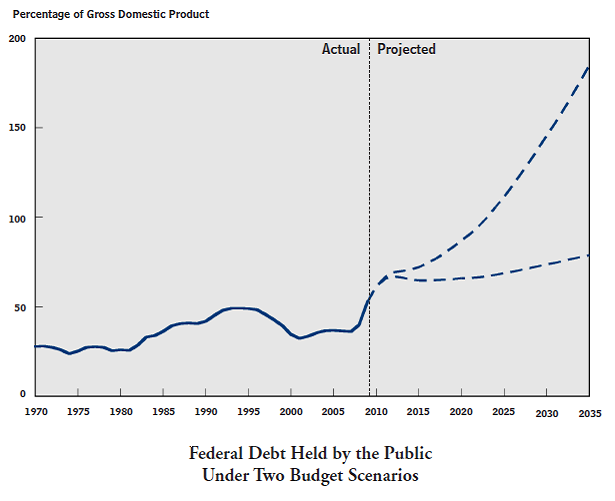

The latest projection puts the federal debt rising to 62% of the nation’s Gross Domestic Product (GDP) by the end of the year (from 40% pre-crisis), the highest percentage since just after World War. (See Graph)

Despite the gloomy projections, many economists seem to agree that a Greek style debt crisis is unlikely to take place in the U.S. due to the size of the economy, the single currency structure and dollar prestige.

After all, Greek debt totals 120% of GDP--twice the US figure--plus a comparison of the long-term bond yield, seem to suggest that the U.S. is in much better fiscal shape.

Or do they?

In a Financial Times op-ed dated July 25, Laurence Kotlikoff, economics professor at Boston University, contends due to the “labeling problem”--governments can describe receipts and payments in any way they like--we are essentially “in a fiscal wonderland of measurement without meaning.”

Kotlikoff believes a better benchmark of fiscal fitness is the fiscal gap, or the present value difference between all future expenditures and receipts. His calculations reveal Greece future expenditure at 11.5% of the value of future GDP, after incorporating the new austerity measures.

The US figure, based on the CBO projections--12.2%--is worse than that of Greece, but not by too much.

However, Kotlikoff says the U.S. is in much worse shape than the 12.2% figure suggests, because the CBO’s projections assume “a 7.2% of GDP belt-tightening by 2020,” with "highly speculative” assumptions, such as a substantial rise in tax receipts and wage growth.

However, Kotlikoff says the U.S. is in much worse shape than the 12.2% figure suggests, because the CBO’s projections assume “a 7.2% of GDP belt-tightening by 2020,” with "highly speculative” assumptions, such as a substantial rise in tax receipts and wage growth.

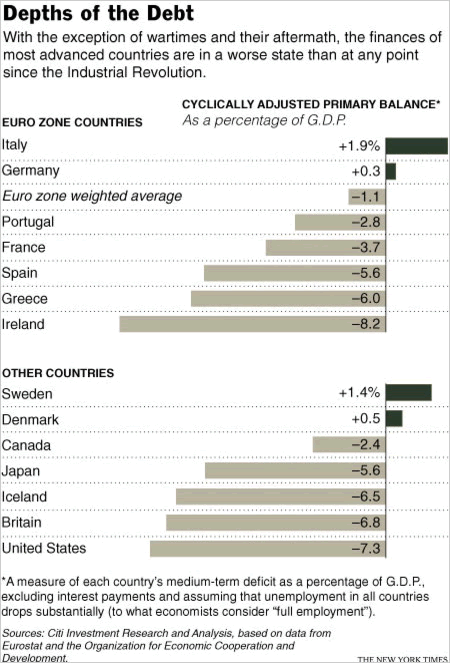

A separate analysis by the New York Times also put the U.S. debt--measured by medium term deficit as a percentage of GDP--higher than that of Greece. (See chart) Furthermore, in a roundabout way, Kotlikoff and Da Gong, the largest credit rating agency in China, seem to be in agreement as to the fiscal position of the United States; although many have dismissed Da Gong’s objectivity when it downgraded the U.S. from AAA to AA.

Will America have a Greek style debt crisis? Probably not, given the country’s resources and resilience.

However, it is a matter of political will to make tough choices between strategic vs. tactical spending and taking necessary measures to put the fiscal house in order.

With the current bond market willing to overlook debt for an economic recovery, tactical spending should take priority in order to give more immediate boost to jobs and to sustain a tepid recovery. Cramming strategic spending during a recession, as with the first stimulus, most likely will only saddle the nation with more debt while impeding growth and recovery.

Meanwhile, the current trajectory would suggest a different kind of debt crisis could manifest sooner or later, and over-confidence, a "Too-Big-To-Fail” mentality some of the nation's leaders seem to have adopted, will only lead to a dangerous path of no return.

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions.

© 2010 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.