The U.S. Economy is Recovering and Employment is Growing - WHO’S LYING?

Economics / US Economy Dec 13, 2010 - 02:32 PM GMTBy: James_Quinn

Have you noticed the latest sound bites coming from the punditry in the corporate mainstream media? Here is the latest wisdom flowing from the lying mouthpieces of the ruling oligarchy (Wall Street, Washington DC, Mega-corporations):

Have you noticed the latest sound bites coming from the punditry in the corporate mainstream media? Here is the latest wisdom flowing from the lying mouthpieces of the ruling oligarchy (Wall Street, Washington DC, Mega-corporations):

The economy is recovering and employment is growing.

Consumers are deleveraging, saving and using cash for purchases.

Retailers are doing fantastic as consumers increase spending.

These are the three themes being proclaimed simultaneously by the mainstream media. Every time I hear these themes proclaimed, I want to shout out like Joe Wilson - "YOU LIE!!!"

How can consumers be deleveraging, saving and increasing spending at the same time? Let's examine the facts to see who is lying.

The fallacy that the economy is recovering and employment is growing can be put to rest by an examination of the BLS data accessed here: ftp://ftp.bls.gov/pub/suppl/empsit.cpseea1.txt.

The number of Americans employed over the last few years is as follows:

- 2007 - 146.0 million

- 2008 - 145.5 million

- 2009 - 139.9 million

- 2010 - 138.9 million

It seems there are 7.1 million less employed people than there were three years ago. Contrary to the spin from the White House, there are 1 million less people employed today than during the horrific 2009 year. Luckily, another 6 million people left the work force, or we'd really have a problem. The truth is that if the government actually counted everyone in the country who wants a job, the unemployment rate is not 9.8%, but 23% and it continues to rise.

The economic recovery lie can be refuted by examining the data from the BEA located HERE and HERE.

The GDP of the US peaked at $14.5 trillion in the 3rd quarter of 2008. Today it stands at $14.8 trillion, two years later. GDP has gone up for one reason and one reason only - the Federal Government has borrowed trillions from future generations in order to artificially prop up a system already crumbling from the weight of too much debt. Highlights from the GDP calculation are:

- Private investment is $216 billion lower today than it was in the 3rd quarter of 2008.

- Exports are $80 billion lower today than they were in the 3rd quarter of 2008.

You may ask yourself how can GDP be higher if private businesses are investing less and exporting less. The answer of course is your friendly neighborhood Feds. The Federal government is spending $128 billion more today than it was in 2008. The last piece to the puzzle is the beloved consumer, who accounts for 70% of GDP. Good old Joe Sixpack has ramped up his spending by a good $470 billion since the 1st quarter of 2009. With this figure, we must be in a strong recovery. Larry Kudlow says so.

A little more digging on the BEA website reveals some interesting data:

- Personal income has risen by $300 billion since the 1st quarter of 2008.

- Strangely, private industry wages have DECLINED by $213 billion since the 1st quarter of 2008.

It seems that personal income has risen due to two major items. You will be glad to know that government wages have risen by $58 billion and drum roll please: government entitlement transfers have increased by $523 billion since the 1st quarter of 2008. The Federal government has borrowed hundreds of billions from future generations and paid it out in the form of unemployment benefits and other social programs so that consumers would spend it today. This is how you generate a positive GDP, without generating a real recovery. And, of course, if the government used an honest CPI rate, GDP would still be negative, just as it has been for most of the past decade.

The great consumer deleveraging lie has been ongoing for the last six months. The savings rate has "surged" from 4.8% in the 2nd quarter of 2008 to 5.8% today. The savings rate is calculated as what is left over when you subtract personal consumption expenditures from disposable personal income. The surge in saving is the result of the Federal government borrowing from the Chinese and handing it to consumers to spend. If the government wasn't transferring these funds from future generations to current generations, the savings rate would be 1.2%.

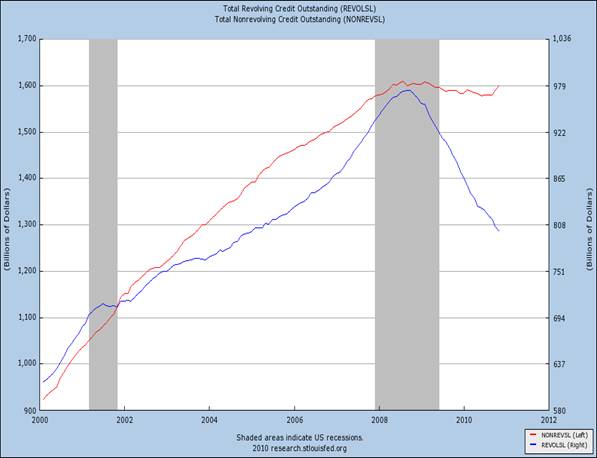

Revolving consumer debt (credit cards) has declined by $173 billion in the last two years. This must mean that consumers are deleveraging.

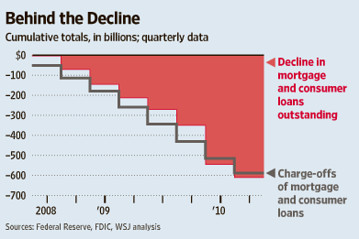

Total consumer credit peaked at $13.9 trillion in the 1st quarter of 2008 and currently stands at $13.4 trillion. It sure looks like consumer deleveraging. Consumers must have paid off $500 billion of debt. But, the facts obliterate this fallacy. The Wall Street banks have written off in excess of $600 billion since the 1st quarter of 2008, as reported by the Wall Street Journal. This means that consumers are actually charging more on their credit cards than they were in 2008. Having your debt written off, rather than paying it off says much about the great economic recovery of 2010.

The false reports circulating on network news programs is that Americans are paying cash, rather than using credit cards. This is completely false, as both Visa and Mastercard reported increases in transaction volumes in their last quarters. Having worked for a big box retailer, I know that the average credit card transaction is 50% to 70% higher than the average cash transaction. If people were truly charging less, the average ticket at the major retailers would be plunging. Retail sales would be plunging. They are not plunging, as the major US retailers report decent comparable store sales in the 2% to 5% range.

The National Retail Federation has forecast November- December holiday sales will rise by 2.3 percent from a year ago, the most since 2006. A Bloomberg survey taken Dec. 2 to Dec. 8 showed economists raised projections for consumer purchases, the biggest part of the economy, to 2.6 percent for next year, up from their 2.3 percent estimate the prior month.

A little reality check about retail sales is in order. According to the US Census Bureau, total retail sales over the last few years are as follows:

- 2007 - $4.5 trillion

- 2008 - $4.4 trillion

- 2009 - $4.1 trillion

- 2010 - $4.4 trillion (estimated)

The fact is that there are thousands more retail outlets today than there were in 2007, and total sales are still below the level reached in 2007. Not only that, but even using the government manipulated CPI, inflation has risen 8% since 2007. On an inflation adjusted basis, 2007 retail sales in today's dollars would be $4.9 trillion. Using the real inflation rate of 20% over this time frame would generate an inflation adjusted retail sales figure of $5.4 trillion. As you can see, the great retail recovery of 2010 is a sham. Comparable store sales increases of 3% are inflation adjusted decreases of 5%. If you drive around with your eyes open, you would think the hot new retailer in America is called SPACE AVAILABLE.

I hate to be a wet blanket during this festive holiday season, but the truth is that there is no self sustaining recovery happening. The powers that be, with the help of their lackeys in the mainstream media are desperately trying to convince you that everything is alright. It is not alright. It is getting worse by the day. The only people spending are Lloyd Blankfein and his ilk, while middle class Americans sink further into despair and debt.

Who's lying? You know.

RULING ELITE

MIDDLE CLASS

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2010 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.