Bankrupting Ireland in Economic Depression Announces Policy of Quantitative Cheesing

Interest-Rates / Global Debt Crisis Nov 14, 2010 - 05:44 PM GMTBy: Nadeem_Walayat

Ireland's economic depression is intensifying as the economy remains in recession and Irish bonds plunged sending yields soaring on concerns of more banking sector losses that continue to send Irelands public debt and liabilities soaring as the bankrupt banks continue offload their huge losses onto Irish tax payers, that negates all of the austerity pain suffered to date, which requires even more sacrifice to ensure that the bankster's and bond holders are bailed out 100%, resulting in an country bankrupting annual budget deficit of 32%, which Ireland cannot monetize through money printing.

Ireland's economic depression is intensifying as the economy remains in recession and Irish bonds plunged sending yields soaring on concerns of more banking sector losses that continue to send Irelands public debt and liabilities soaring as the bankrupt banks continue offload their huge losses onto Irish tax payers, that negates all of the austerity pain suffered to date, which requires even more sacrifice to ensure that the bankster's and bond holders are bailed out 100%, resulting in an country bankrupting annual budget deficit of 32%, which Ireland cannot monetize through money printing.

The irish government is desperate to follow the lead of the UK and USA by printing its way out of its debt crisis, but it cannot do so because it remains firmly anchored along with the other bankrupting PIIGS within the Euro currency zone so money cannot be printed and their currencies cannot be competitively devalued against the might of the German Industrial Empire that holds the rest of the Euro-zone as a captured market for its goods and services.

The people of Ireland having endured over a year of austerity on the promise that it was all necessary to suffer pain today by cutting public spending so as to reduce the annual budget deficit to sustainable level for economic gains tomorrow. Instead the exact opposite is taking place as the Irish economy contracts due to economic austerity whilst its bankrupt banks are sending the countries debt and liabilities soaring, thus resulting in a far worse budgetary position than where Ireland was before the austerity measures were implemented as the bond markets are waking up to evitable debt default which is sending interest rates demanded to hold Irish debt soaring to new credit crisis highs.

An exhausted Irish Government devoid of any new workable solutions to the spiraling debt crisis, unable to print money and inflate their way out of debt are instead announcing policies the likes of Quantitative Cheesing, which literally boils down to handing out parcels of cheese from the European Unions Cheese Mountain to Irish families to consume or trade as opposed to handing out money which they are unable to do. This is no joke, as a 55 ton handout of E.U. cheese is heading for Irish towns and cities, which does not exactly send a message of confidence to the financial markets as to the state of the Irish economy.

Whilst the crisis in Ireland and the other PIIGS may be new to the mainstream press, however when the eyes of the world were focused on Greece 6 months ago, I pointed out that a far bigger crisis was brewing in Ireland (13 Apr 2010 - Britain's Accelerating Trend Towards High Inflation and UK Debt Default Bankruptcy )-

Whilst the mainstream press these past two months has been obsessed with the Greek debt crisis, the above graph clearly illustrates that a far larger debt crisis looms in Ireland that could soon transplant Greece in the debt crisis headlines over the coming months, similarly a number of other Euro Zone countries head the risk towards bankruptcy league table with Belgium and Portugal not far behind Greece. The price that these countries pay for being stuck in the Euro single currency is that they cannot devalue to try and gain some competitive advantage for their economies and therefore try and grow and inflate their way out of a high debt burden that stifles economic activity.

However they also benefit from the fact that had they not been in the Euro then many of these countries would also be where Iceland is today as they would no longer be able to service the debt denominated in foreign currencies as their own currencies would have crashed as investors rush to the exit to preserve as much of the purchasing power of their investments into alternative currencies. The consequence of this in ability to devalue is deflationary as the economies contract in an attempt to reduce the debt burden and budget deficit as they attempt to move to a new sustainable equilibrium within the Euro block that demand greater competitiveness by means of reduction in costs i.e. by deflating wages, failure to do this results in higher interest rates and therefore a greater debt interest burden which again risks default.

As the above illustrates, Greece was and remains just the tip of the Eurozone debt ice-berg as countries such Ireland, Belgium, Portugal and Spain were destined to line up for a Euro-zone (German) bailout. All of the Eurozone PIIGS have since accelerated along the debt deflation path, feeding the economic crisis in Ireland as they cannot print money and devalue as the PIIGS are locked into the Euro which benefits the industrial countries such as Germany that profit from the Eurozone both in terms of a captured internal market that cannot compete against German industry, and exports to outside the Eurozone where the Euro is kept weaker as a consequence of the PIIGS thus enabling Germany to profit from a huge trade surplus.

Ireland Debt Crisis Solutions ?

The same trend continues as I wrote of in April 2010, which requires the same solution of the Eurozone splitting into two or more currency blocks so as to enable competitive currency devaluations to take place, the alternative is for all of the Eurozone trade surplus countries to hand over a large chunk of their annual surpluses to the PIIGS in order to reduce their annual budget deficits to a manageable % level inline with the E.U. average. Neither of these solutions is perfect as ejecting the PIIGS from the Euro would send their currencies sharply lower and inflation soaring as they try to inflate their way out of their debt crisis (as the UK is doing). However the problem here is, as I have identified several times before that most of the debt of the Eurozone PIIGS is denominated in Euro's, which means that a devaluation would increase the value of the debt in the new currencies.

The only solution is for a costly European Union / ECB / IMF bailout of Ireland as they cannot allow the current crisis in ireland to trigger a complete bailout of ALL of the PIIGS which could cost as much as Euros 2 trillion. Therefore the Irish debt crisis has the potential to turn into the mother of all bailouts where today's talk of billions turns into trillions if decisive action is not taken to finance the Irish budget deficit before they triggered a PIIGS debt collapse Euro-zone wide bailout

The price paid would manifest itself in significantly higher Eurozone inflation as the ECB follows the UK and USA with a series of Quantitative Easing, money printing runs to monetize the debt of bankrupting PIIGS, the impact of which will be to increase the relative rate of free fall of the Euro against other major currencies thus give the illusion of a rising Dollar (temporary) and British Pound (less temporary) as the below forecast graphs from recent in depth analysis suggest:

U.S. Dollar Index

The Euro comprises 60% of the USD Index which therefore represents the prime determinant for the USD index trend. The USD is currently at 78, and is forecast to rise to 80 by early December as part of a volatile trend towards USD 69 by mid 2011 (12 Oct 2010 - USD Index Trend Forecast Into Mid 2011, U.S. Dollar Collapse (Again)?)

British Pound

Euro woes also benefit sterling which unlike the PIIGS can print money and inflate its way out of debt and has been doing so with vigour where even the manipulated under reporting official inflation statistics such CPI has spent virtually the whole of 2010 above the Bank of England's 3% upper limit. The forecast trend for sterling is to rally against currencies such as the Euro and U.S. Dollar to target a rate of at least £/$1.85 by mid 2011 which is set against the current rate of £/$1.61 (04 Oct 2010 - British Pound Sterling GBP Currency Trend Forecast into Mid 2011 )

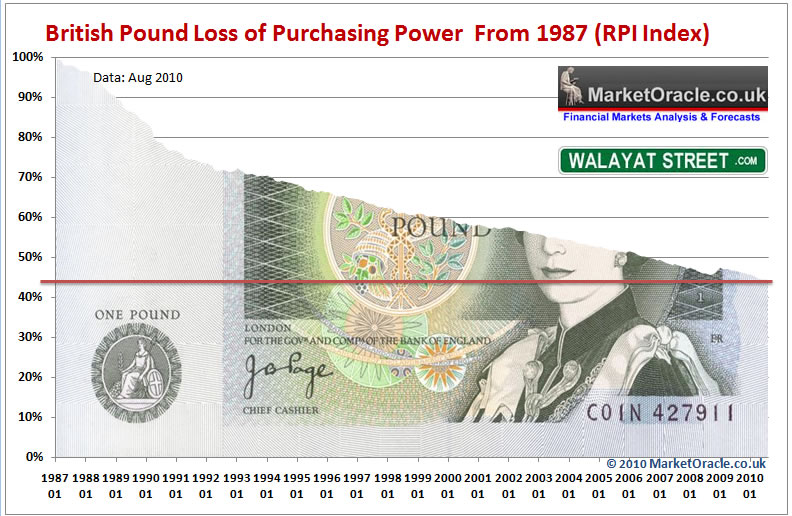

Again, when you view these forecast graphs note that you are viewing the relative rate of free fall between currencies at a particular point in time, as ALL currencies are continuously in free fall which results in the loss of real purchasing power of all currencies of which the official inflation statistics are one measurement. For example the British Pound in exchange rate terms is roughly where it was against the U.S. Dollar 20 years ago, however the following graph shows that sterling has lost over 40% of its purchasing power on the RPI inflation measure over the past 20 years.

Debt Default is the Final Destination

Ultimately all governments are heading towards the same final destination of debt default bankruptcy, the only question mark is will it be outright debt default or stealth default by inflation. Where countries such as Ireland and Greece are concerned then they are currently more probably heading for outright default. Countries such as the UK and USA are DEFINETLTLLY heading along the path of stealth default by means of inflation as engineered by governments which is usually the more probable route as outright debt defaults tend to culminate in extreme crisis events associated with economic collapse (29 Jun 2010 - UK ConLib Government to Use INFLATION Stealth Tax to Erode Value of Public Debt).

Bottom Line: Where Ireland is concerned, the E.U. will do its best to delay the inevitable debt default, which means a Eurozone bailout (one of a series) is imminent, because if one of the PIIGS defaults then so will they all which would require the mentioned Euro 2 trillion QE bailout virtually immediately (a Euro 750 billion bailout fund was announced in May), rather than perhaps Euros 80 billion for Ireland on its own at this stage of the crisis, and after Ireland will soon follow Portugal, then Spain, then Italy before the bailout cycle returns once more for another Greece bailout (probably sooner rather than later). All of which feed the Inflation mega-trend across the Euro-zone.

Comments and Source: http://www.marketoracle.co.uk/Article24281.html

By Nadeem Walayat

Copyright © 2005-10 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis specialises on UK inflation, economy, interest rates and the housing market and he is the author of the NEW Inflation Mega-Trend ebook that can be downloaded for Free. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem Walayat has over 20 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis specialises on UK inflation, economy, interest rates and the housing market and he is the author of the NEW Inflation Mega-Trend ebook that can be downloaded for Free. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.